0000704172

false

0000704172

2023-06-27

2023-06-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): June 27, 2023

PHI

GROUP, INC.

(n/k/a

PHILUX GLOBAL GROUP INC.‚

(Exact

name of registrant as specified in its charter)

| Wyoming |

|

001-38255-NY |

|

90-0114535 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

| 2323

Main Street, Irvine, CA |

|

92614 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: 714-793-9227

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Precommencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Precommencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)). |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

PHIL |

|

OTC

Markets |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provide pursuant to Section 13(a) of the Exchange Act. ☐.

Item

1.02 Termination of Material Definitive Agreements.

1.

Agreement for Termination of Agreement of Purchase and Sale among Philux Global Group, Van Phat Dat Joint Stock Company and Huynh Ngoc

Vu:

On

June 27, 2023, Philux Global Group Inc. (f/k/a PHI Group, Inc.), the Registrant, Van Phat Dat Export Joint Stock Company, a Vietnamese

joint stock company, with principal business address at 316 Le Van Sy Street, Ward 1, Tan Binh District, Ho Chi Minh City, Vietnam, and

its majority shareholder Huynh Ngoc Vu, hereinafter referred to as “Seller,” signed an Agreement to terminate the Agreement

of Purchase and Sale previously entered into by the parties on August 16, 2022 in its entirety, retroactively effective August 16, 2022.

2.

Return of deliveries by the parties

Effective

immediately upon the signing of this Termination Agreement:

Seller

and VPD shall return to PGG and PGT all the deliveries that had been delivered to them at or prior the Closing Date of said Agreement

of Purchase and Sale by PGG and PGT, and

PGG

and PGT shall return to Seller and VPD all the deliveries that had been delivered to them at or prior the Closing Date of said Agreement

of Purchase and Sale by Seller and VPD.

3.

Alternative Potential Cooperation between Seller and Philux Global Group: Following the Termination of said Agreement of Purchase

and Sale, the Seller and Philux Global Group will study an alternative potential cooperation that may inure to the benefits of both Seller

and Philux Global Group.

The

foregoing description of the Agreement to terminate the referenced Agreement of Purchase and Sale is qualified in its entirety by reference

to the full text of said Agreement, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

SECTION

9 – FINANCIAL STATEMENTS AND EXHBITS

Item

9.01 Financial Statements and Exhibits

The

following is a complete list of exhibit(s) filed as part of this Report.

Exhibit

number(s) correspond to the number(s) in the exhibit table of Item 601 of Regulation S-K.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated:

June 28, 2023

| PHILUX

GLOBAL GROUP INC. |

|

| (f/k/a

PHI GROUP, INC.) |

|

| (Registrant)

|

|

| |

|

|

| By: |

/s/

Henry D. Fahman |

|

| |

Henry

D. Fahman, Chairman and CEO |

|

EXHIBIT

10.1

AGREEMENT

FOR TERMINATION

OF

AGREEMENT OF PURCHASE AND SALE

This

AGREEMENT FOR TERMINATION OF AGREEMENT OF PURCHASE AND SALE (“Termination Agreement”) is made on the 27th day of June 2023,

to be retroactively effective August 16, 2022, (the “Effective Date”), by and among Philux Global Group Inc. (f/k/a PHI Group,

Inc., “PGG”), a U.S. public company organized and operating in accordance with the law of the State of Wyoming, with principal

business address at 2323 Main Street, Irvine, CA 92614, USA, hereinafter referred to as “PGG”, Van Phat Dat Export Joint

Stock Company, a Vietnamese joint stock company, with principal business address at 316 Le Van Sy Street, Ward 1, Tan Binh District,

Ho Chi Minh City, Vietnam, hereinafter referred to as “VPD” and its majority shareholder Huynh Ngoc Vu, hereinafter referred

to as “Seller”.

WITNESSETH:

WHEREAS,

effective August 16, 2022 PGG, VPD and Seller entered into an Agreement of Purchase and Sale whereby PGG covenanted and agreed to buy

from Seller on behalf of Philux Global Trade Inc., a subsidiary of PGG (“PGT”), and Seller covenanted and agreed to sell

to PGT Five Million One Hundred Thousand (5,100,000) Shares of Ordinary Stock of VPD, which is equivalent to Fifty-One percent (51.00%)

of all the issued and outstanding Ordinary Stock of VPD, which shares were owned by Seller, for a total price of Six Million One Hundred

Twenty-Seven Thousand Eight Hundred Ninety-Five U.S. Dollars ($US 6,127,895) pursuant to the terms and conditions of this Agreement of

Purchase and Sale.

