Clariant delivered strong Catalysts performance and stabilization

in Care Chemicals in a continued challenging market environment

AD HOC ANNOUNCEMENT PURSUANT TO ART. 53 LR

- Q3 2023

sales decreased by 8 % organically vs. Q3 2022 (13 %

including scope) in local currency to CHF 1.031 billion;

organic sales vs. Q2 2023 showed 2 % volume improvement in

challenging markets

- Catalysts

achieved volume growth and positive pricing; Care Chemicals showed

stabilization; Additives business faced

continuing weaker demand for durable goods

- Q3 2023

reported EBITDA margin decreased to 15.4 % vs. 16.8 % in

Q3 2022; underlying improvement of 340 basis

points vs. Q2 2023, driven by proactive cost measures and

operational improvements

- 9M 2023

sales decreased by 7 % in local currency to

CHF 3.315 billion

- 9M 2023

reported EBITDA margin decreased to 15.1 % vs. 16.9 % in

9M 2022

- Full Year

2023 outlook confirmed

“Our performance is improving, despite continued

uncertainties and risks related to the geopolitical and economic

environment. On a Group basis Clariant has delivered an underlying

sequential quarterly increase of 21% in EBITDA. Organic Group

volumes increased slightly compared to the previous quarter,

although weak demand for durable goods persisted, which primarily

affected our Additives business. Our proactive measures to adjust

our cost base are improving profitability with over

CHF 120 million of savings achieved to date out of our

CHF 170 million commitment. This, together with our

underlying performance improvement, underpinned our strong cash

generation in the third quarter. In addition, we continue to see

strong Catalysts performance, both in volume and pricing. Despite a

continued soft recessionary environment and currency headwinds, we

expect to land in our guidance range for 2023. Our focused

specialty chemicals portfolio and our highly committed people leave

us well-positioned for profitable growth as end markets recover”,

said Conrad Keijzer, Chief Executive Officer of Clariant.

Business Summary

|

|

Third Quarter |

Nine Months |

|

in CHF million |

2023 |

2022 |

% CHF |

% LC |

2023 |

2022 |

% CHF |

% LC |

|

Sales |

1 031 |

1 312 |

- 21 |

- 13 |

3 315 |

3 875 |

- 14 |

- 7 |

|

EBITDA |

159 |

220 |

- 28 |

|

501 |

656 |

- 24 |

|

|

- margin |

15.4 % |

16.8 % |

|

|

15.1 % |

16.9 % |

|

|

|

EBITDA before exceptional items |

164 |

242 |

- 32 |

|

483 |

690 |

- 30 |

|

|

- margin |

15.9 % |

18.4 % |

|

|

14.6 % |

17.8 % |

|

|

Third Quarter 2023 Group

Discussion

MUTTENZ, 30 OCTOBER

2023

Clariant, a sustainability-focused specialty

chemical company, today announced third quarter 2023 sales of

CHF 1.031 billion, down 8 % organically, 13 %

in local currency and 21 % in Swiss francs. Pricing decreased

by 3 % year-on-year and volumes by 5 %. Scope had a net

negative impact of 5 % as the acquisition of the US

Attapulgite business was more than offset by the divestments of the

North America Land Oil and Quats businesses.

Care Chemicals sales decreased by 18 % in

local currency. While Oil Services recorded strong organic volume

growth, sales in the other segments were lower against a very

strong Q3 2022 comparable base. Catalysts sales increased by

8 % in local currency, driven by the Propylene and Syngas

& Fuels segments, continuing the positive project execution

observed in recent quarters. Adsorbents & Additives sales

decreased by 19 % in local currency against a strong

comparable base. In Additives, demand in key end markets remained

challenging with continued destocking.

In Europe, Middle East, and Africa, local

currency sales were down 21 %. Strong sales growth in

Catalysts in the Middle East only partially offset lower sales in

Care Chemicals (partly attributable to the divestment of the Quats

business) and Adsorbents & Additives. In the Americas, sales

declined by 5 % as lower Care Chemicals and Adsorbents &

Additives sales offset growth in Catalysts. Sales in Asia-Pacific

declined by 12 %, with China down 2 %. Group EBITDA

decreased by 28 % to CHF 159 million versus Q3 2022,

with an EBITDA margin of 15.4 %. Currency translation

negatively impacted EBITDA by 14 % while lower volumes

affected production utilization in Care Chemicals and Additives.

