FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of

the Securities Exchange Act of 1934

For 20 February 2024

Commission File Number: 001-10306

NatWest Group plc

Gogarburn, PO Box 1000

Edinburgh EH12 1HQ

________________________________________________

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F __X__ Form 40-F _____

This report on Form 6-K, except for any information contained on any

websites linked in this report, shall be deemed incorporated by reference into the company's Registration Statement on Form F-3 (File

No. 333-261837) and to be a part thereof from the date which it was filed, to the extent not superseded by documents or reports subsequently

filed or furnished.

NatWest Group plc

19 February 2024

Commencement of On Market Share Buyback Programme

NatWest Group plc (the “Company”) announces the commencement

of its programme to buy back ordinary shares in the Company with a nominal value of £1.0769* each (“Ordinary Shares”).

On 16 February 2024, the Company announced its full year results and

a share buyback programme (the “2024 Programme”) of up to £300 million. The 2024 Programme will commence on 19 February

2024 and will end no later than 18 July 2024, provided that the term of the 2024 Programme may be extended to end no later than 15 August

2024 to account for any days where usual trading has not been possible because of market events during the term of the 2024 Programme.

The 2024 Programme, the purpose of which is to reduce the Company’s

issued share capital, will take place within the limitations of the authority granted by shareholders to the Board of the Company at its

Annual General Meeting, held on 25 April 2023 (the “2023 Authority”).

The maximum number of Ordinary Shares that can be purchased by NWG under

the 2024 Programme is 696,743,990**.

The Company has entered into non-discretionary instructions with UBS

AG, London Branch to conduct the Programme on its behalf and to make trading decisions under the Programme independently of the Company.

The Company intends to cancel the repurchased Ordinary

Shares.

* The nominal value of Ordinary

Shares without rounding is £1.076923076923077 per share.

**

This number reflects the impact on the 2023 Authority of the reduction in issued share capital following the off-market buyback announced

on 22 May 2023. It is further reduced by the number of shares purchased to date by the Company under the ongoing share buyback programme

announced on 31 July 2023 (the “2023 Programme”).This

number does not take into account further purchases of Ordinary Shares which (i) may have taken place but have not, at the date of this

announcement, settled under the 2023 Programme or (ii) may take place under the 2023 Programme between the date of this announcement

and the conclusion of the 2023 Programme. These remaining purchases under the

2023 Programme may occur whilst purchases are taking place under the 2024 Programme.

Further information:

Investor Relations

+ 44 (0)207 672 1758

Media Relations

+44 (0)131 523 4205

Legal Entity Identifier: 2138005O9XJIJN4JPN90

Disclaimer

This announcement is for information purposes

only and does not constitute or form a part of an offer to sell or a solicitation of an offer to purchase, or the solicitation to sell,

any securities of the Company.

Forward-looking

statements

This announcement

may include forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995, such

as statements that include, without limitation, the words ‘expect’, ‘estimate’, ‘project’, ‘anticipate’,

‘commit’, ‘believe’, ‘should’, ‘intend’, ‘will’, ‘plan’, ‘could’,

‘probability’, ‘risk’, ‘Value-at-Risk (VaR)’, ‘target’, ‘goal’, ‘objective’,

‘may’, ‘endeavour’, ‘outlook’, ‘optimistic’, ‘prospects’ and similar expressions

or variations on these expressions. These statements concern or may affect future matters, such as NatWest Group's future economic results,

business plans and strategies. In particular, this announcement may include forward-looking statements relating to NatWest Group

plc in respect of, but not limited to: its economic and political risks, its financial position, profitability and financial performance

(including financial, capital, cost savings and operational targets), the implementation of its strategy, its climate and sustainability-related

targets, increasing competition from incumbents, challengers and new entrants and disruptive technologies, its access to adequate sources

of liquidity and funding, its regulatory capital position and related requirements, its exposure to third party risks, its ongoing compliance

with the UK ring-fencing regime and ensuring operational continuity in resolution, its impairment losses and credit exposures under certain

specified scenarios, substantial regulation and oversight, ongoing legal, regulatory and governmental actions and investigations, and

NatWest Group’s exposure to operational risk, conduct risk, cyber, data and IT risk, financial crime risk, key person risk and

credit rating risk. Forward-looking statements are subject to a number of risks and uncertainties that might cause actual results

and performance to differ materially from any expected future results or performance expressed or implied by the forward-looking statements.

Factors that could cause or contribute to differences in current expectations include, but are not limited to, future growth initiatives

(including acquisitions, joint ventures and strategic partnerships), the outcome of legal, regulatory and governmental actions and investigations,

the level and extent of future impairments and write-downs, legislative, political, fiscal and regulatory developments, accounting standards,

competitive conditions, technological developments, interest and exchange rate fluctuations, general economic and political conditions

and the impact of climate-related risks and the transitioning to a net zero economy. These and other factors, risks and uncertainties

that may impact any forward-looking statement or NatWest Group plc's actual results are discussed in NatWest Group plc's 2023 Annual

Report on Form 20-F, and its other public filings. The forward-looking statements contained in this announcement speak only as of the

date of this announcement and NatWest Group plc does not assume or undertake any obligation or responsibility to update any of the forward-looking

statements contained in this announcement, whether as a result of new information, future events or otherwise, except to the extent legally

required.

No Purchases in the United States and No Purchases of American Depositary Receipts (“ADRs”)

Purchases of Ordinary Shares under the

Programme will be made outside the United States only. There will be no purchases of Ordinary Shares from within the United States or

from persons known to be located in the United States, and there will be no purchases of the Company’s ADRs under the Programme.

Signatures

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

NATWEST GROUP plc (Registrant) |

| |

|

|

| |

|

|

| Date: |

19 February 2024 |

|

By: |

/s/ Gary Moore |

| |

|

|

|

Name: |

Gary Moore |

| |

|

|

|

Title: |

Deputy Secretary |

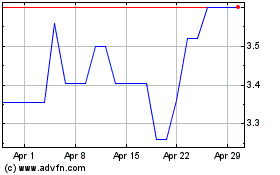

NatWest (PK) (USOTC:RBSPF)

Historical Stock Chart

From Mar 2024 to Apr 2024

NatWest (PK) (USOTC:RBSPF)

Historical Stock Chart

From Apr 2023 to Apr 2024