As

consideration for the issuance of a convertible promissory note (the “Convertible Promissory Note”) by PGT, Seller would

transfer and deliver to PGT the ownership and possession of Five Million One Hundred Thousand (5,100,000) Shares of Ordinary Stock of

VPD, which is equivalent to Fifty-One percent (51.00%) of all the issued and outstanding Ordinary Stock of VPD owned by Seller (“Acquired

Assets”).

As

consideration for the consideration provided by Seller, PGT would pay to Seller and/or their designee(s) the Total Purchase Price of

Six Million One Hundred Twenty-Seven Thousand Eight Hundred Ninety-Five U.S. Dollars ($US 6,127,895) in form of a Convertible Promissory

Note, as defined below.

The

Convertible Promissory Note, which is guaranteed by PGG and carries no interest, shall become due and payable one hundred eight (180)

days commencing the date of issuance and may be convertible into Common Stock of PGT any time after such this subsidiary has become a

publicly traded company in the U.S.A. for at least one week, at a Variable Conversion Price (as defined herein). The Variable Conversion

Price to be used in connection with the conversion into Common Stock of PGT shall mean 50% multiplied by the Market Price (as defined

herein), representing a discount rate of 50%, of that Common Stock. “Market Price” means the average Trading Price for the

Common Stock of PGT during the ten (10) trading-day period ending one trading day prior to the date the Conversion Notice is sent by

the Holder of the Convertible Promissory Note to PGT via facsimile or email (the “Conversion Date”). “Trading Price”

means, for any security as of any date, the closing price on the OTC Markets, OTCQB, NASDAQ Stock Markets, NYSE or applicable trading

market as reported by a reliable reporting service (“Reporting Service”) mutually acceptable to PGT and Holder of the Convertible

Promissory Note.

| |

AGREEMENT FOR TERMINATION OF

AGREEMENT OF PURCHASE AND SALE

VAN PHAT DAT JSC – PHI GROUP INC | 1 |

The

issuance and transfer of shares of Ordinary Stock of VPD from the Seller to PGT would qualify as a transaction in securities that is

fully compliant with the laws of Socialist Republic of Vietnam.

WHEREAS,

on and effective September 30, 2022 PGG, VPD and Seller entered into a Closing Memorandum for the afore-mentioned Agreement of Purchase

and Sale, as reported in Form 8-K filed with the U.S. Securities and Exchange Commission on October 06, 2022.

WHEREAS,

due to a significant change in the operating results of VPD during the latest fiscal year ended December 31, 2022 versus those during

the fiscal year ended December 31, 2021 as well as the Seller’s desire to re-orient the focus of his scope of business, it deems

to be in the best interests of PGG, VPD and Seller to terminate the referenced Agreement of Purchase and Sale in its entirety;

NOW

THEREFORE, the Parties hereto agree as follows:

1.

Agreement for Termination of Agreement of Purchase and Sale dated August 16, 2022 by and among

PHI Group, Inc. (n/k/a Philux Global Group Inc.), Van Phat Dat Joint Stock Company and Seller.

PHI

Group, Inc. (n/k/a Philux Global Group Inc.), Van Phat Dat JSC and Mr. Huynh Ngoc Vu hereby agree to terminate said Agreement of Purchase

and Sale in its entirety. Notwithstanding certain provisions contained therein, said Agreement of Purchase and Sale is considered terminated

and its terms and conditions are null and void retroactively effective August 16, 2022.

2.

Return of deliveries by the parties

Effective

immediately upon the signing of this Termination Agreement:

Seller

and VPD shall return to PGG and PGT all the deliveries that had been delivered to them at or prior the Closing Date of said Agreement

of Purchase and Sale by PGG and PGT, and

PGG

and PGT shall return to Seller and VPD all the deliveries that had been delivered to them at or prior the Closing Date of said Agreement

of Purchase and Sale by Seller and VPD.

3.

Alternative Potential Cooperation between Seller and PGG: Following the Termination of

said Agreement of Purchase and Sale, the Seller and PGG will study an alternative potential cooperation that may inure to the benefits

of both Seller and PGG.

4. Indemnification: Each of the Parties hereto agrees to indemnify and hold harmless the other

Party and their respective officers, directors, employees, equity owners, agents, independent contractors, heirs, administrators, executors,

successors, assigns, representatives, affiliates and/or otherwise related persons and entities, and their respective officers, directors,

employees, equity owners, agents, independent contractors, heirs, administrators, executors, successors, assigns, and representatives,

respectively from and against any and all claims, demands, damages, including but not limited to their reasonable attorneys’ fees

and costs, arising from or relating to any breach of this Termination Agreement and/or its terms and conditions by a breaching Party.

