UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

10-K

(Mark

One)

☒

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the fiscal year ended November 30, 2024

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from _______ to _______

Commission

File No. 000-27688

SURGE

COMPONENTS, INC.

(Exact

name of registrant as specified in its charter)

| Nevada | | 11-2602030 |

(State or Other Jurisdiction of

Incorporation or Organization) | | (I.R.S. Employer

Identification No.) |

| | | |

95 East Jefryn Boulevard Deer Park, New York | | 11729 |

| (Address of principal executive offices) | | (Zip Code) |

| | | |

| (631) 595-1818 |

| (Registrant’s telephone number, including area code) |

Securities

registered pursuant to Section 12(b) of the Exchange Act:

| Title

of Each Class to be so Registered: |

|

Name

of each exchange on which registered |

| None |

|

None |

Securities

registered under Section 12(g) of the Act:

Common

Stock, Par Value $0.001

Preferred

Stock Purchase Rights

(Title

of Class)

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No

☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No

☒

Indicate

by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such

reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No

☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | ☐ | Accelerated Filer | ☐ |

| Non-accelerated Filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report. ☐

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate

by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation

received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As

of May 31, 2024, the aggregate market value of the issued and outstanding common stock held by non-affiliates of the registrant, based

upon the closing price of the common stock, was approximately $8.1 million.

The

registrant’s common stock outstanding as of February 24, 2025, was 5,582,783 shares of common stock.

SURGE

COMPONENTS, INC.

TABLE

OF CONTENTS

FORWARD-LOOKING

STATEMENTS

This

report contains forward-looking statements. All statements other than statements of historical facts contained in this report, including

statements regarding our future results of operations and financial position, business strategy and plans and objectives of management

for future operations, are forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors

that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements

expressed or implied by the forward-looking statements.

In

some cases, forward-looking statements can be identified by terms such as “may,” “will,” “should,”

“expects,” “plans,” “anticipates,” “could,” “intends,” “target,”

“projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential”

or “continue” or the negative of these terms or other similar words. These statements are only predictions. We have based

these forward-looking statements largely on our current expectations and projections about future events and financial trends that we

believe may affect our business, financial condition and results of operations. We discuss many of the risks in greater detail under

the heading “Risk Factors.” Also, these forward-looking statements represent our estimates and assumptions only as of the

date of the filing of this report. Except as required by law, we assume no obligation to update any forward-looking statements after

the date of the filing of this report.

This

report also contains estimates. These estimates involve a number of assumptions and limitations, and investors are cautioned not to give

undue weight to such estimates. In addition, projections, assumptions and estimates of our future performance and the future performance

of the industries in which we operate are subject to a high degree of uncertainty and risk due to a variety of factors, including those

described in “Risk Factors” and elsewhere in this report. These and other factors could cause results to differ materially

from those expressed in the estimates made by the independent parties and by us.

PART

I

Item 1.

Business.

References

to “we,” “us,” “our”, “our company” and “the company” refer to Surge Components,

Inc. (“Surge” or the “Company”) and, unless the context indicates otherwise, includes Surge’s wholly-owned

subsidiaries, Challenge/Surge, Inc. (“Challenge”), and Surge Components, Limited (“Surge Limited”).

We

were incorporated under the laws of the State of New York on November 24, 1981, and re-incorporated in Nevada on August 26, 2010. We

completed an initial public offering of our securities in 1984 and a second offering in August 1996. Our principal executive offices

are located at 95 East Jefryn Boulevard, Deer Park, New York 11729 and our telephone number is (631) 595-1818.

We

are a supplier of electronic products and components. These products include capacitors, which are electrical energy storage devices,

and discrete components, such as semiconductor rectifiers, transistors and diodes, which are single function low power semiconductor

products that are packaged alone as compared to integrated circuits such as microprocessors. The products that we sell are typically

utilized in the electronic circuitry of diverse products, including, but not limited to, automobiles, telecomm, audio, cellular telephones,

computers, consumer electronics, garage door openers, household appliances, power supplies and security equipment. The products that

we sell are sold to both original equipment manufacturers, commonly referred to as OEMs, who incorporate them into their products, and

to distributors of the lines of products we sell, who resell these products within their customer base. Surge sells its products through

three of the top four distributors for electronic components in the world and also supplies its products to subcontractors who manufacture

for their customers. These channels open doors to Surge at customers which Surge may not have access to otherwise. The products that

we sell are manufactured predominantly in Asia by approximately sixteen independent manufacturers. We only have one binding long-term

supply agreement with one of our manufacturers, Lelon Electronics. We have an agreement to act as the exclusive sales agent utilizing

independent sales representative organizations in North America to sell and market the products for one of such manufacturers, Lelon

Electronics. When we act as a sales agent, we receive a commission from our supplier who sold the product to the customer that we introduced

to our supplier. The amount of the commission is determined on a sale by sale basis depending on the profit margin of the product. Commission

revenue totaled $95,584 and $106,885 for the fiscal years ended November 30, 2024 (“Fiscal 2024”) and November 30, 2023 (“Fiscal

2023”), respectively.

Challenge

is engaged in the sale of electronic components. In 1999, Challenge began as a division to sell audible components. We have been

able to increase the types of products that we sell because some of our suppliers introduced new products, and we also located other

products from new suppliers. Our core products include buzzers, speakers, microphones, resonators, alarms, chimes, filters, and discriminators.

We now also work with our suppliers to have our suppliers customize many of the products we sell for many customers through the customers’

own designs and those that we work with our suppliers to have our suppliers redesign for them at our suppliers’ factories. We have

engineers on our staff who work with our suppliers on such redesigns and assists with the introduction of new product lines. We

are continually looking to expand the line of products that we sell. We sell these products through independent representatives that

earn a commission on the products we sell. We are also working with local, regional, and national distributors to sell these products

to local accounts in every state Challenge also at times handles the brokering of certain products, helping their customers find parts

that regular suppliers can’t deliver.

In

order for us to grow, we will depend on, among other things, the continued growth of the electronics and semiconductor industries,

our ability to withstand intense price competition, our ability to obtain new clients, our ability to retain and attract sales and

other personnel in order to expand our marketing capabilities, our ability to secure adequate sources of products, which are in

demand on commercially reasonable terms, our success in managing growth, including monitoring an expanded level of

operations.

Industry

Background

The

United States electronics distribution industry is composed of manufacturers, national and international distributors, as well as regional

and local distributors. Electronics distributors market numerous products, including active components (such as transistors, microprocessors,

integrated circuits and semiconductors), passive components (such as capacitors and audibles), and electro mechanical, interconnect (such

as connectors and wire) and computer products. Surge focuses its efforts on the sale of capacitors, discrete components, and audible

products.

