UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q /A

Amendment #1

[X] QUARTERLY REPORT UNDER TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

FOR THE QUARTERLY PERIOD ENDED

JUNE 30, 2009

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR

15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number

000-53665

AM OIL RESOURCES & TECHNOLOGY

INC.

(Exact name of registrant as specified in its

charter)

NEVADA

(State or other jurisdiction

of incorporation or organization)

27240 Turnberry Lane, Suite 200

Valencia,

California 91355

(Address of principal executive offices,

including zip code.)

800-646-6570

(Registrant’s telephone

number, including area code)

Check whether the issuer (1) filed all reports required to be

filed by Section 13 or 15(d) of the Exchange Act during the past 12 months

(or for such shorter period that the registrant was required to file such

reports), and (2) has been subject to such filing requirements for the last

90 days.

YES [X] NO [ ]

Indicate by check mark whether the registrant is a large

accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,

“accelerated filer,” “non-accelerated filer,” and “smaller reporting

company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated Filer

[ ]

|

Accelerated

Filer

[ ]

|

|

Non-accelerated Filer

[ ]

|

Smaller Reporting Company

[X]

|

Indicate by check mark whether the registrant is a shell company

(as defined in Rule 12b-2 of the Exchange Act).

YES [X] NO

[ ]

State the number of shares outstanding of each of the issuer’s

classes of common equity, as of the latest practicable date: 41,400,000 as

of August 14, 2009.

10-Q - AM OIL RESOURCES & TECHNOLOGY INC. FORM 10-Q FOR

JUNE 30, 2009

PART I

PART II.

PART I – FINANCIAL INFORMATION

ITEM

1. FINANCIAL

STATEMENTS

AM Oil Resources & Technology Inc.

(Formerly Aventerra

Explorations Inc.)

(An Exploration Stage Company)

June 30, 2009

Amendment Explanation: On November 17, 2009, it was

determined that patents which were to be transferred to the Company by a Vendor

had expired for failure to pay maintenance fees by the holder of the patents,

thus leaving the patents open to the public domain. It was determined that US

Patent No. 5979549 expired for failure to pay a maintenance fee on November 11,

2007 and US Patent No. 6129148 expired for failure to pay a maintenance fee on

October 10, 2008. The Company did not have good and marketable title to these

assets. The Vendor did not own and failed to assign the patents to the Company,

being US Patent No. 5979549 and US Patent No. 6129148. As a result, the Vendor

did not have clear title to convey ownership of the patents. Consequently, the

Company never received title to these patents and due to the breach by the

Vendor, the Company was never obligated to pay the $500,000 or issue the

30,000,000 shares pursuant to an agreement with the Vendor. The shares and the

debt were cancelled by the Company and no payments the Company were made

pursuant to the agreement.

Because the Company never received title, the Company

determined that it never owned the assets, which resulted in an error in the

first two quarters of 2009. As a result, this quarterly reports on Form 10-Q is

being amended and restated to remove the patent asset and related debt. In

addition, the cancellation of common stock issued in connection with this

transaction was reflected in the amended quarterly filings.

AM Oil Resources & Technology Inc.

(Formerly Aventerra

Explorations Inc.)

(An Exploration Stage Company)

Consolidated Balance

Sheets

(unaudited)

|

|

|

June 30,

|

|

|

December 31,

|

|

|

|

|

2009

|

|

|

2008

|

|

|

|

|

(Restated)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

$

|

187

|

|

$

|

9,791

|

|

|

|

|

|

|

|

|

|

|

Prepaid expenses

|

|

2,000

|

|

|

–

|

|

|

|

|

|

|

|

|

|

|

Total Assets

|

$

|

2,187

|

|

$

|

9,791

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ DEFICIT

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Liabilities

|

|

|

|

|

|

|

|

Accounts payable

|

|

91,613

|

|

|

47,701

|

|

|

Accounts payable– related

party

|

|

1,994

|

|

|

-

|

|

|

Accrued liabilities

|

|

5,295

|

|

|

3,875

|

|

|

|

|

|

|

|

|

|

|

Total Current

Liabilities

|

|

98,902

|

|

|

51,576

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ (Deficit)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred Stock, 100,000,000 shares

authorized, $0.00001 par value,

No shares issued and outstanding

|

|

–

|

|

|

–

|

|

|

|

|

|

|

|

|

|

Common Stock, 150,000,000 shares

authorized, $0.00001 par value,

41,400,000 and 98,900,000 shares

issued and outstanding

|

|

414

|

|

|

989

|

|

|

|

|

|

|

|

|

|

|

Additional Paid-in Capital

|

|

36,086

|

|

|

50,511

|

|

|

|

|

|

|

|

|

|

|

Deficit Accumulated During the Exploration Stage

|

|

(133,215

|

)

|

|

(93,285

|

)

|

|

|

|

|

|

|

|

|

|

Total Stockholders’ Deficit

|

|

(96,715

|

)

|

|

(41,785

|

)

|

|

|

|

|

|

|

|

|

|

Total Liabilities and Stockholders’ Deficit

|

$

|

2,187

|

|

$

|

9,791

|

|

(The accompanying notes are an integral part of these

consolidated unaudited financial statements)

