false

0001308027

0001308027

2024-07-22

2024-07-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): July 22,

2024

VYSTAR

CORPORATION

(Exact

Name of Registrant as Specified in Charter)

| Georgia |

|

000-53754

|

|

20-2027731 |

(State

or Other Jurisdiction

of

Incorporation |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

101

Aylesbury Rd.

Worcester,

MA |

|

01609

|

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (508) 791-9114

n/a

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Type

of each Class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common |

|

VYST |

|

None |

Indicate

by checkmark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) of Rule 12B-2 of the Securities Exchange act of 1934 (§240.12b-2 of this chapter).

Emerging

Growth Company ☐

If

an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

(c),

(e) The Company has previously announced that Ms. Jamie Rotman was appointed as President of the Company effective December 21, 2023

until any successor is appointed or upon her resignation, termination or retirement. At that time, Ms. Rotman was not a party to any

material plan, contract or arrangement.

On

July 22, 2024, the Company entered into an Employment Agreement (the “Employment Agreement”) with Ms. Rotman, under which

Ms. Rotman receives annual compensation equal to $180,000 payable in Series C Preferred Stock or common stock, either at Ms. Rotman’s

discretion, discounted 50% over the then market price (and payable in cash at Ms. Rotman’s discretion), plus a signing bonus of

$25,000 payable in shares of Series C Preferred Stock, vesting over 2024.

The

Employment Agreement was made retroactive to January 1, 2024. The Employment Agreement also provides for a 24-month severance payment

upon a termination without cause (as defined) and a 24 month change in control severance.

A

copy of the Employment Agreement is attached as Exhibit 10.1.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

VYSTAR

CORPORATION |

| |

|

|

| Date:

July 24, 2024 |

By: |

/s/

Jamie Rotman |

| |

Name: |

Jamie

Rotman |

| |

Title: |

President/Chief

Executive Officer |

Exhibit

Index

Exhibit 10.1

EMPLOYMENT

AGREEMENT

This

EMPLOYMENT AGREEMENT is made and entered into as of the __1st __ day of January 2024, by and between Vystar Corporation (“Vystar”),

with its principal place of business located in Atlanta, Georgia, and Jamie Rotman (“Employee”), who resides in Shrewsbury,

Massachusetts. Vystar and Employee are collectively referred to herein as the “Parties.”

WHEREAS,

Vystar desires to retain the services of Employee as President and Chief Executive Officer of Vystar and any of its subsidiaries (collectively

referred to herein as “the Company” or “the Companies”), and Employee desires to be employed by Vystar in such

capacity, all upon the terms and subject to the conditions set forth in the Agreement.

NOW,

THEREFORE, in consideration of the recitals and the mutual covenants and undertakings herein, each party agrees as follows:

1. Employment

and Duties. Vystar hereby employs Employee, and Employee hereby accepts employment, as President and Chief Executive Officer of

the Companies, upon the terms and conditions hereinafter set forth, both Parties expressly revoking any and all prior employment

agreements between them. In her capacity as President and Chief Executive Officer, Employee, to the best of her abilities, shall be

responsible for performing the duties commensurate with her position. Employee shall report to Vystar’s Board of Directors

(the “Board”), and Employee agrees to perform such duties as the Board may assign to her. Employee shall have no

employment obligations or duties with respect to Murida Furniture Co., Inc. dba Rotmans Furniture.

Employee

agrees that her employment is an employee-at-will, and, as such, her employment and compensation can be terminated, with or without cause,

and with or without notice, at any time, at the option of either Employee or Vystar.

If

Employee dies or becomes totally disabled during the term of the Agreement, Employee’s employment and salary shall terminate at

the end of the month during which death or total disability occurs, and no other compensation or benefits shall be paid to Employee.

For the purposes of the Agreement, Employee shall be deemed to be “totally disabled” if she has been unable to perform her

duties by reason of medical condition for 120 days in any 365-day period, all as determined in good faith by Vystar’s Board.

2. Non-Exclusive

Services. Employee agrees that she will, during the employment term, devote her working time, attention and best efforts to the

performance of the duties as aforesaid and to the business and interests of the Companies, and she shall perform such duties as may

be assigned to her ably, faithfully and diligently. Employee hereby represents and warrants that she is not now subject to any

agreement which is or would be inconsistent or in conflict with her obligations hereunder.

3. Compensation.

(a) Base

Salary. As compensation for the services to be rendered by Employee under the Agreement, Vystar agrees to pay, and Employee

agrees to accept a base salary at the annualized rate of $180,000, plus the signing bonus as total compensation. Employee’s

salary shall be payable in accordance with the Company’s regular payroll practices, subject to withholding and other

applicable taxes.

