0001599117

false

Q2

--12-31

0001599117

2023-01-01

2023-06-30

0001599117

2023-08-11

0001599117

2023-06-30

0001599117

2022-12-31

0001599117

2023-04-01

2023-06-30

0001599117

2022-04-01

2022-06-30

0001599117

2022-01-01

2022-06-30

0001599117

us-gaap:ServiceMember

2023-04-01

2023-06-30

0001599117

us-gaap:ServiceMember

2022-04-01

2022-06-30

0001599117

us-gaap:ServiceMember

2023-01-01

2023-06-30

0001599117

us-gaap:ServiceMember

2022-01-01

2022-06-30

0001599117

MNTR:FinanceLeaseRevenueMember

2023-04-01

2023-06-30

0001599117

MNTR:FinanceLeaseRevenueMember

2022-04-01

2022-06-30

0001599117

MNTR:FinanceLeaseRevenueMember

2023-01-01

2023-06-30

0001599117

MNTR:FinanceLeaseRevenueMember

2022-01-01

2022-06-30

0001599117

us-gaap:PreferredStockMember

2023-03-31

0001599117

us-gaap:CommonStockMember

2023-03-31

0001599117

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001599117

us-gaap:RetainedEarningsMember

2023-03-31

0001599117

us-gaap:ParentMember

2023-03-31

0001599117

us-gaap:NoncontrollingInterestMember

2023-03-31

0001599117

2023-03-31

0001599117

us-gaap:PreferredStockMember

2022-03-31

0001599117

us-gaap:CommonStockMember

2022-03-31

0001599117

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0001599117

us-gaap:RetainedEarningsMember

2022-03-31

0001599117

us-gaap:ParentMember

2022-03-31

0001599117

us-gaap:NoncontrollingInterestMember

2022-03-31

0001599117

2022-03-31

0001599117

us-gaap:PreferredStockMember

2022-12-31

0001599117

us-gaap:CommonStockMember

2022-12-31

0001599117

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001599117

us-gaap:RetainedEarningsMember

2022-12-31

0001599117

us-gaap:ParentMember

2022-12-31

0001599117

us-gaap:NoncontrollingInterestMember

2022-12-31

0001599117

us-gaap:PreferredStockMember

2021-12-31

0001599117

us-gaap:CommonStockMember

2021-12-31

0001599117

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001599117

us-gaap:RetainedEarningsMember

2021-12-31

0001599117

us-gaap:ParentMember

2021-12-31

0001599117

us-gaap:NoncontrollingInterestMember

2021-12-31

0001599117

2021-12-31

0001599117

us-gaap:PreferredStockMember

2023-04-01

2023-06-30

0001599117

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0001599117

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2023-06-30

0001599117

us-gaap:RetainedEarningsMember

2023-04-01

2023-06-30

0001599117

us-gaap:ParentMember

2023-04-01

2023-06-30

0001599117

us-gaap:NoncontrollingInterestMember

2023-04-01

2023-06-30

0001599117

us-gaap:PreferredStockMember

2022-04-01

2022-06-30

0001599117

us-gaap:CommonStockMember

2022-04-01

2022-06-30

0001599117

us-gaap:AdditionalPaidInCapitalMember

2022-04-01

2022-06-30

0001599117

us-gaap:RetainedEarningsMember

2022-04-01

2022-06-30

0001599117

us-gaap:ParentMember

2022-04-01

2022-06-30

0001599117

us-gaap:NoncontrollingInterestMember

2022-04-01

2022-06-30

0001599117

us-gaap:PreferredStockMember

2023-01-01

2023-06-30

0001599117

us-gaap:CommonStockMember

2023-01-01

2023-06-30

0001599117

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-06-30

0001599117

us-gaap:RetainedEarningsMember

2023-01-01

2023-06-30

0001599117

us-gaap:ParentMember

2023-01-01

2023-06-30

0001599117

us-gaap:NoncontrollingInterestMember

2023-01-01

2023-06-30

0001599117

us-gaap:PreferredStockMember

2022-01-01

2022-06-30

0001599117

us-gaap:CommonStockMember

2022-01-01

2022-06-30

0001599117

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-06-30

0001599117

us-gaap:RetainedEarningsMember

2022-01-01

2022-06-30

0001599117

us-gaap:ParentMember

2022-01-01

2022-06-30

0001599117

us-gaap:NoncontrollingInterestMember

2022-01-01

2022-06-30

0001599117

us-gaap:PreferredStockMember

2023-06-30

0001599117

us-gaap:CommonStockMember

2023-06-30

0001599117

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001599117

us-gaap:RetainedEarningsMember

2023-06-30

0001599117

us-gaap:ParentMember

2023-06-30

0001599117

us-gaap:NoncontrollingInterestMember

2023-06-30

0001599117

us-gaap:PreferredStockMember

2022-06-30

0001599117

us-gaap:CommonStockMember

2022-06-30

0001599117

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001599117

us-gaap:RetainedEarningsMember

2022-06-30

0001599117

us-gaap:ParentMember

2022-06-30

0001599117

us-gaap:NoncontrollingInterestMember

2022-06-30

0001599117

2022-06-30

0001599117

MNTR:WasteConsolidatorsIncMember

2023-06-30

0001599117

MNTR:MentorIPLLCMember

2023-06-30

0001599117

MNTR:GFarmaSettlorsMember

MNTR:SettlementAgreementAndMutualReleaseMember

2021-08-27

0001599117

MNTR:SettlementAgreementAndMutualReleaseMember

MNTR:GFarmaSettlorsMember

2022-08-31

0001599117

MNTR:SettlementAgreementAndMutualReleaseMember

MNTR:GFarmaSettlorsMember

2022-09-30

0001599117

MNTR:SettlementAgreementAndMutualReleaseMember

MNTR:GFarmaSettlorsMember

2022-10-31

0001599117

MNTR:GFarmaLabsLimitedMember

2022-01-01

2022-12-31

0001599117

MNTR:GFarmaLabsLimitedMember

2021-01-01

2021-12-31

0001599117

us-gaap:SubsequentEventMember

MNTR:GFarmaSettlorsMember

2023-07-11

2023-07-11

0001599117

MNTR:PuebloWestOrganicsLLCMember

2022-09-27

2022-09-27

0001599117

MNTR:MentorPartnerIILLCMember

us-gaap:ManufacturingFacilityMember

2018-02-08

0001599117

MNTR:MentorPartnerIILLCMember

2019-03-12

2019-03-12

0001599117

MNTR:SettlementAgreementMember

2022-11-18

2022-11-18

0001599117

MNTR:RecoveryPurchaseAgreementMember

MNTR:ElectrumPartnersLLCMember

2022-11-18

0001599117

MNTR:CapitalAgreementMember

MNTR:ElectrumPartnersLLCMember

2022-11-18

0001599117

MNTR:ElectrumPartnersLLCMember

2022-11-18

0001599117

MNTR:ElectrumPartnersLLCMember

MNTR:SecondSecuredCapitalAgreementMember

2019-01-28

0001599117

MNTR:ElectrumPartnersLLCMember

2022-11-18

2022-11-18

0001599117

MNTR:NeuCourtIncMember

2018-12-01

2018-12-21

0001599117

MNTR:NeuCourtIncMember

2023-01-01

2023-06-30

0001599117

MNTR:SeriesDWarrantsMember

2023-06-30

0001599117

2022-01-01

2022-12-31

0001599117

2022-02-15

2022-02-15

0001599117

MNTR:SimpleAgreementForFutureEquitySAFEMember

2023-06-30

0001599117

MNTR:SimpleAgreementForFutureEquitySAFEMember

2022-12-31

0001599117

us-gaap:ComputerEquipmentMember

srt:MinimumMember

2023-06-30

0001599117

us-gaap:ComputerEquipmentMember

srt:MaximumMember

2023-06-30

0001599117

