Clariant generated double-digit sales and EBITDA growth in Q3 2022

AD HOC ANNOUNCEMENT PURSUANT TO ART. 53 LR

- Q3

2022:

Sales increased by

27 % in local currency to

CHF 1.312 billion,

supported by both pricing and volume

growth, EBITDA

margin increased to

16.8 %

versus 15.5 %

- 9M 2022:

Sales increased by 29 % in local currency to

CHF 3.875 billion,

EBITDA margin increased to

16.9 %

versus

16.2 %

- Clariant signs definitive

agreement to sell North American

Land Oil

business

- Full Year 2022

Outlook: Strong local currency

growth for the Group to around

CHF 5.1 billion,

with the confirmed aim

to improve the

year-on-year underlying

Group EBITDA margin

level. Full

year 2022

reported Group

EBITDA margin will be

impacted by restructuring charges

in Q4 2022 related to the implementation

of the new operating model

“Our performance in the third quarter was, as

anticipated, fueled by sustained pricing amidst a moderate

sequential decline in raw material costs, combined with renewed

momentum in Catalysis, most specifically within the Petrochemicals

segment. As signaled previously, we see demand declining in some

segments, most notably in Europe in response to the weakening

economic environment, yet we nevertheless increased sales and

profitability significantly in the third quarter. Further, we

announced today the divestment of our North American Land Oil

business in a further move to focus our business on true specialty

chemicals and to improve our sustainability profile.I would like to

thank all my colleagues for their hard work and for the excellent

results we achieved in a very challenging environment,” said Conrad

Keijzer, Chief Executive Officer of Clariant.

“For the full year 2022, we increase our sales

guidance to approximately CHF 5.1 billion while aiming to improve

our year-on-year underlying Group EBITDA margin versus the prior

year’s level. In the fourth quarter, we anticipate additional

restructuring charges related to the implementation of our new

operating model, which simplifies our organizational structure and

enables continued progress toward our confirmed 2025 goals,” Conrad

Keijzer commented further.

Key Financial Data (1)

| Continuing

operations |

Third Quarter |

|

Nine Months |

| in CHF

million |

2022 |

2021 |

% CHF |

% LC |

|

2022 |

2021 |

% CHF |

% LC |

| Sales |

1 312 |

1 096 |

20 |

27 |

|

3 875 |

3 130 |

24 |

29 |

| EBITDA |

220 |

170 |

29 |

|

|

656 |

506 |

30 |

|

| - margin |

16.8 % |

15.5 % |

|

|

|

16.9 % |

16.2 % |

|

|

| EBITDA before

exceptional items |

242 |

183 |

32 |

|

|

690 |

529 |

30 |

|

| - margin |

18.4 % |

16.7 % |

|

|

|

17.8 % |

16.9 % |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Q3 and Nine Months 2021 restated. The

figures were rounded, and hence, minor reporting deviations might

occur

Third Quarter 2022 –

Continued sales

growth and

profitability progression

MUTTENZ, OCTOBER 27, 2022

Clariant, a focused, sustainable, and innovative

specialty chemical company, today announced its third quarter 2022

results. In the third quarter of 2022, sales from continuing

operations were CHF 1.312 billion, compared to

CHF 1.096 billion in the third quarter of 2021. This

corresponds to an increase of 27 % in local currency and

20 % higher sales in Swiss francs. Both pricing and volume

growth positively impacted the Group sales result by 18 % and

9 %, respectively, while the currency impact was -7 %.

Sales growth was strong in all three Business Areas: Care

Chemicals, Catalysis, and Natural Resources.

In the third quarter of 2022, local currency

sales growth was robust in all geographic regions. European sales

grew by 22 %, as prices were increased while volume growth

slowed. Sales in Asia-Pacific also grew by 19 %, primarily

propelled by pricing in Care Chemicals and Additives, while

Catalysis volumes increased. North American sales were 30 %

higher, and Latin American sales grew 38 %. The strong

advances in both regions were supported by strong pricing in all

three Business Areas. The Middle East & Africa

increased sales by 62 %.

Care Chemicals increased sales by 24 % in

local currency in the third quarter of 2022. This positive

development was driven by double-digit growth in Consumer Care and

Industrial Applications, especially Crop Solutions and Personal

Care. Catalysis sales rose by 28 % in local currency,

primarily due to volume growth in Petrochemicals and Specialty

Catalysts. Natural Resources sales increased by 30 % in local

currency with growth attributable to all three Business Units,

especially Additives.