The net negative operational impact from sunliquid® was

CHF 11 million (an improvement of CHF 2 million

year-on-year). However, cost savings from performance programs of

CHF 14 million addressed remnant costs from divested

businesses and contributed positively to offset inflation. Raw

material costs also eased by 16 % year-on-year.

On a sequential basis, sales of

CHF 1.031 billion in the third quarter of 2023 were

5 % below the second quarter of 2023 due to currency and scope

impacts. Volumes slightly improved organically at a Group level,

compensating lower pricing. Underlying profitability, as reflected

by EBITDA before exceptional items, increased sequentially by

21 % to CHF 164 million, representing a margin

increase of 340 basis points to 15.9 %. This significant

improvement was a result of the proactive measures to align the

cost base to a low volume environment, as well as strong

operational performance in Catalysts and a slight organic volume

increase in Care Chemicals.

Nine Months 2023 Group

Discussion

In the first nine months of 2023, sales

decreased by 7 % to CHF 3.315 billion

(– 5 % organic) in local currency and by 14 % in

Swiss francs. Scope effects (arising from divestments partly offset

by an acquisition) were – 2 %. Volumes were down

6 %, however pricing increased by 1 %.

Local currency sales in Care Chemicals decreased

by 12 %. Strong organic growth (both in volume and price) in

Oil Services did not offset declines in other segments,

particularly Crop Solutions. Catalysts sales grew 18 % with

particularly strong growth in Propylene and Syngas & Fuels.

Adsorbents & Additives sales decreased by 12 % in local

currency due to the continued weak demand for durable goods

impacting Additives volumes.

Local currency sales decreased in all geographic

regions. The most pronounced decline was in Europe, Middle East,

and Africa, with sales down by 10 % year-on-year. Local

currency sales in Asia-Pacific and the Americas declined by

5 % and 4 %, respectively.

Group EBITDA decreased by 24 % to

CHF 501 million, with a corresponding margin of

15.1 %. Profitability was impacted by lower volumes and

currency translation, a CHF 18 million net impact from

sunliquid® (including CHF 7 million restructuring charges

in the second quarter), the CHF 11 million fair value

adjustment of the Heubach Group participation in the first quarter,

as well as inventory devaluation. Positive profitability impacts

included a preliminary CHF 62 million gain on the

disposal of the Quats business in Care Chemicals, declining raw

material costs of 9 %, and cost savings of

CHF 36 million in the period due to the execution of

performance improvement programs.

ESG Update – Leading in

Sustainability

Clariant’s Scope 1 and 2 total greenhouse gas

emissions fell to 0.58 million tons in the last twelve months

(September 2022 to September 2023), a decline of 6 % from

0.62 million tons in the full year 2022. The total indirect

greenhouse gas emissions for purchased goods and services (Scope 3)

also decreased by 13 %, from 2.58 million tons in the

full year 2022 to 2.25 million tons in the last twelve months.

These results are to an extent attributable to the lower sales

volumes in the first nine months of 2023 as well as improvements at

Clariant’s own sites and in its supplier engagement (Scope 3).

This demonstrates Clariant’s continued progress toward reaching the

Group’s 2030 emissions reduction targets.

Outlook – Full Year 2023

Clariant expects to see an easing inflationary

environment, but no economic recovery in the final three months of

2023, with macroeconomic uncertainties and risks remaining. Despite

this backdrop, Clariant confirms its sales guidance for the full

year 2023 of CHF 4.55 – 4.65 billion. This includes

a net divestments/acquisition impact of around

CHF – 150 million relating to the Quats, North

American Land Oil, and Attapulgite transactions as well as an FX

translation impact currently expected at the upper end of the

previously published negative 5 – 10 % range.

Clariant also confirms its reported EBITDA guidance for the full

year 2023 of CHF 650 – 700 million

(14.3 % – 15.1 % reported EBITDA margin),

including a preliminary CHF 62 million gain from the

Quats divestment and approximately CHF 30 million in

restructuring charges. Clariant expects an increased negative

annualized sunliquid® impact to be counterbalanced by savings

benefits from the restructuring programs. Clariant is on track to

deliver its sustainability targets. The Group has become a true

specialty chemical company and remains committed toward its 2025

ambition to deliver profitable sales growth (4 – 6 %

CAGR), a Group EBITDA margin between 19 – 21 %, and

a free cash flow conversion of around 40 %.