| |

AGREEMENT FOR TERMINATION OF

AGREEMENT OF PURCHASE AND SALE

VAN PHAT DAT JSC – PHI GROUP INC | 2 |

5. Governing Law and Forum: This Termination Agreement and the entire relationship among the

Parties will be governed by and construed under the laws of the State of California. Any dispute arising under, out of or in connection

with this Termination Agreement, including any question regarding its existence, validity or termination, shall be referred to and be

finally resolved by binding arbitration in Los Angeles, California before a single arbitrator. The American Arbitration Association Rules

published and current at the date of the referral of any dispute to arbitration pursuant to this clause shall control the selection of

the arbitrator and the arbitration process. The rules and regulations of the American Arbitration Association shall be deemed to be valid

and acceptable by reference into this clause, and no further agreement of the Parties shall be required to initiate such proceeding.

The Party prevailing in such arbitration shall be entitled to recover, in additional to all other remedies or damages, reasonable attorneys’

fees and costs. The Parties acknowledge and agree that the arbitrator shall have the authority to enter orders and make awards of specific

performance and/or injunctive relief.

6.

Notices: Any notice of other communication required or permitted by this Termination Agreement

must be in writing and will be deemed given when (i) delivered in person; (ii) submitted by facsimile with written confirmation of transmission

or by email with receipt verification; (iii) delivered by overnight or two day courier, with receipt and date of delivery stated; or

(iv) when mailed by U.S. First Class Mail addressed to:

| |

If

to VPD and Seller: |

| |

|

| |

Van

Phat Dat Export Joint Stock Company |

| |

Attn:

Mr. Pham Huu Tai, General Director |

| |

316

Le Van Sy Street, Ward 1, Tan Binh District |

| |

Ho

Chi Minh City, Vietnam |

| |

Email:

giathi72@gmail.com |

| |

|

| |

If

to PGG: |

| |

|

| |

PHILUX

Global Group Inc. |

| |

Attn:

Mr. Henry D Fahman, Chairman & CEO |

| |

2323

Main Street |

| |

Irvine,

CA 92614, U.S.A. |

| |

Email:

henry@philuxglobal.com |

7.

Amendments: This Termination Agreement may not be modified or amended except by written

document signed by all the Parties.

8. Parties: This Termination Agreement is for the benefit of, and binds, all the Parties,

their successors and permitted assigns.

9.

Severability: The provisions of this Termination Agreement will be deemed severable, and

if any part of any provision is held illegal, void or invalid under applicable law, such provision will be changed to the extent reasonably

necessary to make the provision, as so changed, legal, valid and binding. If any provision of this Termination Agreement is held illegal,

void or invalid in its entirety, the remaining provisions of this Termination Agreement will not in any way be affected or impaired but

will remain binding in accordance with their terms.

| |

AGREEMENT FOR TERMINATION OF

AGREEMENT OF PURCHASE AND SALE

VAN PHAT DAT JSC – PHI GROUP INC | 3 |

IN

WITNESS WHEREOF, the Parties hereto have agreed and executed this Agreement for Termination of Agreement of Purchase and Sale as

of the day and year first above written.

Dated:

June 27, 2023

| PHILUX

GLOBAL GROUP INC. |

|

VAN

PHAT DAT EXPORT JSC |

| (f/k/a

PHI GROUP, INC.) |

|

a

Vietnamese joint stock company |

| a

Wyoming corporation, U.S.A. |

|

|

| By:/signed

and sealed/ Henry D. Fahman |

|

By:

/signed and sealed/ Pham Huu Tai |

| Henry

D. Fahman |

|

Pham

Huu Tai |

| Chairman

& CEO |

|

General

Director |

| SELLER |

|

WITNESS |

| BÊN

BÁN |

|

CHỨNG

KIẾN |

| By:

/s/ Huynh Ngoc Vu |

|

By:

/s/ Jack Vo |

| Huynh

Ngoc Vu |

|

Jack

Vo |

| An

individual |

|

Vice

President, Philux Global Group Inc. |

| Global

Business Development |

|

|

| |

AGREEMENT FOR TERMINATION OF

AGREEMENT OF PURCHASE AND SALE

VAN PHAT DAT JSC – PHI GROUP INC | 4 |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

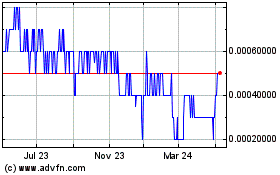

PHI (PK) (USOTC:PHIL)

Historical Stock Chart

From Nov 2024 to Dec 2024

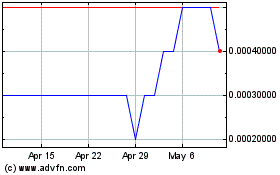

PHI (PK) (USOTC:PHIL)

Historical Stock Chart

From Dec 2023 to Dec 2024