PRELIMINARY

OFFERING CIRCULAR DATED JULY 15, 2024

AN

OFFERING STATEMENT PURSUANT TO REGULATION A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION.

INFORMATION CONTAINED IN THIS PRELIMINARY OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR

MAY OFFERS TO BUY BE ACCEPTED BEFORE THE OFFERING STATEMENT FILED WITH THE COMMISSION IS QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR

SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE

IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF SUCH STATE. THE COMPANY

MAY ELECT TO SATISFY ITS OBLIGATION TO DELIVER A FINAL OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO BUSINESS DAYS AFTER THE COMPLETION

OF THE COMPANY’S SALE TO YOU THAT CONTAINS THE URL WHERE THE FINAL OFFERING CIRCULAR OR THE OFFERING STATEMENT IN WHICH SUCH FINAL

OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

Vivos

Inc.

719

Jadwin Avenue

Richland,

Washington 99352

(509)

736-4000

http://www.radiogel.com

Up

to 60,000,000 Shares of Common Stock, par value $0.001 per share, at

an

offering price of $0.15 per Share ($9,000,000)

SEE

“DESCRIPTION OF CAPITAL STOCK” AT PAGE 46.

| Securities Offered by the Company | |

Price Per Share to Public | | |

Total Number of Shares Being Offered | | |

Broker-Dealer discount and commissions (1) | | |

Proceeds to issuer (2) | |

| Per Share of Common Stock | |

$ | 0.15 | | |

| | | |

$ | - | | |

$ | | |

| Total Minimum | |

$ | 0.15 | | |

| 1 | | |

$ | - | | |

$ | 0.15 | |

| Total Maximum | |

$ | 9,000,000 | | |

| 60,000,000 | | |

$ | - | | |

$ | 9,000,000 | |

| (1)

|

We

may offer the shares of our common stock through registered broker-dealers or a selling agent and we may pay finders, although we

have no current arrangements to do so. We currently do not have any specific plans or arrangements to use a selling agent, broker-dealer

or finder; however, if we choose to do so in the future, information about any such broker dealer, selling agent, or finder shall

be disclosed in an amendment to this Offering Circular. |

| |

|

| (2) |

This

does not account for the payment of expenses of this offering, which is currently estimated to be approximately $100,000. See “Plan

of Distribution.” |

Vivos

Inc. (the “Company”) is offering up to 60,000,000 shares of common stock, par value $0.001 per share, at an offering

price of $0.15 per share. The offering will terminate at the earlier of: (i) the date at which the maximum offering amount has been sold,

(ii) the date which is one year from this offering being qualified by the Securities and Exchange Commission (“SEC”),

or (iii) the date at which the offering is earlier terminated by us in our sole discretion, which may occur at any time.

This

offering is being conducted on a “best efforts” basis without any minimum offering amount pursuant to Regulation A of Section

3(6) of the Securities Act for Tier 2 offerings. We reserve the right to undertake one or more closings on a rolling basis. Until we

complete a closing, the proceeds for the offering will not be kept in an escrow account. All funds derived by us from this offering will

be immediately available for use by us, in accordance with the uses set forth in the section of this Offering Circular entitled “Use

of Proceeds.” If there are no sales of our common stock pursuant to this Offering Circular, or upon termination of this offering

without any corresponding sales, the investments for this offering will be promptly returned to investors, without deduction and generally

without interest. There is no minimum purchase requirement for investors. See “Plan of Distribution.”

We

have yet to identify a broker-dealer or selling agent to act as our lead managing selling agent to offer shares of our common stock to

prospective investors on a “best efforts” basis. In the event that we do identify and make arrangements with a selling agent

to offer our securities, the selling agent may engage one or more co-managing selling agents, sub selling agents or selected dealers.

A selling agent is not required to purchase the shares of common stock being offered pursuant to this Offering Circular and is not required

to sell any specific number or dollar amount of shares of common stock in the offering.

We

expect to commence the offer and sale of the shares of common stock being offered pursuant to this Offering Circular as of the date on

which the offering statement of which this Offering Circular is a part (the “Offering Statement”) is qualified by

the SEC.

THE

UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OR GIVE ITS APPROVAL OF ANY SECURITIES OFFERED OR THE

TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE

SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT

DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION

GENERALLY,

NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME

OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT

DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(d)(2)(i)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING,

WE ENCOURAGE YOU TO REFER TO www.investor.gov.

This

offering is inherently risky. See “Risk Factors” located on page 8 for a discussion of certain risks that

you should consider in connection with an investment in our common stock.

The

Company is following the Form S-1 format of disclosure under Regulation A pursuant to general instructions of

Part II(a)(1)(ii) of Form 1-A for this Offering Circular.

TABLE

OF CONTENTS

In

this Offering Circular, the term “Vivos,” the “Company,” “We” or “Our” refers to Vivos

Inc. and its subsidiaries.

STATEMENT

REGARDING FORWARD-LOOKING STATEMENTS

THIS

OFFERING CIRCULAR MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN

AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY

AVAILABLE TO THE COMPANY’S MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS “ESTIMATE,” “PROJECT,”

“BELIEVE,” “ANTICIPATE,” “INTEND,” “EXPECT” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY

FORWARD-LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT’S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO

RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING

STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE

ON WHICH THEY ARE MADE. THE COMPANY DOES NOT UNDERTAKE ANY OBLIGATION TO REVISE OR UPDATE THESE FORWARD-LOOKING STATEMENTS TO REFLECT

EVENTS OR CIRCUMSTANCES AFTER SUCH DATE OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.

Industry

and Market Data

Although

we are responsible for all disclosure contained in this Offering Circular, in some cases we have relied on certain market and industry

data obtained from third-party sources that we believe to be reliable. Market estimates are calculated by using independent industry

publications in conjunction with our assumptions regarding the medical device industry and market. While we are not aware of any misstatements

regarding any market, industry or similar data presented herein, such data involves risks and uncertainties and is subject to change

based on various factors, including those discussed under the headings “Statement Regarding Forward- Looking Statements”

and “Risk Factors” in this Offering Circular.

OFFERING

CIRCULAR SUMMARY

This

summary highlights selected information contained elsewhere in this Offering Circular. This summary is not complete and does not contain

all the information that you should consider before deciding whether to invest in our common stock. You should carefully read the entire

Offering Circular, including the risks associated with an investment in the Company’s securities discussed in the “Risk Factors”

section of this Offering Circular, before making an investment decision. Some of the statements in this Offering Circular are forward

looking- statements. See the section entitled “Statement Regarding Forward- Looking Statements.”

Overview

Vivos

Inc. (the “Company”, “we”, “us”, “our”) is a radiation oncology

medical device company engaged in the development of its yttrium-90 (“Y-90”) based precision radionuclide therapy

device, RadioGel™, for the treatment of non-resectable tumors. A prominent team of radiochemists, scientists, and engineers, collaborating

with strategic partners, including national laboratories, universities, and private corporations, lead the Company’s development

efforts. The Company’s overall vision is to globally empower physicians, medical researchers, and patients by providing them with

new isotope technologies that offer safe and effective treatments for cancer.