Continuing operations EBITDA grew to

CHF 220 million while the corresponding 16.8 %

margin increased from the 15.5 % reported in the third quarter

of the previous year. This improvement was propelled by pricing

measures that fully offset the continued high raw material cost

increase (approximately 24 % year-on-year) and higher energy

and logistics cost. Additionally, operating leverage from higher

sales and cost savings (CHF 2 million savings from

performance programs during the quarter) also contributed

positively to the margin increase. The absolute EBITDA increased by

29 % versus the previous year and significantly exceeded the

CHF 151 million (14.5 % margin) pre-pandemic level

reported in the third quarter of 2019.Clariant has agreed to enter

into a definitive transaction documentation to divest its North

American Land Oil business to Dorf Ketal, a specialty chemicals

manufacturer and service provider headquartered in India. This

divestment is a further step to structurally improve Clariant’s

portfolio and sustainability profile while focusing operations on

specialty chemicals and value-adding solutions. Clariant’s North

American Land Oil business is a provider of chemical technologies

and services to the North American oil and gas industry and

generated sales of USD 113 million in 2021. The initial

sales price, subject to standard closing conditions, is set at

USD 14.5 million. This transaction will result in a

noncash impairment of approximately CHF 245 million,

which will be recorded before the year-end and does not affect

EBITDA as presented for the third quarter of 2022. The transaction

is subject to customary closing conditions and is expected to be

consummated in the first quarter of 2023.

First Nine Months 2022 –

Specialty chemical portfolio,

pricing, and cost discipline

enabled sales and profitability improvements

In the first nine months of 2022, sales from

continuing operations were CHF 3.875 billion, compared to

CHF 3.130 billion in the first nine months of 2021. This

corresponds to an increase of 29 % in local currency,

26 % of which was organic. Both pricing and volume growth had

a positive impact on the Group of 18 % and 11 % (8 %

of which was organic), respectively, while the currency impact was

-5 %.

In all geographic regions, sales growth in the

first nine months of 2022 exceeded 24 % in local currency with

a particularly strong performance in North America, Latin America,

and the Middle East & Africa.

Care Chemicals grew sales by 37 % in local

currency in the first nine months of 2022 with continued

double-digit sales growth in all key businesses. In Catalysis,

sales rose by 12 % in local currency, underpinned by Specialty

Catalysts and Petrochemicals. All three Business Units,

Oil and Mining Services, Functional Minerals, and

especially Additives, contributed to the 28 % local currency

sales growth reported in Natural Resources.

Continuing operations EBITDA increased by

30 % to CHF 656 million as the Group again improved

profitability on the back of notable sales growth. Continued

pricing measures and operating leverage offset raw material price

increases of approximately 34 %, compared to the first nine

months of 2021. Furthermore, the execution of the performance

improvement programs resulted in additional cost savings of

CHF 10 million in the first nine months of 2022. The

EBITDA margin increased to 16.9 % from 16.2 % in the

first nine months of 2021 due to the Group’s ongoing cost

discipline and the profitability improvement in Care Chemicals and

Natural Resources, which more than offset the relative weakness in

Catalysis.

ESG Update – Leading in

sustainability

Clariant strives to be safe and sustainable in

all of its activities. The Group’s efforts center on fighting

climate change, creating safe and sustainable chemistry, increasing

circularity, fostering a sustainable bioeconomy, minimizing waste,

eliminating pollution, and creating social value. This includes

fostering the development of employees as well as sustainability in

the local communities in which Clariant operates.

Fighting climate change remains high on

Clariant’s agenda and also for many of its stakeholders. The Group

continues to implement its 2030 roadmap to achieve its

science-based climate targets, which aim for a 40 % absolute

reduction in Scope 1 and 2 greenhouse gas emissions and a 14 %

absolute reduction in Scope 3 greenhouse gas emissions from

purchased goods and services by 2030, compared to baseline 2019

levels. These targets are accompanied by intensity-reduction

targets for the key environmental parameters in its operations.

In the first nine months of 2022, the Group’s

Scope 1 and 2 emissions improved as a result of increased energy

efficiency through the sun-drying of clays and an accelerated

transition to renewables – specifically the switch from coal to

biomass at some sites and a higher share of green electricity

purchased. For example, Clariant implemented a ten-year green

electricity supply contract across its business units in Indonesia.

The Group also began a power purchase agreement (PPA) at the Clear

Lake site in the USA together with the site operator Celanese.

Clariant expects its emissions footprint to remain significantly

below last year’s level and the baseline year 2019.

Clariant’s catalysts and adsorbents deliver

significant customer value by driving higher production throughput,

lowering energy consumption, and reducing hazardous emissions from

industrial processes and combustion engines. In recognition of this

accomplishment, Clariant and its engineering and technology

partner, Technip Energies, recently received two industry awards

for their EARTH® technology: the ICIS Innovation Award 2022 for

Best Process Innovation and the Hydrocarbon Process Award 2022 for

Best Refining Technology. In parallel, Clariant and Technip

Energies reached another milestone by installing EARTH® technology

at a large-scale hydrogen plant in one of Europe’s biggest

refineries. The revamp is expected to significantly increase the

plant’s production capacity. EARTH® is a pioneering drop-in

solution that enables a capacity increase in the production of

hydrogen by up to 20 % while decreasing CO2 emissions by up to

10 % and reducing make-up fuel consumption by up to 50 %

per unit of hydrogen produced. The technology is

carbon-capture-ready and can play a key role in global efforts to

reduce emissions with low-carbon hydrogen.