The

electronics industry has been characterized by intense price cutting and rapid technological changes and development, which could materially

adversely affect our future operating results. In addition, the industry has been affected historically by periodic economic downturns,

which have had an adverse economic effect upon manufacturers and end-users of the products that we sell, as well as distributors.

Furthermore, the life-cycle of existing electronic products and the timing of new product development and introduction can affect the

demand for electronic components, including the products that we sell. Accordingly, any downturn in the electronics industry in general

could adversely affect our business and results of operations. Due to rising transportation and employment costs in Asia, we have seen

some U.S. manufacturers start moving their manufacturing facilities to Mexico to reduce transportation costs and bring manufacturing

much closer to home. At this time, however, none of our customers has moved its manufacturing facilities to Mexico.

Products

Surge

supplies a wide variety of electronic components (some of which bear our private “Surge” label) which can be broadly divided

into two categories—capacitors and discrete components. For Fiscal 2024 and Fiscal 2023, capacitors accounted for approximately

28% and 31% of Surge’s sales, respectively, of which approximately 75% for each year was Lelon capacitors (discussed below). Discrete

components accounted for Surge’s remaining sales in Fiscal 2024 and Fiscal 2023. Capacitors and discrete components can be categorized

based on various factors, including function, construction, fabrication and capacity.

We

sell, under the name of the manufacturer, Lelon Electronics, aluminum electrolytic capacitors, which are capacitors that store and release

energy into a circuit incrementally and are used in various applications, including but not limited to, computers, appliances, automotive,

lighting, telecommunications devices and various consumer products. Our sales of products under the Lelon Electronics name accounted

for approximately 28% of our total sales (and approximately 75% of our capacitor sales as noted above) in Fiscal 2024.

The

principal products sold by Surge are sold under the Surge name (except with respect to capacitors, which the Company also sells under

the Lelon Electronics name as noted above) or by Challenge are set forth below.

Capacitors

A

capacitor is an electrical energy storage device used in the electronics industry for varied applications, principally as elements of

resonant circuits, coupling and bypass applications, blockage of DC current, frequency determining and timing elements, filters and delay-line

components. All products are available in traditional leaded as well as surface mount (chip) packages. The product line of capacitors

we sell includes:

Aluminum

Electrolytic Capacitors- These capacitors, which are Surge’s principal product, are storage devices used in power applications

to store and release energy as the electronic circuitry demands. They are commonly used in power supplies and can be found in a wide

range of consumer electronics products. Our supplier has one of the largest facilities for these products in Taiwan and China. These

facilities are fully certified for the International Quality Standard ISO 9001 and QS9000, and TS16949, which means that they meet the

strictest requirements established by the automotive industry and adopted throughout the world to ensure that the facility’s manufacturing

processes, equipment and associated quality control systems will satisfy specific customer requirements. This system is also intended

and designed to facilitate clear and thorough record keeping of all quality control and testing information and to ensure clear communication

from one department to another about the information (i.e., quality control, production or engineering). This certification permits us

to monitor quality control/manufacturing process information and to respond to any customer questions.

Ceramic

Capacitors- These capacitors are the least expensive, and are widely used in the electronics industry. They are commonly used to bypass

or filter semiconductors in resonant circuits and are found predominantly in a wide range of low cost products including computer, telecom,

appliances, games and toys.

Mylar

Film Capacitors- These capacitors are frequently used for noise suppression and filtering. They are commonly used in telecommunication

and computer products. Surge’s suppliers in China have facilities fully certified for all of the above mentioned quality certifications.

Discrete

Components

Discrete

components, such as semiconductor rectifiers, transistors and diodes, are packaged individually to perform a single or limited function,

in contrast to integrated circuits, such as microprocessors and other “chips”, which contain from only a few diodes to as

many as several million diodes and other elements in a single package, and are usually designed to perform complex tasks. Surge almost

exclusively distributes discrete, low power semiconductor components rather than integrated circuits.

The

product line of discrete components we sell includes:

Rectifiers-

Low power semiconductor rectifiers are devices that convert alternating current, or AC power, into one directional current, or DC power,

by permitting current to flow in one direction only. They tend to be found in most electrical apparatuses, especially those drawing power

from an AC wall outlet. All products are available in traditional leaded as well as surface mount (chip) packages. Surge’s rectifier

suppliers all have the aforementioned certifications, giving us an opportunity to market the products that we sell to the automotive

industry.

Transistors-

These products send a signal to the circuit for transmission of waves. They are commonly used in applications involving the processing

or amplification of electric current and electric signals, including data, television, sound and power. All products are available in

traditional leaded as well as surface mount (chip) packages. Surge sells many types of ISO 9002 transistors, including power transistors,

designed for large currents to safely dissipate large amounts of power.

Diodes-

Diodes are two-lead or surface mount components that allow electric current to flow in only one direction. They are used in a variety

of electronic applications, including signal processing and direction of current. All products are available in traditional leaded as

well as surface mount (chip) packages. Diodes sold include:

Circuit

Protection Devices- Our circuit protection devices include transient voltage suppressors and metal oxide varistors, which protect circuits

against switching, lightening surges and other uncontrolled power surges and/or interruptions in circuits. Transient voltage suppressors,

which offer a higher level of protection for the circuit, are required in telecommunication products and are typically higher priced

products than the metal oxide varistors, which are more economically priced and are used in consumer products. All products are available

in traditional leaded as well as surface mount (chip) packages.

Audible

Components- These include audible transducers, Piezo buzzers, speakers, and microphones, which produce an audible sound for, and are

used in back-up power supplies for computers, alarms, appliances, smoke detectors, automobiles, telephones and other products which produce

sounds. Challenge has initiated marketing relationships with certain Asian manufacturers of audible components to sell these products

worldwide. All products are available in traditional leaded as well as surface mount (chip) packages.

New

Products- We periodically introduce new products, which are intended to complement our existing product lines. These products are

ones that are commonly used in the same circuit designs as other of the products that we sell and will further provide a one-

stop-shop for the customer. Some of these products are common items used in all applications and others are niche items with a focus

towards a particular application. These new products include fuses, printed circuit boards and switches. All products are available

in traditional leaded as well as surface mount (chip) versions. In 2019 we were issued a patent on a new pinpoint alarm designed to

improve an individual’s ability to determine the location of the alarm. The improved alarm can be used in a wide variety of

applications including reversing vehicles, medical emergency notification and hardware devices that use Bluetooth or other wireless

communication protocols in combination with mobile software applications to locate lost items.

