UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-U

CURRENT REPORT PURSUANT TO REGULATION A

November 28, 2023

(Date of Report (Date of earliest event reported))

GelStat Corporation

(Exact name of registrant as specified in its charter)

| Delaware |

|

90-0075732 |

| (State or other jurisdiction of incorporation) |

|

(IRS Employer Identification No.) |

333 SE 2nd Avenue,

Suite 2000

Miami, Florida 33131

(Address of principal executive

offices)

(772) 212-1368

(Registrant’s telephone number,

including area code)

Common Stock

(Title of each class of securities

issued pursuant to Regulation A)

Unaudited Financial Statements for the Period Ended

September 30, 2023

On November 28, 2023, GelStat Corporation (the “Company”)

filed its unaudited financial statements for the period ended September 30, 2023 (the “Financial Statements”). A copy of the

Company’s Financial Statements is attached as Exhibit 99.1.

Safe Harbor and Forward-Looking Statements

The information furnished in Form 1-U is not deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, is not subject to the liabilities of

that section, and is not deemed incorporated by reference in any filing under the Securities Act of 1933, as amended.

Exhibits

SIGNATURES

Pursuant to the requirements of Regulation A, the issuer has duly

caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| November 28, 2023 |

GelStat Corp. |

| |

|

| |

By: |

/s/ Javier Acosta |

| |

|

Javier Acosta |

| |

|

Chief Executive Officer |

| |

|

(Principal Executive Officer and Principal Financial and Accounting Officer) |

Exhibit 99.1

GELSTAT

CORPORATION

QUARTERLY

REPORT

QUARTER

ENDED SEPTEMBER 30, 2023

(UNAUDITED)

Table of Contents

GelStat Corporation

Consolidated

Balance Sheets

(Unaudited)

| | |

September 30, | | |

December 31, | |

| Assets | |

2023

(Unaudited) | | |

2022

(Audited) | |

|

| | |

| | |

| |

| Current Assets | |

| | | |

| | |

| Cash | |

$ | 37,464 | | |

$ | 1,730 | |

| Accounts receivable | |

| 3,344 | | |

| 80 | |

| Due to related party | |

| 2,300 | | |

| 2,300 | |

| Total Current Assets | |

| 43,108 | | |

| 4,110 | |

| | |

| | | |

| | |

| Intangible Asset, net | |

| 150,000 | | |

| — | |

| | |

| | | |

| | |

| Other assets: | |

| | | |

| | |

| Warehouse right of use | |

| — | | |

| 12,720 | |

| Security Deposits | |

| — | | |

| 2,000 | |

| | |

| — | | |

| 14,720 | |

| | |

| | | |

| | |

| Total

Assets | |

$ | 193,108 | | |

$ | 18,830 | |

| | |

| | | |

| | |

| Liabilities and Stockholders’ Deficit | |

| | | |

| | |

| | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 47,257 | | |

$ | 76,003 | |

| Accrued expenses | |

| 285,232 | | |

| 259,732 | |

| Other current liabilities | |

| 81,567 | | |

| 25,185 | |

| Deferred revenue | |

| 41,908 | | |

| — | |

| Loans- related party – current portion | |

| 21,916 | | |

| 20,507 | |

| Warehouse lease liability – current portion | |

| — | | |

| 12,720 | |

| Convertible note payable, net of discount | |

| 21,620 | | |

| 68,702 | |

| Total Current Liabilities | |

| 499,499 | | |

| 462,849 | |

| | |

| | | |

| | |

| Other Liabilities | |

| | | |

| | |

| Loans- related party – non current portion | |

| 145,235 | | |

| 117,236 | |

| Convertible notes payable – non current portion | |

| 350,849 | | |

| 144,000 | |

| Total Other Liabilities | |

| 496,084 | | |

| 261,236 | |

| | |

| | | |

| | |

| Stockholders’ Deficit | |

| | | |

| | |

| Common stock, $0.01 par value, 5,000,000,000 shares authorized; | |

| | | |

| | |

| 1,809,874,946 and 686,179,300 and shares issued at September 30, 2023 and December 31, 2022 | |

| 18,098,749 | | |

| 6,861,793 | |

| Additional paid-in-capital | |

| 1,580,774 | | |

| 12,668,256 | |

| Accumulated deficit | |

| (20,481,999 | ) | |

| (20,235,304 | ) |

| Total Stockholders’ Deficit | |

| (802,476 | ) | |

| (705,255 | ) |

| | |

| | | |

| | |

| Total Liabilities and Stockholders' Deficit | |

$ | 193,108 | | |

$ | 18,830 | |

The accompanying notes are an integral part of these financial statements.

