Q.E.P. Co., Inc., Reports Fiscal 2007 First-Quarter Financial Results

July 18 2006 - 7:00AM

Business Wire

Q.E.P. CO., INC. (Nasdaq:QEPC), today announced financial results

for its fiscal 2007 first quarter ended May 31, 2006. For the

fiscal 2007 first quarter, net sales increased 8.5 percent to a

quarterly record $54.1 million, compared with $49.9 million in the

fiscal 2006 first quarter. Increased sales volume in several of the

Company's product categories including underlayment, adhesives and

carpet tools contributed to the first quarter's sales growth. In

addition, the complete integration of the Capitol USA acquisition

contributed to higher sales of the Company's adhesive products.

Sales outside North America accounted for approximately 22 percent

of sales in the fiscal 2007 first quarter. The gross profit for the

fiscal 2007 first quarter increased to $15.3 million from $14.4

million in the same period last year. Gross profit as a percentage

of sales for the fiscal 2007 first quarter was 28.2 percent, up

sequentially from the fourth quarter's 25.7 percent, but down

compared with 28.8 percent for the fiscal 2006 first quarter. Gross

margins continue to be effected by high raw material prices. In

addition, the gross margins for the quarter were also impacted by

higher volumes of rebates from the Company's home center customers.

For the 2007 fiscal first quarter, pretax income was $386,000, down

from $1.5 million in the same period last year, which included a

$1.1 million gain from the sale of Roberts Tape and $505,000

expense for the change in the warrant put liability. For the fiscal

2007 first quarter, the Company reported net income of $244,000, or

$0.06 per diluted share, compared to $770,000, or $0.21 per diluted

share, for the first quarter last fiscal year. Lewis Gould,

Q.E.P.'s Chairman and Chief Executive Officer, stated: "I am

pleased with the progress we are making in the integration of

Capitol USA, the higher level of business compared with the same

period last year, and the sequential financial improvements in cost

controls, price increases and profitability. We are slowly making

progress, even though our profitability has performed under our

expectations for the past six quarters. "In addition, during the

quarter we successfully amended our loan agreement with our lenders

and increased sales to home centers by approximately 10 percent

from further product penetration. We are pleased with the breadth

of our products that answer the needs of the professional and

do-it-yourselfer. The sale of these product offerings is

positioning the Company to increase its market share in our various

niche businesses," concluded Mr. Gould. The Company will host a

conference call at 9:30 a.m. Eastern Time today to discuss this

press release and to answer questions. To participate in the

conference call, please dial 800-936-9754 five to 10 minutes before

the call is scheduled to begin. The financial information to be

discussed during the conference call is included in the Company's

Form 10-Q filed with the Securities and Exchange Commission ("SEC")

on July 17, 2006 and will be added to Q.E.P.'s website at

www.qep.com in the Investor Relations section. Certain statements

in this press release, including statements regarding our

integration of the Capitol USA business, and financial improvements

in cost controls, price increases and profitability, our growth in

our net sales, the sale of our product offerings positioning us to

increase our market share in our various niche businesses and our

ability to implement additional price increases are forward-looking

statements, which are made pursuant to the safe-harbor provisions

of the Securities Litigation Reform Act of 1995. The

forward-looking statements are made only as of the date of this

report and are subject to risks and uncertainties which could cause

actual results to differ materially from those discussed in the

forward-looking statements and from historical results of

operations. Among the risks and uncertainties that could cause such

a difference are our assumptions relating to the expected growth in

sales of our products, the continued success of our manufacturing

processes, continued increases in the cost of raw materials and

finished goods, improvements in productivity and cost reductions,

the continued success of initiatives with certain of our customers,

the success of our price increases initiatives, and the success of

our sales and marketing efforts. A more detailed discussion of

risks attendant to the forward-looking statements included in this

press release are set forth in the "Forward-Looking Statements"

section of our Annual Report on Form 10-K for the year ended

February 28, 2006, filed with the SEC, and in other reports already

filed with the SEC. -0- *T Q.E.P. CO., INC., AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME (In thousands, except per-share

data; unaudited) Three Months Ended 5/31/06 5/31/05 -----------

----------- Net sales $54,132 $49,873 Cost of goods sold 38,866

35,522 ----------- ----------- Gross profit 15,266 14,351 Costs and

expenses Shipping 5,548 5,034 General and administrative 5,052

4,583 Selling and marketing 3,558 4,445 Other expense (2) (1,153)

----------- ----------- Total costs and expenses 14,156 13,800

----------- ----------- Operating income 1,110 2,442 Change in

warrant put liability ---- 505 Interest expense 724 487 -----------

----------- Income before provision for income taxes 386 1,450

Provision for income taxes 142 680 ----------- ----------- Net

income $244 $770 =========== =========== Basic net income per

common share $0.07 $0.22 =========== =========== Diluted net income

per common share $0.06 $0.21 =========== =========== Weighted

average number of common shares - diluted 3,838 3,618 CONDENSED

CONSOLIDATED BALANCE SHEETS (In thousands) 5/31/06 2/28/06

----------- ---------- (unaudited) Assets Current Assets Cash and

cash equivalents $731 $852 Accounts receivable 32,899 33,258

Inventories 33,447 34,128 Other current assets 3,969 4,334

----------- ---------- Total current assets 71,046 72,572 Property

and equipment, net 8,131 8,296 Goodwill 16,967 16,799 Other

intangible assets, net 3,079 3,109 Other assets 212 310 -----------

---------- Total Assets $99,435 $101,086 =========== ==========

Liabilities and Shareholders' Equity Current liabilities Trade

accounts payable $21,630 $24,041 Accrued liabilities 6,423 7,655

Lines of credit 29,342 26,284 Current maturities of long-term debt

4,449 4,431 Warrant put liability 1,789 1,789 -----------

---------- Total current liabilities 63,633 64,200 Notes payable

3,139 4,950 Other long-term debt 4,367 4,197 Deferred income taxes

217 213 ----------- ---------- Total Liabilities 71,356 73,560

Shareholders' equity 28,079 27,526 ----------- ---------- Total

Liabilities and Shareholders' Equity $99,435 $101,086 ===========

========== *T

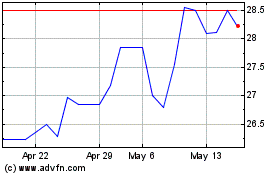

Q E P (QX) (USOTC:QEPC)

Historical Stock Chart

From Feb 2025 to Mar 2025

Q E P (QX) (USOTC:QEPC)

Historical Stock Chart

From Mar 2024 to Mar 2025