Business Discussion

Business Unit Care

Chemicals

|

|

Third Quarter |

Nine Months |

|

in CHF million |

2023 |

2022 |

% CHF |

% LC |

2023 |

2022 |

% CHF |

% LC |

|

Sales |

525 |

725 |

- 28 |

- 18 |

1 771 |

2 223 |

- 20 |

- 12 |

|

EBITDA |

91 |

144 |

- 37 |

|

352 |

435 |

- 19 |

|

|

- margin |

17.3 % |

19.9 % |

|

|

19.9 % |

19.6 % |

|

|

|

EBITDA before exceptional items |

92 |

144 |

- 36 |

|

299 |

435 |

- 31 |

|

|

- margin |

17.5 % |

19.9 % |

|

|

16.9 % |

19.6 % |

|

|

Sales

In the third quarter of 2023, sales in the

Business Unit Care Chemicals decreased by 18 % in local

currency, 8 % of which was organic, and by 28 % in Swiss

francs.

The decrease in pricing during the quarter was

mainly due to adjustments in index-based pricing. Sequentially,

prices went down 3 % compared to the previous quarter, again

primarily driven by index-based pricing, as Clariant continued to

focus on defending value pricing. Volumes for the quarter were down

by a single-digit percentage rate, excluding the impact of the

divestments of the North American Land Oil and Quats businesses.

Although Crop Solutions continued to face challenges due to ongoing

destocking, organic sales across the other segments improved

sequentially. Overall, organic volumes increased sequentially,

offsetting index-based pricing adjustments.

Care Chemicals sales in Europe, Middle East, and

Africa decreased at a high-twenties percentage rate in the quarter

due to the strong performance in the previous year and the Quats

business divestment. In the Americas, sales were down at a mid-teen

percentage rate largely due to the impact of the sale of the North

American Land Oil business. Sales in Asia-Pacific grew organically

at a high single-digit percentage rate, supported by growth in

China at similar levels in all segments.

In the first nine months of 2023, sales in the

Business Unit Care Chemicals decreased by 12 % in local

currency, 7 % of which was organic, and by 20 % in Swiss

francs. Volumes were down by a mid- to high single-digit percentage

rate, excluding the divestment impact, while pricing was flat.

EBITDA Margin

In the third quarter, the EBITDA margin

decreased to 17.3 % versus 19.9 % in the same period last

year as profitability was negatively impacted by lower

volumes and currency impacts. Sequentially, the EBITDA before

exceptional items of CHF 92 million was significantly

above the CHF 77 million realized in the second quarter

of 2023, supported by the organic increase in volumes.

In the first nine months, the Care Chemicals

EBITDA margin increased to 19.9 % from 19.6 %, positively

impacted by the gain from the Quats disposal.

Care Chemicals Insight

With PHASETREAT™ WET, Clariant provides a more

efficient and sustainable solution for the challenges inherent in

traditional oil production processes – most notably, that of

meeting stricter environmental requirements for oil and water

separation. By increasing the active level of the product and

employing nanoemulsion technology, PHASETREAT™ WET reduces

demulsifier dosages by up to 75 % compared to current

solutions. This enables offshore and onshore operators to reduce

freight, inventory, and process safety challenges, not only helping

them reduce operational costs, simplify logistics, and mitigate

safety risks, but also enabling them to provide critical natural

resources with reduced Scope 3 emissions.

Business Unit Catalysts

|

|

Third Quarter |

Nine Months |

|

in CHF million |

2023 |

2022 |

% CHF |

% LC |

2023 |

2022 |

% CHF |

% LC |

|

Sales |

260 |

262 |

- 1 |

8 |

742 |

679 |

9 |

18 |

|

EBITDA |

58 |

30 |

93 |

|

113 |

57 |

98 |

|

|

- margin |

22.3 % |

11.5 % |

|

|

15.2 % |

8.4 % |

|

|

|

EBITDA before exceptional items |

58 |

31 |

87 |

|

122 |

59 |

107 |

|

|

- margin |

22.3 % |

11.8 % |

|

|

16.4 % |

8.7 % |

|

|

Sales

In the third quarter of 2023, sales in the

Business Unit Catalysts rose 8 % in local currency and

declined 1 % in Swiss francs. Volume growth was supported by

continued positive pricing. Sales growth was strongest in Propylene

as well as Syngas & Fuels, both up by more than 40 %.

Due to the project nature of the businesses, Specialties declined

at a low-teens percentage rate, while the decrease in Ethylene was

more pronounced.