us-gaap:FurnitureAndFixturesMember

2023-06-30

0001599117

us-gaap:VehiclesMember

srt:MinimumMember

2023-06-30

0001599117

us-gaap:VehiclesMember

srt:MaximumMember

2023-06-30

0001599117

MNTR:WasteConsolidatorsIncMember

2014-01-01

0001599117

MNTR:WasteConsolidatorsIncMember

1999-12-31

0001599117

MNTR:ExchangeAgreementMember

2015-04-10

2015-04-10

0001599117

MNTR:ExchangeAgreementMember

MNTR:SeriesDWarrantsMember

2015-04-10

0001599117

MNTR:ExchangeAgreementMember

2021-12-31

0001599117

2021-01-01

2021-12-31

0001599117

MNTR:ExchangeAgreementMember

2022-02-16

0001599117

MNTR:ExchangeAgreementMember

2022-02-16

2022-02-16

0001599117

MNTR:ExchangeAgreementMember

2022-01-01

2022-06-30

0001599117

2023-01-10

0001599117

MNTR:WasteConsolidatorsIncMember

2022-12-31

0001599117

MNTR:WasteConsolidatorsIncMember

2023-01-01

2023-06-30

0001599117

MNTR:WasteConsolidatorsIncMember

2023-06-30

0001599117

srt:MaximumMember

2022-01-01

2022-12-31

0001599117

srt:MaximumMember

2022-12-31

0001599117

MNTR:VehicleFleetMember

2023-06-30

0001599117

MNTR:VehicleFleetMember

2022-12-31

0001599117

MNTR:OperatingAgreementsMember

2023-04-01

2023-06-30

0001599117

MNTR:OperatingAgreementsMember

2022-04-01

2022-06-30

0001599117

MNTR:OperatingAgreementsMember

2023-01-01

2023-06-30

0001599117

MNTR:OperatingAgreementsMember

2022-01-01

2022-06-30

0001599117

MNTR:ConvertibleNotesReceivableOneMember

MNTR:NeuCourtIncMember

2017-11-22

0001599117

MNTR:ConvertibleNotesReceivableOneMember

MNTR:NeuCourtIncMember

2017-11-21

2017-11-22

0001599117

MNTR:NeuCourtIncMember

MNTR:ConvertibleNotesReceivableTwoMember

2018-10-31

0001599117

MNTR:ConvertibleNotesReceivableTwoMember

MNTR:NeuCourtIncMember

2018-10-30

2018-10-31

0001599117

MNTR:ConvertibleNotesReceivableTwoMember

MNTR:NeuCourtIncMember

us-gaap:ExtendedMaturityMember

2018-10-30

2018-10-31

0001599117

MNTR:ConvertibleNotesReceivableTwoMember

MNTR:NeuCourtIncMember

2022-06-12

2022-06-13

0001599117

MNTR:NeuCourtIncMember

MNTR:ConvertibleNotesReceivableTwoMember

2022-06-13

0001599117

MNTR:NeuCourtIncMember

2023-06-30

0001599117

MNTR:ConvertibleNotesReceivableMember

MNTR:NeuCourtIncMember

2022-07-14

2022-07-15

0001599117

MNTR:NovemberTwentyTwoTwothousandSeventeenConvertibleNotesMember

MNTR:SimpleAgreementForFutureEquitySAFEMember

2022-07-15

0001599117

MNTR:OctoberThirtyOneTwoThousandEighteenConvertibleNotesMember

MNTR:SimpleAgreementForFutureEquitySAFEMember

2022-07-15

0001599117

MNTR:SimpleAgreementForFutureEquitySAFEMember

2022-07-15

0001599117

MNTR:NeuCourtIncMember

srt:MaximumMember

2022-07-14

2022-07-15

0001599117

MNTR:SimpleAgreementForFutureEquitySAFEMember

2022-07-21

2022-07-22

0001599117

MNTR:SimpleAgreementForFutureEquitySAFEMember

2022-07-31

2022-08-01

0001599117

MNTR:SimpleAgreementForFutureEquitySAFEMember

2022-08-01

0001599117

MNTR:SimpleAgreementForFutureEquitySAFEMember

2023-01-20

0001599117

MNTR:PartnerOneMember

MNTR:MasterEquipmentLeaseAgreementMember

2023-01-01

2023-06-30

0001599117

MNTR:PartnerOneMember

MNTR:MasterEquipmentLeaseAgreementMember

2022-01-01

2022-12-31

0001599117

MNTR:PartnerTwoMember

2023-01-01

2023-06-30

0001599117

MNTR:PartnerTwoMember

2022-01-01

2022-12-31

0001599117

MNTR:MentorPartnerOneMember

2023-06-30

0001599117

MNTR:MentorPartnerOneMember

2022-12-31

0001599117

MNTR:ElectrumPartnersLLCMember

MNTR:SettlementAgreementMember

2022-11-18

0001599117

us-gaap:FairValueInputsLevel1Member

us-gaap:SecuritiesAssetsMember

2021-12-31

0001599117

us-gaap:FairValueInputsLevel2Member

2021-12-31

0001599117

us-gaap:FairValueInputsLevel3Member

MNTR:ContractualInterestsInLegalRecoveriesMember

2021-12-31

0001599117

us-gaap:FairValueInputsLevel3Member

MNTR:InvestmentInCommonStockWarrantsMember

2021-12-31

0001599117

us-gaap:FairValueInputsLevel3Member

MNTR:OtherEquityInvestmentsMember

2021-12-31

0001599117

us-gaap:FairValueInputsLevel1Member

us-gaap:SecuritiesAssetsMember

2022-01-01

2022-12-31

0001599117

us-gaap:FairValueInputsLevel2Member

2022-01-01

2022-12-31

0001599117

us-gaap:FairValueInputsLevel3Member

MNTR:ContractualInterestsInLegalRecoveriesMember

2022-01-01

2022-12-31

0001599117

us-gaap:FairValueInputsLevel3Member

MNTR:InvestmentInCommonStockWarrantsMember

2022-01-01

2022-12-31

0001599117

us-gaap:FairValueInputsLevel3Member

MNTR:OtherEquityInvestmentsMember

2022-01-01

2022-12-31

0001599117

us-gaap:FairValueInputsLevel1Member

us-gaap:SecuritiesAssetsMember

2022-12-31

0001599117

us-gaap:FairValueInputsLevel2Member

2022-12-31

0001599117

us-gaap:FairValueInputsLevel3Member

MNTR:ContractualInterestsInLegalRecoveriesMember

2022-12-31

0001599117

us-gaap:FairValueInputsLevel3Member

MNTR:InvestmentInCommonStockWarrantsMember

2022-12-31

0001599117

us-gaap:FairValueInputsLevel3Member

MNTR:OtherEquityInvestmentsMember

2022-12-31

0001599117

us-gaap:FairValueInputsLevel1Member

us-gaap:SecuritiesAssetsMember

2023-01-01

2023-06-30

0001599117

us-gaap:FairValueInputsLevel2Member

2023-01-01

2023-06-30

0001599117

us-gaap:FairValueInputsLevel3Member

MNTR:ContractualInterestsInLegalRecoveriesMember

2023-01-01

2023-06-30

0001599117

us-gaap:FairValueInputsLevel3Member

MNTR:InvestmentInCommonStockWarrantsMember

2023-01-01

2023-06-30

0001599117

us-gaap:FairValueInputsLevel3Member

MNTR:OtherEquityInvestmentsMember

2023-01-01

2023-06-30

0001599117

us-gaap:FairValueInputsLevel1Member

us-gaap:SecuritiesAssetsMember

2023-06-30

0001599117

us-gaap:FairValueInputsLevel2Member

2023-06-30

0001599117

us-gaap:FairValueInputsLevel3Member

MNTR:ContractualInterestsInLegalRecoveriesMember

2023-06-30

0001599117

us-gaap:FairValueInputsLevel3Member

MNTR:InvestmentInCommonStockWarrantsMember

2023-06-30

0001599117

us-gaap:FairValueInputsLevel3Member

MNTR:OtherEquityInvestmentsMember

2023-06-30

0001599117

MNTR:SeriesHWarrantsMember

MNTR:InvestmentBankingAgreementMember

2023-06-30

0001599117

MNTR:SeriesHWarrantsMember

MNTR:LenoxHillPartnersLLCMember

2022-11-13

2022-11-14

0001599117

MNTR:SeriesHWarrantsMember

2023-06-30

0001599117

MNTR:SeriesHWarrantsMember

2022-12-31

0001599117

MNTR:SeriesBWarrantsMember

2022-01-01

2022-06-30

0001599117

MNTR:SeriesDWarrantsMember

2022-01-01

2022-06-30

0001599117

MNTR:SeriesBAndDCommonStockWarrantsMember

2023-01-01

