Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

February 14 2024 - 5:12AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2024

Commission File Number 001-33098

Mizuho Financial Group, Inc.

(Translation of registrant’s name into English)

5-5, Otemachi 1-chome

Chiyoda-ku, Tokyo 100-8176

Japan

(Address of principal

executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form

20-F or Form 40-F. Form 20-F ☒ Form 40-F ☐

THIS REPORT ON FORM 6-K SHALL BE DEEMED TO BE INCORPORATED BY REFERENCE INTO THE PROSPECTUS FORMING A PART

OF MIZUHO FINANCIAL GROUP, INC.’S REGISTRATION STATEMENT ON FORM F-3 (FILE NO. 333-266555) AND TO BE A PART OF SUCH PROSPECTUS FROM THE DATE ON WHICH THIS

REPORT IS FURNISHED, TO THE EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY FILED OR FURNISHED.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

| Date: |

|

February 14, 2024 |

|

| Mizuho Financial Group, Inc. |

|

|

| By: |

|

/s/ Takefumi Yonezawa |

| Name: |

|

Takefumi Yonezawa |

| Title: |

|

Senior Executive Officer / Group CFO |

February 14, 2024

Mizuho Financial Group, Inc.

Mizuho

Bank, Ltd.

Credit Saison Co., Ltd.

Mizuho Bank to invest in Credit Saison’s Indian subsidiary

Kisetsu Saison Finance (India) Pvt. Ltd.

Today, Mizuho Bank, Ltd. (President & CEO: Masahiko Kato), a subsidiary of Mizuho Financial Group, Inc. (President & Group CEO: Masahiro Kihara), and

Credit Saison Co., Ltd. (Representative, Executive President, and COO: Katsumi Mizuno) came to an agreement for Mizuho Bank and a subsidiary of Mizuho Bank to invest (financed through underwriting the issuance of new shares) up to INR 12 billion

(equivalent to JPY 21 billion; equity ratio: equivalent to 15%*) in Credit Saison’s Indian subsidiary Kisetsu Saison Finance (India) Pvt. Ltd. (“Credit Saison India”).

In addition, Mizuho Bank will dispatch one director to Credit Saison India, and plans to make it an equity method affiliate.

| * |

Calculated on a fully diluted basis. |

| 1. |

Background to this investment |

At Mizuho, we have positioned the new medium-term business plan we launched in FY2023 as a three-year journey connecting various initiatives and co-creating

value-added solutions in order to support our clients and solve social issues, and we are working to identify financial needs in markets around the world from multiple angles. Although Asia is projected to see economic growth accompanying its

population growth, the financial infrastructure of the region is still nascent. We have been striving to play a positive role in resolving such social issues while broadening our business portfolio. This has led us to invest in M-Service in Vietnam,

Tonik in the Philippines, and Kredivo in Indonesia. Following on from these, we have turned to exploring strategic investment in financial businesses in India, where there has been a rapid rise in needs for digital financial services due to high

economic growth and the size of the population, which is the largest in the world.

Credit Saison has committed to a mission of furthering financial

inclusion through its lending business in emerging countries. Since 2014, the company has been putting particular effort into expanding its global business, focusing on Southeast Asia and primarily embarking on joint ventures with local companies.

In 2022, it established an international headquarters in Singapore, following which it moved to strengthen its global business management functions and developed new business to advance its ongoing expansion. Since the start of services in 2019,

Credit Saison India has achieved solid growth. This has enabled the India business strategy’s horizontal rollout, and the 2023 launch of services in Latin America.

1

Looking to ensure Credit Saison India would continue to evolve as a driver of Credit Saison’s global

business going forward, in 2023 Credit Saison began considering options for a general capital strategy.

Credit Saison had developed Credit Saison India from scratch using only its own capital. Since the start of services in 2019, Credit Saison India has achieved

solid growth with a strategy of stepping up its business model to adapt to the current growth phase. Under the highly experienced leadership of local management, Credit Saison India offers services centered on financing for local non-bank financial

companies and co-origination financing in partnership with fintech businesses. It has steadily expanded its business, with profit entering the black for FY2020 and a loan balance of around JPY 150 billion as of September 2023.

Recently, the company has enhanced its direct lending business for customers and clients to improve profitability, and has been working to diversify its

capital procurement methods, including by issuing bonds and commercial paper, helped by it receiving a long-term credit rating of AAA from some of India’s largest credit rating agencies.

With the investment, Mizuho and Credit Saison aim to grow Credit Saison India into a top financing company in India with a capitalization of JPY 1 trillion,

and positively contribute to financial inclusion and sustainable societal development in India.

2

Reference: Corporate profiles (as of September 30, 2023)

Mizuho Bank

|

|

|

| Company name |

|

Mizuho Bank, Ltd. |

| Date of establishment |

|

July 1, 2013 |

| Head Office |

|

1-5-5 Otemachi, Chiyoda-ku, Tokyo |

| Representative |

|

Masahiko Kato, President & CEO |

| Capital |

|

JPY 1.404 trillion |

| Business |

|

Banking |

Credit Saison

|

|

|

| Company name |

|

Credit Saison Co., Ltd. |

| Date of establishment |

|

May 1, 1951 |

| Head Office |

|

1-1 Higashi-Ikebukuro 3-chome, Toshima-ku, Tokyo |

| Representative |

|

Katsumi Mizuno, Representative, Executive President, and COO |

| Capital |

|

JPY 75.929 billion |

| Business |

|

Payments, leasing, finance, real estate-related, global, entertainment |

Credit Saison India

|

|

|

| Company name |

|

Kisetsu Saison Finance (India) Pvt. Ltd. |

| Date of establishment |

|

June 7, 2018 |

| Head Office |

|

IndiQube Lexington Tower, 1st Floor Tavarekere Main Road, S.G. Palya, Bengaluru, Karnataka, India |

| Representative |

|

Presha Paragash, CEO and Director |

| Capital |

|

INR 14.273 billion |

| Business |

|

Lending to individuals and SMEs |

3

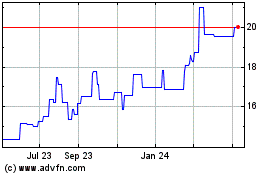

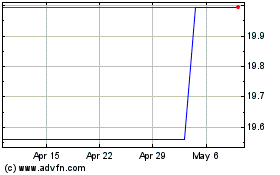

Mizuho Finl (PK) (USOTC:MZHOF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mizuho Finl (PK) (USOTC:MZHOF)

Historical Stock Chart

From Apr 2023 to Apr 2024