GelStat Corporation

Consolidated

Statements of Operations

(Unaudited)

| | |

For the Three Months Ended

September 30 | | |

For the Nine Months Ended

September 30 | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Revenues | |

$ | 34,705 | | |

$ | 595 | | |

$ | 87,090 | | |

$ | 2,139 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of goods sold | |

| — | | |

| 315 | | |

| 44 | | |

| 1,323 | |

| Gross profit | |

| 34,705 | | |

| 280 | | |

| 87,046 | | |

| 816 | |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Personnel costs | |

| 67,625 | | |

| 39,756 | | |

| 200,237 | | |

| 133,316 | |

| Legal, professional and consulting | |

| 12,998 | | |

| 10,420 | | |

| 21,728 | | |

| 62,561 | |

| Rent expense | |

| — | | |

| 4,756 | | |

| 18,645 | | |

| 23,780 | |

| Selling, general and administrative expenses | |

| 21,755 | | |

| 10,469 | | |

| 45,992 | | |

| 26,810 | |

| Stock compensation | |

| 7,400 | | |

| — | | |

| 22,200 | | |

| 244,625 | |

| Total operating expenses | |

| 109,778 | | |

| 65,401 | | |

| 308,802 | | |

| 491,092 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other income(expense): | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| (8,329 | ) | |

| (27,814 | ) | |

| (22,418 | ) | |

| (99,912 | ) |

| Other income (expense) | |

| 957 | | |

| 107 | | |

| 1,013 | | |

| 1,123 | |

| Total Other expense | |

| (7,372 | ) | |

| (27,707 | ) | |

| (21,405 | ) | |

| (98,789 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from continuing operations | |

| (82,445 | ) | |

| (92,828 | ) | |

| (243,161 | ) | |

| (589,065 | ) |

| Loss from discontinuing operations | |

| — | | |

| — | | |

| (3,534 | ) | |

| — | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (82,445 | ) | |

$ | (92,828 | ) | |

$ | (246,695 | ) | |

$ | (589,065 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per

common share - basic and diluted | |

$ | (0.00 | ) | |

$ | (0.00 | ) | |

$ | (0.00 | ) | |

$ | (0.00 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average

number of common shares outstanding - basic and diluted | |

| 1,512,978,664 | | |

| 632,653,995 | | |

| 1,133,523,622 | | |

| 604,505,861 | |

The accompanying notes are an integral part of these financial statements.

GelStat Corporation

Consolidated

Statements of Stockholders’ Deficit

For

the Three and Nine Months Ended September 30, 2023 and 2022

(Unaudited)