Financing

and Strategy

In

November 2019, the Securities and Exchange Commission (the “SEC”) qualified the Company’s offering of its common

stock, par value $0.001 per share, under Regulation A of Section 3(6) of the Securities Act of 1933, as amended (the “Securities

Act”), which offering was and amended from time to time thereafter (the “2019 Regulation A+ Offering”).

In September 2021, the SEC qualified the Company’s offering of Common Stock under Regulation A, which offering was amended from

time to time thereafter (together with the 2019 Regulation A+ Offering, the “Prior Regulation A+ Offerings”). During

the year ended December 31, 2023, $1,179,245 was raised through the sale of 16,132,000 shares of common stock and the private placement

of 18,797,000 warrants. During the period January 1, 2024 through May 10, 2024, the Company raised $834,000 through the issuance of 13,000,000

shares of common stock and the private placement of 2,000,000 warrants.

The

Company anticipates using the proceeds from this offering as follows:

For

the animal therapy market:

| |

● |

Expand

communication on our website, the social media, conference, and journals to increase the number of certified clinics for small animal

and equine therapy and to increase the number of patients. |

| |

● |

Subsidize

some IsoPet® therapies, if necessary, to ensure that all viable candidates are treated. |

| |

● |

Assist

a new regional clinic with their license and certification training. |

For

the human market:

| |

● |

Enhance

the pedigree of the Quality Management System. |

| |

● |

Begin

automation of product manufacturing. |

| |

● |

Fund

liability insurance for human clinical studies. |

| |

● |

Fund

human clinical studies in the US. |

Research

and development of the Company’s precision radionuclide therapy product line has been funded with proceeds from the sale of

equity and debt securities, including from the Prior Regulation A+ Offerings. The Company requires additional funding of

approximately 2.5 million annually to maintain operating activities. Over the 36 months, the Company believes it will cost

approximately $8-9million to: (1) fund the FDA approval process to conduct human clinical trials; (2) conduct Phase I, pilot,

clinical trials; (3) activate several regional clinics to administer IsoPet® across the county; (4) create an independent

production center within the current production site to create a template for future international manufacturing; and (5) initiate

regulatory approval processes outside of the United States. The proceeds raised from the Prior Regulation A+ Offerings were used to

fund this development and proceeds from the current offering will used to continue such development efforts.

The

continued deployment of the precision radionuclide therapy products and a worldwide regulatory approval effort will require additional

resources and personnel. The principal variables in the timing and amount of spending for the precision radionuclide therapy products

in the next 12 to 24 months will be the FDA’s classification of the Company’s precision radionuclide therapy products as

Class II or Class III devices (or otherwise) and any requirements for additional studies which may possibly include clinical studies.

Thereafter, the principal variables in the amount of the Company’s spending and its financing requirements would be the timing

of any approvals and the nature of the Company’s arrangements with third parties for manufacturing, sales, distribution and licensing

of those products and the products’ success in the U.S. and elsewhere. The Company intends to fund its activities through strategic

transactions such as licensing and partnership agreements or from proceeds raised from the Prior Regulation A+ Offering and this offering.

The

Company intends to expand the indications for use in phases: first, for lymph nodes associated with thyroid cancer, secondly, cancerous

lung nodules, and finally, all non-sectable solid tumors. It is anticipated that the medical community may begin to use RadioGel off-label,

we will support but will not encourage that practice.

Following

receipt of required regulatory approvals and financing, in the U.S., the Company intends to outsource material aspects of manufacturing,

distribution, sales and marketing. Outside of the U.S., the Company intends to pursue licensing arrangements and/or partnerships to facilitate

its global commercialization strategy.

Long-term,

the Company intends to consider resuming research efforts with respect to other products and technologies, such as Gamma Gel and Alpha

Gel intended to help improve the diagnosis and treatment of cancer and other illnesses. These long-term goals are subject to the Company:

(1) receiving adequate funding; (2) receiving regulatory approval for RadioGelTM and other precision radionuclide therapy

products; and (3) being able to successfully commercialize its precision radionuclide therapy products.

Based

on the Company’s financial history since inception, the Company’s independent registered public accounting firm has expressed

substantial doubt as to the Company’s ability to continue as a going concern. The Company has limited revenue, nominal cash, and

has accumulated deficits since inception. If the Company cannot obtain sufficient additional capital, the Company will be required to

delay the implementation of its business strategy and may not be able to continue operations.

The

Company’s headquarters are in Southeast Washington., The initial focus of the animal therapy market has been the Northwestern sector

of the United States. The Company has initiated marketing efforts to the animal therapy market in other regions of the United States,

attempting to increase the exposure to our product and increase revenue opportunities..

As

of March 31, 2024, the Company has $1,370,829 cash on hand. There are currently commitments to vendors for products and services purchased.

To continue the development of the Company’s products, the current level of cash may not be enough to cover the fixed and variable

obligations of the Company. The Company has focused on operating on minimum overhead, including using a virtual office for the

last several years and experienced industry consultants available on an as needed basis.. This has helped stretch the investment dollars

on activities that enhance our objectives.

There

is no guarantee that the Company will be able to raise additional funds or to do so at an advantageous price.

Risk

Factors

| ● |

we

are a development stage company with no current revenue, and limited experience developing medical devices, including those intended

for use in the radiation oncology field, which makes it difficult to assess our future viability; |

| |

|

| ● |

the

conservative veterinary community is slow to use a new product such as IsoPet without a great deal of data which requires investment

and time; |

| ● |

we

depend heavily on the success of RadioGel™, and we cannot be certain that we will be able to obtain regulatory approval for,

or successfully commercialize, RadioGel™, or any other future product candidates; |

| |

|

| ● |

failures

or delays in the commencement or business plan could delay, prevent, or limit our ability to generate revenue and continue our business; |

| |

|

| ● |

we

face significant competition, and if we are unable to compete effectively, we may not be able to achieve or maintain significant

market penetration or improve our results of operations; |

| |

|

| ● |

future

sales or issuances of our securities, including the sale of securities being offered hereby,

may cause immediate and substantial dilution to existing stockholders;

|

| ● |

there

is only one supplier of Y-90 in the United States, requiring us to rely entirely on this supplier to provide the Y-90 particles needed

to produce RadioGelTM. If we are unable to obtain a sufficient supply of Y-90 particles, we will not be able to proceed

with our development of RadioGelTM and our business will be materially harmed; |

| |

|

| ● |

if

we are unable to adequately protect our proprietary technology, or obtain and maintain issued patents that are sufficient to protect

our product candidates, others could compete against us more directly, which would have a material adverse impact on our business,

results of operations, financial condition and prospects; and |

| |

|

| ● |

we

have incurred significant net losses since inception and we will continue to incur substantial operating losses for the foreseeable

future. |

See

the section entitled “Risk Factors” for a more thorough discussion of risks related to an investment in our common

stock.

Corporate

Information

Vivos

Inc. was incorporated under the laws of Delaware on December 23, 1994 as Savage Mountain Sports Corporation (“SMSC”).

