Q.E.P. CO., INC. (Nasdaq:QEPC), today announced financial results

for its fiscal 2007 third quarter and nine months ended November

30, 2006. Lewis Gould, Q.E.P.�s Chairman and Chief Executive

Officer, stated: �Because there will be no conference call

highlighting some of the financial results, I have gone into more

detail in discussing my comments for this release, which parallels

our 10-Q filing. Business conditions continued to be challenging.

However, sales stayed firm with the prior quarter and increased 3.1

percent, compared to the same period last year. I am greatly

pleased that our sales for the nine-month period increased 4.8

percent to an all-time record of $163,063,000. �For the fiscal 2007

third quarter, the Company reported net income of $370,000, or

$0.10 per diluted share, compared to net income of $345,000, or

$0.09 per diluted share for the third quarter last year. After

excluding the change in the put warrant liability and other

non-recurring items, the Company reported net income of $971,000,

or $0.26 per diluted share for the nine months as compared to

$829,000, or $0.22 per diluted share during the same period last

year. �I am especially pleased to report that for the third quarter

of fiscal 2007, the Company generated $2.4 million of cash from

operations, compared to $1.3 million in the third quarter of fiscal

2006. For the first nine months of fiscal 2007, the Company

generated $2.5 million of cash from operations, compared to $1.7

million for the same period last year. �Although, the outlook for

the current quarter remains uncertain, the Company is pursuing

several new initiatives to offset current market weaknesses.� On

January 10, 2007, the Company reported that as of November 30,

2006, it was in violation of a financial covenant that requires the

Company to maintain a certain senior debt to trailing EBITDA ratio.

On January 12, 2007, the Company was granted a waiver of the

non-compliance with this covenant from the Company�s lenders.

Certain statements in this press release, including statements

relating to the success of the Company�s several new initiatives to

offset current market weaknesses, are forward-looking statements,

which are made pursuant to the safe-harbor provisions of the

Securities Litigation Reform Act of 1995. The forward-looking

statements are made only as of the date of this report and are

subject to risks and uncertainties which could cause actual results

to differ materially from those discussed in the forward-looking

statements and from historical results of operations. Among the

risks and uncertainties that could cause such a difference are our

assumptions relating to the expected growth in sales of our

products, the continued success of our manufacturing processes,

continued increases in the cost of raw materials and finished

goods, improvements in productivity and cost reductions, the

continued success of initiatives with certain of our customers, the

success of our price increases initiatives, and the success of our

sales and marketing efforts. A more detailed discussion of risks

attendant to the forward-looking statements included in this press

release are set forth in the �Forward-Looking Statements� section

of our Annual Report on Form 10-K for the year ended

February�28,�2006, as amended, filed with the SEC, and in other

reports already filed with the SEC. -Financial Information Follows-

Q.E.P. CO., Inc. and Subsidiaries Consolidated Balance Sheets (In

thousands, except share data) � November 30, 2006 February 28, 2006

(Unaudited) ASSETS CURRENT ASSETS Cash and cash equivalents $

1,111� $ 852� Accounts receivable, less allowance for doubtful

accounts of approximately $276 and $361 as of November 30, 2006 and

February 28, 2006, respectively � 31,605� 33,258� Inventories

30,347� 34,128� Prepaid expenses and other current assets 3,399�

3,717� Deferred income taxes 660� 617� Total current assets 67,122�

72,572� � Property and equipment, net 7,265� 8,296� Goodwill 9,578�

16,799� Other intangible assets, net 2,914� 3,109� Other assets

208� 310� � Total Assets $ 87,087� $ 101,086� � LIABILITIES AND

SHAREHOLDERS' EQUITY CURRENT LIABILITIES Trade accounts payable $

17,996� $ 24,041� Accrued liabilities 7,795� 7,655� Lines of credit

28,463� 26,284� Current maturities of long-term debt 4,162� 4,431�

Put warrant liability 978� 2,298� Total current liabilities 59,394�

64,709� � Notes payable 3,030� 4,950� Other long-term debt 2,601�

4,197� Deferred income taxes 214� 213� Total Liabilities 65,239�

74,069� � Commitments and Contingencies --� --� � SHAREHOLDERS'