| | |

| | |

| | |

| | |

| |

| | |

Common Stock

$0.01 Par Value | | |

Additional Paid | | |

Accumulated | | |

Total

Stockholders' | |

| | |

Shares | | |

Amount | | |

in

Capital | | |

Deficit | | |

Deficit | |

| Balance December 31, 2021 | |

| 558,326,873 | | |

$ | 5,583,269 | | |

$ | 13,561,884 | | |

$ | (19,474,120 | ) | |

$ | (328,967 | ) |

| Shares cancelled from settlement | |

| (101,400,000 | ) | |

| (1,014,000 | ) | |

| 1,014,000 | | |

| — | | |

| — | |

| Stock compensation | |

| 107,843,750 | | |

| 1,078,438 | | |

| (833,813 | ) | |

| — | | |

| 244,625 | |

| Warrant exercise | |

| 53,209,459 | | |

| 532,095 | | |

| (513,687 | ) | |

| — | | |

| 18,408 | |

| Stock issued for debt conversion | |

| 16,666,667 | | |

| 166,667 | | |

| (166,667 | ) | |

| — | | |

| — | |

| Net loss for the nine months ended September 30, 2022 | |

| — | | |

| — | | |

| — | | |

| (589,065 | ) | |

| (589,065 | ) |

| Balance September 30, 2022 | |

| 634,646,749 | | |

$ | 6,346,467 | | |

$ | 13,061,717 | | |

$ | (20,063,185 | ) | |

$ | (655,000 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| | |

Common Stock

$0.01 Par Value | | |

Additional Paid | | |

Accumulated | | |

Total

Stockholders' | |

| | |

| Shares | | |

| Amount | | |

| in

Capital | | |

| Deficit | | |

|

Deficit | |

| Balance June 30, 2022 | |

| 617,980,082 | | |

$ | 6,179,801 | | |

$ | 13,228,384 | | |

$ | (19,970,357 | ) | |

$ | (562,172 | ) |

| Stock issued for debt conversion | |

| 16,666,667 | | |

| 166,667 | | |

| (166,667 | ) | |

| — | | |

| — | |

| Net loss for the three months ended September 30, 2022 | |

| — | | |

| — | | |

| — | | |

| (92,828 | ) | |

| (92,828 | ) |

| Balance September 30, 2022 | |

| 634,646,749 | | |

$ | 6,346,467 | | |

$ | 13,061,717 | | |

$ | (20,063,185 | ) | |

$ | (655,000 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| | |

Common Stock

$0.01 Par Value | | |

Additional Paid | | |

Accumulated | | |

Total

Stockholders' | |

| | |

Shares | | |

Amount | | |

in Capital | | |

Deficit | | |

Deficit | |

| Balance December 31, 2022 | |

| 686,179,300 | | |

$ | 6,861,793 | | |

$ | 12,668,256 | | |

$ | (20,235,304 | ) | |

$ | (705,255 | ) |

| Stock compensation | |

| 139,487,180 | | |

| 1,394,872 | | |

| (1,372,672 | ) | |

| — | | |

| 22,200 | |

| Stock issued for debt conversion | |

| 449,804,531 | | |

| 4,498,045 | | |

| (4,414,562 | ) | |

| — | | |

| 83,483 | |

| Warrants issued to purchase assets | |

| — | | |

| — | | |

| 22,156 | | |

| — | | |

| 22,156 | |

| Warrants exercised for debt conversion | |

| 534,403,935 | | |

| 5,344,039 | | |

| (5,344,039 | ) | |

| — | | |

| — | |

| Warrants issued for debt conversion | |

| | | |

| | | |

| 21,635 | | |

| — | | |

| 21,635 | |

| Net loss for the nine months ended September 30, 2023 | |

| — | | |

| — | | |

| — | | |

| (246,695 | ) | |

| (246,695 | ) |

| Balance September 30, 2023 | |

| 1,809,874,946 | | |

$ | 18,098,749 | | |

$ | 1,580,774 | | |

$ | (20,481,999 | ) | |

$ | (802,476 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Common Stock

$0.01 Par Value | | |

Additional Paid | | |

Accumulated | | |

Total

Stockholders' | |

| | |

Shares | | |

Amount | | |

in Capital | | |

Deficit | | |

Deficit | |

| Balance June 30, 2023 | |

| 1,275,471,011 | | |

$ | 12,754,710 | | |

$ | 6,895,778 | | |

$ | (20,399,554 | ) | |

$ | (749,066 | ) |

| Stock compensation | |

| — | | |

| — | | |

| 7,400 | | |

| — | | |

| 7,400 | |

| Warrants exercise for debt conversion | |

| 534,403,935 | | |

| 5,344,039 | | |

| (5,344,039 | ) | |

| — | | |

| — | |

| Warrants issued for debt conversion | |

| — | | |

| — | | |

| 21,635 | | |

| — | | |

| 21,635 | |

| Net loss for the three months ended September 30, 2023 | |

| — | | |

| — | | |

| — | | |

| (82,445 | ) | |

| (82,445 | ) |

| Balance September 30, 2023 | |

| 1,809,874,946 | | |

$ | 18,098,749 | | |

$ | 1,580,774 | | |

$ | (20,481,999 | ) | |

$ | (802,476 | ) |

The accompanying notes are an integral part of these financial statements.

