Clariant delivers resilient sales performance in challenging environment

May 05 2023 - 12:00AM

Clariant delivers resilient sales performance in challenging

environment

AD HOC ANNOUNCEMENT PURSUANT TO ART. 53 LR

- Q1

2023 sales increased by 1 %

in local currency, down 5 % in Swiss

francs to

CHF 1.200 billion

– positive pricing contribution of 7 %

- Q1

2023 EBITDA down 24 % to

CHF 167 million, EBITDA margin

of

13.9 %,

mainly attributable to 7 % lower volumes

and business mix,

CHF 13 million

negative sunliquid®

impact, and a

CHF 11 milllion negative

one-off fair value adjustment

of the Heubach Group

participation

-

Closing of North American Land Oil

business divestment on 31 March

2023

-

Unchanged Outlook 2023

“Clariant delivered a resilient top-line result

in the first quarter, despite the macroeconomic headwinds. Our

customers have reduced their inventory, and demand in some areas

has been weaker, which, coupled with the negative extraordinary

factors recorded in the quarter, impacted our profitability.

Overall, we have weathered the current global economic headwinds

well, thanks to the actions we have taken in recent quarters to

execute a strong pricing policy, implement our new organizational

model, structurally improve our portfolio, and foster our

sustainable product range. This is underpinned by the fact that our

cash generation continued its positive momentum in the first three

months of 2023. We maintain our full year expectations, however

uncertainties and risks related to the economic environment

remain,” said Conrad Keijzer, Chief Executive Officer of

Clariant.

Key Financial Group Figures

|

|

|

First Quarter |

|

in CHF million |

|

|

|

|

2023 |

2022 |

% CHF |

% LC |

|

Sales |

|

|

|

|

1 200 |

1 262 |

- 5 |

1 |

|

EBITDA |

|

|

|

|

167 |

220 |

- 24 |

|

|

- margin |

|

|

|

|

13.9 % |

17.4 % |

|

|

|

EBITDA before exceptional items |

|

|

|

|

184 |

238 |

- 23 |

|

|

- margin |

|

|

|

|

15.3 % |

18.9 % |

|

|

First Quarter

2023 Group

Discussion

MUTTENZ, May 5,

2023

Clariant, a sustainability-focused specialty

chemical company, today announced first quarter 2023 sales of

CHF 1.200 billion, compared to

CHF 1.262 billion in the first quarter of 2022. This

corresponds to an increase of 1 % in local currency and

5 % lower sales in Swiss francs. The positive pricing impact

was 7 %, and the consolidation of the US Attapulgite business

(scope) added 1 %, while volumes decreased by 7 %. The

currency impact on the quarter was – 6 %. Sales growth

was strong in the Business Unit Catalysts, which to some extent

compensated for the slight sales decreases in the Care Chemicals

and Adsorbents & Additives Business Units.

In the first quarter of 2023, local currency

sales were flat in the Europe,

Middle East & Africa region as Catalysts sales

increased, Care Chemicals slightly weakened at a low single-digit

percentage rate, and Adsorbents & Additives weakened

at a mid-single-digit percentage rate. Sales in the Americas grew

by 7 % primarily due to pricing impacts in Care Chemicals

and Adsorbents & Additives as well as the acquisition

of the US Attapulgite business assets. Sales in the US were

3 % higher, and sales in Brazil grew by 5 %. Sales in

Asia-Pacific were down by 4 % due to 16 % lower sales in

China attributable to a slow recovery versus a high comparison

base. This development was partly compensated for by higher sales

in India and Southeast Asia.

Care Chemicals sales decreased by 2 % in

local currency in the first quarter of 2023. This development was

driven by a volume decline with lower sales in both Consumer Care

and Industrial Applications versus a tough comparison base.

Catalysts sales rose by 18 % in local currency with growth in

all business segments. Adsorbents & Additives sales

decreased by 5 % in local currency due to weaker demand for

Additives in particular, against a very strong first quarter in

2022.

Group EBITDA decreased by 24 % to

CHF 167 million, and the corresponding 13.9 % margin

was below the 17.4 % reported in the first quarter of the

previous year. Pricing measures supported the profitability

development. However, these measures did not fully offset the

negative impact from lower volumes impacting production utilization

in certain businesses and a CHF 13 million negative

impact from sunliquid®. In addition, the fair value adjustment of

the Heubach Group participation resulted in a negative

CHF 11 million one-off charge in Corporate in the first

quarter of 2023. Excluding the CHF 13 million negative

sunliquid® impact and the CHF 11 million one-off Heubach

Group fair value adjustment, the EBITDA margin was 15.9 % in

the first quarter of 2023. Cost savings of approximately

CHF 8 million from performance programs contributed

positively to the margin by absorbing higher selling, general, and

administrative expenses, i.e., related to trade fairs and a pickup

in traveling activities.

ESG Update – Leading in

sustainability

Clariant’s Scope 1 and 2 total greenhouse gas

emissions fell to 0.60 million tons in the last twelve months

(April 2022 to March 2023), a decline of 3 % from 0.62 million

tons in the full year 2022. The total indirect greenhouse gas

emissions for purchased goods and services (Scope 3) also decreased

by 5 %, from 2.58 million tons in the full year 2022 to 2.46

million tons in the last twelve months. These results demonstrate

continued progress toward reaching the Group’s 2030 emissions

reduction targets.