F-1

AM Oil Resources & Technology Inc.

(Formerly Aventerra

Explorations Inc.)

(An Exploration Stage Company)

Consolidated

Statements of Expenses

(unaudited)

|

|

|

|

|

|

|

|

|

Six months ended June 30,

|

|

|

Period from

|

|

|

|

|

Three months ended June 30,

|

|

|

|

|

|

|

|

|

February 27, 2007

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Inception)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To June 30,

|

|

|

|

|

2009

|

|

|

2008

|

|

|

2009

|

|

|

2008

|

|

|

2009

|

|

|

|

|

(Restated)

|

|

|

|

|

|

(Restated)

|

|

|

|

|

|

(Restated)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and Administrative

|

$

|

16,187

|

|

$

|

–

|

|

$

|

31,002

|

|

$

|

–

|

|

$

|

36,977

|

|

|

Management fees

|

|

9,000

|

|

|

–

|

|

|

9,000

|

|

|

–

|

|

|

9,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total costs and expenses

|

|

(25,187

|

)

|

|

–

|

|

|

(40,002

|

)

|

|

–

|

|

|

(45,977

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency exchange gain

|

|

–

|

|

|

–

|

|

|

72

|

|

|

–

|

|

|

72

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss Before Discontinued Operations

|

|

(25,187

|

)

|

|

(16,887

|

)

|

|

(39,930

|

)

|

|

(28,994

|

)

|

|

(45,905

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from discontinued operations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discontinued operations

|

|

–

|

|

|

(16,887

|

)

|

|

–

|

|

|

(28,994

|

)

|

|

(87,310

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss

|

$

|

(25,187

|

)

|

$

|

(16,887

|

)

|

$

|

(39,930

|

)

|

$

|

(28,994

|

)

|

$

|

(133,215

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss Per Common Share

– Basic and Diluted:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discontinued Operations

|

|

N/A

|

|

$

|

( 0.00

|

)

|

|

N/A

|

|

$

|

( 0.00

|

)

|

|

|

|

|

Net Loss

|

$

|

(0.00

|

)

|

$

|

( 0.00

|

)

|

$

|

( 0.00

|

)

|

$

|

( 0.00

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Common Shares

Outstanding– Basic and Diluted

|

|

41,400,000

|

|

|

8,600,000

|

|

|

58,237,000

|

|

|

8,600,000

|

|

|

|

|

(The accompanying notes are an integral part of these

consolidated unaudited financial statements)

F-2

AM Oil Resources & Technology Inc.

(Formerly Aventerra

Explorations Inc.)

(An Exploration Stage Company)

Consolidated

Statements of Cash Flows

(unaudited)

|

|

|

|

|

|

|

|

|

Period from

|

|

|

|

|

|

|

|

|

|

|

February 27,

|

|

|

|

|

Six months ended June 30,

|

|

|

2007

|

|

|

|

|

|

|

|

|

|

|

(Date of

|

|

|

|

|

|

|

|

|

|

|

Inception)

|

|

|

|

|

|

|

|

|

|

|

To June 30,

|

|

|

|

|

2009

|

|

|

2008

|

|

|

2009

|

|

|

|

|

(Restated)

|

|

|

|

|

|

(Restated)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Activities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