EQUITY Preferred stock, 2,500,000 shares authorized, $1.00 par

value; 336,660 shares issued and outstanding at November 30, 2006

and February 28, 2006, respectively � 337� 337� Common stock;

20,000,000 shares authorized, $.001 par value; 3,513,341 and

3,458,341 shares issued, and 3,430,401 and 3,387,401 shares

outstanding at November 30, 2006 and February 28, 2006,

respectively � � 3� 3� Additional paid-in capital 9,964� 9,539�

Retained earnings 15,151� 21,205� Treasury stock; 82,940 and 70,940

shares held at cost outstanding at November 30, 2006 and February

28, 2006, respectively (639) (543) Accumulated other comprehensive

income (2,968) (3,524) 21,848� 27,017� TOTAL LIABILITIES AND

SHAREHOLDERS' EQUITY $ 87,087� $ 101,086� Q.E.P. CO., INC. AND

SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands

except per share data) (Unaudited) � For the Three Months Ended

November 30, For the Nine Months Ended November 30, 2006 2005 2006

2005 As Restated As Restated Net sales $ 54,455� $ 52,822� $

163,063� $ 155,641� Cost of goods sold 39,760� 38,472� 118,238�

112,540� Gross profit 14,695� 14,350� 44,825� 43,101� � Operating

costs and expenses: Shipping 5,560� 5,095� 16,665� 15,416� General

and administrative 4,430� 4,721� 14,565� 13,944� Selling and

marketing 3,551� 3,555� 10,842� 10,665� Impairment loss on goodwill

and other intangibles (78) -� 7,520� -� Other expense (income), net

(38) (111) (41) (1,275) Total operating costs and expenses 13,425�

13,260� 49,551� 38,750� � Operating income (loss) 1,270� 1,090�

(4,726) 4,351� � Change in put warrant liability 3� 88� 1,319�

1,050� Interest expense, net (711) (681) (2,167) (1,811) � Income

(loss) before provision for income taxes 562� 497� (5,574) 3,590� �

Provision for income taxes 192� 152� 457� 1,003� � Net income

(loss) $ 370� $ 345� $ (6,031) $ 2,587� � Net income (loss) per

share: Basic $ 0.10� $ 0.10� $ (1.78) $ 0.76� Diluted $ 0.10� $

0.09� $ (1.78) $ 0.69� � Weighted-average number of common shares

outstanding � Basic 3,423� 3,387� 3,402� 3,387� Diluted 3,623�

3,741� 3,402� 3,756� Net Income (Loss) Compared to Net Income

Adjusted for the Change in the Put Warrant Liability and

Non-Recurring Items (In thousands except per share data) � While

Net Income Adjusted for the Change in the Put Warrant Liability and

Non-Recurring Items is not a measure of financial performance under

generally accepted accounting principles, the Company believes that

the measure provides meaningful comparisons of the Company�s

current and projected operating performance with its historical

results. The Company uses Net Income Adjusted for the Change in the

Put Warrant Liability and Non-Recurring Items as an internal

measure of its business and believes it is utilized as an important

measure of performance by the investment community. Net Income

Adjusted for the Change in the Put Warrant Liability and

Non-Recurring Items is not meant to be considered a substitute or

replacement for Net Income as prepared in accordance with generally

accepted accounting principles. The reconciliation of Net Income to

Net Income Adjusted for the Change in the Put Warrant Liability and

Non-Recurring Items is as follows: � Net Income Adjusted for the

Change in the Put Warrant Liability and Other Non-Recurring Items �

For the Three Months Ended For the Nine Months Ended November 30,

November 30, 2006 2005 2006 2005 (As Restated) (As Restated) � Net