Inventory

In

order to adequately service our customers’ needs, we believe that it is necessary to maintain large inventories, which makes us

more susceptible to price and technology changes. At any given time, we attempt to maintain a one-to-two month inventory on certain products

in high demand for customers and at least one month for other products. Our inventory currently contains more than 100 million component

units consisting of more than 3,000 different part numbers. The products that we sell range in sales price from less than one cent for

a commercial diode to more than $2.00 for high power capacitors and semiconductors. As of November 30, 2024, we maintained inventory

valued at $5,000,707.

Because

of the experience of our management, including Ira Levy and Steven Lubman, we believe that we know the best prices to buy the products

we sell and as a result we generally waive rights to manufacturers’ inventory protection agreements (including price protection

and inventory return rights), and thereby bear the risk of increases in the prices charged by our manufacturers and decreases in the

prices of products held in our inventory or covered by purchase commitments. If prices of components, which we hold in inventory decline,

or if new technology is developed that displaces products that we sell, our business could be materially adversely affected. The Company

has experienced very little impact from customer design changes and slowdown but this can potentially increase due to economic conditions

and customer-specific business conditions. If our customers experience these changes, our business could be adversely affected.

Product

Availability

Surge

and Challenge obtain a significant amount of their products from manufacturers in Asia. Of the total goods purchased by Surge and

Challenge in Fiscal 2024, those foreign manufactured products were supplied from manufacturers in Taiwan (31%), Hong Kong (15%),

elsewhere in Asia including China, South Korea and Singapore (49%) and overseas outside of Asia (less than 1%). The Company

purchases the balance of its products from the United States. The Company purchases its products from approximately sixteen

different manufacturers.

Most

of the facilities that manufacture products for Surge have obtained International Quality Standard ISO 9002 and other certifications.

We typically purchase the products that we sell in United States currency in order to minimize the risk of currency fluctuations.

In most cases, Surge utilizes two or more alternative sources of supply for each of its products with one primary and one complementary

supplier for each product. Surge’s relationships with many of its suppliers date back to the commencement of our import operations

in 1983. We have established payment terms with our manufacturers of between 30 and 60 day open account terms.

We

only have one agreement with a supplier, Lelon Electronics, which is terminable by either party upon six months’

notice to the other party. We have an agreement to act as the sales agent in North America for one of our manufacturers, Lelon Electronics.

While we believe that we have established close working relationships with our principal manufacturers, our success depends, in large

part, on maintaining these relationships and developing new supplier relationships for our existing and future product lines. Because

of the lack of long- term contracts, we may not be able to maintain these relationships.

For

Fiscal 2024 and Fiscal 2023, one of Surge’s vendors, Lelon Electronics, accounted for approximately 28% and 31% of Surge’s

consolidated purchases, respectively. The loss of or a significant disruption in the relationship with Lelon Electronics, which is our

major supplier, could have a material adverse effect on our business and results of operations until a suitable replacement could be

obtained.

The

Company has a written agreement with Lelon Electronics regarding the supply of inventory for the Company’s customers. The

Company purchases products under both the Company’s name and Lelon’s brand name for the Company’s inventory in

order to supply the Company’s customers. For the majority of purchases from Lelon Electronics, the Company takes title to the

products, houses them in the Company’s warehouse and sells directly to the Company’s customers. There is no right of

return on the products purchased from Lelon and the Company accepts all credit risk with regards to sales of these

products.

The

components business has, from time to time, experienced periods of shortages in product supply, usually as the result of demand exceeding

available supply. When these shortages occur, suppliers tend to either increase prices and or reduce the number of units sold to given

customers. Should there be shortages in the future, such shortages may benefit our business if we get preferential supply from our manufacturers.

It could also have an adverse effect upon our business, in the case that our manufacturers don’t have enough capacity to provide

enough components. Conversely, due to poor market demand, there could be an excess of components in the market, causing stronger competition

and an erosion of prices. In cases of shortages, customers may purchase more than they need and thus reducing future demand for their

products while they use up their excess inventory.What is the status now?

Marketing

and Sales

Surge’s

sales efforts are directed towards Original Equipment Manufacturer (OEM) customers in numerous industries where the products that we

sell have wide application. Surge currently employs nine sales and marketing personnel, not including two of its executive officers,

who are responsible for certain key customer relationships. In addition, Surge has expanded its sales team, hiring a Europe manager based

in London as well as one based in China.

We

also use independent sales representatives or organizations, which often specialize in specific products and areas and have specific

knowledge of and contacts in particular markets. We currently have representation agreements with approximately 30 sales representative

organizations. Sales representative organizations, which are generally paid a 5% commission on net sales, are generally responsible in

their respective geographic markets for identifying customers and soliciting customer orders. Pursuant to arrangements with our independent

sales representatives, they are permitted to represent other electronics manufacturers, but are generally prohibited from carrying a

line of products competitive with the products that we sell. These arrangements can be terminated on written notice by either party or

if breached by either party. These organizations normally employ between one and twelve sales representatives. The individual sales representatives

employed by the sales organizations generally possess an expertise which enhances the scope of our marketing and sales efforts. This

permits us to avoid the significant costs associated with creating a direct marketing network. We have had relationships with certain

sales organizations since 1988 and continue to engage new sales organizations as needed. We believe that additional sales organizations

and representatives are available to us, if required.

We

have initiated a formal national distribution program to attract more distributors to promote the products that we sell. We expect this

market segment to contribute significantly to our sales growth over time.

Many

customers require their suppliers to have a local presence and Surge’s network of independent sales representatives are responsive

to these needs. Surge formed a Hong Kong corporation, Surge Components, Limited and hired a regional sales manager to service the Hong

Kong/Greater China region customers.

Other

marketing efforts include generation and distribution of catalogs and brochures of the products we sell and attendance at trade shows.

We have produced an exhibit for display at electronics trade shows throughout the year. The products that we sell have been exhibited

at the electronic distribution show in Las Vegas, and we intend to continue our commitment and focus on the distribution segment of the

industry by our visibility at the Electronic Distributor Trade Show. In addition, we have updated our website to make it more informative

and user friendly. Our search engines have been improved so that customers can find us more easily and we have developed a new portal

system to help with lead management and disbursement.

Customers

The

products that we sell are sold to distributors and OEMs in such diverse industries as the automotive, computer, communications, cellular

telephones, consumer electronics, garage door openers, security equipment, audio equipment, telecomm products, computer related products,

power supply products, utility meters and household appliances industries. We request our distributors to provide point of sales reporting,

which enables us to gain knowledge of the breakdown of industries into which the products that we sell are sold. Two of our customers

accounted for 19% and 15% of net sales for Fiscal 2024, and 20% and 18% of net sales for Fiscal 2023. Our discrete components are

often sold to the same clients as our capacitors. These OEM customers typically accept samples for evaluation and, if approved, we work

towards procuring the next orders for these items.