Outlook – Full Year 2022

Clariant aims to grow above the market to

achieve higher profitability through sustainability and innovation.

The Group concluded its portfolio transformation program by

divesting Healthcare Packaging in 2019, Masterbatches in 2020, and

Pigments in January of 2022. Clariant has become a true specialty

chemical company and confirms its 2025 ambition to deliver

profitable growth (4 – 6 % CAGR), a Group EBITDA margin

between 19 – 21 %, and a free cash flow conversion of around

40 %.

In the fourth quarter of 2022, Clariant expects

to generate continued solid sales growth in local currency versus

the prior year, underpinned by higher prices in all Business Areas

despite an expected sequential normalization in volumes in Care

Chemicals and Natural Resources and an increasingly challenging

comparable base. Clariant expects Catalysis’s performance to

further improve despite a continued negative impact from the

sunliquid® ramp up. Additional restructuring charges will be booked

in the fourth quarter due to the cost of implementing the new

operating model. The fourth quarter 2022 reported EBITDA margin is

therefore expected to be clearly lower than the restated

year-on-year margin levels.

For the full year 2022, Clariant expects strong

sales growth in local currency for the Group to around

CHF 5.1 billion, based on continued pricing measures and

the strong first nine months of 2022. The current high level of

uncertainty resulting from geopolitical conflicts, the suspension

of business with Russia, and the resurgence of COVID-19 are

expected to continue to negatively impact global economic growth

and consumer demand in the fourth quarter of 2022 and in 2023.

Clariant expects the high inflationary environment with regard to

raw materials (despite some easing from peak levels) and energy (in

Europe in particular) to persist. Despite the additional

restructuring charges, the continued negative impact related to the

sunliquid® ramp up, and the increasingly challenging economic

environment, Clariant aims to improve its year-on-year underlying

Group EBITDA margin level via solid revenue growth, driven by

pricing and continued cost discipline. The full year 2022 reported

Group EBITDA margin will be impacted by restructuring charges in

the fourth quarter of 2022 related to the implementation of the new

operating model.

Q3 9M Media Release EN

| CORPORATE

MEDIA RELATIONS Jochen DubielPhone

+41 61 469 63 63jochen.dubiel@clariant.com Anne

MaierPhone +41 61 469 63 63anne.maier@clariant.com

Ellese CaruanaPhone +41 61 469 63

63ellese.caruana@clariant.com |

INVESTOR

RELATIONS Andreas Schwarzwälder

Phone +41 61 469 63 73andreas.schwarzwaelder@clariant.com

Maria IvekPhone +41 61 469 63

73maria.ivek@clariant.com Alexander

KambPhone +41 61 469 63 73alexander.kamb@clariant.com |

|

Follow us on Twitter, Facebook, LinkedIn, Instagram. This

media release contains certain statements that are neither reported

financial results nor other historical information. This document

also includes forward-looking statements. Because these

forward-looking statements are subject to risks and uncertainties,

actual future results may differ materially from those expressed in

or implied by the statements. Many of these risks and uncertainties

relate to factors that are beyond Clariant’s ability to control or

estimate precisely, such as future market conditions, currency

fluctuations, the behavior of other market participants, the

actions of governmental regulators and other risk factors such as:

the timing and strength of new product offerings; pricing

strategies of competitors; the Company’s ability to continue to

receive adequate products from its vendors on acceptable terms, or

at all, and to continue to obtain sufficient financing to meet its

liquidity needs; and changes in the political, social and

regulatory framework in which the Company operates or in economic

or technological trends or conditions, including currency

fluctuations, inflation and consumer confidence, on a global,

regional or national basis. Readers are cautioned not to place

undue reliance on these forward-looking statements, which speak

only as of the date of this document. Clariant does not undertake

any obligation to publicly release any revisions to these

forward-looking statements to reflect events or circumstances after

the date of these materials. www.clariant.com

Clariant is a focused, sustainable, and innovative specialty

chemical company based in Muttenz, near Basel/Switzerland. On 31

December 2021, Clariant totaled a staff number of 11 537 and

recorded sales of CHF 4.372 billion in the fiscal year

for its continuing businesses. The company reports in three

Business Areas: Care Chemicals, Catalysis, and Natural Resources.

Clariant’s corporate strategy is led by the overarching purpose of

‘Greater chemistry – between people and planet,’ and reflects the

importance of connecting customer focus, innovation,

sustainability, and people. |

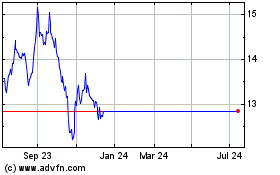

Clariant (LSE:0QJS)

Historical Stock Chart

From Jan 2025 to Feb 2025

Clariant (LSE:0QJS)

Historical Stock Chart

From Feb 2024 to Feb 2025