Tonogold Resources, Inc. (OTC:TNGL) wishes to provide the market

with an update with regard to the agreement that was reached with

Mil-ler Resources and Energy SA ("

Mil-ler"), a

private Mexican company and owner of the Nevmex Iron Ore project in

Mexico, details of which were announced late last year. The

principal terms of the agreement provided Tonogold with the

exclusive right to subscribe for 51,515 new shares in Mil-ler

(increasing Mil-ler's issued capital to 151,515 shares)

representing a 34% equity interest in Mil-ler by investing $10

million in two tranches of $5 million each.

Subsequently, Tonogold announced a proposed Private Placement

Offering of 120 million new shares in Tonogold at 5-cents per share

to raise $6 million (before costs), in order to fund the initial

investment in Mil-ler.

Tonogold believes that having the ability to take a controlling

interest (+50%) in Mil-ler will substantially enhance the investor

appeal of Tonogold.

New Agreements

Tonogold, Mil-ler and Mil-ler's current shareholders initiated

discussions in this regard, and as a result Tonogold is pleased to

advise the following:

1. Mil-ler has formally agreed to extend the term of the

original option such that:

a. Tonogold's ability to elect to invest the initial $5 million

(to secure a 17% interest in Mil-ler) has been extended to March

28th 2014 (requiring the payment of $50,000 before February 28th

2014).

b. Tonogold's right to invest a further $5 million to bring it's

interest in Mil-ler to 34% will expire 6 months from the date that

the initial option is exercised (the "Second

Option").

2. The current shareholders in Mil-ler have today executed an

agreement with Tonogold that provides Tonogold with an exclusive

right (not obligation) to acquire from them, 25,758 existing

Mil-ler shares ("Existing

Shares"), representing 17% of Mil-ler's enlarged

issued capital, which if acquired, would result in Tonogold owning

77,273 Mil-ler shares (i.e. 51% equity interest). The principal

terms of this agreement provide for the following:

a. Tonogold's right to acquire the Existing Shares shall expire

on the same day that the Second Option expires as described in

paragraph 1b above (just over 7 months from now).

b. In the event that Tonogold elects to acquire the

Existing Shares, the consideration payable shall be $6.0 million

cash plus 59 million Tonogold shares. The number of Tonogold shares

to be issued is subject to an adjustment formula in the event that

Tonogold's share price is above 10-cents per share at the time of

the election. Further details are provided in Schedule 1 below.

Investment opportunity

Three strong and significant magnetic anomalies (shown as the

darker areas in the diagram) have recently been identified on

tenements held by Mil-ler. At least one of these anomalies is

coincidental with major iron ore outcropping. Each anomaly is over

5 kms (3.1 miles) long and up to 2 km (1.2 miles) - each having the

potential to transform this project into a world-class iron ore

producer.

A diagram accompanying this release is available at

http://media.globenewswire.com/cache/11159/file/24752.pdf

The initial $5 million investment contemplated by Tonogold will

be used to fund a 4 month, major drill program to test one of these

anomalies.

The diagram shows the three strong and significant magnetic

signature over tenements held by Mil-Ler (covering some 350 square

kilometers - 135 square miles) as well as the more subtle anomalies

over the two open pits that represent the current mining activities

(Ponderosa and Fito). Note the darker shading highlights high

magnetic signatures.

Ponderosa and Fito, were drilled in 2011 on a 25 by 25 meter

pattern over an area of approximately 130,000 square meters, and is

the basis of a mine plan that will provide 550,000 tonnes of ore

per year, which after beneficiation will yield ~360,000 tonnes pa

of final Iron Ore product which is shipped and sold to China.

A ground geophysical program will be undertaken followed by a

drill program to test one of the three major anomalies immediately

following Tonogold's initial $5 million investment in Mil-ler.

Drilling will be mainly core (diamond), employing 3-4 rigs for

approximately 43,000 meters (~450 holes) down to a depth of around

100 meters on an initial grid pattern of 100 meters by 100 meters

covering an area 5.0 kilometers by 0.9 kilometers. The area covered

by this forthcoming drill program, (4,500,000 square meters), is

some 33 times larger than that which hosts the deposits currently

being mined, providing an order-of-magnitude of the potential for a

quantum increase in iron ore production in the future.

