2nd UPDATE:ConocoPhillips To Sell Syncrude Stake To Sinopec

April 12 2010 - 4:48PM

Dow Jones News

ConocoPhillips (COP) has agreed to sell its 9% stake in the

Syncrude oil-sands project in Canada to China Petroleum &

Chemical Corp. (SNP, 0386.HK) for $4.65 billion--a sign that

China's national oil companies have secured a strong foothold in

one of the world's most important crude sources.

The deal marks the biggest energy investment of a Chinese

government-backed company in North America, and it underscores

China's increasingly assertive strategy to secure energy resources

around the world. The country's rapid growth and emerging middle

class has made it the top automobile market in the world,

surpassing the U.S. in 2009, and its state-backed oil companies

have been acquiring both oil and gas reserves and storage

globally.

Just last month, Cnooc Ltd. (0883.HK), China's top offshore oil

explorer, said it agreed to pay $3.1 billion in cash for a stake in

one of the largest Argentine oil exploration companies. Last year,

Cnooc bought stakes in the U.S. Gulf of Mexico from Norway's

Statoil ASA (STO). The Chinese companies' successful bids stand in

stark contrast to Cnooc's 2005 attempt to buy Unocal, which the

company abandoned after it sparked stiff resistance from U.S.

lawmakers.

The move by Sinopec, as the international arm of China Petroleum

and Chemical Corp. is known, further strengthens China's presence

in Alberta's oilsands, a rich oil-producing area that has enabled

Canada to become the largest exporter of crude to the U.S. In

February, PetroChina purchased a stake in an Athabasca oil Sands

Corp. (ATH.T) project for C$1.9 billion.

Canada has generally been open to investment from China--the

last major dispute was over a proposed takeover of Canadian miner

Noranda Inc. in 2004 by a state-owned Chinese company, expected to

be valued at more than $7 billion. The deal fell apart amid

controversy over the Chinese company's human-rights practices in

China.

In a press conference in Washington D.C, Canadian Prime Minister

Stephen Harper said he had no "immediate reaction" about the deal.

"Foreign takeovers of a certain size have to be reviewed to assure

they're of net benefit to the country, and we do also have the

national security review provision in our legislation as well."

Industry Canada, a federal bureau, reviews all acquisitions of

Canadian assets over C$299 million by any foreign company. Factors

considered are the effect of the investment on production levels,

employment and competition in Canada, as well as "the compatibility

of the investment with our economic and cultural policies," said

Industry Canada in a statement. Acquisitions by state-owned foreign

entities undergo additional scrutiny of the company's "corporate

governance and commercial orientation," the statement said.

Syncrude is the largest Canadian oil-sands project, and it

produced an average of 280,000 barrels per day last year, or about

10% of Canada's oil production. It's a joint venture operated by

Canadian Oil Sands Trust (COSWF, COS.UN.T), Imperial Oil Ltd. (IMO,

IMO.T), Suncor Energy Inc. (SU, SU.T), ConocoPhillips (COP), Nexen

Inc. (NXY, NXY.T), Murphy Oil Corp. (MUR) and Mocal Energy, a unit

of Japan's Nippon Oil Corp. (5020.TO). ConocoPhillips owns the

third-largest stake at 9.03%.

The deal increases ConocoPhillips' credibility with investors

that it will be able to obtain $10 billion from its asset sale,

which was announced last October as part of a restructuring plan to

shore up its finances. The deal price almost doubles the best

estimates analysts had for Conoco's Syncrude stake, according to

Fadel Gheit, an analyst with Oppenheimer & Co. Inc.

"This is a very strong start," Gheit said. "Conoco beat

everybody's expectations."

ConocoPhillips, the third-largest U.S. oil company by market

value after ExxonMobil Corp. (XOM) and Chevron Corp. (CVX), said in

March that a big portion of the asset sales are expected in the

second half of the year.

ConocoPhillips has been the hardest hit among U.S. major oil

companies, as it amassed more debt and was more exposed than others

to the drop in natural gas prices, which hit a seven-year low in

2009.

The transaction to sell the stake to Sinopec is expected to

close in the third quarter once Canadian and Chinese government

approvals are obtained. Sinopec is Asia's largest refiner by

capacity and has been a bit acquisitive lately, as it agreed last

month to acquire deep-water oil assets in Angola, its first

acquisition of overseas upstream assets.

ConocoPhillips' shares closed at $55.96, up 1.16%, while

Sinopec's American depositary shares closed down 1.08% to

$84.93.

-By Isabel Ordonez, Dow Jones Newswires; 713-547-9208;

isabel.ordonez@dowjones.com

(John Kell contributed to this article.)

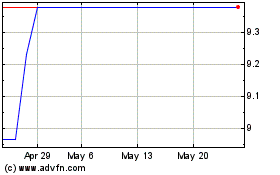

ENEOS (PK) (USOTC:JXHLY)

Historical Stock Chart

From Feb 2025 to Mar 2025

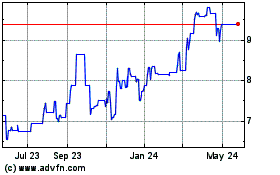

ENEOS (PK) (USOTC:JXHLY)

Historical Stock Chart

From Mar 2024 to Mar 2025