(b) Bonus. Employee shall be eligible to receive compensation under the Company’s

Executive Incentive Plan. The specific goals criteria and target for earning such compensation will be mutually agreed upon by the Parties

within the context of the Employee Incentive Plan and in good faith by the Parties.

All

of Employee’s compensation is subject to deductions for regular payroll taxes and withholding, as required by State and Federal

law, as well as other deductions that Employee authorizes.

(c) Stock Incentives. Employee shall receive the stock incentives set forth on the attached

Exhibit A.

(d) Fringe

Benefits. Employee also shall be entitled to the following benefits in each year of the Agreement:

(i)

Employee shall be eligible to participate in the Company’s various benefit plans (including health, dental, life, disability and

retirement) on the same basis as the Company’s other employees; and

(ii)

Employee shall be eligible to receive the Company’s various paid time off benefits (including paid vacations and holidays) on the

same basis as the Company’s other employees.

4. Confidentiality.

Employee is aware that the Companies develop and utilize, and that she has had and will continue to have, access to valuable

technical and nontechnical trade secrets and confidential information including, but not limited to, knowledge, information and

materials about the Companies’ trade secrets, mailing lists, methods of operation, advertiser lists, advertisers, customer

lists, customers or clients, products, services, know-how, business plans and confidential information about financial, marketing,

pricing, compensation and other proprietary matters relating to the Companies which are not in the public domain

(“Confidential Information”), all of which constitutes a valuable part of the assets of the Companies which the

Companies seek to protect.

Accordingly,

Employee shall not at any time during or after the termination of her employment by the Companies for any reason, reveal, disclose or

make known to any person (other than as may be required by law or in the performance of her duties), or use for her own or another’s

account or benefit, any such Confidential Information, whether or not developed, devised or otherwise created in whole or in part by

the efforts of Employee.

Employee

represents and warrants that she has not revealed, disclosed or made known to any person (other than as may be required by law or in

the performance of her duties), or used for her own or another’s account or benefit, any such Confidential Information, whether

or not developed, devised or otherwise created in whole or in part by the efforts of Employee.

Upon

cessation of Employee’s employment, no documents, records or other matter or information belonging to the Companies, whether prepared

by Employee or otherwise, and relating in any way to the business of the Companies, shall be taken or kept by Employee without the written

consent of the Companies.

5. Innovations.

(a)

Employee hereby assigns, transfers and conveys to Vystar and its successors and assigns the entire right, title, and interest in any

and all inventions, processes, procedures, systems, discoveries, designs, configurations, technology, works of authorship, trade secrets

and improvements (whether or not they are made, conceived or reduced to practice during working hours or using any of the Companies’

data or facilities) (collectively, “Innovations”) which Employee makes, authors, conceives, reduces to practice or otherwise

acquires during any period of her employment by Vystar (either solely or jointly with others), and which are related to the Companies’

present or planned business, the Companies’ services or products, and any and all patents, copyrights, trademarks, trade names

and applications therefor, in the United States and elsewhere, relating thereto. The Innovations shall be the sole property of Vystar

and shall at all times be held by Employee in a fiduciary capacity for the sole benefit of Vystar.

(b)

All such Innovations that consist of works of authorship capable of protection under copyright laws shall be prepared by Employee as

works made for hire, with the understanding that Vystar shall own all of the exclusive rights to such works of authorship under the United

States copyright law and all international copyright conventions and foreign laws. The foregoing notwithstanding, to the extent that

any such Innovations is not deemed a work made for hire, Employee hereby assigns to Vystar the entire right, title, and interest in such

Innovations and any and all patents, copyrights, trademarks, trade names and applications therefor, in the United States and elsewhere,

relating thereto.

(c)

Employee shall maintain adequate and current written records of all such Innovations, which shall be available to and remain the sole

property of Vystar at all times. Employee shall promptly disclose to Vystar the details of any and all such Innovations and shall provide

Vystar with all information relative thereto. Employee, without further compensation, shall fully cooperate with and assist Vystar in

obtaining and enforcing for its own benefit patents and copyright registrations on and in respect of such Innovations in all countries

in all ways that Vystar may request, to secure and enjoy the full benefits and advantages of such Innovations, including executing any

and all documents that Vystar deems necessary to obtain, maintain, and/or enforce its rights in such Innovations and providing any testimony

required to obtain, maintain, and/or enforce such Innovations. Employee agrees, for herself, and her heirs, legal representatives and

assigns, without further compensation, to execute further assignments and other lawful documents as Vystar may reasonably request to

effectuate fully the assignment. Employee understands that her obligations under the section shall continue after the termination of

her employment by Vystar.

