Zacks maintains target of $1.10 as NI 43-101 inferred resource report on the Manfo is expected this year - Analyst Blog

July 18 2012 - 8:15AM

Zacks

Zacks maintains target of $1.10 as NI 43-101 inferred

resource report on the Manfo is expected this year

Steven Ralston, CFA

Pelangio Exploration (V.PX: TSX-V and PGXPF:

OTC) is a junior gold exploration company currently

continuing with a Second phase Drilling program at the company’s

Manfo property located in Ghana. The Manfo diamond drilling program

was increased to 40,000 meters in early 2012. Management expects to

file an initial NI 43-101 compliant inferred resource report on the

Pokukrom East, Pokukrom West and Nfante West deposits on Manfo

property later in 2012.

On the Manfo property, Pelangio has completed over 160 diamond

drill holes totaling 34,199 meters in the Second Phase program. The

pace of drilling increased with the addition of a third drilling

rig early in 2012. During the first quarter, a follow-up induced

polarization (IP) survey was completed at Manfo. A 350 line

kilometer program identified 20 new targets in areas of high

resistivity where cover appears to mask underlying gold

mineralization that geochemical surveys cannot detect.

Drilling results at Pokukrom East have defined a strike length

of bulk gold mineralization of at least 850 meters, which is open

to the north and at depth. The geochemical anomaly is much longer

at approximately 1,200 meters in length. In addition, to the north

the zone plunges at approximately 40 degrees from near-surface to a

depth of 210 meters with a currently defined length of

approximately 600 meters.

Earlier this month, Pelangio announced results from preliminary

scoping metallurgical tests on composite samples taken from

Pokukrom East and Pokukrom West. Undertaken by SGS Mineral

Services, four samples exhibited a conventional metallurgical

profile with the expectation of gold recoveries between 84% and

94%. Initial indications suggest a recovery circuit composed of

crushing and grinding, gravity separation (achieving recoveries

between 21% and 50%) and cyanide leaching (48 hours in the

laboratory test). Though the optimal grind size has yet to be

determined, the 84% to 94% recovery rates assumed 80% of the ore

passing through 75 micron screens. Also, the study suggested that a

whole ore cyanide leaching circuit with oxygen injection may be

able to achieve similar levels of gold recovery.

At Obuasi earlier in the year, Pelangio completed three trenches

totaling 331 meters and four prospecting pits for a total depth of

4.90 meters; 357 trench samples, 252 outcrop samples and 4,091 soil

samples were collected. During the third quarter, management plans

to continue prospecting, mapping and surveying at Obuasi.

Concerning the Akroma property, the company confirmed through an

announcement that the second payment of 40,000 shares was made to

the optionor in June. In order to earn a 100% interest in the

property, Pelangio need only issue an additional 125,000 shares to

the optionor over the next two years. Since initially optioning the

property last year, Pelangio has explored the property by

collecting 3,712 soil samples from three areas for the purpose of

identifying targets for an upcoming drill program.

Pelangio has been very successful raising funds for the

acquisition of potential mining properties and its exploration

program. During 2011, the company’s exploration activities

were adequately funded by $16,919,544 in net proceeds from the sale

of securities and the exercise of options and warrants. During the

first quarter of 2012, the exercise of options provided $97,500 of

additional working capital.

We maintain our Outperformrating and price target of $1.10 due

to the company’s continued positive drilling results coupled with

the success in raising funds for further exploration. We expect

that the NI 43-101 compliant inferred resource report on the Manfo

property will act as a catalyst for price appreciation.

Please visit scr.zacks.com to access a free copy of the full

PX.V research report.

PELANGIO EXPL (PGXPF): Free Stock Analysis Report

(V.PX): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

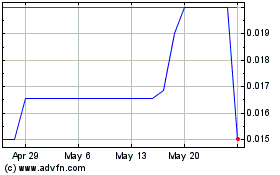

Pelangio Exploration (PK) (USOTC:PGXPF)

Historical Stock Chart

From Jun 2024 to Jul 2024

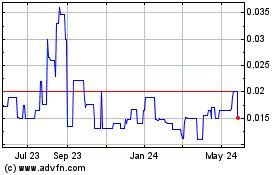

Pelangio Exploration (PK) (USOTC:PGXPF)

Historical Stock Chart

From Jul 2023 to Jul 2024