GelStat Corporation

Consolidated

Statements of Cash Flows

(Unaudited)

| | |

For the Nine Months Ended September 30, | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| CASH FLOWS FROM OPERATING ACTIVITIES | |

| | | |

| | |

| Net loss | |

$ | (246,695 | ) | |

$ | (589,065 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Amortization of loan discount | |

| 15,542 | | |

| 91,027 | |

| Accrued interest of related party note | |

| 26,536 | | |

| 9,576 | |

| Accrued interest on convertible debt | |

| — | | |

| 2,814 | |

| Stock Compensation | |

| 14,800 | | |

| 244,625 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| (3,265 | ) | |

| 6 | |

| Inventory | |

| — | | |

| 59 | |

| Employee advances | |

| — | | |

| (15,520 | ) |

| Accounts payable | |

| 12,412 | | |

| 15,218 | |

| Accrued expenses | |

| 25,500 | | |

| 60,038 | |

| Deferred revenue | |

| 41,908 | | |

| — | |

| Other current liabilities | |

| 56,382 | | |

| 22,780 | |

| Net cash used in operating activities | |

| (56,880 | ) | |

| (158,442 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES | |

| | | |

| | |

| Loan repayments- related party | |

| (26,330 | ) | |

| (22,281 | ) |

| Proceeds from related party loan | |

| 16,940 | | |

| — | |

| Proceeds from convertible note | |

| 102,000 | | |

| 120,000 | |

| Net Cash Provided By Financing Activities | |

| 92,610 | | |

| 97,719 | |

| | |

| | | |

| | |

| Net increase (decrease) in cash | |

| 35,730 | | |

| (60,723 | ) |

| | |

| | | |

| | |

| Cash - beginning of period | |

| 1,730 | | |

| 67,138 | |

| | |

| | | |

| | |

| Cash - end of period | |

$ | 37,460 | | |

$ | 6,415 | |

| | |

| | | |

| | |

| SUPPLEMENTARY DISCLOSURE OF CASH FLOW INFORMATION: | |

| | | |

| | |

| Cash paid during the year/period for: | |

| | | |

| | |

| Interest | |

$ | — | | |

$ | — | |

| Taxes | |

$ | — | | |

$ | — | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| SUPPLEMENTARY DISCLOSURE OF NON-CASH INVESTING AND FINANCING ACTIVITIES: | |

| | | |

| | |

| | |

| | | |

| | |

| Purchase of intangible assets by issuance of a convertible note | |

$ | 150,000 | | |

$ | — | |

| | |

| | | |

| | |

| Conversion of accounts payable to common stock | |

$ | 41,158 | | |

$ | — | |

| | |

| | | |

| | |

| The convertible of note to equity | |

$ | 83,483 | | |

$ | — | |

| | |

| | | |

| | |

| Warrants issued for purchase assets | |

$ | 22,155 | | |

$ | — | |

| | |

| | | |

| | |

| Warrants issued for debt conversion | |

$ | 21,635 | | |

$ | — | |

The accompanying notes are an integral part of these financial statements.

GELSTAT CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

September 30, 2023 and 2022 (Unaudited)

NOTE 1

- Business

GelStat Corporation ("the Company" or "GelStat")

is a publicly traded company trading under the symbol (“GSAC”) that is engaged in research, development, marketing and branding

of innovative advanced technology operations. The Company's strategy is to build shareholder value through organic growth and strategic

acquisitions.

On May 22, 2023, the Company Formed GSAC Engineering

Corporation, a wholly owned subsidiary of GSAC. The subsidiary will be our division dedicated to developing innovative technologies for

clean energy and industrial security. Our vision is to create a more sustainable and secure future for our customers and society. We are

committed to integrating STEM (science, technology, engineering and math) into our processes and products, as we believe that STEM skills

are essential for solving complex challenges and creating value in the 21st century. On June 29, 2023, GSAC engineering acquired key intellectual

Property of Duos Technology Group, Inc ( see Note 4) to give the Company greater opportunities in this sector.

NOTE 2- Liquidity and Going Concern

The financial statements have been prepared on a

going concern basis which assumes the Company will be able to realize its assets and discharge its liabilities in the normal course

of business for the foreseeable future. The Company had a net loss of $246,695 and $589,065 for the nine months ended September

30, 2023 and 2022. The Company has an accumulated deficit of $20,481,999 and a stockholders’ deficit of $802,476 as of

September 30, 2023, and used $56,880 and $158,442 in cash flow from operating activities for the nine months ended September 30,

2023 and 2022.

Management believes these conditions raise substantial

doubt about the Company’s ability to continue as a going concern for the next twelve months from the date these financial statements

were issued. The ability to continue as a going concern is dependent upon profitable future operations, positive cash flows, and additional

financing.