$

|

(39,930

|

)

|

$

|

(28,994

|

)

|

$

|

(133,215

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustment to reconcile net loss

to cash used in operating activities:

|

|

|

|

|

|

|

|

|

|

|

Donated services and expenses

|

|

–

|

|

|

3,000

|

|

|

10,500

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

|

Prepaid expenses

|

|

(2,000

|

)

|

|

(1,224

|

)

|

|

(2,000

|

)

|

|

Account payable

|

|

28,912

|

|

|

10,626

|

|

|

53,803

|

|

|

Accrued liabilities

|

|

1,420

|

|

|

1,767

|

|

|

5,295

|

|

|

Due to related party

|

|

1,994

|

|

|

–

|

|

|

1,994

|

|

|

Net Cash Used in Operating Activities

|

|

(9,604

|

)

|

|

(14,825

|

)

|

|

(63,623

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

Financing Activities

|

|

|

|

|

|

|

|

|

|

|

Issuance of common stock

|

|

–

|

|

|

–

|

|

|

41,000

|

|

|

Due to related party

|

|

–

|

|

|

–

|

|

|

22,810

|

|

|

Net Cash Provided by Financing Activities

|

|

–

|

|

|

–

|

|

|

63,810

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase (Decrease) in Cash

|

|

(9,604

|

)

|

|

(14,825

|

)

|

|

187

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

– Beginning of Period

|

|

9,791

|

|

|

30,841

|

|

|

–

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

– End of Period

|

$

|

187

|

|

$

|

16,016

|

|

$

|

187

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental Disclosures

|

|

|

|

|

|

|

|

|

|

|

Interest paid

|

|

–

|

|

|

–

|

|

|

–

|

|

|

Income taxes paid

|

|

–

|

|

|

–

|

|

|

–

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-Cash Disclosures

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reclass of related party debt to accounts payable

|

$

|

–

|

|

$

|

–

|

|

$

|

22,810

|

|

|

Repurchase of common stock

|

$

|

15,000

|

|

$

|

–

|

|

$

|

15,000

|

|

(The accompanying notes are an integral part of these

consolidated unaudited financial statements)

F-3

AM Oil Resources & Technology Inc.

(Formerly Aventerra

Explorations Inc.)

(An Exploration Stage Company)

Notes to the

Consolidated Statements of Cash Flows

|

1.

|

Basis of Presentation

|

|

|

|

|

|

The accompanying unaudited interim financial statements

of AM Oil Resources & Technology, Inc. (the “Company”) have been

prepared in accordance with accounting principles generally accepted in

the United States of America and the rules of the Securities and Exchange

Commission (“SEC”), and should be read in conjunction with the audited

financial statements and notes thereto contained in the Company’s December

31, 2008 Annual Report filed with the SEC on Form 10-K. In the opinion of

management, all adjustments, consisting of normal recurring adjustments,

necessary for a fair presentation of financial position and the results of

operations for the interim periods presented have been reflected herein.

The results of operations for interim periods are not necessarily

indicative of the results to be expected for the full year. Notes to the

financial statements which would substantially duplicate the disclosure

contained in the audited financial statements for the most recent fiscal

year end December 31, 2008 as reported on Form 10-K, have been

omitted.

|

|

|

|

|

|

Reclassifications

|

|

|

|

|

|

Certain prior year amounts have been reclassified to

conform with the current year presentation.

|

|

|

|

|

|

Recently Issued Accounting

Pronouncements

|

|

|

|

|

|

The company does not expect the adoption of recently

issued accounting pronouncements to have a significant impact on its

results of operations, financial position or cash flows.

|

|

|

|

|

|

Effective this quarter, the Company implemented

Accounting Standard Codification (ASC) 855 Subsequent Events (“ASC855”).

This standard establishes general standards of accounting for and

disclosure of events that occur after the balance sheet date but before

financial statements are issued. The adoption of ASC 855 did not impact

the Company’s financial position or results of operations. The Company

evaluated all events or transactions that occurred after June 30, 2009 up

through August 14, 2009, the date the Company issued these financial

statements. During this period, the Company did not have any material

recognizable subsequent events.

|

|

|

|

|

2.

|

Going Concern

|

|

|

|

|

|

These consolidated financial statements have been

prepared on a going concern basis, which implies the Company will continue

to realize its assets and discharge its liabilities in the normal course

of business. The Company has not generated revenues since inception and

has never paid any dividends and is unlikely to pay dividends or generate

earnings in the immediate or foreseeable future. The continuation of the

Company as a going concern is dependent upon the continued financial

support from its shareholders, the ability of the Company to obtain

necessary equity financing to continue operations and to determine the

existence, discovery and successful exploitation of economically

recoverable reserves in its resource properties, confirmation of the

Company’s interests in the underlying properties, and the attainment of

profitable operations. As at June 30, 2009, the Company has working

deficit and an accumulated deficit. These consolidated financial

statements do not include any adjustments to the recoverability and

classification of recorded asset amounts and classification of liabilities

that might be necessary should the Company be unable to continue as a

going concern. These factors raise substantial doubt regarding the

Company’s ability to continue as a going concern.

|

F-4

|

3.

