Yen Surges as Brexit Vote Sparks Search for Safety

June 24 2016 - 12:30AM

Dow Jones News

The Japanese yen surged Friday and other Asian currencies were

battered as voters in the U.K. upset market expectations and backed

their nation leaving the European Union.

The yen, considered a haven currency, strengthened to as high as

¥ 99.00 against the U.S. dollar—its strongest level since November

2013, and a 7.2% appreciation from its Thursday closing level.

While the British pound was the main focus of currency-market

action, having fallen to its weakest level versus the U.S. dollar

since September 1985, the yen's surge is the latest headache for

policy makers trying to nurse the Japanese economy back to

health.

Some traders said the rocketing yen could potentially trigger

the Ministry of Finance to direct the Bank of Japan to intervene in

the market. The yen later pulled back and was recently at 101.90

against the dollar.

Takashi Hiratsuka, a trading group leader at the

asset-management division of Resona Bank, said the ministry might

not engage in direct yen selling as some in the market expect.

He said the Japanese Finance Ministry is unlikely to intervene

without consent from U.S. authorities, who have so far officially

said the yen has been stable.

"I believe the authorities will come up with a scenario to guide

the yen weaker indirectly by using steps, including more easing,"

Mr. Hiratsuka said.

The pullback in the yen after its dramatic strengthening was

likely due to market participants betting that the Bank of Japan

could step in to soothe the currency's excessive volatility,

analysts said.

The yen shot past the 100.00 psychological barrier as preset

trading orders were triggered, rallied to 99.00 versus the U.S.

dollar, then rebounded to 101.50.

The prospect of global financial-market upheaval over Britain

leaving the EU has upset currency markets around the globe.

Most of the moves may have been due to a reversal of earlier

consensus bets that the U.K. would vote to stay.

China's yuan slid as much as 0.6% against the U.S. dollar Friday

to notch a five-year low of 6.6148. The depreciation was of a

greater extent than the central bank's daily yuan benchmark, which

had implied a 0.2% weakening of the local currency.

The onshore-traded yuan has now stabilized with the People's

Bank of China intervening in the market, a Shanghai-based senior

trader at a domestic bank said, though the volume of its

yuan-buying hasn't been very large. The yuan has crossed the 6.6000

psychological barrier twice this month, due to wild swings in major

currencies.

Among other currencies in Asia, the Singapore dollar and the

South Korean won were most affected by the unfolding U.K. vote

results.

The Singapore dollar and the won slumped as much as 2.4% against

the U.S. unit, versus their Thursday closing levels.

Malaysia's ringgit fell 1.7%, Indonesia's rupiah lost 1.0%,

while the Philippine peso weakened 0.9% versus the greenback.

The Singapore dollar is highly vulnerable to external economic

risks, more so than its neighbors, due to the city-state's reliance

on global trade.

Victor Yong, interest-rates strategist for United Overseas Bank

in Singapore, said that if a Brexit were to occur, the Bank of

England might cut its base interest rate from the current record

low of 0.50% potentially to zero, and this could happen within

days, or at most weeks.

Given the urgency of the situation, the BOE will likely act

quickly, though its first priority would be to ensure that

interbank funding liquidity doesn't dry up.

Banks might refuse to lend to each other for fear of a

deterioration of creditworthiness in the wake of a Brexit. The BOE

has already laid out arrangements with other global central banks

to flush the market with liquidity to prevent a freezing of the

financial system, said Mr. Yong.

An interest-rate cut likely wouldn't happen on the same day, he

said, but the central bank's bias would certainly shift toward

easing policy. Mr. Yong said a zero interest-rate policy might

prove too radical given the recent debate about its effectiveness,

but a quarter percentage-point cut combined with an asset-purchase

program might be announced, to buffer the Brexit's negative shock

to the U.K. economy.

Kosaku Narioka and Shen Hong contributed to this article.

Write to Ewen Chew at ewen.chew@wsj.com

(END) Dow Jones Newswires

June 24, 2016 01:15 ET (05:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

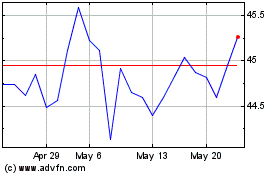

United Overseas Bk (PK) (USOTC:UOVEY)

Historical Stock Chart

From Jan 2025 to Feb 2025

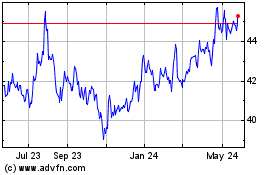

United Overseas Bk (PK) (USOTC:UOVEY)

Historical Stock Chart

From Feb 2024 to Feb 2025