On September 6, 2006, the Company changed its name to Advanced Medical Isotope Corporation, and on December 28, 2017, to Vivos Inc. The

Company has authorized capital of 950,000,000 shares of common stock, $0.001 par value per share, and 20,000,000 shares of preferred

stock, $0.001 par value per share.

Our

principal place of business is located at 719 Jadwin Avenue, Richland, WA 99352. Our telephone number is (509) 736-4000. Our corporate

website address is http://www.radiogel.com. Our common stock is currently quoted on the OTCQB Marketplace under the symbol “RDGL.”

THE

OFFERING

| Issuer: |

|

Vivos

Inc. |

| |

|

|

| Securities

offered by the Company: |

|

A

maximum of 60,000,000 shares of our common stock, par value $0.001 per share. See the section entitled “Plan of Distribution.” |

| |

|

|

| Number

of shares of common stock outstanding before the offering: |

|

410,842,241

shares |

| |

|

|

| Number

of shares of common stock to be outstanding after the offering: |

|

Up

to 470,842,241 shares |

| |

|

|

| Price

per share: |

|

$0.15

per share |

| |

|

|

| Minimum

offering amount: |

|

1

share of common stock ($0.15) |

| Maximum

offering amount: |

|

60,000,000

shares of common stock ($9,000,000) |

| |

|

|

| Trading

market |

|

OTCQB

Marketplace under the symbol “RDGL” |

| |

|

|

Use

of proceeds:

|

|

We

currently intend to use the majority of the proceeds we receive from this offering secure the Investigational Device Exemption (“IDE”),

which will set the stage for human clinical trials and to expand our animal therapy business to new regional clinics and increase

related marketing activities. Our intent is to initiate and target to complete Pilot trials and subject to FDA feedback, initiate

and complete Pivotal trials. This is dependent on the responsiveness and timing of FDA comments on the IDE. In addition, we intend

to apply certain proceeds towards expanding domestic and international patent protection, offering expenses, public company and corporate

costs, research and development and other application development, and working capital. See the section entitled “Use of

Proceeds” for additional details regarding out intended use of proceeds. |

Summary

Financial Information

The

following table summarizes the relevant financial data for our business and should be read with our financial statements, which are included

later in this Offering Circular.

| | |

Three Months Ended March 31, | | |

Year Ended December 31, | |

| | |

2024 | | |

2023 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Revenues, net | |

$ | 4,500 | | |

$ | 6,000 | | |

$ | 19,500 | | |

$ | 36,499 | |

| Cost of Goods sold | |

| (6,000 | ) | |

| (7,536 | ) | |

| (25,536 | ) | |

| (28,779 | ) |

| Gross (loss) profit | |

| (1,500 | ) | |

| (1,536 | ) | |

| (6,036 | ) | |

| 7,720 | |

| | |

| | | |

| | | |

| | | |

| | |

| OPERATING EXPENSES | |

| | | |

| | | |

| | | |

| | |

| Professional fees, including stock-based compensation | |

| 403,637 | | |

| 84,216 | | |

| 1,606,923 | | |

| 1,755,316 | |

| Payroll expenses | |

| 91,125 | | |

| 72,508 | | |

| 281,716 | | |

| 275,240 | |

| Research and development | |

| 57,447 | | |

| 46,375 | | |

| 732,698 | | |

| 343,802 | |

| General and administrative expenses | |

| 23,420 | | |

| 43,683 | | |

| 165,773 | | |

| 151,111 | |

| Total Operating Expenses | |

| 575,629 | | |

| 246,782 | | |

| 2,787,110 | | |

| 2,525,469 | |

| | |

| | | |

| | | |

| | | |

| | |

| OPERATING LOSS | |

| (577,129 | ) | |

| (248,318 | ) | |

| (2,793,146 | ) | |

| (2,517,749 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| NON-OPERATING INCOME (EXPENSE) | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 18,590 | | |

| - | | |

| 49,577 | | |

| - | |

| Loss on issuance of shares | |

| - | | |

| - | | |

| (151,184 | ) | |

| | |

| Gain on debt extinguishment | |

| - | | |

| - | | |

| - | | |

| 47,588 | |

| Total Non-Operating Income (Expenses) | |

| 18,590 | | |

| - | | |

| (101,607 | ) | |

| 47,588 | |

| | |

| | | |

| | | |

| | | |

| | |

| NET LOSS BEFORE PROVISION FOR INCOME TAXES | |

| (558,539 | ) | |

| (248,318 | ) | |

| (2,894,753 | ) | |

| (2,470,161 | ) |

| Provision for income taxes | |

| - | | |

| - | | |

| - | | |

| - | |

| NET LOSS | |

| (558,539 | ) | |

| (248,318 | ) | |

$ | (2,894,753 | ) | |

$ | (2,470,161 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share - basic and diluted | |

$ | (0.00 | ) | |

$ | (0.00 | ) | |

$ | (0.01 | ) | |

$ | (0.01 | ) |

| Weighted average common shares outstanding – basic | |

| 389,406,447 | | |

| 362,541,528 | | |

| 368,805,214 | | |

| 351,425,912 | |

| | |

At December 31, | | |

At March 31, 2024 | |

| Consolidated Balance Sheet Data: | |

2023 | | |

Actual | | |

Pro Forma (1) | |

| Cash | |

$ | 1,592,287 | | |

$ | 1,370,829 | | |

$ | [●] | |

| Total assets | |

| 1,610,124 | | |

| 1,382,329 | | |

| [●] | |

| Accounts payable and accrued expenses | |

| 245,004 | | |

| 74,766 | | |

| [●] | |

| Total stockholders’ equity | |

| 1,365,120 | | |

| 1,307,563 | | |

| [●] | |

| (1) |

The

pro forma information included herein assumes that we sell the maximum number of shares of common stock offered hereby at public

offering price of $0.15 per share and includes and $704,000 raised by the company in May 2024. |

RISK

FACTORS

Investing

in our common stock involves a high degree of risk. You should carefully consider the risks described below, as well as the other information

in this Offering Circular, including our financial statements and the related notes and “Management’s Discussion and Analysis

of Financial Condition and Results of Operations,” before deciding whether to invest in our securities. The occurrence of any of

the events or developments described below could harm our business, financial condition, operating results, and growth prospects. In

such an event, the market price of our common stock could decline, and you may lose all or part of your investment. Additional risks

and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations.

RISKS

ASSOCIATED WITH THE COMPANY’S BUSINESS

Our

independent registered public accounting firms’ reports on its financial statements questions the Company’s ability to continue

as a going concern.

The

Company’s independent registered public accounting firms’ reports on the Company’s financial statements for the years

ended December 31, 2023 and 2022 express substantial doubt about the Company’s ability to continue as a going concern. The reports

include an explanatory paragraph stating that the Company has suffered recurring losses, used significant cash in support of its operating

activities and based on its current operating levels, require additional capital or restructuring to sustain its operation for the foreseeable

future. There is no assurance that the Company will be able to obtain sufficient additional capital to continue its operations and to

alleviate doubt about its ability to continue as a going concern. If the Company obtains additional financing, such funds may not be

available on favorable terms and likely would entail considerable dilution to existing shareholders. Any debt financing, if available,

may involve restrictive covenants that restrict its ability to conduct its business. It is extremely remote that the Company could obtain

any financing on any basis that did not result in considerable dilution for shareholders. Inclusion of a “going concern qualification”

in the report of its independent accountants or in any future report may have a negative impact on our ability to obtain debt or equity

financing and may adversely impact our stock price.