|

Restatement

|

|

|

|

|

|

On November 25, 2008, we entered into a preliminary Asset

Purchase Agreement (the “Agreement”) with AM Oil Resources &

Technology Inc., (the “Vendor”), an unrelated company prior to the

purchase of the patents, to acquire two patents for technologies that

maximize oil production from existing oil wells. This Agreement was

finalized on March 11, 2009. Pursuant to the Agreement, we recognized the

acquisition of the two patents in exchange for $500,000, in the form of a

payable, and 30,000,000 shares of common stock. The patents covered

certain oil and gas recovery enhancement techniques and were to expire in

2020.

|

|

|

|

|

|

Because our stock is not actively traded, the patents

were valued using a discounted future cash flow model, which was based on

management’s projections of future cash flows generated from the sale,

license or other arrangement involving these patents. Based on the model,

the patents were valued at $5,100,000 and were being amortized using the

straight-line method over the life of the patents. The present value of

the non-interest bearing $500,000 payable was recorded and the difference

between the discounted rate and the face value was being accreted into

interest expense over the life of the liability. Consequently we recorded

a discount of $76,795 relating to the payable.

|

|

|

|

|

|

During the quarter ended September 30, 2009, we

discovered that the patents expired prior to the Agreement because certain

maintenance fees were not kept current by the Vendor. As a result, the

Vendor did not have clear title to convey ownership of the patents.

Consequently, we never received title to these patents and due to the

breach by the Vendor, we were never obligated to pay the $500,000 or issue

the 30,000,000 shares pursuant to the Agreement. The shares and the debt

were cancelled by the company and no payments were made pursuant to the

Agreement.

|

|

|

|

|

|

Based on our findings, we never owned the patents and

recording this transaction in the first quarter was in error. As a result,

we are restating the June 30, 2009 financial statements filed on Form 10-Q

to correct this error in those prior periods. The effect of the

restatement is to derecognize the patent asset and related liability, as

well as cancel the 30,000,000 shares issued under the Agreement.

|

|

|

|

|

|

The following tables illustrate the effects of the

restatement on the June 30, 2009 financial

statements:

|

|

|

Statement of Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six

months ended June 30, 2009

|

|

|

|

|

|

As Reported

|

|

|

Adjustments

|

|

|

As Restated

|

|

|

|

Costs and Expenses

|

|

|

|

|

|

|

|

|

|

|

|

Amortization

|

$

|

148,750

|

|

$

|

(148,750

|

)

|

$

|

–

|

|

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

20,243

|

|

|

(20,243

|

)

|

|

–

|

|

|

|

Net loss

|

$

|

(208,923

|

)

|

$

|

168,993

|

|

$

|

(39,930

|

)

|

|

|

Net Loss per Common Share – Basic and Diluted

|

$

|

(0.00

|

)

|

$

|

(0.01

|

)

|

$

|

(0.00

|

)

|

|

|

Weighted average common shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted

|

|

79,452,000

|

|

|

(21,215,000

|

)

|

|

58,237,000

|

|

|

|

Statement of Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three

months ended June 30, 2009

|

|

|

|

|

|

As Reported

|

|

|

Adjustments

|

|

|

As Restated

|

|

|

|

Costs and Expenses

|

|

|

|

|

|

|

|

|

|

|

|

Amortization

|

$

|

127,500

|

|

$

|

(127,500

|

)

|

$

|

–

|

|

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

18,541

|

|

|

(18,541

|

)

|

|

–

|

|

|

|

Net loss

|

$

|

(171,228

|

)

|

$

|

(146,041

|

)

|

$

|

(25,187

|

)

|

|

|

Net Loss per Share – Basic and Diluted

|

$

|

(0.00

|

)

|

$

|

(0.00

|

)

|

$

|

(0.00

|

)

|

|

|

Weighted average common shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted

|

|

71,400,000

|

|

|

(30,000,000

|

)

|

|

41,400,000

|

|

|

|

Statement of Cash Flows

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six

months ended June 30, 2009

|

|

|

|

|

|

As Reported

|

|

|

Adjustments

|

|

|

As Restated

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Activities

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss

|

$

|

(208,923

|

)

|

$

|

168,993

|

|

$

|

39,930

|

|

|

|

Accretion of discount on promissory note

|

|

20,243

|

|

|

(20,243

|

)

|

|

–

|

|

|

|

Amortization

|

|

148,750

|

|

|

(148,750

|

)

|

|

–

|

|

|

|

Net Cash Used in Operating Activities

|

$

|

(9,604

|

)

|

$

|

–

|

|

$

|

(9,604

|

)