6. Injunctive

Relief. Employee acknowledges that the restrictions contained in Sections 4 and 5 above, in view of the nature of the business

in which the Companies are engaged, are reasonable and necessary to protect the legitimate interests of the Companies. Employee

understands that the remedies at law for her violation of any of the covenants or provisions of Sections 4 and 5 may be inadequate,

that such violations may cause irreparable injury within a short period of time, and that the Companies shall be entitled to seek

preliminary injunctive relief and other injunctive relief against such violation. Such injunctive relief shall be in addition to,

and in no way in limitation of, any and all other remedies the Companies shall have in law and equity for the enforcement of those

covenants and provisions.

7. Severance

Benefits.

(a) Termination

Without Cause Severance Benefits. As set forth in Section 1 above, Employee’s employment by Vystar is on an at-will basis.

However, in the event of that Employee’s employment is involuntarily terminated without Cause (as defined below) and for

reasons unrelated to Employee’s death or disability, or a Change of Control (as defined below), (i) the Company will pay

Employee severance in an amount which is equivalent to her weekly salary (at the rate then in effect) for fifty-two (52) weeks, and

(ii) if Employee is a participant in Vystar’s group health plan and she elects continuation of

coverage either under COBRA or an Exchange under the Affordable Care Act, Vystar will reimburse her in an amount equal to the

Company’s share of her prior health and dental insurance premium payment covering her 52-week severance

period.

For

the purposes of the Section 8(a), “Cause” means (i) willful and deliberate misconduct by Employee, such as being under the

influence of drugs or alcohol on the job, dishonesty, misappropriation of assets, insubordination or refusal to follow reasonable directives

and other misconduct of comparable magnitude and kind; (ii) willful neglect of duty or other material breach of the Agreement by Employee;

(iii) commission of any act of fraud involving Vystar, involvement in any material conflict of interest or self-dealing involving Vystar,

or conviction of a felony or any offenses involving moral turpitude or any criminal offense involving Vystar; (iv) any act or omission

by Employee which has a material adverse effect on the business activities, financial condition, affairs or reputation of Vystar; (v)

violation of any of Vystar’s policies or (vi) Employee’s failure or refusal to perform a substantial or important portion

of her duties under the Agreement (for a reason other than illness or incapacity), which failure or refusal continues for thirty (30)

days after Vystar’s written notice to Employee, which notice reasonably informs her of such failure or refusal, and he fails to

cure such failure within such 30-day period (the determination as to whether the Employee has cured such failure will be determined by

Vystar’s Board in its sole discretion).

(b)

Change-in-Control Severance Benefits. In the event that Employee’s employment

involuntarily terminates as a result of Vystar’s “change in control” (as defined below), Employee will be paid severance

in an amount which is equivalent to her regular bi-weekly salary (at the rate then in effect) for a period of twenty-four (24) months;

provided, however, that Employee will not be entitled to such severance payments or the continuation of such severance payments, as the

case may be, if Employee violates any of her obligations under Sections 4 and 5 above. For the purposes of the provision, a “change

of control” is defined as (i) a merger or consolidation of Vystar in which the stockholders of Vystar immediately prior to such

transaction would own, in the aggregate, less than 50% of the total combined voting power of all classes of capital stock of the surviving

entity normally entitled to vote for the election of directors of the surviving entity, and is a change of ownership under Treasury Regulations

Section 1.409A-3(i)(5)(v) or a change in effective control of Vystar under Treasury Regulation Section 1.409A-3(i)(5)(vi) or (ii) the

sale of a substantial portion of Vystar’s assets, as defined under Treasury Regulation Section 1.409A-3(i)(5)(vii), in one transaction

or in a series of related transactions.

(c) Separation Agreement. As a prerequisite to receiving any severance pay or benefits under

the Agreement, Employee shall be required to sign a separation agreement, including a release of claims against Vystar and its affiliated

entities, excluding Murida Furiniture Co., Inc., dba Rotmans Furniture and their employees, officers, and directors. Such severance payments

shall be paid according to Vystar’s regular payroll schedule and shall be subject to and reduced by regular payroll taxes and withholding,

and the first installment of the severance payments shall be paid on the Company’s first regular pay day following the expiration

of the separation agreement’s seven-day revocation period.

(d)

Section 409A. The Agreement is intended to meet the requirements of Section 409A of

the Internal Revenue Code, and shall be interpreted and construed and administered consistent with that intent. Without limiting the

foregoing, the use of the concept of “termination of employment” shall mean a “separation from service with the employer”

within the meaning of Treasury Regulation Section 1.409A-3(a)(1).