Comments

Tonogold's CEO Mr. Ashley said, "Tonogold's decision to increase

its investment in Mil-Ler from 17% to 51% will be made with the

benefit of the results from the major drill program which is

expected to confirm the magnitude of one of the three major

magnetic anomalies and the ability to transform this project, and

in turn, Tonogold, into a substantial profitable iron ore

producer." He added that he remains totally committed and

extremely excited with the potential that this opportunity

provides, and offered his appreciation for the commitment and

flexibility of the management and shareholders of Mil-Ler in aiding

Tonogold's participation.

Mr. Travis Miller, the CEO and 50% shareholder in Mil-Ler

stated, "I am confident that the strength, experience and

commitment of Tonogold's management team will provide the necessary

complimentary skills and disciplines required to optimize and

unlock the significant value that we have already identified this

project undoubtedly holds and to ensure a smooth transition to

becoming a major iron ore producer."

Tonogold expects that the re-structured arrangement will enable

the successful completion of the capital raising expeditiously.

Further information on Mil-ler

- Production from the Ponderosa and Fito open pits commenced

early 2013 and ramped up to a rate of 180,000 tonnes pa of final

iron ore product grading around 57% Iron (Fe) by mid 2013.

- Mil-ler owns its own mining fleet and process facility, which

was originally funded from shareholder equity and more recently

from funds generated from operation. Toward the end of 2013,

Mil-ler acquired additional mining equipment that will enable

production to double to 360,000 tpa of final iron ore product in

early 2014.

- Mining fleet owned by Mil-ler includes: -- 5 x Caterpillar

Excavators -- 2 x Caterpillar front-end loaders -- 5 x 40 tonne

trucks (2 Caterpillar and 2 Volvo) -- 2 x Caterpillar Bulldozers --

Grader, water truck, light towers

- Mil-ler's un-audited balance sheet at December 31st 2013

highlights: -- Current assets of $0.6 million -- Net book value of

Mining fleet and Process facilities - $3.4 million -- Net book

value (other assets) - $0.3 million -- Current Liabilities - $0.2

million -- Long Term Assets and Long term liabilities – Zero --

Equity - $4.1 million -- Note. Exploration and capital development

costs are written off in the year that they are incurred.

- Mil-ler is debt free

- Additional mining fleet was delivered at the end of 2013 and

early 2014. Mining activities have been focused on advanced

pre-strip in preparation for both open pits to be able to sustain a

mining rate supporting the planned 360,000 tonnes per annum of

final iron ore product.

- In-situ iron grade of ~45% is upgraded to ~57% in the final

product via a simple beneficiation process that involves 2-stage

crushing followed by dry magnetic separation. Recovery of iron is

estimated at 84% with 65% of tonnage recovered.

- Mil-ler made three shipments to China during 2013, totaling

80,000 WMT of Iron Ore at an average grade of 57% Fe, and received

about $100 per tonne (gross). Costs of around $61/t include mining,

processing, road transport to the Port of Guaymas, port fees and

cost of shipping to China.

Schedule 1

Consideration for the Existing Shares

1. If the 30-day volume weighted average share price

for Tonogold shares ("30-day VWAP") at the time of

Tonogold's election to acquire the Existing Shares is 10-cents or

less, the number of Tonogold shares to be issued to satisfy the

share component of the consideration will be 59 million.

2. If the 30-day VWAP of Tonogold's shares is above

10-cents per share at the time of Tonogold's election to acquire

the Existing Shares, the number of Tonogold shares to be issued to

satisfy the share component of the consideration will be the

adjusted share component valuation (as described in 3 below)

divided by the 30-day VWAP of Tonogold's shares.

3. The value of the share component of the

consideration payable in respect of the Existing Shares will

increase by $0.77 million (from a base of $5.9 million) for each

1-cent increase above 10-cents per share calculated by using the

30-day volume weighted average share price for Tonogold at the time

of Tonogold's election to acquire the Existing Shares. This formula

is designed to provide the current owners of the Existing Shares a

share of the implied increase value of Mil-ler as reflected in

Tonogold's share price.