|

|

|

Balance Sheet

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June

30, 2009

|

|

|

|

|

|

|

|

|

Current Year

|

|

|

|

|

|

|

|

|

As Reported

|

|

|

Adjustments

|

|

|

As Restated

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

Intangible

assets

|

$

|

4,951,250

|

|

$

|

(4,951,250

|

)

|

$

|

–

|

|

|

|

Total assets

|

$

|

4,953,437

|

|

$

|

(4,951,250

|

)

|

$

|

2,187

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

Note payable

|

$

|

443,448

|

|

$

|

(443,448

|

)

|

$

|

–

|

|

|

|

Total liabilities

|

|

542,350

|

|

|

(443,448

|

)

|

|

98,902

|

|

|

|

Stockholders’ equity

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock

|

|

714

|

|

|

(300

|

)

|

|

414

|

|

|

|

Additional Paid-In Capital

|

|

4,712,581

|

|

|

(4,676,495

|

)

|

|

36,086

|

|

|

|

Retained earnings (deficit)

|

|

(302,208

|

)

|

|

168,993

|

|

|

(133,215

|

)

|

|

|

Total stockholders’

deficit

|

|

4,411,087

|

|

|

(4,507,802

|

)

|

|

96,715

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders’

equity

|

$

|

4,953,437

|

|

$

|

(4,951,250

|

)

|

$

|

2,187

|

|

F-5

|

4.

|

Related Party Transactions

|

|

|

|

|

|

|

a)

|

At June 30, 2009 and December 31, 2008, the Company is

indebted to a director of the Company for $1,994 and $nil, respectively,

representing expenditures paid on behalf of the Company.

|

|

|

|

|

|

|

b)

|

During the six month period ended June 30, 2009 and 2008,

the Company recognized $nil and $3,000, respectively, for management

services at $500 per month provided by the former President of the

Company. These services were terminated in November 2008.

|

|

|

|

|

|

|

c)

|

At June 30, 2009 and December 31, 2008, the Company is

indebted to a former director of the Company for $23,445 and $22,810,

respectively, representing expenditures paid on behalf of the Company. The

former director resigned as director and officer on November 25, 2008, and

amounts due to the former director were reclassified to accounts

payable.

|

|

|

|

|

|

|

d)

|

On February 22, 2009, 57,500,000 shares of common stock

were cancelled and returned to treasury by the former President of the

Company in consideration for $15,000. As at June 30, 2009, the amount is

include in accounts payable.

|

|

5.

|

Common Stock

|

|

|

|

|

|

|

a)

|

The preferred stock may be divided into and issued in

series by the Board of Directors. The Board is authorized to fix and

determine the designations, rights, qualifications, preferences,

limitations and terms, within legal limitations. As of June 30, 2009 and

December 31, 2008, there was no preferred stock issued and

outstanding.

|

|

|

|

|

|

|

b)

|

On February 18, 2009, the Company reduced the authorized

shares of common stock from 1,150,000,000 shares of common stock with a

par value of $0.00001 per share to 150,000,000 shares of common stock with

a par value of $0.00001 per share. The authorized shares of preferred

stock will remain unchanged.

|

|

|

|

|

|

|

c)

|

On February 22, 2009, 57,500,000 shares of common stock

were cancelled and returned to treasury by the former President of the

Company in consideration for $15,000. As at June 30, 2009, the amount is

include in accounts payable.

|

|

6.

|

Discontinued Operations

|

|

|

|

|

|

During 2008, the Company abandoned further activity

related to its mineral exploration business. As a result, the financial

information in prior periods related to the mineral exploration business

has been presented as discontinued operations.

|

|

|

|

|

|

The results of discontinued operations are summarized as

follows:

|

|

|

|

|

|

|

|

|

|

|

Period from

|

|

|

|

|

|

For the

|

|

|

For the

|

|

|

February 27,

|

|

|

|

|

|

Three months

|

|

|

Six Months

|

|

|

2007

|

|

|

|

|

|

Ended

|

|

|

Ended

|

|

|

(Inception)

|

|

|

|

|

|

June 30,

|

|

|

June 30,

|

|

|

To June 30,

|

|

|

|

|

|

2008

|

|

|

2008

|

|

|

2009

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative

|

$

|

2,163

|

|

$

|

5,736

|

|

$

|

20,041

|

|

|

|

Mineral property costs

|

|

–

|

|

|

|

|

|

16,000

|

|

|

|

Professional fees

|

|

14,724

|

|

|

23,258

|

|

|

51,269

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss from Discontinued Operations

|

$

|

(16,887

|

)

|

$

|

(28,994

|

)

|

$

|

(87,310

|

)

|

F-6

ITEM

2.

