Hannover House Posts Significant Revenue and Profit Increases During Q4, 2013

January 29 2014 - 6:35AM

Access Wire

Springdale, AR / January 29, 2014 / ACCESSWIRE / Hannover House,

Inc. (OTC: HHSE), a leading independent distributor of films, books

and entertainment products, reported that gross revenues for the

fourth quarter, ending December 31, 2013, increased by

approximately 390% over the same quarterly period in the previous

year.

Gross revenues for the Q4 reporting quarter were $1,153,136 with

pre-tax net income of approximately $279,268. This is the sixteenth

consecutive quarter of profitability for Hannover House since the

company became publicly traded in January, 2010. Management

believes that the growing revenue results validate the business

plan of balancing low-investment, direct-to-video and

video-on-demand releases with higher-profile theatrical titles as a

means to maximize revenues and bottom line results. As first noted

in the prior quarter, the Q4 results also reflect sales revenues

from international licensing of films, representing a significant

new media income stream for the studio.

Gross revenues for last year's fourth quarter (2012) were

$295,822. For the current 2013 reporting period, sales revenues of

$1,153,136 represents a significant increase from last year's Q4

results. Net (pre-tax) income for Q4, 2012 was $107,081 as compared

to net (pre-tax) income for the just ended period in 2013 of

$279,268, representing an increase in the company’s bottom line of

261%.

Principal revenue components for Hannover House in Q4 of this

year were direct sales of DVD and Blu-Ray units, Video-On-Demand

revenues, new release books and international sales licenses.

Top-selling titles for each of the principal revenue-generating

categories include "Amityville Asylum"

(DVD), "Toys in the Attic"

(Blu-Ray), "All’s Faire In Love"

(Video-on-Demand), "One of the Lucky

Ones" (new release books) and "Mother

Goose" (international sales). Initial shipments

of the new release drama, “Blues for Willadean”

were also included in the Q4, 2013 results, although the on-sale

street date for that item is a Q1, 2014 event.

Full financials for the Q4 period, and the entire 2013 year,

will be released next week on the OTC Markets site, as well as

through S.E.C. Edgar filings. Ongoing audit activities for Hannover

House may impact the categorization and recognition of some of the

company’s capitalized costs and investments customarily appearing

on the balance sheets; as such, current Q4 balance sheets are not

being published as of the date of this revenues release, but will

be included within the year-end results.

Hannover House believes that the company is ideally suited for

rapid growth during 2014 and 2015. Newly announced activities to

develop major motion pictures with a variety of pre-sale and

non-recourse financing structures will provide Hannover House with

high profile theatrical releases that could significantly increase

revenues, profits and corporate stature. Additionally, a consumer

roll-out launch of the video-on-demand venture, “VODwiz.com” (and

an IPTV VODwiz channel) could generate parallel revenue paths with

a business plan combining elements of the Netflix streaming

structure with the Redbox discount pricing model. While developing

these new revenue streams, Hannover House will continue to operate

its core business of monthly DVD and V.O.D. releases, with

additional release activity occurring with book publishing and

theatrical activities throughout the year.

Key retail accounts for Hannover House include Walmart Stores,

Inc., Redbox, Netflix, Barnes & Noble and thousands of

independent video retailers, schools, libraries and booksellers.

The company also sells entertainment products to a wide range of

internet sites, and services most major video-on-demand portals.

Hannover House stock is traded on the OTC Markets under ticker

symbol: HHSE.

SAFE HARBOR STATEMENT

This press release may contain certain forward-looking

statements within the meaning of Sections 27A & 21E of the

amended Securities and Exchange Acts of 1933-34, which are intended

to be covered by the safe harbors created thereby. Although the

company believes that the assumptions underlying the

forward-looking statements contained herein are reasonable, there

can be no assurance that these statements included in this press

release will prove accurate.

For more information contact:

Eric Parkinson, Hannover House, 479-751-4500 /

Eric@HannoverHouse.com

Source: Hannover House, Inc.

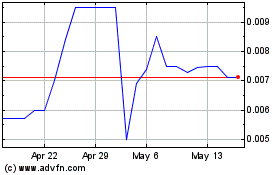

Hannover House (PK) (USOTC:HHSE)

Historical Stock Chart

From Feb 2025 to Mar 2025

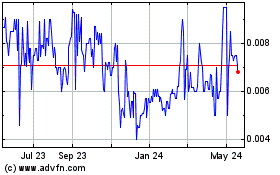

Hannover House (PK) (USOTC:HHSE)

Historical Stock Chart

From Mar 2024 to Mar 2025