Typically,

we do not maintain contracts with our customers and generally sell products pursuant to customer purchase orders. Although our customer

base has increased, the loss of our largest customers as well as, to a lesser extent, the loss of any other material customer, could

have a materially adverse effect on our operations during the short-term until we are able to generate replacement business, although

we may not be able to obtain such replacement business. Because of our contracts and good working relationships with our distributors,

we offer the OEMs, when purchasing through distributors, extended payment terms, just-in- time deliveries and one-stop shopping for many

types of electronic products.

Competition

We

conduct business in the highly competitive electronic components industry. We expect this industry to remain competitive. We face intense

competition in both our selling efforts and purchasing efforts from the many companies that manufacture or distribute electronic components.

Our principal competitors in the sale of capacitors include Nichicon, Panasonic, Illinois Capacitor, NIC, AVX, Murata, Epcos, United

Chemicon, Rubycon, Vishay and Kemet. Our principal competitors in the sale of discrete components include Vishay, General Semiconductor

Division, General Instrument Corp., OnSemi, Inc., Microsemi Corp., Diodes, Inc. and Littlefuse, and Copper Bussman Division. Our principal

competition in the audible business include AVX, Murata, Panasonic, Projects Unlimited, International Components Corp. and Star Micronics.

Many of these companies are well established with substantial expertise, and have much greater assets and greater financial, marketing,

personnel, and other resources than we do. Many larger competing suppliers also carry product lines which we do not carry. Generally,

large semiconductor manufacturers and distributors do not focus their direct selling efforts on small to medium sized OEMs and distributors,

which constitute many of our customers. As our customers become larger, and as the market becomes more competitive, our competitors may

find it beneficial to focus direct selling efforts on those customers, which could result in our facing increased competition, the loss

of customers or pressure on our profit margins. We are finding increased competition from manufacturers located in Asia due to the increased

globalization nature of the business. There can be no assurance that we will be able to continue to compete effectively with existing

or potential competitors. Other factors that will affect our success in these markets include our continued ability to attract additional

experienced marketing, sales and management talent, and our ability to expand our support, training and field service capabilities. Additionally,

since the tsunami and earthquake in Japan in 2012, our competitors have established manufacturing facilities in China enabling them to

be more competitive by lowering their labor rates and manufacturing costs. Also, as the world continues to become global and customers

have easier access to suppliers in Asia, our business could be adversely affected since the internet enables customers to meet and

interact with suppliers through Google and other search engines which customers had not previously done.

Customer

Service

We

have customer service employees whose time is dedicated largely to responding to customer inquiries such as price quote requests, delivery

status of new or existing purchase orders, changes of existing order dates, quantities, dates, etc. We intend to increase our customer

service capabilities, as necessary.

Foreign

Trade Regulation

Most

products sold by Surge are manufactured in Asia, including such countries as Taiwan, South Korea, Hong Kong, India, Japan and China.

The purchase of goods manufactured in foreign countries is subject to a number of risks, including economic disruptions, transportation

delays and interruptions, foreign exchange rate fluctuations, impositions of tariffs and import and export controls, and changes in governmental

policies, any of which could have a material adverse effect on our business and results of operations. Potential concerns may include

drastic devaluation of currencies, loss of supplies and increased competition within the region.

From

time to time, protectionist pressures have influenced United States trade policy concerning the imposition of significant duties or other

trade restrictions upon foreign products. We cannot predict whether additional United States customs quotas, duties, taxes or other charges

or restrictions will be imposed upon the importation of foreign components in the future or what effect such actions could have on our

business, financial condition or results of operations.

Our

ability to remain competitive with respect to the pricing of imported components could be adversely affected by increases in tariffs

or duties, changes in trade treaties, strikes in air or sea transportation, and possible future United States legislation with

respect to pricing and import quotas on products from foreign countries. Our ability to remain competitive could also be affected by

other governmental actions related to, among other things, anti-dumping legislation and international currency

fluctuations. While we do not believe that any of these factors adversely impact our business at the present time, there can be no

assurance that these factors will not materially adversely affect us in the future. Since July 2018, when tariffs started to impact

some of the Company’s sales, the Company has been able to pass on the tariffs to its U.S. and Canadian customers. We have also

changed our shipping terms with our Mexico customers to Free Carrier, which means we deliver the goods to the customers’ Hong

Kong freight forwarder, who then becomes responsible for the transportation and tariff costs. Any significant disruption in the

delivery of merchandise from our suppliers, substantially all of whom are foreign, could have a materially adverse impact on our

business and results of operations.

Government

Regulation

Various

laws and regulations relating to safe working conditions, including the Occupational Safety and Health Act, are applicable to our Company.

We believe we are in substantial compliance with all material federal, state and local laws and regulations regarding safe working conditions.

We believe that the cost of compliance with such governmental regulations is not material.

We

are subject to the United States Foreign Corrupt Practices Act, which generally prohibits United States companies from engaging in bribery

or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. Foreign companies, including some

that may compete with us, are not subject to these prohibitions. If our employees or other agents are found to have engaged in such practices,

we could suffer severe penalties and other consequences that may have a material adverse effect on our business, financial condition

and results of operations. To the Company’s knowledge, none of our employees or other agents have engaged in such practices.

The

Company has been impacted by the tariffs in effect or being considered by the United States to impose on Chinese goods being imported

into the United States, which includes the Company’s products. The imposition of such tariffs will likely cause our costs, as well

as the prices we charge customers, to increase.

Environmental

and Regulatory Compliance

We

are subject to various environmental laws and regulations relating to the protection of the environment, including those governing the

handling and management of certain chemicals used in electronic components.

We

do not believe that compliance with these laws and regulations will have a material adverse effect on our capital expenditures, earnings,

or competitive position.

Patents,

Trademarks and Proprietary Information

In

September 2018, we were issued a U.S. patent application with the United States Patent and Trademark Office for an improved pinpoint

alarm designed to improve an individual’s ability to determine the location of an alarm versus standard single, multi-frequency,

or broadband alarms. The improved alarm can be used in a wide variety of applications, including reversing vehicles, medical emergency

notification, and hardware devices that use Bluetooth or other wireless communications protocols in combination with mobile software

applications to locate lost items, including phones, wallets, and keys. Our patent issued on December 31, 2019, as United States Patent

No. 10,522,008. With regard to our other products, although we have no knowledge that such products infringe patents or trademarks, or

violate proprietary rights of others, it is possible that alleged infringement of existing or future patents, trademarks or proprietary

rights of others may occur. In the event that the products that we sell are alleged to infringe proprietary rights of others, these products

may have to be modified or redesigned. However, there can be no assurance that any infringing products will be able to be modified or

redesigned in a way that does not infringe on the proprietary rights of others, which could have a material adverse effect upon our operations.