2023-06-30

0001599117

MNTR:SeriesBCommonStockWarrantsMember

2021-12-31

0001599117

MNTR:SeriesDCommonStockWarrantsMember

2021-12-31

0001599117

MNTR:SeriesBAndDCommonStockWarrantsMember

2021-12-31

0001599117

MNTR:SeriesBCommonStockWarrantsMember

2022-01-01

2022-12-31

0001599117

MNTR:SeriesDCommonStockWarrantsMember

2022-01-01

2022-12-31

0001599117

MNTR:SeriesBAndDCommonStockWarrantsMember

2022-01-01

2022-12-31

0001599117

MNTR:SeriesBCommonStockWarrantsMember

2022-12-31

0001599117

MNTR:SeriesDCommonStockWarrantsMember

2022-12-31

0001599117

MNTR:SeriesBAndDCommonStockWarrantsMember

2022-12-31

0001599117

MNTR:SeriesBCommonStockWarrantsMember

2023-01-01

2023-06-30

0001599117

MNTR:SeriesDCommonStockWarrantsMember

2023-01-01

2023-06-30

0001599117

MNTR:SeriesBCommonStockWarrantsMember

2023-06-30

0001599117

MNTR:SeriesDCommonStockWarrantsMember

2023-06-30

0001599117

MNTR:SeriesBAndDCommonStockWarrantsMember

2023-06-30

0001599117

MNTR:SeriesHWarrantsMember

2021-12-31

0001599117

MNTR:SeriesHWarrantsMember

2022-01-01

2022-12-31

0001599117

MNTR:SeriesHWarrantsMember

2023-01-01

2023-06-30

0001599117

2014-08-06

2014-08-08

0001599117

MNTR:SeriesQPreferredStockMember

2017-07-13

0001599117

MNTR:SeriesQPreferredStockMember

2023-01-01

2023-06-30

0001599117

MNTR:SeriesQPreferredStockMember

2018-05-29

2018-05-30

0001599117

MNTR:SeriesQPreferredStockMember

2018-05-30

0001599117

MNTR:SeriesQPreferredStockMember

2023-06-30

0001599117

MNTR:SeriesQPreferredStockMember

2022-12-31

0001599117

MNTR:AprilOneThroughAprilThirtyTwentyTwentyThreeMember

2023-04-01

2023-06-30

0001599117

MNTR:AprilOneThroughAprilThirtyTwentyTwentyThreeMember

2023-06-30

0001599117

MNTR:MayOneThroughMaylThirtyOneTwentyTwentyThreeMember

2023-04-01

2023-06-30

0001599117

MNTR:MayOneThroughMaylThirtyOneTwentyTwentyThreeMember

2023-06-30

0001599117

MNTR:JuneOneThroughJunelThirtyTwentyTwentyThreeMember

2023-04-01

2023-06-30

0001599117

MNTR:JuneOneThroughJunelThirtyTwentyTwentyThreeMember

2023-06-30

0001599117

us-gaap:LoansPayableMember

2023-01-01

2023-06-30

0001599117

MNTR:LoansPayableOneMember

2023-01-01

2023-06-30

0001599117

MNTR:LoansPayableTwoMember

2023-01-01

2023-06-30

0001599117

MNTR:EconomicInjuryDisasterLoanMember

2020-07-07

2020-07-07

0001599117

MNTR:WasteConsolidatorsIncMember

2020-07-07

0001599117

MNTR:WasteConsolidatorsIncMember

2020-07-07

2020-07-07

0001599117

MNTR:WasteConsolidatorsIncMember

2023-01-07

2023-01-07

0001599117

MNTR:EconomicInjuryDisasterLoanMember

2023-01-01

2023-06-30

0001599117

MNTR:EconomicInjuryDisasterLoanMember

2022-01-01

2022-06-30

0001599117

MNTR:EconomicInjuryDisasterLoanMember

2023-06-30

0001599117

MNTR:EconomicInjuryDisasterLoanMember

2022-12-31

0001599117

MNTR:WasteConsolidatorsIncMember

2023-06-30

0001599117

MNTR:WasteConsolidatorsIncMember

2022-12-31

0001599117

MNTR:WasteConsolidatorsIncMember

2023-01-01

2023-06-30

0001599117

srt:MaximumMember

2023-01-01

2023-06-30

0001599117

srt:MaximumMember

2023-06-30

0001599117

MNTR:WasteConsolidatorsIncMember

2020-12-15

2020-12-15

0001599117

MNTR:WasteConsolidatorsIncMember

2020-12-15

0001599117

MNTR:WasteConsolidatorsIncMember

2022-02-15

0001599117

MNTR:MentorCapitalIncCEOMember

2021-03-12

2021-03-12

0001599117

MNTR:MentorCapitalIncCEOMember

2021-03-12

0001599117

MNTR:MentorCapitalIncCEOMember

2021-06-17

2021-06-17

0001599117

MNTR:MentorCapitalIncCEOMember

2022-06-05

2022-06-05

0001599117

MNTR:MentorCapitalIncCEOMember

2022-12-01

0001599117

MNTR:GFarmaLabsLimitedMember

2020-06-30

0001599117

MNTR:GFarmaLabsLimitedMember

2020-04-01

2020-06-30

0001599117

MNTR:SettlementAgreementAndMutualReleaseMember

MNTR:GFarmaSettlorsMember

2021-08-27

2021-08-27

0001599117

MNTR:GFarmaLabsLimitedMember

2023-01-01

2023-06-30

0001599117

MNTR:HistoricSegmentMember

2023-04-01

2023-06-30

0001599117

MNTR:FacilityOperationsRelatedMember

2023-04-01

2023-06-30

0001599117

MNTR:CorporateAndEliminationsMember

2023-04-01

2023-06-30

0001599117

MNTR:HistoricSegmentMember

2022-04-01

2022-06-30

0001599117

MNTR:FacilityOperationsRelatedMember

2022-04-01

2022-06-30

0001599117

MNTR:CorporateAndEliminationsMember

2022-04-01

2022-06-30

0001599117

MNTR:HistoricSegmentMember

2023-01-01

2023-06-30

0001599117

MNTR:FacilityOperationsRelatedMember

2023-01-01

2023-06-30

0001599117

MNTR:CorporateAndEliminationsMember

2023-01-01

2023-06-30

0001599117

MNTR:HistoricSegmentMember

2023-06-30

0001599117

MNTR:FacilityOperationsRelatedMember

2023-06-30

0001599117

MNTR:CorporateAndEliminationsMember

2023-06-30

0001599117

MNTR:HistoricSegmentMember

2022-01-01

2022-06-30

0001599117

MNTR:FacilityOperationsRelatedMember

2022-01-01

2022-06-30

0001599117

MNTR:CorporateAndEliminationsMember

2022-01-01

2022-06-30

0001599117

MNTR:HistoricSegmentMember

2022-06-30

0001599117

MNTR:FacilityOperationsRelatedMember

2022-06-30

0001599117

MNTR:CorporateAndEliminationsMember

2022-06-30

0001599117

us-gaap:SubsequentEventMember

MNTR:GFarmaSettlorsMember

2023-07-11

2023-07-11

0001599117

us-gaap:SubsequentEventMember

us-gaap:CommonStockMember

2023-07-01

2023-07-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

MNTR:Segment

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-Q

☒

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the quarterly period ended June 30, 2023

OR

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from _______________ to __________________

Commission

file number 000-55323

| Mentor

Capital, Inc. |

| (Exact

name of registrant as specified in its charter) |

| Delaware |

|

77-0395098 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

No.) |

| 5964

Campus Court, Plano, Texas 75093 |

| (Address

of principal executive offices) (Zip Code) |

Registrant’s

telephone number, including area code (760) 788-4700

Securities

registered pursuant to Section 12(b) of the Act: N/A

| |

|

|

|

|

| Title

of each class to be so registered |

|

Trading

Symbols (s) |

|

Name

of each exchange on which each class is to be registered |

Securities

registered pursuant to section 12(g) of the Act:

| Common

Stock |

| (Title

of class) |

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒. No ☐.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). Yes ☒. No ☐.