income (loss), as reported (a) $ 370� $ 345� $ (6,031) $ 2,587� �

Add back (deduct): Impairment loss on goodwill and other intangible

assets (78) -� 7,520� -� Realization of currency translation loss

related to the disposition of certain assets and obligations of the

Holland subsidiary -� -� 447� -� Loss related to the disposition of

certain assets and obligations of the Holland subsidiary, net of

tax benefit -� -� 354� -� Gain on sale of carpet seaming tape

business, net of tax -� -� -� (708) Change in put warrant liability

(3) (88) (1,319) (1,050) Net income adjusted for the change in the

put warrant liability and non-recurring items (b) $ 289� $ 257� $

971� $ 829� � Earnings (loss) per share, as reported: Basic

((a)/(c)) $ 0.10� $ 0.10� $ (1.78) $ 0.76� Diluted ((a)/(d)) $

0.10� $ 0.09� $ (1.78) $ 0.69� � Weighted average number of shares

outstanding, as reported: Basic (c) 3,423� 3,387� 3,402� 3,387�

Diluted (d) 3,623� 3,741� 3,402� 3,756� � Earnings per share

adjusted for the change in the put warrant liability and

non-recurring items: Basic ((b)/(e)) $ 0.08� $ 0.08� $ 0.28� $

0.24� Diluted ((b)/(f)) $ 0.08� $ 0.07� $ 0.26� $ 0.22� � Weighted

average number of shares outstanding as adjusted for the change in

the put warrant liability and non-recurring items: Basic (e) 3,423�

3,387� 3,402� 3,387� Diluted (f) 3,623� 3,741� 3,679� 3,756� Q.E.P.

CO., INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS

(In Thousands) (Unaudited) � For the Nine Months Ended November 30,

2006 2005 - As Restated - Cash flows from operating activities: Net

income (loss) $ (6,031) $ 2,587� � Adjustments to reconcile net

income (loss) to net cash provided by operating activities: �

Depreciation and amortization 1,895� 3,101� Impairment loss on

goodwill and other intangibles 7,520� -� Change in fair value of

put warrant liability (1,319) (1,050) Write-off of Holland

accumulated foreign translation 447� -� Bad debt expense 171� 328�

Gain on sale of business -� (1,120) Stock-based compensation

expense 191� -� Deferred income taxes (42) (234) Changes in assets

and liabilities, net of acquisitions: Accounts receivable 1,482�

(4,552) Inventories 3,782� 303� Prepaid expenses and other current

assets 318� 634� Other assets 4� (621) Trade accounts payable and

accrued liabilities (5,930) 2,307� Net cash provided by operating

activities 2,488� 1,683� � Cash flows from investing activities:

Capital expenditures (485) (1,267) Acquisitions, net of cash

acquired -� (2,512) Net cash used in investing activities (485)

(3,779) � Cash flows from financing activities: Net borrowings

under lines of credit 1,552� 900� Borrowings of long-term debt -�

3,224� Repayments of long-term debt (2,087) (1,677) Repayments of

acquisition debt (1,834) (870) Payments related to the purchase of

treasury stock (90) (90) Proceeds from exercise of stock options

257� 10� Dividends (22) (8) Net cash (used in) provided by

financing activities (2,224) 1,489� � Effect of exchange rate

changes on cash 480� (168) � Net decrease in cash 259� (775) � Cash

and cash equivalents at beginning of period 852� 1,869� � Cash and

cash equivalents at end of period $ 1,111� $ 1,094�

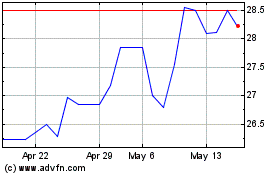

Q E P (QX) (USOTC:QEPC)

Historical Stock Chart

From Feb 2025 to Mar 2025

Q E P (QX) (USOTC:QEPC)

Historical Stock Chart

From Mar 2024 to Mar 2025