In addition, there can be no assurance that we will have the financial or other resources necessary to enforce or defend a patent infringement

or proprietary rights violation action. Moreover, if the products we sell infringe patents, trademarks or proprietary rights of others,

we could, under certain circumstances, become liable for damages, which also could have a material adverse effect on our business.

With

respect to the other products that we sell, we have no patents, trademarks or copyrights registered in the United States Patent and Trademark

Office or in any state. Additionally, to the best of our knowledge the manufacturers of the products that we sell do not have patents,

trademarks or copyrights registered in the United States Patent and Trademark Officer or in any state. We rely on the know-how, experience

and capabilities of our management personnel.

Backlog

As

of November 30, 2024, our backlog was approximately $9,432,962, as compared with $11,427,000 at November 30, 2023. Substantially all

backlog is expected to be shipped by us within 365 days of booking date. Due to the economic downturn, some of the Company’s customers

have cancelled orders while others are not placing as many new orders. Year to year comparisons of backlog are not necessarily indicative

of future operating results.

Employees

As

of November 30, 2024, Surge and Challenge employed 42 persons, two of whom are employed in executive capacities, nine are engaged in

sales, four in engineering, four in purchasing, five in administrative capacities, twelve in customer service, two in accounting

and four in warehousing. None of our employees are covered by a collective bargaining agreement, and we consider our relationship with

our employees to be good.

Competitive

pay and benefits. The Company’s compensation programs are designed to provide the proper incentives to attract, retain and motivate

employees to achieve superior results. We provide employee wages that are competitive and consistent with employee positions, skill levels,

experience, knowledge and geographic location. Annual increases and incentive compensation are based on merit, which is communicated

to the employees at the time of hiring. Employees are eligible for paid and unpaid leaves, a retirement plan, and disability/accident

coverage.

Health

and safety. The health and safety of our employees is our highest priority. Our safety focus is also evident in our response to the COVID-19

pandemic.

| |

● |

Adding

work from home flexibility. |

| |

● |

Adjusting

attendance policies to encourage those who are sick to stay home. |

| |

● |

Increasing

cleaning protocols across all locations. |

| |

|

|

| |

● |

Providing

additional personal protective equipment and cleaning supplies. |

Item 1A.

Risk Factors

An

investment in our common stock involves a high degree of risk. An investor should carefully consider the risks described below as well

as other information contained in this annual report on Form 10-K. If any of the following risks actually occur, our business, financial

condition or results of operations could be materially adversely affected, the value of our common stock could decline, and an investor

may lose all or part of his or her investment.

Risks

Related to our Business

We

have an agreement with only one of our suppliers and we depend on a limited number of suppliers

We

have an agreement with only one of our suppliers (Lelon Electronics), which agreement is terminable by either party upon notice to the

other party. Lelon Electronics accounted for approximately 28% and 31% of the Company’s consolidated purchases in the years ending

November 30, 2024 and November 30, 2023. We also act as the exclusive sales agent in North America for Lelon Electronics. While we believe

that we have established close working relationships with our principal suppliers, our success depends, in large part, on maintaining

these relationships and developing new supplier relationships for our existing and future product lines. There is no assurance that we

will be able to maintain these relationships. While we believe that there are alternative semiconductor and capacitor suppliers whose

replacement products may be acceptable to our customers, the loss of, or a significant disruption in the relationship with, one or more

of our major suppliers would likely have a material adverse effect on our business and results of operations.

We

need to maintain large inventories in order to succeed and as a result, price fluctuations could harm us.

In

order to adequately service our customers, we believe that it is necessary to maintain a large inventory of products. Accordingly,

we attempt to maintain a one-to-two month inventory of those products which we supply to our customers. As a result of our strategic

inventory purchasing policies, under which we order products to obtain preferential pricing, we generally waive the right to manufacturers’

inventory protection agreements (including price protection and inventory return rights). As a result, we bear the risk of increases

in the prices charged by our manufacturers to the Company and decreases in the prices we are able to charge our customers. If prices

of components which we hold in inventory decline or if new technology is developed that displaces products which we sell, our business

could be materially adversely affected. Typically the Company has experienced very little impact from customer design changes and slowdown

but this can potentially increase due to economic conditions and specific customers business conditions. If our customers experience

these changes, our business could be adversely affected... There can be no assurances that we will be required to take additional reserves

in the future.

Our

operations would be adversely effected if we lose certain of our customers.

For

Fiscal 2024, approximately 19% and 15% of our net sales were derived from sales to two customers. Although our customer base has

increased, the loss of our largest customers as well as, to a lesser extent, the loss of any other material customer, would be expected

to have a materially adverse effect on our operations until we are able to generate replacement business, although we may not be able

to obtain such replacement business.

We

may not be able to compete against large competitors who have better resources.

We

face intense competition, in both our selling efforts and purchasing efforts, from the many companies that manufacture or distribute

electronic components and semiconductors. Our principal competitors in the sale of capacitors include Nichicon, Panasonic, Illinois Capacitor,

NIC, AVX, Murata, Epcos, United Chemicon, Rubycon, Vishay and Kemet, General Semiconductor Division, General Instrument Corp., OnSemi,

Inc., Microsemi Corp., Diodes, Inc. and Littlefuse, and Copper Bussman Division. Many of these companies are well established with substantial

expertise, and have much greater assets and greater financial, marketing, personnel, and other resources than we do. Many larger competing

suppliers also carry product lines which we do not carry. Generally, large semiconductor manufacturers and distributors do not focus

their direct selling efforts on small to medium sized OEMs and distributors, which constitute most of our customers. As our customers

become larger, however, our competitors may find it beneficial to focus direct selling efforts on those customers, which could result

in our facing increased competition, the loss of customers or pressure on our profit margins. There can be no assurance that we will

be able to continue to compete effectively with existing or potential competitors. The Company periodically introduces new products to

the market.

System

failure or cybersecurity breaches of our network security could subject us to increased operating costs, as well as litigation and other

potential losses.