A

combination of our current financial condition and the FDA’s determinations to date regarding Radiogel™ raise material concerns

about ability to continue as a going concern.

The

Company will not be able to continue as a going concern unless the Company obtains financing. Depending upon the amount of financing,

if any, the Company can obtain, the Company may not receive adequate funds to continue the approval process for RadioGel™ or other

precision radionuclide therapy products with the FDA, which would disrupt our business operations or derail our business strategy, and

materially and adversely affect our business, financial condition and results of operations.

The

Company has generated operating losses since inception, which are expected to continue, and has increasing cash requirements, which it

may be unable to satisfy.

The

Company has generated material operating losses since inception. The Company has had recurring net losses since inception which has resulted

in an accumulated deficit of $83,009,320 and $82,450,781 as of March 31, 2024 and December 31, 2023, respectively, including net losses

of $558,539 and $2,894,753 for the three months ended March 31, 2024 and the year ended December 31, 2023. Historically, the Company

has relied upon investor funds to maintain its operations and develop its business. The Company needs to raise additional capital from

investors for working capital as well as business expansion, and there is no assurance that additional investor funds will be available

on terms acceptable to the Company, or at all. If the Company is unable to unable to obtain additional financing to meet its working

capital requirements, the Company likely would cease operations.

The

Company requires funding of at least $2.5 million to maintain current operating activities through 2025. Over the next 36 months, the

Company believes it will cost approximately $9 million to: (1) fund the FDA approval process to conduct human clinical trials; (2) conduct

pilot, and pivotal trials; (3) activate several regional clinics to administer IsoPet® across the county; (4) create an

independent production center within the current production site to create a template for future international manufacturing; and (5)

initiate regulatory approval processes outside of the United States.

The

principal variables in the timing and amount of spending for in the next 12 to 24 months will be the timing of the receipt, if any, of

the Investigation Device Exemption (IDE) from the FDA. FDA’s classification of Radiogel™ as Class II or Class III devices

(or otherwise) and the requirements for initiating and completing pilot and pivotal trials. Thereafter, the principal variables in the

amount of the Company’s spending and its financing requirements would be the timing of any approvals and the nature of the Company’s

arrangements with third parties for manufacturing, sales, distribution and licensing of those products and the products’ success

in the U.S. and elsewhere. The Company intends to fund its activities through strategic transactions such as licensing and partnership

agreements or additional capital raises.

Recent

economic events, the inherent instability in global capital markets, as well as the lack of liquidity in the capital markets, could adversely

impact the Company’s ability to obtain financing and its ability to execute its business plan, which would materially and adversely

affect our business and operations.

The

Company has a limited operating history, which may make it difficult to evaluate its business and prospects.

The

Company has a limited operating history upon which one can base an evaluation of its business and prospects. As a company in the development

stage, there are substantial risks, uncertainties, expenses, and difficulties to which its business is subject. To address these risks

and uncertainties, the Company must do the following:

| |

● |

successfully

develop and execute the business strategy; |

| |

|

|

| |

● |

respond

to competitive developments; and |

| |

|

|

| |

● |

attract,

integrate, retain and motivate qualified personnel. |

There

is no assurance that the Company will achieve or maintain profitable operations or that the Company will obtain or maintain adequate

working capital to meet its obligations as they become due. The Company cannot be certain that its business strategy will be successfully

developed and implemented or that the Company will successfully address the risks that face its business. In the event that the Company

does not successfully address these risks, its business, prospects, financial condition, and results of operations could be materially

and adversely affected.

The

Company’s products are regulated and require appropriate clearances and approvals to be marketed in the U.S. and globally.

There

is no assurance the FDA or other global regulatory authorities will grant the Company permission to market the Company’s precision

radionuclide therapy Y-90 RadioGel™ device.

The

Company has been working with the FDA to obtain clearance for its precision radionuclide therapy Y-90 RadioGelTM device, but

no assurances have been received. On December 23, 2014, the Company announced that it submitted a de novo application to the FDA

for marketing clearance for its patented Y-90 RadioGelTM device pursuant to Section 513(f)(2) of the U.S. Food, Drug and Cosmetic

Act (the “Act”). In June 2015, the FDA notified the Company the de novo application was not granted. In February

2014, the FDA found the same device under Section 510(k) of the Act not substantially equivalent and concluded that the device is classified

by statute as a Class III medical device, unless the device is reclassified. The Company is seeking reclassification of the product to

Class II. If the Company is successful in seeking reconsideration of the Company’s de novo application, as a regulatory

matter, the device could be on an easier and faster path to market in the United States. However, there would still be the requirements

to complete the in vitro and in vivo testing, and then some human clinical trials. That testing date is submitted in a de novo pre-market

application and if accepted we could then go to market. As a practical matter, the Company would still need to secure funding and commercial

arrangements before marketing could commence. If the de novo application is declined and if the Company obtains funding to permit

it to continue operations, the Company will explore steps toward seeking approval for the device as a Class III medical device. Generally,

the time period and cost of seeking approval as a Class III medical device is materially greater than the time period and cost of seeking

approval as a Class II medical device. If the Company seeks approval as a Class III device, human clinical trials will be necessary.

Generally, human trials for Class III products are larger, of longer duration and costlier than those for Class II devices.

There

will be additional cost and time to reach marketing clearance or approval. Unless the Company obtains sufficient funding, it will be

unable to undertake such activities. There can be no assurance that the product will be approved as either a Class II or Class III device

by the FDA even if additional data is provided. There can be no assurance that the Company will receive FDA approval, or if it does,

the timing thereof.

If

the Company is successful in increasing the size of its organization, the Company may experience difficulties in managing growth.

The

Company is a small organization with a minimal number of employees. If the Company is successful, it may experience a period of significant

expansion in headcount, facilities, infrastructure and overhead and further expansion may be required to address potential growth and

market opportunities. Any such future growth will impose significant added responsibilities on members of management, including the need

to improve the Company’s operational and financial systems and to identify, recruit, maintain and integrate additional managers.

The Company’s future financial performance and its ability to compete effectively will depend, in part, on the ability to manage

any future growth effectively.

The

Company’s business is dependent upon the continued services of the Company’s Chief Executive Officer, Michael Korenko. Should

the Company lose the services of Dr. Korenko, the Company’s operations will be negatively impacted.

The

Company’s business is dependent upon the expertise of its Chief Executive Officer, Michael Korenko. Dr. Korenko is essential to

the Company’s operations. Accordingly, an investor must rely on Dr. Korenko’s management decisions that will continue to

control the Company’s business affairs. The Company does not maintain key man insurance on Dr. Korenko’s life. The loss of

the services of Dr. Korenko would have a material adverse effect upon the Company’s business. To mitigate this risk, David Swanberg,

a current consultant to the Company, has been identified as a potential candidate to succeed Dr. Korenko, although no formal arrangement

has been reached. See “Directors, Executive Officers and Significant Consultants” on page. 38.