Management intends to raise money through a new Regulation

A Funding to be filed in 2023. During 2022 the Company raised $144,000 through the execution of convertible notes and it intends to use

the issuance of Convertible Notes in the foreseeable future to provide liquidity to support expanded operations. Such funds will enable

the company to develop and market its products and for its working capital needs. Management cannot provide any assurances that the Company

will be successful in completing these undertakings and accomplishing any of its plans.

NOTE 3 - Summary of Significant Accounting Policies

Basis of Presentation

The accompanying consolidated financial statements

of the Company have been prepared in accordance with accounting principles generally accepted in the United States of America (U.S. GAAP)

under the accrual basis of accounting and includes the accounts of its wholly owned subsidiary GSAC Engineering Corporation.

Management's Estimates

In preparing financial statements in conformity with

accounting principles generally accepted in the United States of America, management makes estimates and assumptions that affect the reported

amounts of assets and liabilities and disclosures of contingent assets and liabilities at the dates of the financial statements, as well

as the reported amounts of revenues and expenses during the reporting periods. The Company’s

significant estimates include, the valuation of inventories and the realizability of income tax assets. Actual results could differ from

these estimates.

GELSTAT CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

September 30, 2023 and 2022 (Unaudited)

Concentration of Credit Risk

The Company’s financial instruments that are

exposed to concentrations of credit risk primarily consist of its cash. The Company places its cash with financial institutions of high

credit worthiness. At times, its cash with a particular financial institution may exceed any applicable government insurance limits. The

Company’s management plans to assess the financial strength and credit worthiness of any parties to which it is a credit counterparty,

and as such, it believes that any associated credit risk exposures are limited.

Risks and Uncertainties

The Company is undertaking a new business venture

that is inherently subject to significant risks and uncertainties, including financial, operational, technological and other risks that

could potentially have a risk of business failure.

Cash and Cash Equivalents

The Company considers all short-term investments with

a maturity of three months or less when purchased to be cash and equivalents for purposes of the statement of cash flows.

Accounts Receivable

Accounts receivables are recorded at the invoiced

amount and do not bear interest. As of September 30, 2023 and December 31, 2022, the Company did not record an allowance for uncollectible

accounts.

Inventories

Inventories are valued using average actual cost.

Inventory items replaced by an alternative and rendered unusable or diminished in value are considered to be obsolete. Obsolete inventory

items are written down to zero.

Intangible Assets

Intangible assets are amortized

on a straight-line basis over the estimated useful lives. The Company assesses the potential impairment to its intangible assets when

events or changes in circumstances indicate that the carrying amount may not be recoverable.

Revenue Recognition

In accordance

with ASC 606 revenue is recognized upon transfer of control of promised products and/or services to customers in an amount that reflects

the consideration the Company expects to receive in exchange for those products and services. The Company recognizes revenue from sales

of services over the life of a contract (typically 12 months) beginning the first month after the contract is signed. At the time of contract

signed, service fees are recorded as deferred revenue and are recognized as revenue ratably over the service period.

Cost of Revenue

Cost of revenues consists primarily of product costs

and shipping and handling, which are directly attributable to the sale of services.

Advertising

Advertising costs, including the cost of promotional

products, which totaled $5,760 and $7,492 for the nine months ended September 30, 2023 and 2022, are charged to operations when incurred.

GELSTAT CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

September 30, 2023 and 2022 (Unaudited)

Impairment of Long-Lived Assets

The Company accounts for impairment of long-lived

assets in accordance with Accounting Standards Codification (“ASC”) 360, Property, Plant and Equipment, (“ASC 360”).

Long-lived assets consist primarily of property, plant and equipment. In accordance with ASC 360, the Company periodically evaluates long-lived

assets whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. When triggering

event indicators are present, the Company obtains appraisals on an asset-by-asset basis and will recognize an impairment loss when the

sum of the appraised values is less than the carrying amounts of such assets. The appraised values, based on reasonable and supportable

assumptions and projections, require subjective judgments. Depending on the assumptions and estimates used, the appraised values projected

in the evaluation of long-lived assets can vary within a range of outcomes. The appraisals consider the likelihood of possible outcomes

in determining the best estimate for the value of the assets. As of September 30, 2023 and 2022, the Company did not record any impairment

losses.

