UPDATE: EU Opens In-Depth Investigation Into Universal Buy Of EMI

March 23 2012 - 2:10PM

Dow Jones News

The European Commission's antitrust arm will look in detail at

the proposed acquisition by Vivendi SA's (VIVEF, VIV.FR) Universal

Music Group of EMI's recorded music business, under the second

phase of its merger review process, it said Friday.

"The commission's initial market investigation indicated that

the proposed transaction may raise competition concerns in the

wholesale of physical and digital recorded music in numerous member

states as well as in the European Economic Area as a whole,

particularly in light of the merged entity's high market shares and

increased market power," the commission said.

Universal, in a statement issued soon after the investigation

announcement, said that "Phase II was always expected; we recognise

that the Commission needs time to fully review this transaction"

and pledged to "continue to co-operate fully with them and look

forward to a successful resolution of the process."

The commission's competition arm now has 90 working days, until

Aug. 8, to look into the planned $1.9 billion transaction, which

would create a new entity with control of roughly 40% of the global

recorded music market, according to some estimates. EMI is home to

stars including Blur, Iron Maiden, The Beatles and Katy Perry.

The commission's vice president in charge of competition policy,

Joaquin Almunia, said: "The proposed acquisition could reduce

competition in the recorded music market to the detriment of

European consumers. The commission needs to make sure that

consumers continue to have access to a wide variety of music in

different physical and digital formats at competitive

conditions."

It can decide to allow the deal to go ahead, ask for Vivendi to

make concessions such as disposals, or block it completely, as it

did recently with Deutsche Boerse (DBOEF, DB1.XE) and NYSE

Euronext's (NYX) proposed merger.

The initial investigation has already led those opposed to voice

their concerns and lobby the commission.

Edgar Bronfman Jr., on his final day as chairman of Warner Music

Group in January, said the deal is "problematic" and that "Warner

is going to fight this tooth and nail." IMPALA, which represents

independent music labels, has said it wants an "outright no" to the

proposed tie-up, which would push up music prices.

Citigroup Inc. (C) agreed to split up and sell the legendary

U.K. music company in November, having previously seized the

company from former owner Terra Firma Capital. In a separate deal,

it will sell the music publishing business to a consortium led by

rival Sony/ATV for $2.2 billion.

-By Frances Robinson and Matina Stevis, Dow Jones Newswires;

+32499646573; frances.robinson@dowjones.com

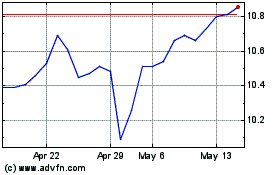

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Jul 2023 to Jul 2024