The

Company is heavily dependent on consultants for many of the services necessary to continue operations. The loss of any of these consultants

could have a material adverse effect on the Company’s business, results of operations and financial condition.

The

Company’s success is heavily dependent on the continued active participation of certain consultants and collaborating scientists.

Certain consultants have no written contracts. Loss of the services of any one or more of its consultants could have a material adverse

effect upon the Company’s business, results of operations and financial condition.

If

the Company is unable to hire and retain additional qualified personnel, the business and financial condition may suffer.

The

Company’s success and achievement of its growth plans depend on its ability to recruit, hire, train and retain highly qualified

technical, scientific, regulatory, and managerial employees, consultants and advisors. Competition for qualified personnel among pharmaceutical

and biotechnology companies is intense, and an inability to attract and motivate additional highly skilled personnel required for the

expansion of the Company’s activities, or the loss of any such persons, could have a material adverse effect on its business, results

of operations and financial condition.

The

Company’s revenues have historically been derived from sales made to a small number of customers. The Company has discontinued

prior operations related to its core business. To succeed, we will need to recommence our operations and achieve sales to a materially

larger number of customers.

The

Company’s revenues relate to their commercializing of its products and procedures performed. The Company had $19,500 and $36,499

in operating revenues, net of discounts for the years ended December 31, 2023 and 2022, respectively, as we have commenced sales of IsoPet®.

Many

of the Company’s competitors have greater resources and experience than the Company has.

Many

of the Company’s competitors have greater financial resources, longer history, broader experience, greater name recognition, and

more substantial operations than the Company has, and they represent substantial long-term competition for us. The Company’s competitors

may be able to devote more financial and human resources than the Company can to research, new product development, regulatory approvals,

and marketing and sales. The Company’s competitors may develop or market products that are viewed by customers as more effective

or more economical than the Company’s products. There is no assurance that the Company will be able to compete effectively against

current and future competitors, and such competitive pressures may adversely affect the Company’s business and results of operations.

The

Company’s future revenues depend upon acceptance of its current and future products in the markets in which they compete.

The

Company’s future revenues depend upon receipt of financing, regulatory approval and the successful production, marketing, and sales

of the various isotopes the Company might market in the future. The rate and level of market acceptance of each of these products, if

any, may vary depending on the perception by physicians and other members of the healthcare community of its safety and efficacy as compared

to that of any competing products; the clinical outcomes of any patients treated; the effectiveness of its sales and marketing efforts

in the United States, Europe, Far East, Middle East, and Russia; any unfavorable publicity concerning its products or similar products;

the price of the Company’s products relative to other products or competing treatments; any decrease in current reimbursement rates

from the Centers for Medicare and Medicaid Services or third-party payers; regulatory developments related to the manufacture or continued

use of its products; availability of sufficient supplies to either purchase or manufacture its products; its ability to produce sufficient

quantities of its products; and the ability of physicians to properly utilize its products and avoid excessive levels of radiation to

patients. Any material adverse developments with respect to the commercialization of any such products may adversely affect revenues

and may cause the Company to continue to incur losses in the future.

The

Company currently relies on a single supplier for Y-90 particles, and that supplier is the only supplier in the United States. An inability

to procure Y-90 particles will materially harm the Company’s business.

There

is only one supplier of Y-90 particles in the United States, requiring us to rely entirely on this supplier to provide the Y-90 particles

needed to produce RadioGelTM. If we are unable to obtain a sufficient supply of Y-90 particles, we will not be able to proceed

with our development of RadioGelTM and our business would be materially harmed.

The

Company currently subcontracts the manufacturing of RadioGelTM to IsoTherapeutics. Eckert and Ziegler is the sole supplier

of the Y-90 particles used by IsoTherapeutics and is the only supplier of Y-90 particles in the United States. In the event PerkinElmer

is unable to satisfy our supply requirements or stope producing Y-90 particles, we will be unable to continue with development of RadioGel™

and our business would be materially harmed.

The

Company will rely heavily on a limited number of suppliers for the foreseeable future.

Some

of the products the Company might market, and components thereof, are currently available only from a limited number of suppliers, several

of which are international suppliers. Failure to obtain deliveries from these sources would have a material adverse effect on the Company’s

ability to operate.

The

Company may incur material losses and costs as a result of product liability claims that may be brought against it.

The

Company faces an inherent business risk of exposure to product liability claims in the event that products supplied by the Company fail

to perform as expected or such products result, or is alleged to result, in bodily injury. Any such claims may also result in adverse

publicity, which could damage the Company’s reputation by raising questions about the safety and efficacy of its products and could

interfere with its efforts to market its products. A successful product liability claim against the Company in excess of its available

insurance coverage or established reserves may have a material adverse effect on its business. Although the Company currently maintains

liability insurance in amounts it believes are commercially reasonable, any product liability the Company may incur may exceed its insurance

coverage.

The

Company is subject to the risk that certain third parties may mishandle the Company’s products.

If

the Company markets products, the Company likely will rely on third parties, such as commercial air courier companies, to deliver the

products, and on other third parties to package the products in certain specialized packaging forms requested by customers. The Company

thus would be subject to the risk that these third parties may mishandle its product, which could result in material adverse effects,

particularly given the radioactive nature of some of the products.

The

Company is subject to uncertainties regarding reimbursement for use of its products.

Hospitals

and freestanding clinics may be less likely to purchase the Company’s products if they cannot be assured of receiving favorable

reimbursement for treatments using its products from third-party payers, such as Medicare and private health insurance plans. Third-party

payers are increasingly challenging the pricing of certain medical services or devices, and there is no assurance that they will reimburse

the Company’s customers at levels sufficient for it to maintain favorable sales and price levels for the Company’s products.

There is no uniform policy on reimbursement among third-party payers, and there is no assurance that the Company’s products will

continue to qualify for reimbursement from all third-party payers or that reimbursement rates will not be reduced. A reduction in or

elimination of third-party reimbursement for treatments using the Company’s products would likely have a material adverse effect

on the Company’s revenues.

The

Company’s future growth is largely dependent upon its ability to develop new technologies that achieve market acceptance with appropriate

margins.

The

Company’s business operates in global markets that are characterized by rapidly changing technologies and evolving industry standards.

Accordingly, future growth rates depend upon a number of factors, including the Company’s ability to (i) identify emerging technological

trends in the Company’s target end-markets, (ii) develop and maintain competitive products, (iii) enhance the Company’s products

by adding innovative features that differentiate the Company’s products from those of its competitors, and (iv) develop, manufacture

and bring products to market quickly and cost-effectively. The Company’s ability to develop new products based on technological

innovation can affect the Company’s competitive position and requires the investment of significant resources. These development

efforts divert resources from other potential investments in the Company’s business, and they may not lead to the development of

new technologies or products on a timely basis or that meet the needs of the Company’s customers as fully as competitive offerings.