8. Mediation/Arbitration

of Disputes. In the event of a dispute between the Parties, Employee and Vystar agree to work cooperatively to resolve the

dispute amicably at appropriate, mutually determined management levels. In the event that a resolution at such management levels

does not occur, either party may submit the dispute to mediation. Both Parties shall agree on one mediator and participate in said

mediation in good faith. If the matter has not been resolved pursuant to mediation within sixty (60) days of the commencement of

such procedure, which may be extended by mutual agreement of the Parties, the dispute shall be settled by final and binding

arbitration in Worcester, Massachusetts in accordance with the rules then prevailing of the American Arbitration Association.

Judgment upon the award rendered by the arbitrators may be entered in any court of competent jurisdiction, and each party shall bear

her or its own costs, including attorneys’ fees. Notwithstanding the foregoing, any dispute relating Employee’s

obligations pursuant to Sections 4 and 5 above shall not be subject to the mediation/arbitration provisions set forth in the

Section.

9. Agreement

Binding Upon Successors. The Agreement shall be binding upon and inure to the benefit of the Parties hereto and their respective

successors, assigns, personal representatives, heirs, legatees and beneficiaries, provided, however, that Employee may not delegate

her duties and obligations hereunder to any other person, and further provided that no assignment of the Agreement by Vystar shall

relieve Vystar of any of its obligations under the terms of the Agreement.

10. Waiver

of Breach. The waiver of either party hereto of a breach of any provision of the Agreement shall not operate or be construed as

a waiver of any subsequent breach by either Vystar or Employee. The failure to enforce any provision(s) of the Agreement shall not

be construed as a waiver of such provision(s).

11. Severability.

It is the desire and intent of the Parties that the provisions of the Agreement be enforced to the fullest extent permissible under

the laws and public policies applied in each jurisdiction in which enforcement is sought. Each provision of the Agreement or part

thereof shall be severable. If for any reason any provision or part thereof of the Agreement is finally determined to be invalid and

contrary to, or in conflict with any existing or future law or regulation of a court or agency having valid jurisdiction, such

determination shall not impair the operation or affect the remaining provisions of the Agreement, and such remaining provisions will

continue to be given full force and effect and bind each party.

12. Notices.

Any notices or other communications required or permitted to be given under the Agreement shall be in writing and shall be deemed to

have been duly given if delivered personally, or sent by registered or certified mail, return receipt requested, postage prepaid, to

the address listed below for the Parties, or to such other address as any party may hereafter direct in writing to the other

party.

| |

To Vystar: |

To Employee: |

| |

Board

of Directors |

Jamie Rotman |

| |

|

jrotman@vytex.com |

13. Entire

Agreement; Amendment. The Agreement contains the entire agreement of the Parties and supersedes any and all prior agreements

between the Parties. It may not be changed orally but only by an agreement in writing signed by both Parties hereto.

14. Governing

Law. The Agreement is made in, and shall be governed by, the laws of the Commonwealth of Massachusetts without reference to its

conflict of laws provisions.

IN

WITNESS WHEREOF, the Parties hereto, individually or by their duly authorized representatives, have executed and delivered the Agreement

to be effective as of the day and year first above written.

| |

VYSTAR CORPORATION |

| |

|

|

| |

By: |

/s/

Bryan Stone |

| |

Name: |

Bryan Stone |

| |

Title: |

BOD |

| |

|

|

| |

EMPLOYEE |

| |

|

|

| |

/s/ Jamie Rotman |

| |

Jamie Rotman |

EXHIBIT

A

STOCK

INCENTIVES

| ■ | $15,000

per month, which equals, $180K annual salary in restricted shares of Vystar Series C Preferred

stock (Converts 1-1000 into common shares) or common at employees’ discretion, based

on the 20-day average share price with a 50% discount with a floor of $.01. To be clear $.01

would be the floor price used to calculate prior to the 50% discount. Salary may also be

paid in cash at employees’ direction. If employee chooses to, board or head of audit

committees’ approval is required. |

| | | |

| ■ | Signing

bonus and compensation for time worked in 2023, $25K worth of restricted shares of Vystar

Series C Preferred stock (Converts 1-1000 into common shares), at .01 per share (above market),

as of June 18th 2024, whereas, stock is trading at .0055. These options are redeemable

25% immediately 25% October 31st, 2024, 50% December 31st 2024. |

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

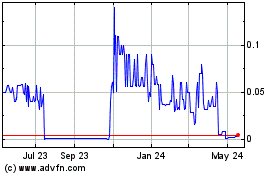

Vystar (PK) (USOTC:VYST)

Historical Stock Chart

From Jan 2025 to Feb 2025

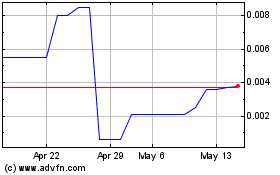

Vystar (PK) (USOTC:VYST)

Historical Stock Chart

From Feb 2024 to Feb 2025