Income Taxes

The Company accounts for income tax using Accounting

Standard Codification (“ASC 740”) “Accounting for Income Taxes”, which requires the asset and liability approach

for financial accounting and reporting for income taxes. Under this approach, deferred income taxes are provided for the estimated future

tax effects attributable to temporary differences between financial statement carrying amounts of assets and liabilities and their respective

tax bases, and for the expected future tax benefits from loss carry-forwards and provisions, if any. Deferred tax assets and liabilities

are measured using the enacted tax rates expected in the years of recovery or reversal and the effect from a change in tax rates is recognized

in the statement of operations and comprehensive income in the period of enactment. A valuation allowance is provided to reduce the amount

of deferred tax assets if it is considered more likely than not that some portion of, or all of, the deferred tax assets will not be realized.

Stock Based Compensation

The Company applies the fair value method of ASC 718,

Share Based Payment, in accounting for its stock-based compensation. This accounting standard states that compensation cost is measured

at the grant date based on the value of the award and is recognized over the service period, which is usually the vesting period, if any.

As the Company does not have sufficient, reliable, and readily determinable values relating to its common stock, the Company has used

the stock value pursuant to its most recent sale of stock for purposes of valuing stock-based compensation.

Earnings or Loss per Common Share

Basic earnings or loss per share is calculated as

the income or loss attributable to common stockholders divided by the weighted average number of shares outstanding during each period.

Diluted earnings or loss per share is calculated by dividing the net income or loss attributable to common shareholders by the diluted

weighted average number of shares outstanding during the year.

Recent Accounting Pronouncements

There are no other recent accounting pronouncements that are expected to

have a material effect on the Company's financial statements.

NOTE 4 – Intangible Assets

On June 29, 2023, the Company acquired the intellectual

property of Duos Technology Group, Inc., a Florida corporation. The Company exchanged a note for $165,000 for the assets which were valued

at $150,000. The differential of $15,000 was recorded as a debt discount. The Company estimated the useful life of the technology to be

5 years. As of September 30, 2023, $1,875 amortization expense was recorded.

GELSTAT CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

September 30, 2023 and 2022 (Unaudited)

NOTE 5– Debt

Notes Payable

The Company’s notes payable relating to financing

agreements classified as current liabilities consist of the following as of:

| | |

| |

| Notes

Payable | |

September

30, 2023 | | |

Interest

rate | | |

December

31, 2022 | | |

Interest

rate | |

| Related

party note payable | |

$ | 167,150 | | |

| 10 | % | |

$ | 137,742 | | |

| 10 | % |

| Less

noncurrent portion | |

| 145,235 | | |

| | | |

| 117,235 | | |

| | |

| Current

portion of related party note payable | |

$ | 21,916 | | |

| | | |

$ | 20,507 | | |

| | |

| Convertible

notes, net of discount | |

$ | 372,469 | | |

| 10 | % | |

$ | 212,702 | | |

| 10 | % |

| Less

noncurrent portion | |

| 350,849 | | |

| | | |

| 144,000 | | |

| | |

| Current

portion of convertible notes | |

$ | 21,620 | | |

| | | |

$ | 68,702 | | |

| | |

Related Party

The Company entered into an agreement with a related

party on July 31, 2020, whereby the related party loaned the Company the aggregate principal amount of up to $78,750 in tranches, pursuant

to a note, repayable on June 30, 2022. The note carried an annual interest rate of 12% and an Original Issue Discount (OID) of 5%. In

addition, the Company issued warrants permitting the related party to purchase for cash 78,750,000 shares of the Company’s common

stock at a price to be determined once sufficient authorized shares are available for issuance such that these shares do not exceed the

amount of available authorized shares. On January 1, 2022, the note was modified to a principal balance of $132,285 along with $6,292

of accrued interest and the interest rate was modified to 10% per annum. The balance of this note as of June 30, 2023 and December 31,

2022 was $156,682 and $137,742. This includes accrued interest of $8,099 and $12,264 at June 30, 2023 and December 31, 2022, respectively.

On September 1, 2023, the note was restructured through the assumption of two personal loans of the lender and a cash payment in the amount

of $3,470, assumption of a total of $43,997 plus accrued interest, and a conversion of the remaining balance of $106,003 on terms to be

determined. On September 30, 2023 the total balance of the assumed loans and the portion to be restructured totaled $167,150

including a noncurrent portion of $145,235.