Catalysts sales grew in the Americas and Europe,

Middle East, and Africa regions, driven by positive project trends

in the US and the Middle East. In Asia-Pacific, the largest

geographic market, sales declined at a low-teens percentage rate.

In China, sales grew at a mid-single-digit percentage rate,

supported by the continued strong CATOFIN® (propane

dehydrogenation) catalyst demand, which is being served from the

new CATOFIN® production site in Jiaxing.

In the first nine months of 2023, sales in the

Business Unit Catalysts increased by 18 % in local currency

and by 9 % in Swiss francs. Growth was a result of both

positive pricing and mid-teens percentage volume growth, while on a

segment basis, the performance was particularly strong in Propylene

and Syngas & Fuels.

EBITDA Margin

In the third quarter, the EBITDA margin

increased to 22.3 % from 11.5 % year-on-year due to

continued positive pricing, improved operating leverage due to

higher volumes, and a positive business mix. When excluding the

CHF – 11 million impact of sunliquid®, the EBITDA

margin was 26.5 % in the third quarter, compared to

16.4 % on a like-for-like basis in the previous year.

Sequentially, the EBITDA before exceptional items of

CHF 58 million was above the CHF 51 million

realized in the second quarter of 2023.

On sunliquid®, its impact of

CHF – 11 million on EBITDA in the third quarter was

a CHF 2 million improvement from the prior year. The

Clariant team has continued its efforts to address the mechanical,

bio-chemical, and operational challenges involved in the ramp-up of

this first-of-a-kind technology. Clariant is actively evaluating

strategic options for sunliquid® and will provide an update by the

end of 2023.

In the first nine months, Catalysts EBITDA

margin increased to 15.2 % from 8.4 %, driven by positive

pricing, higher volumes, and positive business mix effects.

Catalysts Insight

Clariant’s MegaMax® catalyst was chosen by

European Energy for the world’s largest e-methanol plant, with an

annual capacity of 32 000 tons. Located in Kasso, Denmark, the

facility is scheduled to start operations by the end of 2023.

MegaMax® was chosen because it is proven to deliver high activity

and stability under the challenging conditions of CO2-to-methanol

conversion. MegaMax® is also very well suited to pure CO2

conditions because it delivers high conversion rates when combined

with green hydrogen feed. The catalyst’s superior selectivity also

prevents the formation of by-products in the yield, which greatly

improves the sustainability and economics of green methanol

synthesis. A large portion of the plant’s annual yield has already

been allocated to the shipping and logistics company Maersk for

powering its first-ever carbon-neutral fleet. The remaining green

methanol will be supplied to the Lego Group and Novo Nordisk.

Business Unit Adsorbents &

Additives

|

|

Third Quarter |

Nine Months |

|

in CHF million |

2023 |

2022 |

% CHF |

% LC |

2023 |

2022 |

% CHF |

% LC |

|

Sales |

246 |

325 |

- 24 |

- 19 |

802 |

973 |

- 18 |

- 12 |

|

EBITDA |

30 |

79 |

- 62 |

|

102 |

241 |

- 58 |

|

|

- margin |

12.2 % |

24.3 % |

|

|

12.7 % |

24.8 % |

|

|

|

EBITDA before exceptional items |

30 |

79 |

- 62 |

|

110 |

242 |

- 55 |

|

|

- margin |

12.2 % |

24.3 % |

|

|

13.7 % |

24.9 % |

|

|

Sales

In the third quarter of 2023, sales in the

Business Unit Adsorbents & Additives decreased by

19 % in local currency and by 24 % in Swiss francs. The

acquisition of the US-based Attapulgite business assets contributed

2 % to sales growth in local currency. Weak demand in key

Additives end markets continued to impact volumes and pricing in

the Additives business, which declined in the low-thirties

percentage range and mid-single-digit percentage range,

respectively. In Adsorbents, sales grew due to scope effects and

positive pricing.

Sales declined in all geographic regions. This

includes a high twenties percentage rate drop in Asia-Pacific as

volumes declined in both Additives and Adsorbents. China declined

by a high-teens percentage rate, as slightly positive pricing was

offset by low volumes in Additives. In Europe, Middle East, and

Africa, the largest region, as well as the Americas, growth in

Adsorbents through pricing did not offset lower sales in

Additives.

