Las Vegas Sands Revenue Drops 97% -- WSJ

July 23 2020 - 2:02AM

Dow Jones News

By Katherine Sayre

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 23, 2020).

Casino magnate Sheldon Adelson's Las Vegas Sands Corp. reported

a 97% decline in revenue as the global pandemic damps visitation to

the gambling hubs of Las Vegas and Macau, and executives expressed

little optimism about a return to business as usual.

On Wednesday, Sands posted $98 million in net revenue for the

three months ended June 30, down from $3.3 billion a year earlier.

The company had a net loss of $985 million for the quarter,

compared with net income of $1.11 billion a year earlier.

Nevada allowed casinos throughout the state, including the Las

Vegas Strip, to reopen June 4 after an unprecedented shutdown in

March of the state's most important industry. Since then, Covid-19

cases have been on the rise in Nevada. Casino visitors and workers

alike are required to wear masks on casino floors, which are also

subject to a 50% occupancy limit.

During a conference call with Wall Street analysts to discuss

the results, Sands Chief Operating Officer Robert Goldstein offered

a pessimistic outlook for Las Vegas, at least in the near future.

Even if casino revenue rebounds, he said, conventions and other

group events have supplanted gambling as the company's economic

engine -- and there is no sign that business will return this year.

Even the outlook for 2021 remains uncertain, he said, depending on

the development of a Covid-19 vaccine.

"In all of the years I've been here in Las Vegas, I've never

felt more gloomy than I do today about what's happening in Las

Vegas short term," Mr. Goldstein said. "Hope long term we will see

a better day."

In essence, he said, Las Vegas Strip resorts are now running

like a regional casino operator relying on nearby gamblers driving

in.

Sands owns the Venetian and Palazzo casinos and the Sands Expo

& Convention Center on the Strip.

Meanwhile, in the gambling enclave of Macau, monthly gross

gambling revenue fell 97% in June from a year earlier, according to

government data. Travel restrictions have limited the flow of

gamblers into the Chinese territory.

Sands' Macau resorts offer the biggest potential upside for the

company right now, depending on how long it takes for travel

restrictions to be relaxed further, and the company still believes

there is pent-up demand in that market, Mr. Goldstein said.

Sands China Ltd., the company's subsidiary in Macau, reported a

net loss of $549 million for the quarter, compared with net income

of $511 million a year earlier.

The company's Marina Bay Sands resort in Singapore reopened this

month.

Sands reported a cash balance of $3.02 billion and total debt of

$13.82 billion as of June 30.

Also on Wednesday, rival Wynn Resorts Ltd. said it would be

furloughing an unspecified number of Las Vegas workers, thanks to

the weak market there. "We now know how challenged business volumes

in Las Vegas are and are staffing to the significantly reduced

demand," a spokeswoman said.

Write to Katherine Sayre at katherine.sayre@wsj.com

(END) Dow Jones Newswires

July 23, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

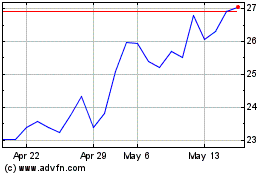

Sands China (PK) (USOTC:SCHYY)

Historical Stock Chart

From Jan 2025 to Feb 2025

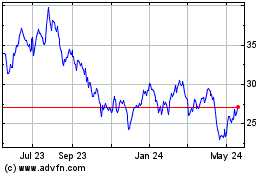

Sands China (PK) (USOTC:SCHYY)

Historical Stock Chart

From Feb 2024 to Feb 2025