Clariant completes divestment of 50 % stake in Scientific Design joint venture

April 14 2022 - 10:45AM

Clariant completes divestment of 50 % stake in Scientific Design

joint venture

MUTTENZ, APRIL

14,

2022

Clariant, a focused, sustainable and innovative specialty

chemicals company, today announced that it has completed the

divestment of its 50 % stake in the joint venture which owns

Scientific Design Company Inc. The transaction was announced on

2 February, 2022.

Clariant’s 50 % share in Scientific Design was valued at

USD 130 million. Together with a profit-sharing agreement

beginning on 1 January, 2021 until the closing of the

transaction, Clariant’s net cash inflow, before tax and transaction

cost amounts to USD 139.4 million.

Clariant intends to use the proceeds of the divestment to invest

into growth projects within the core Business Areas, execute the

strategy along sustainability and innovation, fund the performance

improvement programs as well as strengthen Clariant’s balance sheet

to reach and defend a solid investment grade rating.

| CORPORATE

MEDIA RELATIONS Jochen DubielPhone

+41 61 469 63

63jochen.dubiel@clariant.com Anne

MaierPhone +41 61 469 63

63anne.maier@clariant.com Ellese GolderPhone

+41 61 469 63 63Ellese.golder@clariant.com |

INVESTOR

RELATIONS Andreas Schwarzwälder

Phone +41 61 469 63

73andreas.schwarzwaelder@clariant.com Maria

IvekPhone +41 61 469 63

73maria.ivek@clariant.com Alexander

KambPhone +41 61 469 63 73alexander.kamb@clariant.com |

|

Follow us on

Twitter, Facebook, LinkedIn, Instagram. This

media release contains certain statements that are neither reported

financial results nor other historical information. This document

also includes forward-looking statements. Because these

forward-looking statements are subject to risks and uncertainties,

actual future results may differ materially from those expressed in

or implied by the statements. Many of these risks and uncertainties

relate to factors that are beyond Clariant’s ability to control or

estimate precisely, such as future market conditions, currency

fluctuations, the behavior of other market participants, the

actions of governmental regulators and other risk factors such as:

the timing and strength of new product offerings; pricing

strategies of competitors; the Company’s ability to continue to

receive adequate products from its vendors on acceptable terms, or

at all, and to continue to obtain sufficient financing to meet its

liquidity needs; and changes in the political, social and

regulatory framework in which the Company operates or in economic

or technological trends or conditions, including currency

fluctuations, inflation and consumer confidence, on a global,

regional or national basis. Readers are cautioned not to place

undue reliance on these forward-looking statements, which speak

only as of the date of this document. Clariant does not undertake

any obligation to publicly release any revisions to these

forward-looking statements to reflect events or circumstances after

the date of these

materials. www.clariant.com Clariant is a focused,

sustainable and innovative specialty chemical company based in

Muttenz near Basel/Switzerland. On 31 December 2020, the company

employed a total workforce of 13 235. In the financial year 2020,

Clariant recorded sales of CHF 3.860 billion for its continuing

businesses. The company reports in three business areas: Care

Chemicals, Catalysis and Natural Resources. Clariant’s corporate

strategy is led by the overarching purpose of ‘Greater chemistry –

between people and planet’ and reflects the importance of

connecting customer focus, innovation, sustainability, and

people. |

- Clariant Media Release_Closing ScientificDesign

Divestment_20220414 EN

- Clariant Media Release_Closing ScientificDesign Divestment

20220414 DE

Clariant (LSE:0QJS)

Historical Stock Chart

From Feb 2025 to Mar 2025

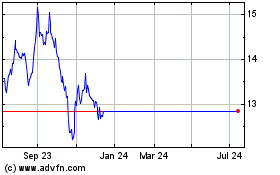

Clariant (LSE:0QJS)

Historical Stock Chart

From Mar 2024 to Mar 2025