- Current report filing (8-K)

June 23 2009 - 9:28AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of the Securities Exchange Act of 1934

|

Date

of Report (Date of earliest event reported):

June 17,

2009

|

|

|

|

SOLAR

THIN FILMS, INC.

(Exact

name of registrant as specified in its charter)

|

|

|

|

Delaware

(State

or other jurisdiction of incorporation)

|

000-19404

(Commission

File Number)

|

95-4359228

(IRS

Employer Identification No.)

|

|

|

|

|

|

25 Highland Blvd., Dix Hills,

New York 11746

Telephone

No.: (516) 417-8454

(Address

and telephone number of Registrant's principal

executive

offices and principal place of

business)

|

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

ྎ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

ྎ

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

ྎ

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b))

ྎ

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4(c))

Item

2.04 Triggering Events That Accelerate or Increase a Direct Financial Obligation

or an Obligation under an Off-Balance Sheet Arrangement.

As previously reported by Solar Thin

Films, Inc. (the “

Company

”) in its

Current Report on Form 8-K filed with the Securities and Exchange Commission

(the “

SEC

”) on

June 20, 2006, and as updated in subsequent periodic filings with the SEC, on

June 14, 2006 the Company entered into a financing arrangement with several

investors (the "

Investors

") pursuant

to which it sold $6,000,000 in senior secured convertible notes (the "

Notes

") due June 14,

2009 (the “

Maturity

Date

”) and Series A through Series D warrants to purchase an aggregate of

12,000,000 shares of common stock at exercise prices of $2.00, $2.20, $3.00 and

$3.30, respectively, until June 14, 2009. The Company granted the

Investors a first priority security interest in all of its assets. In addition,

the Company pledged 100% of the shares (the “

Pledged Shares

”) held

in its wholly owned subsidiary, Kraft Elektronikai Zrt (“

Kraft

”), as

collateral to the Investors.

As

of June 17, 2009, there is approximately $1,165,000 principal amount of Notes

outstanding. However, as a result of an event of default which occurred on June

17, 2009, the Investors may seek a redemption premium equal to 125% of the

outstanding principal amount. As of the date of this Current Report,

one June 2006 Investor has submitted an event of default redemption notice to

the Company seeking payment of $153,750.

The

Company has been actively and diligently engaging in negotiations with the

Investors in order to reach an amicable resolution, including, without

limitation, entering into extension, forbearance or other agreements, which the

Company anticipates completing in July 2009. In addition, the Company has been

actively seeking sources of financing in order to repay the outstanding debt

owed to the Investors. Notwithstanding the foregoing, there can be no assurance

that the Company will enter into definitive agreements to consummate either of

the transactions described above. If the Company is unable to enter

into extension, forbearance or other agreements with the Investors, or is unable

to obtain financing on terms acceptable to the Company in order to repay the

outstanding debt owed to the Investors, the Investors may elect to exercise

their first priority security interest in all of the assets of the Company, as

well as sell, transfer or assign the Pledged Shares. In such event,

the Company may be required to cease operations and/or seek protection from its

creditors under the Federal Bankruptcy Act

.

Item

9.01 Financial Statements and Exhibits.

(a)

Financial statements of

businesses acquired

.

Not applicable.

(b)

Pro forma financial

information

.

Not applicable.

(c)

Shell company

transactions

.

Not applicable.

(d)

Exhibits

.

None.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has

duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

|

|

|

|

|

SOLAR

THIN FILMS, INC.

|

|

|

|

|

|

Date: June

23, 2009

|

By:

|

/s/

Robert M.

Rubin

|

|

|

Robert

M. Rubin

|

|

|

Chief

Executive Officer

|

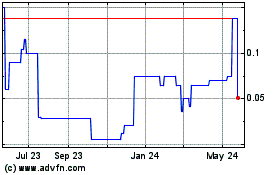

Silverton Energy (PK) (USOTC:SLTN)

Historical Stock Chart

From May 2024 to Jun 2024

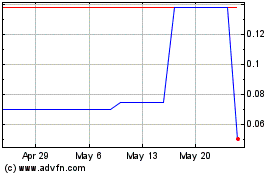

Silverton Energy (PK) (USOTC:SLTN)

Historical Stock Chart

From Jun 2023 to Jun 2024