In addition, the markets for the Company’s products may not develop or grow as it currently anticipates. The failure of the Company’s

technologies or products to gain market acceptance due to more attractive offerings by the Company’s competitors could significantly

reduce the Company’s revenues and adversely affect the Company’s competitive standing and prospects.

The

Company may rely on third parties to represent it locally in the marketing and sales of its products in international markets and its

revenue may depend on the efforts and results of those third parties.

The

Company’s future success may depend, in part, on its ability to enter into and maintain collaborative relationships with one or

more third parties, the collaborator’s strategic interest in the Company’s products and the Company’s products under

development, and the collaborator’s ability to successfully market and sell any such products.

The

Company intends to pursue collaborative arrangements regarding the marketing and sales of its products; however, it may not be able to

establish or maintain such collaborative arrangements, or if it is able to do so, the Company’s collaborators may not be effective

in marketing and selling its products. To the extent that the Company decides not to, or is unable to, enter into collaborative arrangements

with respect to the sales and marketing of its products, significant capital expenditures, management resources and time will be required

to establish and develop an in-house marketing and sales force with technical expertise. To the extent that the Company depends on third

parties for marketing and distribution, any revenues received by the Company will depend upon the efforts and results of such third parties,

which may or may not be successful.

The

Company may pursue strategic acquisitions that may have an adverse impact on its business.

Executing

the Company’s business strategy may involve pursuing and consummating strategic transactions to acquire complementary businesses

or technologies. In pursuing these strategic transactions, even if the Company does not consummate them, or in consummating such transactions

and integrating the acquired business or technology, the Company may expend significant financial and management resources and incur

other significant costs and expenses. There is no assurance that any strategic transactions will result in additional revenues or other

strategic benefits for the Company’s business. The Company may issue shares of the Company’s stock as consideration for acquisitions,

joint ventures or other strategic transactions, and the use of stock as purchase consideration could dilute the interests of its current

stockholders. In addition, the Company may obtain debt financing in connection with an acquisition. Any such debt financing may involve

restrictive covenants relating to capital-raising activities and other financial and operational matters, which may make it more difficult

for the Company to obtain additional capital and pursue business opportunities, including potential acquisitions. In addition, such debt

financing may impair the Company’s ability to obtain future additional financing for working capital, capital expenditures, acquisitions,

general corporate or other purposes, and a substantial portion of cash flows, if any, from the Company’s operations may be dedicated

to interest payments and debt repayment, thereby reducing the funds available to the Company for other purposes.

The

Company will need to hire additional qualified accounting personnel in order to remediate a material weakness in its internal control

over financial accounting, and the Company will need to expend any additional resources and efforts that may be necessary to establish

and to maintain the effectiveness of its internal control over financial reporting and its disclosure controls and procedures.

As

a public company, the Company is subject to the reporting requirements of the Securities Exchange Act of 1934, as amended, and the Sarbanes-Oxley

Act of 2002. The Company’s management is required to evaluate and disclose its assessment of the effectiveness of the Company’s

internal control over financial reporting as of each year-end, including disclosing any “material weakness” in the Company’s

internal control over financial reporting. A material weakness is a control deficiency, or combination of control deficiencies, that

results in more than a remote likelihood that a material misstatement of the annual or interim financial statements will not be prevented

or detected. As a result of its assessment, management has determined that there is a material weakness due to the lack of segregation

of duties and, due to this material weakness, management concluded that, as of December 31, 2023 and 2022, the Company’s internal

control over financial reporting was ineffective. This material weakness has the potential of adversely impacting the Company’s

financial reporting process and the Company’s financial reports. Because of this material weakness, management also concluded that

the Company’s disclosure controls and procedures were ineffective as of December 31, 2023 and 2022. The Company needs to hire additional

qualified accounting personnel in order to resolve this material weakness. The Company also will need to expend any additional resources

and efforts that may be necessary to establish and to maintain the effectiveness of the Company’s internal control over financial

reporting and disclosure controls and procedures.

The

Company’s patented or other technologies may infringe on other patents, which may expose us to costly litigation.

It

is possible that the Company’s patented or other technologies may infringe on patents or other rights owned by others. The Company

may have to alter its products or processes, pay licensing fees, defend infringement actions or challenge the validity of the patents

in court, or cease activities altogether because of patent rights of third parties, thereby causing additional unexpected costs and delays

to the Company. Patent litigation is costly and time consuming, and the Company may not have sufficient resources to pursue such litigation.

If the Company does not obtain a license under such patents, if it is found liable for infringement, or if it is not able to have such

patents declared invalid, the Company may be liable for significant money damages, may encounter significant delays in bringing products

to market or may be precluded from participating in the manufacture, use or sale of products or methods of treatment requiring such licenses.

Protecting

the Company’s intellectual property is critical to its innovation efforts.

The

Company owns or has a license to use several U.S. and foreign patents and patent applications, trademarks and copyrights. The Company’s

intellectual property rights may be challenged, invalidated or infringed upon by third parties, or it may be unable to maintain, renew

or enter into new licenses of third party proprietary intellectual property on commercially reasonable terms. In some non-U.S. countries,

laws affecting intellectual property are uncertain in their application, which can adversely affect the scope or enforceability of the

Company’s patents and other intellectual property rights. Any of these events or factors could diminish or cause the Company to

lose the competitive advantages associated with the Company’s intellectual property, subject the Company to judgments, penalties

and significant litigation costs, or temporarily or permanently disrupt its sales and marketing of the affected products or services.

The

Company may not be able to protect its trade secrets and other unpatented proprietary technology, which could give competitors an advantage.

The

Company relies upon trade secrets and other unpatented proprietary technology. The Company may not be able to adequately protect its

rights with regard to such unpatented proprietary technology, or competitors may independently develop substantially equivalent technology.

The Company seeks to protect trade secrets and proprietary knowledge, in part through confidentiality agreements with its employees,

consultants, advisors and collaborators. Nevertheless, these agreements may not effectively prevent disclosure of the Company’s

confidential information and may not provide the Company with an adequate remedy in the event of unauthorized disclosure of such information,

and as result the Company’s competitors could gain a competitive advantage.

The

Company is subject to extensive government regulation in jurisdictions around the world in which it does business. Regulations address,

among other things, environmental compliance, import/export restrictions, healthcare services, taxes and financial reporting, and those

regulations can significantly increase the cost of doing business, which in turn can negatively impact operations, financial results

and cash flow.

If

the Company is successful in developing manufacturing capability, the Company will be subject to extensive government regulation and

intervention both in the U.S. and in all foreign jurisdictions in which it conducts business. Compliance with applicable laws and regulations

will result in higher capital expenditures and operating costs, and changes to current regulations with which the Company complies can

necessitate further capital expenditures and increases in operating costs to enable continued compliance. Additionally, from time to

time, the Company may be involved in proceedings under certain of these laws and regulations. Foreign operations are subject to political

instabilities, restrictions on funds transfers, import/export restrictions, and currency fluctuation.