MANAGEMENT'S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION.

This section of the report includes a number of forward-looking

statements that reflect our current views with respect to future events and

financial performance. Forward-looking statements are often identified by words

like: believe, expect, estimate, anticipate, intend, project and similar

expressions, or words which, by their nature, refer to future events. You should

not place undue certainty on these forward-looking statements, which apply only

as of the date of this report. These forward-looking statements are subject to

certain risks and uncertainties that could cause actual results to differ

materially from historical results or our predictions.

We are a start-up, development stage corporation and have not

yet generated or realized any revenues from our business activities.

These financials have been prepared on a going concern basis.

This means that there is substantial doubt that we can continue as an on-going

business for the next twelve months unless we generate revenues. We currently do

not have sufficient capital to maintain operations for the next twelve months.

Liquidity and Capital Resources

The accompanying financial statements have been prepared on a

going concern basis, which implies the Company will continue to realize its

assets and discharge its liabilities in the normal course of business. We have

not generated any revenues and we do not anticipate to generate revenues until

we begin selling, marketing and implementing our technology. Accordingly, we

must raise cash from sources other than the sale of equipment or by developing

strategic alliances with other oil and gas producers. Our only other source for

cash at this time is investment in our private placement. The cash we raise will

allow us to stay in business for at least one year. Our success or failure will

be determined by creating alliances with oil and gas producers who need our

technology.

We issued 57,500,000 shares of common stock through a private

placement pursuant to Regulation S of the Securities Act of 1933 to Patricia

Traczykowski, one of our two officers and directors at that time, in

consideration of $5,000. Ms. Traczykowski was a non-US person and the

transaction took place outside the United States of America. This was accounted

for as a purchase of shares of common stock.

In December 28, 2007, we completed a private placement of

41,400,000 restricted shares of common stock pursuant to Reg. S of the

Securities Act of 1933 and raised $36,000. All of the shares were sold to non-US

persons and all transactions closed outside the United States of America. This

was accounted for as a purchase of shares of common stock.

Results of Operations

As of June 30, 2009, our total assets were $2,187 and our total

liabilities were $98,902. Total assets decreased from December 31, 2008 by

$7,604 and total liabilities increased from by $47,326. This is mainly due to

the independent patent valuation. Because the Company’s stock is not actively

traded, the patents were valued using a discounted future cash flow model, which

was based on management’s projections of future cash flows generated from the

sale, license or other arrangement involving these patents.

We have no revenues in the periods ended June 30, 2009 and

2008. In the six month periods ended June, 2009 and 2008, we incurred net losses

of $39,930 and $28,994. From February 27, 2007 (inception date) to June 30, 2009

we incurred a net loss of $133,215. Overall, operating expenses increased due to

an increase in professional fees related to legal and accounting fees. These

expenses were offset by a decrease in mineral property costs due to the

Company’s decision to temporarily discontinue pursuing mineral properties

research and development.

Limited Capital

We intend to use our limited cash to pay for our minimal

operations and legal, accounting and professional services required to prepare

and file our reports with the SEC. Our remaining cash, however, will only be

sufficient to sustain us for the short-term. If we are unable to locate

additional financing within the short-term, we will be forced to suspend all

public reporting with the SEC and possibly liquidate. Furthermore, our ability

to execute on these business objectives may be subject to material doubt as our

management team will likely be limited to one part-time individual who will have

minimal cash resources to support operations for more than the short-term.

Business

Our

business is to use, sell and produce our patent and patent pending technologies,

providing an environmentally safe and cost-effective method that maximizes oil

production from existing oil wells. Marketing this technology strategically

allows us to benefit from worldwide demand for oil, resulting in significant

growth in both revenues and profits for the company. Our goal is to provide

solutions to help minimize U.S. dependence on foreign oil; thus providing

innovative solutions to the world that will recover dormant lying crude oil in

reserves all around the world.

Our

patented technology is characterized as a portable steam generator unit or

apparatus. The unit is equipped with a drumless boiler, water softener system,

diesel powered electric generator, high pressure pump, low emission 5-25 million

BTU per hour burner, computerized control panel and hot water generator system.

The unit is capable of delivering hot water and steam at temperatures of up to

500º F to well depths of 2,500 feet or less. The system is powered by variable

fuels to heat water pumped from a groundwater aquifer. The complete system has

the ability to deliver variable water temperature, pressure and volume to meet a

wide variety of recovery applications.