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

Emerging

growth company |

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

At

August 11, 2023, there were 22,941,357 shares of Mentor Capital, Inc.’s common stock outstanding and 11 shares of Series Q Preferred

Stock outstanding.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

report contains “forward-looking statements,” as defined in the United States Private Securities Litigation Reform Act of

1995 and Section 21E of the Securities and Exchange Act 1934, as amended. All statements contained in this report, other than statements

of historical fact, including statements regarding our future results of operations and financial position, our business strategy and

plans, and our objectives for future operations, are forward-looking statements. The words “believe,” “may,”

“will,” “estimate,” “continue,” “anticipate,” “seek,” “look,”

“hope,” “intend,” “expect,” and similar expressions are intended to identify forward-looking statements.

We have based these forward-looking statements largely on our current expectations and projections about future events and trends that

we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations

and objectives, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties, and assumptions.

For example, statements in this Form 10-Q regarding the potential future impact of inflation, interest rate increases, tax increases,

tariff increases, recession, climate regulation, the COVID-19 outbreak, economic sanctions, cybersecurity risks, potential banking crises,

future weakness in the credit markets, increased rates of default and bankruptcy, and the outbreak of war in Ukraine on the Company’s

business and results of operations are forward-looking statements. Moreover, due to our past investments in the cannabis-related industry

or other industries, we may be subject to heightened scrutiny, and our portfolio companies may be subject to additional laws, rules,

regulations, and statutes. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on

our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained

in any forward-looking statements we may make. In light of these risks, uncertainties, and assumptions, the future events and trends

discussed in this Form 10-Q may not occur, and actual results could differ materially and adversely from those anticipated or implied

in the forward-looking statements.

You

should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking

statements may not be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable,

we cannot guarantee future results, levels of activity, performance, or achievements. The Company assumes no obligation to revise or

update any forward-looking statements for any reason, except as required by law.

All

references in this Form 10-Q to the “Company,” “Mentor,” “we,” “us,” or “our,”

are to Mentor Capital, Inc.

MENTOR

CAPITAL, INC.

TABLE

OF CONTENTS

PART

I. FINANCIAL INFORMATION

Item

1. Financial Statements

Mentor

Capital, Inc.

Condensed

Consolidated Balance Sheets (Unaudited)

| | |

June 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| ASSETS | |

| | | |

| | |

| | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 836,770 | | |

$ | 789,930 | |

| Investments in securities, fair value | |

| 4,675 | | |

| | |

| Accounts receivable, net | |

| 646,641 | | |

| 633,778 | |

| Other receivable | |

| 58,157 | | |

| 230,322 | |

| Prepaid expenses and other current assets | |

| 74,399 | | |

| 66,000 | |

| | |

| | | |

| | |

| Total current assets | |

| 1,620,642 | | |

| 1,720,030 | |

| | |

| | | |

| | |

| Property and equipment | |

| | | |

| | |

| Property and equipment | |

| 394,314 | | |

| 355,725 | |

| Accumulated depreciation and amortization | |

| (240,018 | ) | |

| (208,847 | ) |

| | |

| | | |

| | |

| Property and equipment, net | |

| 154,296 | | |

| 146,878 | |

| | |

| | | |

| | |

| Other assets | |

| | | |

| | |

| Operating lease right-of-use assets | |

| 339,765 | | |

| 370,164 | |

| Finance lease right-of-use assets | |

| 1,156,159 | | |

| 895,323 | |

| Investment in account receivable, net of discount and current portion | |

| 214,316 | | |

| 315,309 | |

| Security Deposit | |

| 22,477 | | |

| 25,575 | |

| Long term investments | |

| 104,431 | | |

| 94,431 | |

| Goodwill | |

| 1,426,182 | | |

| 1,426,182 | |

| | |

| | | |

| | |

| Total other assets | |

| 3,263,330 | | |

| 3,126,984 | |

| | |

| | | |

| | |

| Total assets | |

$ | 5,038,268 | | |

$ | 4,993,892 | |

See

accompanying Notes to Financial Statements

Mentor

Capital, Inc.

Condensed

Consolidated Balance Sheets (Unaudited, Continued)

| | |

June 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 34,808 | | |

$ | 32,092 | |

| Accrued expenses | |

| 553,942 | | |

| 658,743 | |

| Economic injury disaster loan, current portion | |

| 11,900 | | |

| 3,191 | |

| Finance lease liability, current portion | |

| 309,852 | | |

| 232,058 | |

| Operating lease liability, current portion | |

| 66,132 | | |

| 62,861 | |

| Current portion of long-term debt | |

| 30,470 | | |

| 29,011 | |

| Total current liabilities | |

| 1,007,104 | | |

| 1,017,956 | |

| | |

| | | |

| | |

| Long-term liabilities | |

| | | |

| | |

| Accrued salary, retirement, and incentive fee - related party | |

| 1,166,581 | | |

| 1,153,948 | |

| Economic injury disaster loan, net of current portion | |

| 147,170 | | |

| 157,869 | |

| Finance lease liability, net of current portion | |

| 766,683 | | |

| 575,852 | |

| Operating lease liability, net of current portion | |

| 273,633 | | |

| 307,303 | |

| Long term debt, net of current portion | |

| 39,110 | | |

| 54,865 | |

| Total long-term liabilities | |

| 2,393,177 | | |

| 2,249,837 | |

| Total liabilities | |

| 3,400,281 | | |

| 3,267,793 | |

| | |

| | | |

| | |

| Commitments and Contingencies | |

| - | | |

| - | |

| | |

| | | |

| | |

| Shareholders’ equity | |

| | | |

| | |

| Preferred

stock, $0.0001 par

value, 5,000,000 shares

authorized; 11 and

11 shares

issued and outstanding at June 30, 2023 and December 31, 2022* | |

| - | | |

| - | |

| Common stock, $0.0001 par value, 75,000,000 shares authorized; 22,941,357 and 22,941,357 shares issued and outstanding at June 30, 2023 and December 31, 2022 | |

| 2,294 | | |

| 2,294 | |

| Additional paid in capital | |

| 13,085,380 | | |

| 13,085,993 | |

| Accumulated deficit | |

| (11,524,123 | ) | |

| (11,345,465 | ) |

| Non-controlling interest | |

| 74,436 | | |

| (16,723 | ) |

| Total shareholders’ equity | |

| 1,637,987 | | |

| 1,726,099 | |

| Total liabilities and shareholders’ equity | |

$ | 5,038,268 | | |

$ | 4,993,892 | |

See

accompanying Notes to Financial Statements

Mentor

Capital, Inc.