Convertible notes

On July 8, 2021, GelStat issued a one-year $59,444

convertible note and received $50,000 in proceeds after discount and fees. (The note bears no interest and is due July 8, 2022.) After

the maturity date, the convertible note was revised to include the default fees of 150% of principal and interest, resulting in an increase

of the total amount to $98,082. On various dates during the six months ended June 30, 2023, the Company converted $98,082 of debt into

482,248,977 shares at an average conversion price of $0.0002 per share of common stock. The Company also issued 25,000,000 shares and

a five-year warrant to purchase 5,944,444 shares with an exercise price of $0.01 as additional consideration for this note. After the

maturity date, the warrants were revised to increase the total purchase shares to 594,444,400 with the exercise price $0.0001. As of September

27, 2023, a total 538,738,480 warrants have been exercised at an exercise price of $0.0001 per share with proceeds totaling $53,874, resulting

in the issuance of 534,403,935 shares of common stock.

On February 23, 2022, the Company issued a $120,000

convertible note at a discounted price of $100,000. The note bears an interest rate of 0% per annum and is convertible into common stock

of the Company at a fixed conversion rate of $0.003 per share of common stock. The holder of the note has the right to convert all

or part of the principal and interest into common stock. The maturity date of the convertible note is February 26, 2024. In connection

with the issuance of the convertible note, the Company issued a common stock purchase warrant to the same investor to purchase up to 10,000,000

shares of common stock. The common stock purchase warrant is exercisable through February 23, 2025, at a rate of $0.003 per share

of common stock. On August 17, 2023, the note was modified to a principal balance of $240,000 at a discounted price of $220,000,

the sum of original issue discount (OID) is $40,000 with a conversion of $0.0004 with a maturity date of August 17, 2025. The company

will grant an additional 25% warrant coverage on the new investment with a three-year term and $0.0004 strike price

GELSTAT CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

September 30, 2023 and 2022 (Unaudited)

On July 22, 2022, the Company issued 2,000,000 common

stock purchase warrants in connection with the issuance of a convertible note in the amount of $24,000 and received $20,000 in proceeds

after discount and fees. The common stock purchase warrant is exercisable through July 22, 2025, at a rate of $0.003 per share of common

stock.

On June 14, 2023, the Company issued a two-year $41,158

convertible note to a vendor as a result of a settlement agreement for warehouse space. The note bears an interest rate of 0% per annum

and is convertible into common stock of the Company at a fixed conversion rate of $0.003 per share of common stock.

As described in Note 4, the Company issued a two-year

$165,000 convertible note which carries an original issue discount (OID) of 10%. The note bears an interest rate of 0% per annum and is

convertible into common stock of the Company at a fixed conversion rate of $0.003 per share of common stock. In addition, the Company

issued a five-year warrant permitting the seller to purchase up to 55,000,000 shares of common stock, at a rate of $0.01 per share of

common stock. The warrant was valued using the Black-Scholes pricing model resulting in a fair value of $22,155 which will be amortized

over the 5 year term of the note using the straight-line method. The company recorded note amortization of $1,875 and warrants insurance

amortization of $2,769 as of September 30,2023.

NOTE 6 – Accrued Salary

As of September 30, 2023 and 2022, the Company has

accrued $285,232 and $259,732 in salary to its CEO.

On January 30, 2023, the Board of Directors approved

a bonus is the amount of $100,000 payable in stock to its CEO and $198,000 to the members of the Board, $148,000 of such is payable in

stock at the closing price on January 30, 2023 of $0.000975 per share, with vesting over 5 years. On February 15, 2022, the Company issued

139,487,180 shares of common stock. To account for the vesting the Company recorded deferred stock compensation of $125,800 at September

30, 2023.

NOTE 7 – Warehouse Lease Agreement

On June 28, 2020, the company entered into a warehouse

and office lease agreement for 7554 SW Jack James Drive, Stuart, Florida. The lease started July 1, 2020 and expired on June 30, 2023.

The right-to-use asset was $0 and $12,720 on September 30, 2023 and December 31, 2022, respectively.

NOTE 8– Shareholders’ Equity

On February 14, 2023, the company converted

$13,600 of debt into 34,000,000 shares at a conversion price of $0.0004 per share of common stock.

On February 15, 2022, the Company issued 139,487,180

shares of common stock to execute stock-based compensation at $0.000975 per share for total proceeds of $136,000.