RISKS

RELATED TO THE COMPANY’S COMMON STOCK

The

Company’s common stock is currently quoted on the OTCQB Marketplace. Failure to develop or maintain a more active trading market

may negatively affect the value of the Company’s common stock, may deter some potential investors from purchasing the Company’s

common stock or other equity securities, and may make it difficult or impossible for stockholders to sell their shares of common stock.

The

Company’s average daily volume of shares traded for the years ended December 31, 2023 and 2022 was 512,332 and 496,720, respectively.

Failure to develop or maintain an active trading market may negatively affect the value of the Company’s common stock, may make

some potential investors unwilling to purchase the Company’s common stock or equity securities that are convertible into or exercisable

for the Company’s common stock, and may make it difficult or impossible for the Company’s stockholders to sell their shares

of common stock and recover any part of their investment.

The

Company’s outstanding securities, the stock or other securities that it may become obligated to issue under existing agreements,

and certain provisions of those securities, may cause immediate and substantial dilution to existing stockholders and may make it more

difficult to raise additional equity capital.

The

Company had 410,842,241 shares of common stock outstanding as of June 14, 2024. The Company also had outstanding on that date dilutive

securities consisting of preferred stock, restricted stock units, options, and warrants (collectively, “Common Stock Equivalents”)

that if they had been exercised and converted in full on June 14, 2024, would have resulted in the issuance of up to 56,746,379 additional

shares of common stock. The issuance of shares upon the exercise of the Common Stock Equivalents may result in substantial dilution to

each stockholder by reducing that stockholder’s percentage ownership of the Company’s total outstanding shares of common

stock. The issuance of some or all those warrants and any exercise of those warrants will have the effect of further diluting the percentage

ownership of the Company’s other stockholders.

Future

sales of the Company’s securities, including sales following exercise or conversion of derivative securities, or the perception

that such sales may occur, may depress the price of common stock and could encourage short sales.

The

sale or availability for sale of substantial amounts of the Company’s shares in the public market, including shares issuable upon

exercise of the Common Stock Equivalents, or the perception that such sales may occur, may adversely affect the market price of the Company’s

common stock. Any decline in the price of the Company’s common stock may encourage short sales, which could place further downward

pressure on the price of the Company’s common stock.

The

Company’s stock price is likely to be volatile.

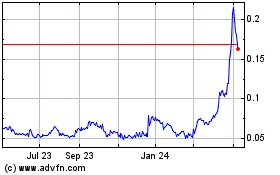

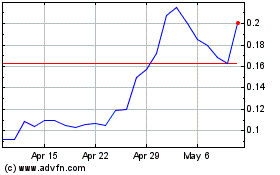

For

the year ended December 31, 2023, the reported low closing price for the Company’s common stock was $0.0412 per share, and the

reported high closing price was $0.1195 per share. For the year ended December 31, 2022, the reported low closing price for the Company’s

common stock was $0.04 per share, and the reported high closing price was $0.1264 per share. There is generally significant volatility

in the market prices, as well as limited liquidity, of securities of early-stage companies, particularly early-stage medical product

companies. Contributing to this volatility are various events that can affect the Company’s stock price in a positive or negative

manner. These events include, but are not limited to: governmental approvals, refusals to approve, regulations or other actions; market

acceptance and sales growth of the Company’s products; litigation involving the Company or the Company’s industry; developments

or disputes concerning the Company’s patents or other proprietary rights; changes in the structure of healthcare payment systems;

departure of key personnel; future sales of its securities; fluctuations in its financial results or those of companies that are perceived

to be similar to us; investors’ general perception of us; and general economic, industry and market conditions. If any of these

events occur, it could cause the Company’s stock price to fall, and any of these events may cause the Company’s stock price

to be volatile.

The

Company’s common stock is subject to the “Penny Stock” rules of the SEC and the trading market in its securities is

limited, which makes transactions in its common stock cumbersome and may reduce the value of an investment in the Company’s stock.

The

SEC has adopted Rule 3a51-1, which establishes the definition of a “penny stock,” for the purposes relevant to us, as any

equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject

to certain exceptions. For any transaction involving a penny stock, unless exempt, Rule 15g-9 requires that a broker or dealer approve

a person’s account for transactions in penny stocks and that the broker or dealer receive from the investor a written agreement

to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

In

order to approve a person’s account for transactions in penny stocks, the broker or dealer must obtain financial information and

investment experience and objectives of the person and must make a reasonable determination that the transactions in penny stocks are

suitable for that person and that the person has sufficient knowledge and experience in financial matters to be capable of evaluating

the risks of transactions in penny stocks.

The

broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to

the penny stock market, which sets forth the basis on which the broker or dealer made the suitability determination, and that the broker

or dealer received a signed, written agreement from the investor prior to the transaction.

Generally,

brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more

difficult for investors to dispose of the Company’s common stock and may cause a decline in the market value of its stock.

Disclosure

also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions

payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies

available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent

price information for the penny stock held in the account and information on the limited market in penny stocks.

As

a result of the Company issuing preferred stock, the rights of holders of the Company’s common stock and the value of the Company’s

common stock may be adversely affected.

The

Company’s Board of Directors is authorized to issue classes or series of preferred stock, without any action on the part of the

stockholders. The Company’s Board of Directors also has the power, without stockholder approval, to set the terms of any such classes

or series of preferred stock, including voting rights, dividend rights and preferences over the common stock with respect to dividends

or upon the liquidation, dissolution or winding-up of its business, and other terms. The Company has issued preferred stock that has

a preference over the common stock with respect to the payment of dividends or upon liquidation, dissolution or winding-up, and with

respect to voting rights. In accordance with that and with the issuance of preferred stock, our common stockholders voting rights have

been diluted and it is possible that the rights of holders of the common stock or the value of the common stock have been adversely affected.

The

Company does not expect to pay any dividends on common stock for the foreseeable future.

The

Company has not paid any cash dividends on its common stock to date and does not anticipate it will pay cash dividends on its common

stock in the foreseeable future. Accordingly, stockholders must be prepared to rely on sales of their common stock after price appreciation

to earn an investment return, which may never occur. Any determination to pay dividends in the future will be made at the discretion

of the Company’s board of directors and will depend on the Company’s results of operations, financial conditions, contractual

restrictions, restrictions imposed by applicable law, and other factors that the Company’s board deems relevant.

GENERAL

RISK FACTORS

Volatility

in raw material and energy costs, interruption in ordinary sources of supply, and an inability to recover from unanticipated increases

in energy and raw material costs could result in lost sales or could increase significantly the cost of doing business.

Market

and economic conditions affecting the costs of raw materials, utilities, energy costs, and infrastructure required to provide for the

delivery of the Company’s products and services are beyond the Company’s control. Any disruption or halt in supplies, or

rapid escalations in costs, could adversely affect the Company’s ability to manufacture products or to competitively price the

Company’s products in the marketplace. To date, the ultimate impact of energy costs increases has been mitigated through price

increases or offset through improved process efficiencies; however, continuing escalation of energy costs could have a negative impact

upon the Company’s business and financial performance.

General

economic conditions in markets in which the Company does business can impact the demand for the Company’s goods and services. Decreased

demand for the Company’s products and services could have a negative impact on its financial performance and cash flow.