The

computer systems and network infrastructure that we use could be vulnerable to unforeseen hardware and cybersecurity issues, including

“hacking” and “identity theft.” Our operations are dependent upon our ability to protect our computer equipment

against damage from fire, power loss, telecommunications failure or a similar catastrophic event. Any damage or failure that causes an

interruption in our operations could have an adverse effect on our financial condition and results of operations. In addition, our operations

are dependent upon our ability to protect our computer systems and network infrastructure against damage from physical break-ins, cybersecurity breaches

and other disruptive problems caused by the Internet or other users. Such computer break-ins and other disruptions would jeopardize the

security of information stored in and transmitted through our computer systems and network infrastructure, which may result in significant

liability to us and damage our reputation.

Despite

efforts to ensure the integrity of our systems, we will not be able to anticipate all security breaches of these types, nor will we be

able to implement guaranteed preventive measures against such security breaches. Persistent attackers may succeed in penetrating defenses

given enough resources, time and motive. The techniques used by cyber criminals change frequently, may not be recognized until launched

and can originate from a wide variety of sources, including outside groups such as external service providers, organized crime affiliates,

terrorist organizations or hostile foreign governments.

A

successful attack to our system security could cause us serious negative consequences, including significant disruption of operations,

misappropriation of confidential information, or damage to our computers or systems or those of our customers. A successful security

breach could result in violations of applicable privacy and other laws, financial loss to us or to our customers, loss of confidences

in our security measures, significant litigation exposure, and harm to our reputation, all of which could have a material adverse effect

on our business and results of operations.

In

April 2021, the Company launched an investigation into a ransomware attack on the Company’s systems. Based on the review of the

forensic files, it was determined that the threat actor used ransomware to access Company files. No ransom was paid to the threat actors

and all parties associated with the compromised files were notified.

Our

business will be adversely affected if there is a shortage of components.

The

components business has, from time to time, experienced periods of extreme shortages in product supply, generally as the result of demand

exceeding available supply. When these shortages occur, suppliers tend to either increase prices or reduce the number of units sold to

customers. We believe that because of our large inventory and our relationships with our manufacturers, we have not been adversely affected

by shortages in certain discrete semiconductor components. However, future shortages may have an adverse effect upon our business especially

if we were to reduce inventory to cut costs and reduce risks of obsolescence. Currently, the Company believes that its lead time

is better than their competitors and we have been able to maintain the customers we have as well as in some instances acquire new customers

. However, our business could be affected if the Company is unable to maintain the levels of inventory needed to keep our customers lines

running. In addition, customers could order extra inventory of products from several suppliers when they are concerned about a possible

shortage and then not reorder such products in the future for such time as they work off their excess inventory purchased.

Our

success depends on key personnel whose continued service is not guaranteed.

Our

continued success and our ability to manage anticipated future growth depend, in large part, upon the efforts of key personnel, particularly

Ira Levy and Steven Lubman, our chief executive officer and vice president, respectively, who have extensive industry knowledge and relationships

and exercise substantial influence over our operations. The loss of services of one or both of these individuals, or our inability to

attract and retain highly qualified personnel, could adversely affect our business, and weaken our relationships with suppliers, business

partners, and industry personnel, which could adversely affect our financial condition, results of operations, cash flow and trading

price of our common stock.

Our

business is subject to risks from trade regulation and foreign economic conditions.

Approximately

95% of the total goods which we purchased in Fiscal 2024 were manufactured in foreign countries, with the majority purchased from

Taiwan (31%), Hong Kong (15%), elsewhere in Asia (49%) and outside of Asia (less than 1%). These purchases subject us to a number of

risks, including economic disruptions, transportation delays and interruptions, foreign exchange rate fluctuations, imposition of tariffs

and import and export controls and changes in governmental policies, any of which could have a materially adverse effect on our business

and results of operations. Potential concerns may include drastic devaluation of currencies, loss of supplies and increased competition

within the region.

The

ability to remain competitive with respect to the pricing of imported components could be adversely affected by increases in tariffs

or duties, changes in trade treaties, strikes in air or sea transportation, and possible future United States legislation with

respect to pricing and import quotas on products from foreign countries. For example, it is possible that political or economic

developments in China, or with respect to the United States’ relationship with China, could have an adverse effect on our

business. Our ability to remain competitive could also be affected by other governmental actions related to, among other things,

tariffs, anti-dumping legislation and international currency fluctuations. While we do not believe that any of these factors have

adversely impacted our business in the past, there can be no assurance that these factors will not materially adversely affect us in

the future. Because the China internal consumption market is depressed, this will increase competition, as there is now a smaller

market potential target. Therefore, we believe certain of our competitors will reduce their pricing to capture more market

share.

Electronics

industry cyclicality may adversely affect our operations.

The

electronics industry has been affected historically by general economic downturns, which have had an adverse economic effect upon manufacturers

and end-users of capacitors and semiconductors. In addition, the life-cycle of existing electronic products and the timing of new product

developments and introductions can affect demand for semiconductor components. Any downturns in the electronics distribution industry

could adversely affect our business and results of operations.

Most

of our products are not protected by patents, trademarks and proprietary information.

On

December 31, 2019, a U.S. patent which was issued by the United States Patent and Trademark Office for an improved pinpoint alarm designed

to improve an individual’s ability to determine the location of an alarm versus standard single, multi-frequency, or broadband

alarms, which can be used in a wide variety of applications, including reversing vehicles, medical emergency notification, and hardware

devices that use Bluetooth or other wireless communications protocols in combination with mobile software applications to locate lost

items, including phones, wallets, and keys. We have no other patents, trademarks or copyrights registered with the United States Patent

and Trademark Office.

Although

we have no knowledge that our products infringe patents or trademarks, or violate proprietary rights of others, it is possible that alleged infringement

of existing or future patents, trademarks or proprietary rights of others may occur. In the event that the products that we sell are

alleged to infringe proprietary rights of others, these products may have to be modified or redesigned. However, there can be no assurance

that any infringing products will be able to be modified or redesigned in a way that does not infringe on the proprietary rights of others,

which could have a material adverse effect upon our operations. In addition, there can be no assurance that we will have the financial

or other resources necessary to enforce or defend a patent infringement or proprietary rights violation action. Moreover, if the products

we sell infringe patents, trademarks or proprietary rights of others, we could, under certain circumstances, become liable for damages,

which also could have a material adverse effect on our business.

Additionally

to the best of our knowledge the manufacturers of the products that we sell do not have patents, trademarks or copyrights registered

in the United States Patent and Trademark Officer or in any state.

Risks

Related to our Common Stock

Our

common stock is quoted on the OTC Market, which may limit the liquidity and price of our common stock more than if our common stock were

listed on the Nasdaq Stock Market or another national exchange.

Our

securities are currently quoted on the OTC Market, an inter-dealer electronic quotation and trading system or equity securities.