Condensed

Consolidated Income Statements (Unaudited)

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30, | | |

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenue | |

| | | |

| | | |

| | | |

| | |

| Service fees | |

$ | 2,105,670 | | |

$ | 1,860,146 | | |

$ | 4,280,805 | | |

$ | 3,700,027 | |

| | |

| | | |

| | | |

| | | |

| | |

| Finance lease revenue | |

| - | | |

| 8,473 | | |

| - | | |

| 17,491 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total revenue | |

| 2,105,670 | | |

| 1,868,619 | | |

| 4,280,805 | | |

| 3,717,518 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of sales | |

| 1,414,121 | | |

| 1,284,650 | | |

| 2,674,723 | | |

| 2,433,666 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 691,549 | | |

| 583,969 | | |

| 1,606,082 | | |

| 1,283,852 | |

| | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administrative expenses | |

| 827,861 | | |

| 1,247,730 | | |

| 1,669,781 | | |

| 1,916,237 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating income (loss) | |

| (136,312 | ) | |

| (663,761 | ) | |

| (63,699 | ) | |

| (632,385 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income and (expense) | |

| | | |

| | | |

| | | |

| | |

| Employee retention credits | |

| 6,921 | | |

| 1,350,161 | | |

| 6,921 | | |

| 1,350,161 | |

| Gain (loss) on investments | |

| (224 | ) | |

| 929 | | |

| (224 | ) | |

| (40,251 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 10,174 | | |

| 13,391 | | |

| 16,834 | | |

| 27,744 | |

| Interest expense | |

| (27,838 | ) | |

| (19,562 | ) | |

| (46,797 | ) | |

| (37,769 | ) |

| Gain on asset disposal | |

| - | | |

| 30,287 | | |

| - | | |

| 56,455 | |

| Other income (expense) | |

| 1,291 | | |

| 1,897 | | |

| 13,410 | | |

| 1,897 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total other income and (expense) | |

| (9,676 | ) | |

| 1,377,103 | | |

| (9,856 | ) | |

| 1,358,237 | |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Provision for income taxes | |

| 5,784 | | |

| 33,320 | | |

| 13,944 | | |

| 46,890 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) | |

| (151,772 | ) | |

| 680,022 | | |

| (87,499 | ) | |

| 678,962 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gain (loss) attributable to non-controlling interest | |

| (22,526 | ) | |

| 372,515 | | |

| 91,159 | | |

| 464,114 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) attributable to Mentor | |

$ | (129,246 | ) | |

$ | 307,507 | | |

$ | (178,658 | ) | |

$ | 214,848 | |

| | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted net income (loss) per Mentor common share: | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

$ | (0.006 | ) | |

$ | 0.013 | | |

$ | (0.008 | ) | |

$ | 0.009 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of shares of Mentor common stock outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 22,941,357 | | |

| 22,941,357 | | |

| 22,941,357 | | |

| 22,941,357 | |

| Diluted | |

| 22,941,357 | | |

| 22,941,357 | | |

| 22,941,357 | | |

| 22,941,357 | |

See

accompanying Notes to Financial Statements

Mentor

Capital, Inc.

Condensed

Consolidated Statement of Shareholders’ Equity (Unaudited)

For

the Three Months Ended June 30, 2023 and 2022

| | |

| | |

* | | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

Controlling Interest | | |

| | |

| |

| | |

Preferred stock | | |

Common stock | | |

| | |

| | |

| | |

| | |

| |

| | |

Shares | | |

$0.0001 par* | | |

Shares | | |

$0.0001

par | | |

Additional paid in

capital | | |

Accumulated equity

(deficit) | | |

Total | | |

Non- controlling equity (deficit) | | |

Totals | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance at March 31, 2023 | |

| 11 | | |

$ | - | | |

| 22,941,357 | | |

$ | 2,294 | | |

$ | 13,085,993 | | |

$ | (11,394,877 | ) | |

$ | 1,693,410 | | |

$ | 96,962 | | |

$ | 1,790,372 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Treasury stock buy-backs | |

| | | |

| | | |

| | | |

| | | |

| (613 | ) | |

| | | |

| (613 | ) | |

| | | |

| (613 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (129,246 | ) | |

| (129,246 | ) | |

| (22,526 | ) | |

| (151,772 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balances at June 30, 2023 | |

| 11 | | |

$ | - | | |

| 22,941,357 | | |

$ | 2,294 | | |

$ | 13,085,380 | | |

$ | (11,524,123 | ) | |

$ | 1,563,551 | | |

$ | 74,436 | | |

$ | 1,637,987 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balances at March 31, 2022 | |

| 11 | | |

$ | - | | |

| 22,941,357 | | |

$ | 2,294 | | |

$ | 13,085,992 | | |

$ | (10,966,738 | ) | |

$ | 2,121,548 | | |

$ | (29,585 | ) | |

$ | 2,091,963 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 307,507 | | |

| 307,507 | | |

| 372,515 | | |

| 680,022 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balances at June 30, 2022 | |

| 11 | | |

$ | - | | |

| 22,941,357 | | |

$ | 2,294 | | |

$ | 13,085,992 | | |

$ | (10,659,231 | ) | |

$ | 2,429,055 | | |

$ | 342,930 | | |

$ | 2,771,985 | |

See

accompanying Notes to Financial Statements

Mentor

Capital, Inc.

Condensed

Consolidated Statement of Shareholders’ Equity (Unaudited)

For

the Six Months Ended June 30, 2023 and 2022

| | |

Controlling Interest | | |

| | |

| |

| | |

Preferred stock | | |

Common stock | | |

| | |

| | |

| | |

| | |

| |

| | |

Shares | | |

$0.0001 par* | | |

Shares | | |

$0.0001

par | | |

Additional paid in

capital | | |

Accumulated equity

(deficit) | | |

Total | | |

Non- controlling equity (deficit) | | |

Totals | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance at December 31, 2022 | |

| 11 | | |

| - | | |

| 22,941,357 | | |

$ | 2,294 | | |

$ | 13,085,993 | | |

$ | (11,345,465 | ) | |

$ | 1,742,822 | | |

$ | (16,723 | ) | |

$ | 1,726,099 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Treasury stock buy-backs | |

| - | | |

| - | | |

| - | | |

| - | | |

| (613 | ) | |

| - | | |

| (613 | ) | |

| - | | |

| (613 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (178,658 | ) | |

| (178,658 | ) | |

| 91,159 | | |

| (87,499 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balances at June 30, 2023 | |

| 11 | | |

$ | - | | |

| 22,941,357 | | |

$ | 2,294 | | |

$ | 13,085,380 | | |

$ | (11,524,123 | ) | |

$ | 1,563,551 | | |

$ | 74,436 | | |

$ | 1,637,987 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balances at December 31, 2021 | |

| 11 | | |

$ | - | | |

| 22,850,947 | | |

$ | 2,285 | | |

$ | 13,071,655 | | |

$ | (10,874,079 | ) | |

$ | 2,199,861 | | |

$ | (121,184 | ) | |

$ | 2,078,677 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Conversion of warrants to common stock | |

| - | | |

| - | | |

| 90,410 | | |

| 9 | | |

| 14,337 | | |

| - | | |

| 14,346 | | |

| - | | |

| 14,346 | |

| Net income (loss) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 214,848 | | |

| 214,848 | | |

| 464,114 | | |

| 678,962 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balances at June 30, 2022 | |

| 11 | | |

$ | - | | |

| 22,941,357 | | |

$ | 2,294 | | |

$ | 13,085,992 | | |

$ | (10,659,231 | ) | |

$ | 2,429,055 | | |

$ | 342,930 | | |

$ | 2,771,985 | |

| * |

Par

value of series Q preferred shares is less than $1. |

See

accompanying Notes to Financial Statements

Mentor

Capital, Inc.