The American Society of Mechanical Engineers (“ASME”) has

certified that the innovative boiler design is built in full conformity with

their current standards relating to the production of steam boilers and/or

generators.

This

technology is designed to stimulate marginally producing stripper oil wells to

profitable production levels and to maintain them producing profitably. This

complete process is designed to reduce the viscosity of the oil in the reservoir

with heat, in the form of steam. This methodology allows the reservoir oil to

flow more readily to the surface, which will enhance the oil production process.

Trends

Crude oil development and production in U.S. oil reservoirs can

include up to three distinct phases: primary, secondary, and tertiary (or

enhanced) recovery. During primary recovery, the natural pressure of the

reservoir or gravity drive oil into the wellbore combined with artificial lift

techniques (such as pumps) which bring the oil to the surface. But only about 10

percent of a reservoir's original oil in place is typically produced during

primary recovery. Secondary recovery techniques are employed to extend the

field's productive life, generally by injecting water or gas to displace oil and

drive it to a production wellbore, resulting in the recovery of 20 to 40 percent

of the original oil in place.

However, with much of the easy-to-produce oil already recovered

from U.S. oil fields, producers have attempted several tertiary, or enhanced oil

recovery (EOR), techniques that offer prospects for ultimately producing 30 to

60 percent, or more, of the reservoir's original oil in place.

Three major categories of EOR have been found to be

commercially successful to varying degrees:

|

1.

|

Thermal recovery, which involves the introduction of heat

such as the injection of steam to lower the viscosity, or thin, the heavy

viscous oil, and improve its ability to flow through the reservoir.

Thermal techniques account for over 50 percent of U.S. EOR production,

primarily in California.

|

|

|

|

|

2.

|

Gas injection, which uses gases such as natural gas,

nitrogen, or carbon dioxide that expand in a reservoir to push additional

oil to a production wellbore, or other gases that dissolve in the oil to

lower its viscosity and improves its flow rate. Gas injection accounts for

nearly 50 percent of EOR production in the United States.

|

|

|

|

|

3.

|

Chemical injection, which can involve the use of

long-chained molecules called polymers to increase the effectiveness of

waterfloods, or the use of detergent-like surfactants to help lower the

surface tension that often prevents oil droplets from moving through a

reservoir. Chemical techniques account for less than one percent of U.S.

EOR production.

|

Each of these techniques has been hampered by its relatively

high cost and, in some cases, by the unpredictability of its effectiveness.

Crude oil prices above $28.00 per barrel can sustain the implementation and

utilization of these recovery methodologies. According to the EIA (Energy

Information Administration) April 14, 2009; they project that crude oil prices

will average $42.00 per barrel in 2009 and $53.00 per barrel for 2010.

Therefore, the trend for enhanced recovery is optimistic in the short term.

Off-Balance Sheet Arrangements

We have

no off-balance sheet arrangements.

ITEM

3.

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

We are a smaller reporting company as defined by Rule 12b-2 of

the Securities Exchange Act of 1934 and are not required to provide the

information under this item.

ITEM

4.

CONTROLS AND PROCEDURES.

Under the supervision and with the participation of our

management, including the Principal Executive Officer and Principal Financial

Officer, we have evaluated the effectiveness of our disclosure controls and

procedures as required by Exchange Act Rule 13a-15(b) as of the end of the

period covered by this report. Based on that evaluation, the Principal Executive

Officer and Principal Financial Officer have concluded that these disclosure

controls and procedures are not effective.

There were no changes in our internal control over financial

reporting during the quarter ended June 30, 2009 that have materially affected,

or are reasonably likely to materially affect, our internal control over

financial reporting.

PART II. OTHER INFORMATION

ITEM 1A.

RISK FACTORS

We are a

smaller reporting company as defined by Rule 12b-2 of the Securities Exchange

Act of 1934 and are not required to provide the information under this item.

ITEM

5.

OTHER EVENTS

At

September 10, 2008, the Company effected a 11.5:1 forward stock split of the

authorized, and outstanding common stock. As a result, the authorized shares of

common stock increased from 100,000,000 shares of common stock with a par value

of $0.00001 per share to 1,150,000,000 shares of common stock with a par value

of $0.00001 per share. The issued and outstanding shares of common stock

increased from 8,600,000 shares to 98,900,000 shares. The information contained

in this report reflects the stock split.

On

November 25, 2008, the Company entered into an Asset Purchase Agreement (the

“Agreement”) with AM Oil Resources & Technology Inc., (the “Vendor”) to

acquire two patents for technologies that maximize oil production from existing

oil wells. The closing date of the Agreement was December 22, 2008.

