- Current report filing (8-K)

January 06 2009 - 4:12PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of the Securities and Exchange Act of 1934

Date of

Report (Date of earliest reported): December 30, 2008

KESSELRING HOLDING CORPORATION

(Exact

name of registrant as specified in charter)

|

Delaware

|

000-52375

|

20-4838580

|

|

(State or Other Jurisdiction

of Incorporation or Organization)

|

(Commission

File Number)

|

(IRS

Employer Identification

No.)

|

1956 Main

Street, Sarasota, Florida, Florida 34236

(Address

of principal executive offices) (Zip Code)

Registrant's

telephone number, including area code: (941) 953-5774

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

[ ]

Written communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

[ ]

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

[ ]

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b))

[ ]

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4(c))

Item

1.01 Entry

Into a Material Definitive Agreement

On

December 30, 2008, Kesselring Holding Corporation (the “Company”) entered into

an Agreement with Vision Opportunity Master Fund, Ltd. (“Vision”) pursuant to

which Vision agreed to return for cancellation 2,467,348 shares of common stock

of the Company and 1,000,000 shares of preferred stock of the Company, waive all

rights and penalties under that certain Registration Rights Agreement entered by

and between the Company and Vision in May 2007 (the “Vision Registration

Agreement”), terminate the Vision Registration Agreement and amend its right to

participate in future financings providing that such right shall terminate in

December 2010 in consideration of the payment of $100. In addition,

the Company agreed to amend that certain Class A Common Stock Purchase Warrant

to purchase 3,091,959 shares of common stock to reduce the exercise price to

$.01 per share and that certain Class J Common Stock Purchase Warrant to

purchase 3,091,959 shares of common stock to provide a termination date of

December 31, 2012.

Item

4.01 Change

in Registrants Certifying Accountant

On

January 5, 2009 (the “Resignation Date”), Lougheed & Company LLC (the

“Former Auditor”) advised the Company that it is withdrawing for reelection or

reappointment to serve as the Company’s independent registered public accounting

firm. Except as noted in the paragraph immediately below, the reports

of the Former Auditor on the Company’s consolidated financial statements for the

years ended September 30, 2008 and 2007 did not contain an adverse opinion or

disclaimer of opinion, and such reports were not qualified or modified as to

uncertainty, audit scope, or accounting principle.

The

reports of the Former Auditor on the Company’s consolidated financial statements

as of and for the years ended September 30, 2008 and 2007, contained an

explanatory paragraph which noted that there was substantial doubt as to the

Company’s ability to continue as a going concern as the Company had recurring

losses and management does not believe that working capital is sufficient to

maintain operations at their current levels.

During

the years ended September 30, 2008 and 2007, and through the Resignation Date,

the Company has not had any disagreements with the Former Auditor on any matter

of accounting principles or practices, financial statement disclosure or

auditing scope or procedure, which disagreements, if not resolved to the Former

Auditor’s satisfaction, would have caused them to make reference thereto in

their reports on the Company’s consolidated financial statements for such

years.

During

the years ended September 30, 2008 and 2007, and through the Dismissal Date,

there were no reportable events, as defined in Item 304(a)(1)(v) of

Regulation S-K.

The

Company has requested that Former Auditor furnish it with a letter addressed to

the Securities and Exchange Commission stating whether it agrees with the above

statements. A copy of this letter is attached hereto to this

amendment to the Form 8K as Exhibit 16.1.

Item

9.01

Financial Statements and Exhibits

|

(a)

|

Financial

statements of businesses acquired.

|

Not

applicable

|

(b)

|

Pro

forma financial information.

|

Not

applicable

|

(c)

|

Shell company

transactions.

|

Not

applicable

(d)

Exhibits

|

Exhibit

No.

|

Description

of Exhibit

|

|

|

|

|

10.1

|

Agreement

between Kesslering Holding Corporation and Vision Opportunity Master Fund,

Ltd. dated December 30, 2008

|

|

|

|

|

10.2

|

Amendment

to the Class A Common Stock Purchase Warrant

|

|

|

|

|

10.3

|

Amendment

to the Class J Common Stock Purchase Warrant

|

|

|

|

|

16.1

|

Letter

from Lougheed &

Company

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has

duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

|

KESSELRING HOLDING

CORPORATION

|

|

|

|

|

|

|

|

Date:

January 6, 2009

|

By:

|

/s/ Kenneth

Craig

|

|

|

|

|

Name:

Kenneth Craig

|

|

|

|

|

Title:

CEO

|

|

|

|

|

|

|

3

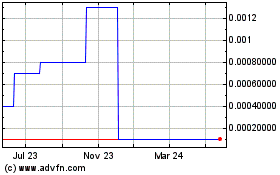

Kingfish (CE) (USOTC:KSSH)

Historical Stock Chart

From Jun 2024 to Jul 2024

Kingfish (CE) (USOTC:KSSH)

Historical Stock Chart

From Jul 2023 to Jul 2024