Condensed

Consolidated Statements of Cash Flows (Unaudited)

| | |

2023 | | |

2022 | |

| | |

For the Six Months Ended | |

| | |

June 30, | |

| | |

2023 | | |

2022 | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | | |

| | |

| Net (loss) | |

$ | (87,499 | ) | |

$ | 678,962 | |

| Adjustments to reconcile net (loss) to net cash provided by (used by) operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 31,171 | | |

| 33,640 | |

| Amortization of right of use asset | |

| 165,088 | | |

| 87,708 | |

| Gain on asset disposal | |

| - | | |

| (26,168 | ) |

| | |

| - | | |

| - | |

| Bad debt expense | |

| 10,198 | | |

| 42,000 | |

| Amortization of discount on investment in account receivable | |

| (16,607 | ) | |

| (25,838 | ) |

| Decrease in accrued investment interest income | |

| - | | |

| 1,250 | |

| Loss on investment in securities at fair value | |

| 224 | | |

| 821 | |

| Loss on long-term investments | |

| - | | |

| 42,430 | |

| Decrease in deposits | |

| 3,098 | | |

| - | |

| Decrease (increase) in operating assets | |

| | | |

| | |

| Finance leases receivable | |

| - | | |

| 39,869 | |

| Accounts receivable – trade | |

| (23,061 | ) | |

| 26,306 | |

| Other receivables | |

| 172,165 | | |

| (1,301,076 | ) |

| Prepaid expenses and other current assets | |

| (8,328 | ) | |

| (23,192 | ) |

| Employee advances | |

| (71 | ) | |

| (950 | ) |

| Increase (decrease) in operating liabilities | |

| | | |

| | |

| Accounts payable | |

| 2,716 | | |

| (3,723 | ) |

| Accrued expenses | |

| (106,791 | ) | |

| 634,344 | |

| Deferred revenue | |

| - | | |

| (2,272 | ) |

| Accrued salary, retirement, and benefits – related party | |

| 12,633 | | |

| 13,128 | |

| | |

| | | |

| | |

| Net cash provided by operating activities | |

| 154,936 | | |

| 217,239 | |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | |

| Purchase of investment securities | |

| (14,899 | ) | |

| - | |

| Purchases of property and equipment | |

| (38,589 | ) | |

| (5,422 | ) |

| Proceeds from sale of property and equipment | |

| - | | |

| - | |

| Down payments on right of use assets | |

| - | | |

| (13,408 | ) |

| Proceeds from investment in receivable | |

| 117,600 | | |

| 400 | |

| | |

| | | |

| | |

| Net cash (used by) investing activities | |

| 64,112 | | |

| (18,430 | ) |

See

accompanying Notes to Financial Statements

Mentor

Capital, Inc.

Condensed

Consolidated Statements of Cash Flows (Unaudited, Continued)

| | |

For the Six Months Ended | |

| | |

Ended June 30, | |

| | |

2023 | | |

2022 | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | |

| Proceeds from related party loan | |

$ | - | | |

$ | 50,000 | |

| Proceeds from Paycheck Protection Program loan | |

| - | | |

| - | |

| Warrants converted to common stock | |

| - | | |

| 14,346 | |

| Payments on repurchase of stock | |

| (613 | ) | |

| - | |

| Payments on related party payable | |

| - | | |

| (21,950 | ) |

| Payments on long-term debt | |

| (14,296 | ) | |

| (12,633 | ) |

| Payments on finance lease liability | |

| (157,299 | ) | |

| (85,130 | ) |

| | |

| | | |

| | |

| Net cash provided by (used by) financing activities | |

| (172,208 | ) | |

| (55,367 | ) |

| | |

| | | |

| | |

| Net change in cash | |

| 46,840 | | |

| 143,442 | |

| | |

| | | |

| | |

| Beginning cash | |

| 789,930 | | |

| 453,939 | |

| | |

| | | |

| | |

| Ending cash | |

$ | 836,770 | | |

$ | 597,381 | |

| | |

| | | |

| | |

| SUPPLEMENTARY INFORMATION: | |

| | | |

| | |

| Cash paid for interest | |

$ | 6,775 | | |

$ | 1,726 | |

| | |

| | | |

| | |

| Cash paid for income taxes | |

$ | 9,864 | | |

$ | 4,450 | |

| | |

| | | |

| | |

| NON-CASH INVESTING AND FINANCING TRANSACTIONS: | |

| | | |

| | |

| Right of use assets acquired through operating lease liability | |

$ | - | | |

$ | - | |

| | |

| | | |

| | |

| Right of use assets acquired through finance lease liability | |

$ | 425,924 | | |

$ | 99,025 | |

| | |

| | | |

| | |

| Property and equipment acquired through long-term debt | |

| - | | |

| 22,480 | |

See

accompanying Notes to Financial Statements

Note

1 - Nature of operations

Corporate

Structure Overview

Mentor

Capital, Inc. (“Mentor” or “the Company”), reincorporated under the laws of the State of Delaware in September

2015.

The

entity was originally founded as an investment partnership in Silicon Valley, California, by the current CEO in 1985 and subsequently

incorporated under the laws of the State of California on July 29, 1994. On September 12, 1996, the Company’s offering statement

was qualified pursuant to Regulation A of the Securities Act, and the Company began to trade its shares publicly. On August 21, 1998,

the Company filed for voluntary reorganization, and on January 11, 2000, the Company emerged from Chapter 11 reorganization. The Company

relocated to San Diego, California, and contracted to provide financial assistance and investment in small businesses. On May 22, 2015,

a corporation named Mentor Capital, Inc. (“Mentor Delaware”) was incorporated under the laws of the State of Delaware. A

shareholder-approved merger between Mentor and Mentor Delaware was approved by the California and Delaware Secretaries of State and became

effective September 24, 2015, thereby establishing Mentor as a Delaware corporation. In September 2020, Mentor relocated its corporate

office from San Diego, California, to Plano, Texas.

The

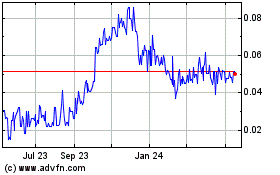

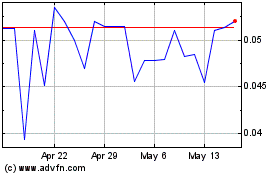

Company’s common stock trades publicly under the trading symbol OTCQB: MNTR.

The

Company’s broad target industry focus includes energy, staffing, facilities operations, and management services with the goal of

ensuring increased market opportunities.

Mentor

has a 51% interest in Waste Consolidators, Inc. (“WCI”). WCI was incorporated in Colorado in 1999 and operates in Arizona

and Texas. It is a long-standing investment of the Company since 2003.

Mentor’s

100% owned subsidiaries, Mentor IP, LLC (“MCIP”), Mentor Partner I, LLC, (“Partner I”), Mentor Partner II, LLC

(“Partner II”), and TWG, LLC (“TWG”), are headquartered in Plano, Texas.

MCIP

holds intellectual property and licensing rights related to one United States and one Canadian patent associated with THC and CBD vape

pens. Patent application and national phase maintenance fees were expensed when paid rather than capitalized and therefore, no capitalized

assets related to MCIP are recognized on the consolidated financial statements at June 30, 2023 and December 31, 2022.

On

August 27, 2021, the Company and Mentor Partner I entered into a Settlement Agreement and Mutual Release with the G Farma Entities and

guarantors (“G Farma Settlors”) to resolve and settle all outstanding claims on an unpaid finance lease receivable and notes

receivable of balances of $803,399 and $1,045,051, respectively, plus accrued interest (“Settlement Agreement”). On October

12, 2021, the parties filed a Stipulation for Dismissal and Continued Jurisdiction with the Superior Court of California in the County

of Marin. The Court ordered that it retain jurisdiction over the parties under Section 664.6 of the California Code of Civil Procedure

to enforce the Settlement Agreement until the performance in full of its terms is met.

In

August 2022, September 2022, and October 2022, the G Farma Settlors failed to make monthly payments, and failed to cure each default

within 10 days’ notice from Company pursuant to the Settlement Agreement. As a result, $2,000,000 should be added to the amount

payable by the G Farma Settlors in accordance with the terms of the Settlement Agreement. In February 2023, the Company and Mentor Partner

I filed a Request for Court Judgment requesting that the stipulated judgment be entered against the G Farma Settlors for (1) the remaining

amount of the $500,000 settlement amount which has not yet been paid by the G Farma Settlors plus $2,000,000 and all accrued unpaid interest,

(2) the Company’s incurred costs, and (3) attorneys’ fees paid by the Company to obtain the judgment.

The

Company has retained the reserve on collections of the unpaid lease receivable balance due to the long history of uncertain payments

from G Farma. Payments from G Farma will be recognized in Other Income as they are received. Recovery payments of $3,550 and $2,000 were

included in other income in the consolidated financial statements for the year ended December 31, 2022 and 2021, respectively. No recovery

payments have received since October 11, 2022. See Notes 8 and 18.

Subsequent

to quarter end, on July 11, 2023, the Court entered judgment against the G Farma Settlors and in favor of Mentor and Partner I in the

amount of $2,539,596.73. Mentor and Mentor Partner I will continue to pursue collection of the judgment amount from the G Farma Settlors.