Demand

for the Company’s products and services, in part, depends on the general economic conditions affecting the countries and industries

in which the Company does business. A downturn in economic conditions in a country or industry that the Company serves may adversely

affect the demand for the Company’s products and services, in turn negatively impacting the Company’s operations and financial

results. Further, changes in demand for the Company’s products and services can magnify the impact of economic cycles on the Company’s

businesses. Unanticipated contract terminations by customers can negatively impact operations, financial results and cash flow. The Company’s

earnings, cash flow and financial position are exposed to financial market risks worldwide, including interest rate and currency exchange

rate fluctuations and exchange rate controls. Fluctuations in domestic and world financial markets could adversely affect interest rates

and impact the Company’s ability to obtain credit or attract investors.

RISKS

RELATED TO THIS OFFERING

Purchasers

in this offering will experience immediate and substantial dilution in the book value of their investment.

Because

the public offering price per share is substantially higher than the book value per share of our common stock, you will incur immediate

and substantial dilution in the net tangible book value of the common stock you purchase in this offering. After giving effect to the

assumed sale by us of the maximum of 60,000,000 shares of our common stock at an assumed public offering price of $0.15 per share, and

after deducting the estimated offering expenses payable by us, which we estimate will be approximately $100,000, you will suffer immediate

and substantial dilution of $0.128 per share in the pro forma net tangible book value of the common stock you purchase in this

offering.

To

the extent outstanding options, warrants or other derivative securities are ultimately exercised or converted, or if we issue restricted

stock to our employees under our 2015 Omnibus Securities and Incentive Plan, there will be further dilution to investors who purchase

shares in this offering. In addition, if we issue additional equity securities or derivative securities, investors purchasing shares

in this offering will experience additional dilution. For a further description of the dilution that you will experience immediately

after this offering, see “Dilution” on page 19.

We

may allocate the net proceeds from this offering in ways that differ from our estimates based on our current plans and assumptions discussed

in the section titled “Use of Proceeds” and with which you may not agree.

The

allocation of net proceeds of the offering set forth in the “Use of Proceeds” section of this Offering Circular represents

our estimates based upon our current plans and assumptions regarding industry and general economic conditions, our future revenues and

expenditures. The amounts and timing of our actual expenditures will depend on numerous factors, including market conditions, cash generated

by our operations, business developments and related rate of growth. We may find it necessary or advisable to use portions of the proceeds

from this offering for other purposes. Circumstances that may give rise to a change in the use of proceeds and the alternate purposes

for which the proceeds may be used are discussed in the section in this Offering Circular entitled “Use of Proceeds.”

You may not have an opportunity to evaluate the economic, financial or other information on which we base our decisions on how to use

our proceeds. As a result, you and other stockholders may not agree with our decisions. See “Use of Proceeds” on page

18 for additional information.

Sales

of a substantial number of shares of our common stock, or the perception that such sales may occur, may adversely impact the price of

our common stock.

Sales

of a substantial number of shares of our common stock in the public market could occur at any time. These sales, or the perception that

such sales may occur, may adversely impact the price of our common stock, even if there is no relationship between such sales and the

performance of our business. The Company had 410,842,241 shares of common stock outstanding as of June 14, 2024. The Company also had

outstanding on that date dilutive securities consisting of preferred stock, restricted stock units, options, and warrants (collectively,

“Common Stock Equivalents”) that if they had been exercised and converted in full on June 14, 2024, would have resulted

in the issuance of up to 56,746,379 additional shares of common stock. The exercise of such outstanding derivative securities may result

in further dilution of your investment.

USE

OF PROCEEDS

The

maximum gross proceeds from the sale of the shares of our common stock being offered hereby is $9,000,000. Assuming that we sell the

maximum number of shares of common stock being offered pursuant to this Offering Circular, we currently estimate that we will receive

net proceeds of approximately $8,900,000 after the payment of estimated offering expenses payable by us. The estimate of the budget for

offering costs is an estimate only, and the actual offering costs may differ from those expected by management.

We

currently intend to use the majority of the proceeds we receive from this offering to 1) proceed with clinical trials, assuming the FDA

approves the IDE and the Mayo Clinic IRB authorizes the trials and 2) expand our animal therapy business. This includes supporting the

startup of regional centers beyond our initial pilot clinic, polymer developmental testing to optimize the production parameters to reduce

production costs and to enhance reproducibility with FDA Good Manufacturing Practices (“GMP”) protocols, enhance product

yield and shorten the product ordering to delivery cycle. We will also continue our emphasis on intellectual property protection by expanding

the number of allowed claims on our current patent applications and completing the previous filing on particle production filing in both

the United States and international markets.

In

addition, we intend to apply certain proceeds towards offering expenses, public company and corporate costs, research and development

and other application development, and working capital. We expect that approximately 10% of the proceeds from this offering will be used

for general working capital purposes.

Pending

these uses, we intend to invest the net proceeds from this offering in short-term, investment-grade interest-bearing securities such

as money market accounts, certificates of deposit, commercial paper and guaranteed obligations of the U.S. government.

The

precise amounts that we will devote to each of the foregoing items, and the timing of expenditures, will vary depending on numerous factors.

The

expected use of net proceeds from this offering represents our intentions based on our current plans and business conditions, which could

change in the future as our plans and business conditions evolve and change. The amounts and timing of our actual expenditures, specifically

with respect to working capital, may vary significantly depending on numerous factors. As a result, the Company reserves the right to

change the above use of proceeds if management believes it is in the best interests of the Company.

In

the event we do not sell all of the shares being offered, we may seek additional financing from other sources to support the intended

use of proceeds indicated above. If we secure additional equity funding, investors in this offering would be diluted. No plans for additional

financing are currently being contemplated by the Company; however, in the event only the minimum proceeds are received in this offering,

management may seek additional financing. No assurances can be given that additional financing would be available, and if available,

on terms acceptable to us.

The

following table sets forth the uses of proceeds assuming the sale of 100%, 75%, 50% and 25% of the securities offered for sale by the

Company at $0.15 per share. No assurance can be given that we will raise the full $9,000,000 as reflected in the following table:

| Use of Proceeds (at $.15 per share)(1) | |

100% of Offering | | |

75% of Offering | | |

50% of Offering | | |

25% of Offering | |

| Production Transformation | |

$ | 1,127,000 | | |

| 845,000 | | |

| 563,000 | | |

| 282,000 | |

| Animal Market Development | |

| 1,097,000 | | |

| 200,000 | | |

| 200,000 | | |

| 200,000 | |

| Pilot Clinical Trials | |

| 3,013,000 | | |

| 2,310,000 | | |

| 1,607,000 | | |

| 803,000 | |

| Working capital(2) | |

| 3,763,000 | | |

| 3,395,000 | | |

| 2,130,000 | | |

| 965,000 | |

| TOTAL | |

$ | 9,000,000 | | |

$ | 6,750,000 | | |

$ | 4,500,000 | | |

$ | 2,250,000 | |

| |

(1) |

As

of the date of this Offering Circular, we have not entered into any agreements with selling agents or broker dealers for the sale