On March 13, 2023, the company converted $15,000 of

debt into 42,857,143 shares at a conversion price of $0.0003 per share of common stock.

On March 31, 2023, the company converted $10,400 of

debt into 40,160,000 shares at a conversion price of $0.0003 per share of common stock.

On April 12, 2023, the company converted $10,900 of

debt into 44,672,131 shares at a conversion price of $0.0002 per share of common stock.

On April 13, 2023, the company converted $9,600 of

debt into 49,230,769 shares at a conversion price of $0.0002 per share of common stock.

GELSTAT CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

September 30, 2023 and 2022 (Unaudited)

On May 15, 2023, the company converted $5,170 of debt

into 51,700,000 shares at a conversion price of $0.0001 per share of common stock.

On May 22, 2023, the company converted $5,400 of debt

into 54,000,000 shares at a conversion price of $0.0001 per share of common stock.

On June 1, 2023, the company converted $5,400 of debt

into 54,000,000 shares at a conversion price of $0.0001 per share of common stock.

On June 8, 2023, the company converted $5,900 of debt

into 59,000,000 shares at a conversion price of $0.0001 per share of common stock.

On June 14, 2023, the Company converted $2,473 of

debt into 20,184,490 shares at a conversion price of $0.0001 per share of common stock.

On August 17, 2023, the previous $120,000 note was

modified to a principal balance of $240,000 at a discounted price of $220,000, the sum of original issue discount (OID) is $40,000 with

a conversion of $0.0004. The maturity date of the convertible note is August 17, 2025. The company will grant an additional 25% warrant

coverage on the new investment with a three-year term and $0.0004 strike price. (See Note 6)

On September 1, 2023, the loan with related party

was restructure through a combination of two personal loans of cash payment in the amount of $3,469.97, assumption of a total of $43,996.92

plus accrued interest, and a conversion of the balance of $106,003.08 with an original issue discount (OID ) of 20%. (See Note 6)

On July 19, 2023, 67,623,878 warrants were exercised

at an exercise price of $0.0001 per share with proceeds of $6,762 and resulting in the issuance of 67,623,878 shares of common stock.

On July 27, 2023, 67,623,878 warrants were exercised

at an exercise price of $0.0001 per share with proceeds of $6,762 and resulting in the issuance of 67,623,878 shares of common stock.

On August 4, 2023, 74,372,741 warrants were exercised

at an exercise price of $0.0001 per share with proceeds of $7,437 and resulting in the issuance of 74,372,741 shares of common stock.

On August 15, 2023, 73,086,068 warrants were exercised

at an exercise price of $0.0001 per share with proceeds of $7,309 and resulting in the issuance of 73,086,068 shares of common stock.

On August 25, 2023, 71,738,040 warrants were exercised

at an exercise price of $0.0001 per share with proceeds of $7,174 and resulting in the issuance of 71,738,040 shares of common stock.

On September 1, 2023, 89,903,837 warrants were exercised

at an exercise price of $0.0001 per share with proceeds of $8,990 and resulting in the issuance of 89,903,837 shares of common stock.

On September 14, 2023, 94,390,038 warrants were exercised

at an exercise price of $0.0001 per share with proceeds of $9,439 and resulting in the issuance of 94,390,038 shares of common stock.

On September 27, 2023, 55,705,920 warrants were exercised

at an exercise price of $0.0001 per share with proceeds of $5,570.59 and resulting in the issuance of 44,564,736 shares of common stock.

NOTE 9 – Subsequent Events

Management’s Evaluation

Management has evaluated subsequent events through

November 28, 2023, the date on which the financial statements were available to be issued. Management has determined that none of the

events (other than those identified above) occurring after the date of the balance sheet through the date of Management’s review

substantially affect the amounts and disclosure of the accompanying financial statements.

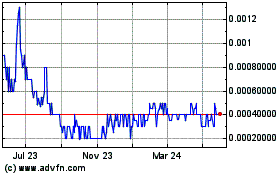

GelStat (PK) (USOTC:GSAC)

Historical Stock Chart

From Feb 2025 to Mar 2025

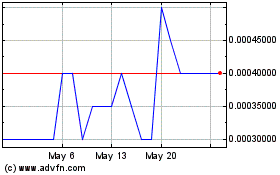

GelStat (PK) (USOTC:GSAC)

Historical Stock Chart

From Mar 2024 to Mar 2025