See Note 20.

Note

1 - Nature of operations (continued)

On

September 27, 2022, Pueblo West Organics, LLC, a Colorado limited liability company (“Pueblo West”) exercised a lease prepayment

option and purchased manufacturing equipment from Partner II for $245,369. On September 28, 2022 Partner II transferred full title to

the equipment to Pueblo West. Originally, Mentor contributed $400,000 to Partner II to facilitate the purchase of manufacturing equipment

to be leased from Partner II by Pueblo West under a Master Equipment Lease Agreement dated February 11, 2018, as amended. On March 12,

2019, Mentor agreed to use Partner II earnings of $61,368 to facilitate the purchase of additional manufacturing equipment to Pueblo

West under a Second Amendment to the lease. See Note 8.

On

November 18, 2022, following the filing of a declaratory relief action, Mentor received $459,990 from Electrum Partners, LLC (“Electrum”)

pursuant to a certain November 14, 2022 Settlement Agreement and Mutual Release, following the Company’s October 21, 2022 lawsuit

against Electrum and the escrow agent in the County of San Mateo. The Company applied $196,666 to a certain October 30, 2018, Recovery

Purchase Agreement, and $200,000 to an October 31, 2018 and January 28, 2019 Capital Agreement. The Company applied the remaining $63,324

to its $194,028 equity interest in Electrum; this resulted in a $130,704 loss on the Company’s investment in Electrum. See Note

9.

On

December 21, 2018, Mentor paid $10,000 to purchase 500,000 shares of NeuCourt, Inc. (“NeuCourt”) common stock, representing

approximately 6.13% of NeuCourt’s issued and outstanding common stock at June 30, 2023.

Note

2 - Summary of significant accounting policies

Condensed

consolidated financial statements

The

unaudited condensed consolidated financial statements of the Company for the six month period ended June 30, 2023 and 2022 have been

prepared in accordance with accounting principles generally accepted in the United States of America for interim financial information

and pursuant to the requirements for reporting on Form 10-Q and Regulation S-K. Accordingly, they do not include all the information

and footnotes required by accounting principles generally accepted in the United States of America for complete financial statements.

However, such information reflects all adjustments (consisting solely of normal recurring adjustments), which are, in the opinion of

management, necessary for the fair presentation of the financial position and the results of operations. Results shown for interim periods

are not necessarily indicative of the results to be obtained for a full fiscal year. The balance sheet information as of December 31,

2022 was derived from the audited financial statements included in the Company’s financial statements as of and for the year ended

December 31, 2022 included in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”)

on March 28, 2023. These financial statements should be read in conjunction with that report.

Basis

of presentation

The

accompanying consolidated financial statements and related notes include the activity of subsidiaries in which a controlling financial

interest is owned. The consolidated financial statements have been prepared in accordance with accounting principles generally accepted

in the United States of America (“GAAP”). Significant intercompany balances and transactions have been eliminated in consolidation.

Certain prior period amounts have been reclassified to conform with the current period presentation.

As

shown in the accompanying financial statements, the Company has a significant accumulated deficit of $11,524,123 as of June 30, 2023.

The Company continues to experience negative cash flows from operations.

Ongoing Capital Formation

The

Company may seek to recover unused funds from its affiliated entities, sell one or more investments that management has determined

are at the end of their lifecycle or no longer fit within the Company’s desired focus, or raise additional capital to fund its

operations. Mentor will continue to attempt to raise capital resources from both related and unrelated parties Additionally, the

Company has 6,250,000 Series

D warrants outstanding in which the Company can reset the exercise price substantially below the current market price. These

condensed consolidated financial statements do not include any adjustments that might result from repricing the outstanding

warrants. Management’s plans include monetizing existing mature business projects and increasing revenues through

acquisition, investment, and organic growth. Management anticipates funding new activities by raising additional capital through the

sale of equity securities and debt.

Impact

Related to COVID-19 and Global Economic Factors

The

effect of the novel coronavirus (“COVID-19”) has significantly impacted the United States and the global economy. COVID-19

and the measures taken by many countries in response have adversely affected and could in the future materially adversely impact the

Company’s business, results of operations, financial condition, and stock price. The ongoing worldwide economic situation, including

the COVID-19 outbreak, economic sanctions, the impact of inflation, interest rate increases, tax increases, tariff increases, recession,

climate regulation, cybersecurity risks, potential banking crises, the outbreak of war in Ukraine, future weakness in the credit markets,

increased rates of default and bankruptcy, and significant liquidity problems for the financial services industry may impact our financial

condition in a number of ways. For example, our current or potential customers, or the current or potential customers of our partners

or affiliates, may delay or decrease spending with us, or may not pay us, or may delay paying us for previously purchased products and

services. Also, we, or our partners or affiliates, may have difficulties in securing additional financing. Additionally, due to a reduction

in expected collections, the collectability of our investment in accounts receivable was impaired by $116,430 at December 31, 2022, and

on February 15, 2022, the terms of the investment were modified, resulting in an additional loss of $41,930, see Note 3.

Public

health efforts to mitigate the impact of COVID-19 have included government actions such as travel restrictions, limitations on public

gatherings, shelter-in-place orders, and mandatory closures. These actions are being lifted to varying degrees. Supply chain disruptions,

inflation, interest rate increases, tax increases, recession, high energy prices, and supply-demand imbalances are expected to continue

in 2023. WCI has not experienced an overall reduced demand for services initially anticipated because WCI helps lower monthly service

costs paid by its client properties. However, WCI has been directly affected by rapid increases to direct costs of fuel, labor, and landfill

usage in 2020, 2021, 2022, and 2023. WCI’s clients may experience a delay in collecting rent from tenants, which may cause slower

payments to WCI. WCI closely monitors customer accounts and has not experienced significant delays in the collection of accounts receivable.

We

anticipate that current cash and associated resources will be sufficient to execute our business plan for the next twelve months. The

ultimate impact of COVID-19 impacts, the outbreak of war in Ukraine, and inflation, interest rate increases, tax increases, and a potential

recession on our business, results of operations, cybersecurity, financial condition, and cash flows are dependent on future developments,

including the duration of COVID-19 and the crisis in Ukraine, government responses, and the related drag on the economy, which are uncertain

and cannot be predicted at this time.

Use

of estimates

The

preparation of our condensed consolidated financial statements in conformity with GAAP requires management to make estimates, assumptions,

and judgments that affect the reported amounts of assets and liabilities, and the disclosure of contingent assets and liabilities at

the date of our consolidated financial statements, and the reported amount of revenues and expenses during the reporting period.

Note

2 - Summary of significant accounting policies (continued)

Significant

estimates relied upon in preparing these consolidated financial statements include revenue recognition, accounts and notes receivable

reserves, expected future cash flows used to evaluate the recoverability of long-lived assets, estimated fair values of long-lived assets

used to record impairment charges related to investments, goodwill, amortization periods, accrued expenses, and recoverability of the

Company’s net deferred tax assets and any related valuation allowance.

Although

the Company regularly assesses these estimates, actual results could differ materially from these estimates. Changes in estimates are

recorded in the period in which they become known. The Company bases its estimates on historical experience and various other assumptions

that it believes to be reasonable under the circumstances. Actual results may differ from management’s estimates if past experience

or other assumptions do not turn out to be substantially accurate.

Recent

Accounting Standards

From

time to time, the FASB, or other standards-setting bodies issue new accounting pronouncements. Updates to the FASB Accounting Standard

Codifications (“ASCs”) are communicated through the issuance of an Accounting Standards Update (“ASU”). Unless

otherwise discussed, we believe that the impact of recently issued guidance, whether adopted or to be adopted in the future, is not expected

to have a material impact on our consolidated financial statements upon adoption.

There

were no accounting pronouncements issued during the six months ended June 30, 2023, that are expected to have a material impact on the

Company’s condensed consolidated financial statements.