Quotation of our securities on the OTC Market may limit the liquidity and price of our securities more than if our securities were listed

on The Nasdaq Stock Market or another national exchange. Some investors may perceive our securities to be less attractive because they

are traded in the over-the-counter market. In addition, as an OTC quoted company, we do not attract the extensive analyst coverage that

accompanies companies listed on national exchanges. Further, institutional and other investors may have investment guidelines that restrict

or prohibit investing in securities traded on the OTC Market. These factors may have an adverse impact on the trading and price of our

common stock.

The

market price of our common stock may fluctuate significantly in response to the following factors, most of which are beyond our control:

| |

● |

variations

in our quarterly operating results; |

| |

|

|

| |

● |

changes

in general economic conditions; |

| |

|

|

| |

● |

changes

in market valuations of similar companies; |

| |

|

|

| |

● |

announcements

by us or our competitors of significant new contracts, acquisitions, strategic partnerships or joint ventures, or capital commitments; |

| |

|

|

| |

● |

loss

of a major supplier or customer; and |

| |

|

|

| |

● |

the

addition or loss of key managerial and collaborative personnel. |

Any

such fluctuations may adversely affect the market price of our common stock, regardless of our actual operating performance. As a result,

stockholders may be unable to sell their shares, or may be forced to sell them at a loss.

The

application of the “penny stock” rules could adversely affect the market price of our common stock and increase an investor’s

transaction costs to sell those shares.

Rule

3a51-1 of the Exchange Act defines “penny stock,” in part, as any equity security that has a market price of less than $5.00

per share or an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock,

unless exempt, Rule 15g-9 of the Exchange Act requires that a broker or dealer:

| |

● |

approve

a person’s account for transactions in penny stocks; and |

| |

|

|

| |

● |

receive

from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. |

In

order to approve a person’s account for transactions in penny stocks, the broker or dealer must:

| |

● |

obtain

financial information and investment experience and objectives of the person; and |

| |

|

|

| |

● |

make

a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge

and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. |

The

broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to

the penny stock market, which:

| |

● |

sets

forth the basis on which the broker or dealer made the suitability determination; and |

| |

|

|

| |

● |

that

the broker or dealer received a signed, written agreement from the investor prior to the transaction. |

Generally,

brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more

difficult for investors to dispose of our common stock and cause a decline in the market value of our stock.

Anti-takeover

provisions in our organizational documents and the shareholder rights plan that we have adopted may discourage or prevent a change of

control, even if an acquisition would be beneficial to our stockholders, which could affect our stock price adversely and prevent attempts

by our stockholders to replace or remove our current management.

Our

articles of incorporation and bylaws currently contain provisions that could delay or prevent a change of control of our company or changes

in our Board of Directors that our stockholders might consider favorable. Some of these provisions:

| |

● |

authorize

the issuance of preferred stock which can be created and issued by the Board of Directors without prior stockholder approval, with

rights senior to those of our common stock; |

| |

● |

prohibit

our stockholders from calling special stockholder meetings or taking action by written consent; and |

| |

● |

require

advance written notice of stockholder proposals and director nominations. |

We

have also adopted a shareholder rights plan that could make it more difficult for a third party to acquire, or could discourage a third

party from acquiring, us or a large block of our common stock. A third party that acquires 5% or more of our common stock could suffer

substantial dilution of its ownership interest under the terms of the shareholder rights plan through the issuance of our shares to all

stockholders other than the acquiring person. These and other provisions in our articles of incorporation and bylaws could make it more

difficult for stockholders or potential acquirers to obtain control of our Board of Directors or initiate actions that are opposed by

our then-current Board of Directors, including a merger, tender offer, or proxy contest involving our company. Any delay or prevention

of a change of control transaction or changes in our Board of Directors could cause the market price of our common stock to decline.

Item

1B. Unresolved Staff Comments

Not

applicable.

Item

1C. Cybersecurity

We have developed and implemented a cybersecurity risk management program intended to protect the confidentiality, integrity, and availability

of our critical systems and information. Our cybersecurity risk management program is integrated into our overall enterprise risk management

program, and shares common methodologies, reporting channels and governance processes that apply across the enterprise risk management

program to other legal, compliance, strategic, operational, and financial risk areas.

Key elements of our

cybersecurity risk management program include but are not limited to,

| ● | risk assessments designed to help identify material risks

from cybersecurity threats to our critical systems, information, services, and our broader enterprise IT environment; |

| ● | individuals, including employees and external third party

service providers, who are responsible for managing our cybersecurity risk assessment processes, our security controls, and our response

to cybersecurity incidents; cybersecurity incident response plan that includes procedures for responding to cybersecurity incidents;

and |

| ● | a cybersecurity insurance policy in place to help mitigate monetary losses of a potential cybersecurity attack. |

Our management team is responsible

for assessing and managing our material risks from cybersecurity threats. The team has primary responsibility for our overall cybersecurity

risk management program and supervises both our internal cybersecurity personnel and our retained external cybersecurity consultants.

Members of our management team have prior work experience in supervising and implementing cybersecurity risk mitigation efforts in highly-regulated

industries. Our internal cybersecurity personnel and retained external cybersecurity consultants also have a breadth of expertise across

core cybersecurity disciplines including governance, risk, compliance, and security architecture.

Our management team takes steps to stay

informed and monitors efforts to prevent, detect, mitigate, and remediate cybersecurity risks and incidents through various means, which

may include briefings from internal security personnel; threat intelligence and other information obtained from governmental, public or

private sources, including external consultants engaged by us; and alerts and reports produced by security tools deployed in the IT environment

Our Board considers cybersecurity risk as part of its risk oversight function and receives regular updates from the management team on

our cybersecurity risks and in addition, management updates the Board where it deems appropriate, regarding any cybersecurity incidents

it considers to be significant or potentially significant.

Item

2. Properties.

Our

executive offices and warehouse facilities are located at 95 East Jefryn Boulevard, Deer Park, New York, 11729. We lease our facilities

from Great American Realty of Jefryn Blvd., LLC (“Great American”), an entity that is 50% owned by Ira Levy, Surge’s

president and Steven Lubman, Surge’s vice president. Our lease is through September 30, 2030 and our monthly rent for the

year ended November 30, 2024 was $17,187 We occupy approximately 23,250 square feet of office space and warehouse space. The rental

rate is typical for the type and location of Surge’s and Challenge’s facilities.

The

Company has a lease to rent office space and a warehouse in Hong Kong Through June 2025. Annual minimum rental payments for this space

are approximately $73,580.

The

Company has a lease to rent additional warehouse space in Hong Kong through November 30, 2025. Annual minimum rental payments for this

space are approximately $76,170.