In the first nine months of 2023, sales in the

Business Unit Adsorbents & Additives decreased by 12 % in

local currency, with a 14 % organic decrease, and by 18 %

in Swiss francs. While volumes were negative due to the weakness in

Additives, pricing remained positive.

EBITDA Margin

In the third quarter, the EBITDA margin

decreased to 12.2 % from a high 24.3 % in the same period

of the previous year. Profitability levels were impacted by

substantially lower volumes in Additives in particular, which

resulted in lower operating leverage and fixed cost absorption,

while the relatively strong Adsorbents performance led to a less

favorable business mix. Sequentially, the EBITDA before exceptional

items of CHF 30 million was above the

CHF 25 million realized in the second quarter of

2023.

In the first nine months, Adsorbents &

Additives EBITDA margin decreased to 12.7 % from 24.8 %

due to similar factors that influenced the last quarter.

Adsorbents & Additives

Insight

Clariant’s Ceridust® 8330 is a unique additive.

Made from a renewable resource, it is a real breakthrough for all

kinds of printing inks. It combines its bio-based origin with

superior rub resistance properties, easy dispersion in both water

and solvent-based ink systems, and a dosage reduction potential

that enables more efficient ink usage. This makes it the kind of

high-performance solution that the printing industry is looking for

as it switches away from traditional Polytetrafluorethylene

(PTFE)-based additives. Sustainability challenges and the

regulatory landscape are driving the demand for environmentally

friendly alternatives and with products like Ceridust® 8330,

Clariant helps drive the ever-evolving world of sustainable

printing inks.

|

CORPORATE MEDIA RELATIONS Jochen

DubielPhone +41 61 469 63 63 jochen.dubiel@clariant.com

Anne SchäferPhone +41 61 469 63 63

anne.schaefer@clariant.com Ellese Caruana

Phone +41 61 469 63 63 ellese.caruana@clariant.com

Follow us on X, Facebook, LinkedIn, Instagram. |

INVESTOR RELATIONS Andreas

SchwarzwälderPhone +41 61 469 63

73andreas.schwarzwaelder@clariant.com Thijs

BouwensPhone +41 61 469 63 73thijs.bouwens@clariant.com

|

|

This media release contains certain statements that are

neither reported financial results nor other historical

information. This document also includes forward-looking

statements. Because these forward-looking statements are subject to

risks and uncertainties, actual future results may differ

materially from those expressed in or implied by the statements.

Many of these risks and uncertainties relate to factors that are

beyond Clariant’s ability to control or estimate precisely, such as

future market conditions, currency fluctuations, the behavior of

other market participants, the actions of governmental regulators

and other risk factors such as: the timing and strength of new

product offerings; pricing strategies of competitors; the Company’s

ability to continue to receive adequate products from its vendors

on acceptable terms, or at all, and to continue to obtain

sufficient financing to meet its liquidity needs; and changes in

the political, social and regulatory framework in which the Company

operates or in economic or technological trends or conditions,

including currency fluctuations, inflation and consumer confidence,

on a global, regional or national basis. Readers are cautioned not

to place undue reliance on these forward-looking statements, which

speak only as of the date of this document. Clariant does not

undertake any obligation to publicly release any revisions to these

forward-looking statements to reflect events or circumstances after

the date of these materials. www.clariant.com

Clariant is a focused specialty chemical company led by the

overarching purpose of ‘Greater chemistry – between people and

planet’. By connecting customer focus, innovation, and people the

company creates solutions to foster sustainability in different

industries. On 31 December 2022, Clariant totaled a staff number of

11 148 and recorded sales of CHF 5.198 billion in the fiscal year

for its continuing businesses. As of January 2023, the Group

conducts its business through the three newly formed Business Units

Care Chemicals, Catalysts, and Adsorbents & Additives. Clariant

is based in Switzerland. |

- 20231030_CLARIANT ANALYST PRESENTATION_LUCAS MEYER

COSMETICS_Q3_9M 2023

- 20231030_CLARIANT MEDIA RELEASE Q3_9M 2023 EN

- 20231030_CLARIANT MEDIA RELEASE Q3_9M 2023 DE

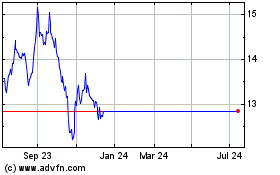

Clariant (LSE:0QJS)

Historical Stock Chart

From Feb 2025 to Mar 2025

Clariant (LSE:0QJS)

Historical Stock Chart

From Mar 2024 to Mar 2025