Concentrations

of cash

The

Company maintains its cash and cash equivalents in bank deposit accounts, which at times may exceed federally insured Federal Deposit

Insurance Corporation limits. The Company has not experienced any losses in such accounts, nor does the Company believe it is exposed

to any significant credit risk on cash and cash equivalents. The Company will continue to monitor its accounts and the banking sector

for potential financial institution risk.

Cash

and cash equivalents

The

Company considers all short-term debt securities purchased with a maturity of three months or less to be cash equivalents. The Company

had no short-term debt securities as of June 30, 2023 and December 31, 2022.

Accounts

receivable

Accounts

receivable consists of trade accounts arising in the normal course of business and are classified as current assets and carried at original

invoice amounts less an estimate for doubtful receivables based on historical losses as a percent of revenue in conjunction with a review

of outstanding balances on a quarterly basis. The estimate of the allowance for doubtful accounts is based on the Company’s bad

debt experience, market conditions, and aging of accounts receivable, among other factors. If the financial condition of the Company’s

customers deteriorates, resulting in the customer’s inability to pay the Company’s receivables as they come due, additional

allowances for doubtful accounts will be required. At June 30, 2023 and December 31, 2022, the Company has an allowance for doubtful

receivables in the amount of $51,959 and $53,692, respectively.

Investments

in securities at fair value

Investment

in securities consists of debt and equity securities reported at fair value. Under ASU 2016-01, “Financial Instruments - Overall:

Recognition and Measurement of Financial Assets and Financial Liabilities,” the Company elected to report changes in the fair

value of equity investment in realized investment gains (losses), net.

Note

2 - Summary of significant accounting policies (continued)

Long

term investments

The

Company’s investments in entities where it is a minority owner and does not have the ability to exercise significant influence

are recorded at fair value if readily determinable. If the fair market value is not readily determinable, the investment is recorded

under the cost method. Under this method, the Company’s share of the earnings or losses of such investee company is not included

in the Company’s financial statements. The Company reviews the carrying value of its long-term investments for impairment each

reporting period.

Investments

in debt securities

At

June 30, 2023 and December 31, 2022, the Company held no investments in debt securities. The Company’s former investment in debt

securities consisted of two convertible notes receivable from NeuCourt, Inc. On July 15, 2022, all principal and accrued interest on

the notes were converted into a Simple Agreement for Future Equity (“SAFE”). At June 30, 2023 and December 31, 2022, the

SAFE Purchase Amount was $93,756 and $83,756, respectively. See Note 7.

Investment

in account receivable, net of discount

The

Company’s investments in accounts receivable is stated at face value, net of unamortized purchase discount. The discount is amortized

to interest income over the term of the exchange agreement. In the fourth quarter of 2020, we were notified that due to the effect of

COVID-19 on the estimated receivable, we may not receive the 2020 installment payment or the full 2021 installment payment. Due to a

reduction in expected collections, the collectability of our investment in accounts receivable was impaired by $116,430 at December 31,

2022, and on February 15, 2022, the terms of the investment were modified, resulting in an additional loss of $41,930, see Note 3.

Credit

quality of notes receivable and finance leases receivable, and credit loss reserve

As

our notes receivable and finance leases receivable are limited in number, our management is able to analyze estimated credit loss reserves

based on a detailed analysis of each receivable as opposed to using portfolio-based metrics. Our management does not use a system of

assigning internal risk ratings to each of our receivables. Rather, each note receivable and finance lease receivable are analyzed quarterly

and categorized as either performing or non-performing based on certain factors including, but not limited to, financial results, satisfying

scheduled payments, and compliance with financial covenants. A note receivable or finance lease receivable will be categorized as non-performing

when a borrower experiences financial difficulty and has failed to make scheduled payments.

Lessee

Leases

We

determine whether an arrangement is a lease at inception. Lessee leases are classified as either finance leases or operating leases.

A lease is classified as a finance lease if any one of the following criteria is met: (i) the lease transfers ownership of the asset

by the end of the lease term, (ii) the lease contains an option to purchase the asset that is reasonably certain to be exercised, and

(iii) the lease term is for a significant part of the remaining useful life of the asset or the present value of the lease payments equals

or exceeds substantially all of the fair value of the asset. A lease is classified as an operating lease if it does not meet any one

of these criteria. Our operating leases are comprised of office space leases and office equipment. Fleet vehicle leases entered into

prior to January 1, 2019, are classified as operating leases based on an expected lease term of four years. Fleet vehicle leases entered

into on or after January 1, 2019, for which the lease is expected to be extended to five years, are classified as finance leases. Our

leases have remaining lease terms of one to forty-eight months. Our fleet finance leases contain a residual value guarantee which, based

on past lease experience, is unlikely to result in liability at the end of the lease. As most of our leases do not provide an implicit

rate, we use our incremental borrowing rate based on the information available at the commencement date to determine the present value

of lease payments.

Note

2 - Summary of significant accounting policies (continued)

Costs

associated with operating lease assets are recognized on a straight-line basis, over the term of the lease, within cost of goods sold

for vehicles used in direct servicing of WCI customers and in operating expenses for costs associated with all other operating leases.

Finance lease assets are amortized within cost of goods sold for vehicles used in direct servicing of WCI customers and within operating

expenses for all other finance lease assets, on a straight-line basis over the shorter of the estimated useful lives of the assets or

the lease term. The interest component of a finance lease is included in interest expense and recognized using the effective interest

method over the lease term. We have agreements that contain both lease and non-lease components. For vehicle fleet operating leases,

we account for lease components together with non-lease components (e.g., maintenance fees).

Property

and equipment

Property

and equipment are recorded at cost less accumulated depreciation. Depreciation is computed on the declining balance method over the estimated

useful lives of various classes of property. The estimated lives of the property and equipment are generally as follows: computer equipment,

3 to 5 years; furniture and equipment, 7 years; and vehicles and trailers, 4 to 5 years. Depreciation on vehicles used by WCI to service

its customers is included in cost of goods sold in the consolidated income statements. All other depreciation is included in selling,

general and administrative costs in the consolidated income statements.

Expenditures

for major renewals and improvements are capitalized, while minor replacements, maintenance, and repairs, which do not extend the asset

lives, are charged to operations as incurred. Upon sale or disposition, the cost and related accumulated depreciation are removed from

the accounts, and any gain or loss is included in operations. The Company continually monitors events and changes in circumstances that

could indicate that the carrying balances of its property and equipment may not be recoverable in accordance with the provisions of ASC

360, “Property, Plant, and Equipment.” When such events or changes in circumstances are present, the Company assesses

the recoverability of long-lived assets by determining whether the carrying value of such assets will be recovered through undiscounted

expected future cash flows. If the total of the future cash flows is less than the carrying amount of those assets, the Company recognizes

an impairment loss based on the excess of the carrying amount over the fair value of the assets.

The

Company reviews intangible assets subject to amortization quarterly to determine if any adverse conditions exist or a change in circumstances

has occurred that would indicate impairment or a change in the remaining useful life. Conditions that may indicate impairment include,

but are not limited to, a significant adverse change in legal factors or business climate that could affect the value of an asset, a

product recall, or an adverse action or assessment by a regulator. If an impairment indicator exists, we test the intangible asset for

recoverability. For purposes of the recoverability test, we group our amortizable intangible assets with other assets and liabilities

at the lowest level of identifiable cash flows if the intangible asset does not generate cash flows independent of other assets and liabilities.

If the carrying value of the intangible asset (asset group) exceeds the undiscounted cash flows expected to result from the use and eventual

disposition of the intangible asset (asset group), the Company will write the carrying value down to the fair value in the period identified.

Goodwill

Goodwill

of $1,324,142 was derived from consolidating WCI effective January 1, 2014, and $102,040 of goodwill was derived from the 1999 acquisition

of a 50% interest in WCI. In accordance with ASC 350, “Intangibles-Goodwill and Other,” goodwill and other intangible

assets with indefinite lives are no longer subject to amortization but are tested for impairment annually or whenever events or changes

in circumstances indicate that the asset might be impaired.

Note

2 - Summary of significant accounting policies (continued)

The