Item

3. Legal Proceedings.

None.

Item

4. Mine Safety Disclosures.

Not

applicable.

PART

II

Item

5. Market For Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

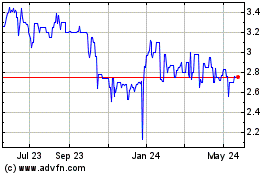

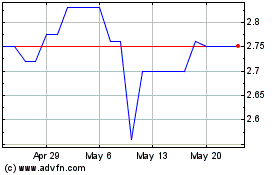

Shares

of our common stock are quoted on the OTC Pink Market maintained by OTC Markets Group under the symbol “SPRS”. Trading in

our common stock is limited. Quotations represent inter-dealer prices without retail mark-up, mark-down, or commission and may not necessarily

represent actual transactions.

As

of the date of the filing of this report, there are 5,582,783 shares of common stock issued and outstanding.

As

of the date of the filing of this report, there are approximately 176 holders of record of our common stock.

Purchases

of Equity Securities by the Issuer and Affiliated Purchasers

None.

Equity

Compensation Plan Information

The

following table provides information as of November 30, 2024 with respect to the shares of common stock that may be issued under our

existing equity compensation plans:

| Plan Category | |

Number of

securities to be

issued upon

exercise of

outstanding

options,

warrants

and rights

(a) | | |

Weighted-

average

exercise

price of

outstanding

options,

warrants

and

rights

(b) | | |

Number of

securities

remaining

available for

future

issuance under

equity

compensation

plans

(excluding

securities

reflected in

column a

(c) | |

| Equity compensation plan approved by security holders (1) | |

| 345,000 | | |

$ | 2.59 | | |

| 1,855,177 | |

| | |

| | | |

| | | |

| | |

| Equity compensation plan not yet approved by security holders | |

| - | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | |

| Total | |

| 345,000 | | |

$ | 2.59 | | |

| 1,855,177 | |

| (1) |

Represents

the Company’s 2015 Incentive Stock Plan and the 2024 Equity Incentive Stock Plan. |

Recent

Sales of Unregistered Securities.

None.

Dividend

Policy

We

have never declared or paid cash dividends on our common stock. We currently do not anticipate paying any cash dividends in the foreseeable

future for our common stock. Any future determination to declare cash dividends will be made at the discretion of our board of directors,

subject to applicable laws, and will depend on our financial condition, results of operations, capital requirements, general business

conditions and other factors that our board of directors may deem relevant.

Item

6. [Reserved]

We

are a smaller reporting company and therefore, we are not required to provide information required by this Item of Form 10-K.

Item 7.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

This

report contains forward-looking statements. All statements other than statements of historical facts contained herein, including statements

regarding our future results of operations and financial position, business strategy and plans and objectives of management for future

operations, are forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may

cause our actual results, performance or achievements to be materially different from any future results, performance or achievements

expressed or implied by the forward-looking statements.

In

some cases, forward-looking statements can be identified by terms such as “may,” “will,” “should,”

“expects,” “plans,” “anticipates,” “could,” “intends,” “target,”

“projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential”

or “continue” or the negative of these terms or other similar words. These statements are only predictions. We have based

these forward-looking statements largely on our current expectations and projections about future events and financial trends that we

believe may affect our business, financial condition and results of operations. We discuss many of the risks in greater detail under

the heading “Risk Factors.” Also, these forward-looking statements represent our estimates and assumptions only as of the

date of the filing of this report. Except as required by law, we assume no obligation to update any forward-looking statements after

the date of the filing of this report.

Overview

The

Company operates with two sales groups, Surge Components (“Surge”) and Challenge Electronics (“Challenge”). Surge

is a supplier of electronic products and components. These products include capacitors, which are electrical energy storage devices,

and discrete semiconductor components, such as rectifiers, transistors and diodes, which are single function low power semiconductor

products that are packaged alone as compared to integrated circuits such as microprocessors. The products sold by Surge are typically

utilized in the electronic circuitry of diverse products, including, but not limited to, automobiles, audio products, temperature control

products, lighting products, energy related products, computer related products, various types of consumer products, garage door openers,

household appliances, power supplies and security equipment. These products are sold to both original equipment manufacturers, commonly

referred to as OEMs, who incorporate them into their products, and to distributors of the lines of products we sell, who resell these

products within their customer base. These products are manufactured predominantly in Asia by approximately sixteen independent manufacturers.

We act as the master distribution agent utilizing independent sales representative organizations in North America to sell and market

the products for one such manufacturer pursuant to a written agreement. When we act as a sales agent, our supplier who sold the product

to the customer that we introduced to our supplier pays us a commission. The amount of the commission is determined on a sale by sale

basis depending on the profit margin of the product. Commission revenue totaled $95,584 and $106,885 for the fiscal year ended November

30, 2024 and November 30, 2023 respectively.

Challenge

is engaged in the sale of electronic components. In 1999, Challenge began as a division to sell audible components. We have

been able to increase the types of products that we sell because some of our suppliers introduced new products, and we also located

other products from new suppliers. Our core products include buzzers, speakers, microphones, resonators, alarms, chimes, filters,

and discriminators. We now also work with our suppliers to have our suppliers customize many of the products we sell for many

customers through the customers’ own designs and those that we work with our suppliers to have our suppliers redesign for them

at our suppliers’ factories. We have engineers on our staff who work with our suppliers on such redesigns and assists

with the introduction of new product lines. We are continually looking to expand the line of products that we sell. We sell these

products through independent representatives that earn a commission on the products we sell. We are also working with local,

regional, and national distributors to sell these products to local accounts in every state. Challenge also at times handles the

brokering of certain products, helping their customers find parts that that regular suppliers can’t deliver.

The

Company has a Hong Kong office to effectively handle the transfer business from United States customers purchasing and manufacturing

in Asia after designing the products in the United States. This office has strengthened the Company’s global position, improving

our capabilities and service to our customer base.

The

world of business continues to change because of “disruptors,” which are significant changes in traditional business practices

that did not previously exist. For example, customers continue to centralize purchasing from regional purchasing and are stretching their

payment terms. These changes also include customers moving their manufacturing operations from North America to Asia, and the trend of

globalization. Some of our customers have been involved in mergers and acquisitions, causing consolidation. This trend makes business

more complicated and costly for the Company. The Company must have a presence in Asia to service and further develop the business. For

these reasons, we established Surge Ltd., our Hong Kong subsidiary. Currency fluctuations may also have an effect on doing business outside

of North America. Customers have moved to reduce their supply chain, which could adversely affect the Company. In some market segments,