The table below provides an illustration of the consideration

payable (Cash and Tonogold shares) over various 30-day VWAP of

Tonogold's shares in the event that Tonogold elects to exercise the

Share Option.

| |

| 30-day |

Consideration of

the Existing Shares |

No. of |

| VWAP |

Total |

Cash |

Shares |

TNGL |

| TNGL ($/sh) |

$M's |

$M's |

$M's |

shares |

| $0.05 |

$8.95 |

$6.00 |

$2.95 |

59,000,000 |

| $0.06 |

$9.54 |

$6.00 |

$3.54 |

59,000,000 |

| $0.07 |

$10.13 |

$6.00 |

$4.13 |

59,000,000 |

| $0.08 |

$10.72 |

$6.00 |

$4.72 |

59,000,000 |

| $0.09 |

$11.31 |

$6.00 |

$5.31 |

59,000,000 |

| $0.10 |

$11.90 |

$6.00 |

$5.90 |

59,000,000 |

| $0.11 |

$12.67 |

$6.00 |

$6.67 |

60,636,364 |

| $0.12 |

$13.44 |

$6.00 |

$7.44 |

62,000,000 |

| $0.13 |

$14.21 |

$6.00 |

$8.21 |

63,153,846 |

| $0.14 |

$14.98 |

$6.00 |

$8.98 |

64,142,857 |

| $0.15 |

$15.75 |

$6.00 |

$9.75 |

65,000,000 |

Tonogold Resources, Inc. is a minerals exploration company based

in La Jolla, California. For more information on the company visit

their website www.tonogold.com.

Safe Harbor Statement

This press release contains certain forward-looking information

about Tonogold Resources, Inc. ("Tonogold") which is intended to be

covered by the safe harbor for "forward-looking statements"

provided by the Private Securities Litigation Reform Act of

1995. Forward-looking statements are statements that are not

historical facts. Words such as "expect(s)," "feel(s),"

"believe(s)," "will," "may," "anticipate(s)," and similar

expressions are intended to identify forward-looking

statements. These statements include, but are not limited to,

financial projections and estimates and their underlying

assumptions; statements regarding plans, objectives and

expectations with respect to future operations, products and

services; and statements regarding future performance. Such

statements are subject to certain risks and uncertainties, many of

which are difficult to predict and generally beyond the control of

Tonogold Resources, Inc. that could cause actual results to differ

materially from those expressed in, or implied or projected by, the

forward-looking information and statements. These risks and

uncertainties include: our lack of operating revenue and

earnings history, our need for additional capital to pursue our

business strategy, some of our managers lack formal training in the

mining business, the grade and quantity of minerals in our projects

may not be economic, we do not have fee title to our properties,

but derive our rights through leases and the Mining Law, changes to

the Mining Law may increase the cost of doing business, we are a

non-reporting company and as such do not make periodic filings with

the Securities and Exchange Commission, we trade on the Pink Sheets

and there can be no assurances that a liquid market will develop in

our securities, mining is subject to extensive environmental

regulations and can create substantial environmental liabilities,

gold, silver and other metals are commodities which have

substantial price fluctuations, a drop in prices could adversely

affect future profitability and capital raising efforts, and mining

can be dangerous and present operational hazards for employees and

contractors. Readers are cautioned not to place undue reliance

on these forward-looking statements. Tonogold does not

undertake any obligation to republish revised forward-looking

statements to reflect events or circumstances after the date hereof

or to reflect the occurrence of unanticipated events.

CONTACT: For further information please contact:

Mark Ashley, mjashley3@gmail.com

Phone: (858) 456-1273

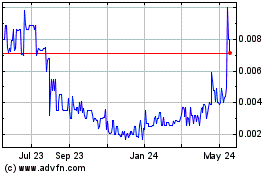

Tonogold Resources (PK) (USOTC:TNGL)

Historical Stock Chart

From Dec 2024 to Jan 2025

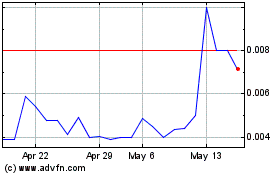

Tonogold Resources (PK) (USOTC:TNGL)

Historical Stock Chart

From Jan 2024 to Jan 2025