In consideration for the acquisition of the patents, the

Company shall:

|

|

ii)

|

issue 30,000,000 restricted common stock to the

Vendor;

|

|

|

|

|

|

|

iii)

|

pay $500,000 to the Vendor within 60 days of signing the

Agreement and $500,000 in 3 equal instalments over three years;

|

|

|

|

|

|

|

iv)

|

pay a 5% royalty to the Vendor from the sale of every

unit sold domestically and internationally.

|

On February 18, 2009, the Company reduced the authorized shares

of common stock from 1,150,000,000 shares of common stock with a par value of

$0.00001 per share to 150,000,000 shares of common stock with a par value of

$0.00001 per share. The authorized shares of preferred stock will remain

unchanged.

On February 22, 2009, 57,500,000 shares of common stock were

cancelled and returned to treasury by the President of the Company.

On March 11, 2009, the Company amended the Agreement to reduce

the cash payment to the Vendor to $500,000 payable in 25 monthly payments of

$20,000 beginning April 30, 2009, and ending on April 30, 2011. Each monthly

payment is provided a 30 day grace period, though the total $500,000 must be

paid prior to April 30, 2011.

On July

20, 2009, Patricia Traczykowski was appointed to our board of directors and was

appointed our president, principal executive officer, treasurer, principal

financial officer and principal accounting officer.

On July

20, 2009 Keith Johnson resigned as our president, principal executive officer,

treasurer, principal financial officer, and principal accounting officer and as

a member of the board of directors. Further, on the same date, Greg Brown

resigned as a member of our board of directors.

From

February 27, 2007 to November 25, 2008, Ms. Traczykowski was our president,

principal executive officer, treasurer, principal financial officer and

principal accounting officer and a member of the board of directors.

Since

June 4, 2007, Ms. Traczykowski has been the sole officer and director of our

wholly owned subsidiary corporation, Aventerra Explorations Ltd., a corporation

organized under the laws of England. Since March 2007, Ms. Traczykowski has

operated her own consultancy company called Community Regeneration Consultancy,

which is focused on delivering economic development and regeneration projects in

London, England. Clients include London New Deal for Communities (NDC), Cheswold

Park Hospital, London Chamber of Commerce and London Primary Care Trust (NHS).

From June 2004 to February 2007, Ms. Traczykowski worked as the Project Manager

for the London Chamber of Commerce where she was responsible in assisting

certain disadvantaged communities raise their standards of living by

implementing sustainable economic programs. Prior to this position, Ms.

Traczykowski was a Personal Advisor to Reed in Partnership, which is a

government funded employment and enterprise project in London, England. From

November 2003 to June 2004 her role at Reed in Partnership was to assist parents

who are dependent on Social Income, and aid them back into sustainable

employment. Before this, Ms. Traczykowski worked as a Training Consultant with

Norwich Union, in London, England. From January 2002 to November 2003, she

worked at a Senior Staff level in charge of staff training and managing the

Business Learning Center.

Also on

July 20, 2009 the board of directors resolved that on May 22, 2009 Mr. Anthony

Miller’s appointment is -void as a matter of law since a quorum of the board was not present in

order to conduct business. As the Secretary and the President at that time did

not comply with Article II, Section 7 of our bylaws. Article II, Section 7 of

the bylaws requires a majority of the board to be present in order to constitute

a quorum of the board of directors. A majority of the board of directors were

not present.

ITEM

6.

EXHIBITS.

The

following documents are included herein:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of

1934, this report has been signed below by the following person on behalf of the

Registrant and in the capacities on the 9th day of April, 2010.

|

|

AM OIL RESOURCES & TECHNOLOGY INC.

|

|

|

|

|

|

|

|

|

|

|

BY:

|

NING C.

WU

|

|

|

|

Ning C. Wu,

|

|

|

|

President, Principal Executive Officer,

Principal Financial Officer, Principal Accounting Officer

and a member of the Board of Directors.

|

EXHIBIT INDEX

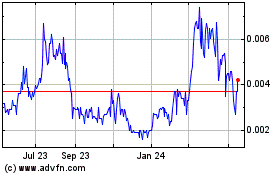

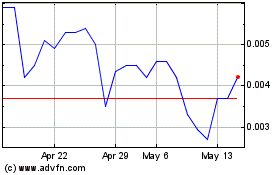

Medical Care Technologies (PK) (USOTC:MDCE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Medical Care Technologies (PK) (USOTC:MDCE)

Historical Stock Chart

From Jul 2023 to Jul 2024