In 2022, several projects implemented within

Clariant to shift to lower-emission raw materials positively

impacted the first quarter of 2023 and will continue to generate a

benefit for the Group going forward. Clariant expects full year

2023 emissions to remain below last year’s level despite the

inclusion of additional sites in the reported Scope 1 and 2

emissions, the acquired Attapulgite site in the US, and the

sunliquid® bioethanol plant in Romania.

Clariant is executing on its strategy to lead

the Group through sustainability and innovation across the

portfolio. The recently launched advanced skincare ingredient

Rootness® Mood+ in the Business Unit Care Chemicals is an example

of how Clariant promotes a sustainable bio-economy as it uses a

smart plant cultivation technology,

Plant Milking Technology. It ensures that the host plant

is not destroyed during the chemical production process, requires

90 % less water compared to conventional culture, and provides

Clariant’s customers with traceability from the seed to the

ingredient. Clariant’s focus on sustainability is also reflected in

the bio-based ingredients for paints and coatings provided by the

Adsorbents & Additives Business Unit. The lower

carbon footprints of these ingredients help customers to reduce

their Scope 3 emissions.

Outlook – Full Year 2023

From a macroeconomic perspective, Clariant

anticipates a soft recessionary environment in the first half of

2023, compared to a very strong first half of 2022, and expects to

see an economic recovery in the second half of 2023, while

uncertainties and risks related to the economic environment remain.

For the full year 2023, Clariant expects to achieve sales of around

CHF 5 billion, including a net negative top line impact

of around CHF 130 million from divestments and the

bolt-on acquisition. Clariant aims to slightly improve its

year-on-year reported EBITDA margin due to continued growth in

Catalysts, which is expected to offset lower sales in the other

Business Units. Clariant expects an increasing negative annualized

sunliquid® impact and an easing inflationary environment given the

current economic outlook, counterbalanced by savings benefits from

the restructuring programs.

In the medium term, Clariant aims to grow above

the market to achieve higher profitability through sustainability

and innovation. The Group has become a true specialty chemical

company and confirms its 2025 ambition to deliver profitable sales

growth (4 – 6 % CAGR), a Group EBITDA margin between

19 – 21 %, and a free cash flow conversion of around

40 %.

Q1 2023 Media Release

|

CORPORATE MEDIA RELATIONS Jochen DubielPhone +41 61 469 63

63jochen.dubiel@clariant.com Anne MaierPhone +41 61 469 63

63anne.maier@clariant.com Ellese CaruanaPhone +41 61 469 63

63ellese.caruana@clariant.com Follow us on

Twitter, Facebook, LinkedIn, Instagram. |

INVESTOR RELATIONS Andreas Schwarzwälder Phone +41 61 469

63 73andreas.schwarzwaelder@clariant.com Maria IvekPhone +41

61 469 63 73maria.ivek@clariant.com Thijs BouwensPhone +41 61

469 63 73thijs.bouwens@clariant.com |

|

This media release contains certain statements that are

neither reported financial results nor other historical

information. This document also includes forward-looking

statements. Because these forward-looking statements are subject to

risks and uncertainties, actual future results may differ

materially from those expressed in or implied by the statements.

Many of these risks and uncertainties relate to factors that are

beyond Clariant’s ability to control or estimate precisely, such as

future market conditions, currency fluctuations, the behavior of

other market participants, the actions of governmental regulators

and other risk factors such as: the timing and strength of new

product offerings; pricing strategies of competitors; the Company’s

ability to continue to receive adequate products from its vendors

on acceptable terms, or at all, and to continue to obtain

sufficient financing to meet its liquidity needs; and changes in

the political, social and regulatory framework in which the Company

operates or in economic or technological trends or conditions,

including currency fluctuations, inflation and consumer confidence,

on a global, regional or national basis. Readers are cautioned not

to place undue reliance on these forward-looking statements, which

speak only as of the date of this document. Clariant does not

undertake any obligation to publicly release any revisions to these

forward-looking statements to reflect events or circumstances after

the date of these materials. www.clariant.com Clariant is

a focused specialty chemical company led by the overarching purpose

of ‘Greater chemistry – between people and planet’. By connecting

customer focus, innovation, and people the company creates

solutions to foster sustainability in different industries. On 31

December 2022, Clariant totaled a staff number of 11 148 and

recorded sales of CHF 5.198 billion in the fiscal year

for its continuing businesses. As of January 2023, the Group

conducts its business through the three newly formed Business Units

Care Chemicals, Catalysts, and Adsorbents & Additives. Clariant

is based in Switzerland. |

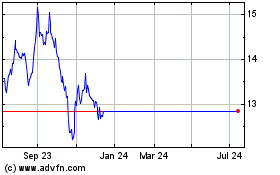

Clariant (LSE:0QJS)

Historical Stock Chart

From Feb 2025 to Mar 2025

Clariant (LSE:0QJS)

Historical Stock Chart

From Mar 2024 to Mar 2025