TIDMAAU

RNS Number : 8893Z

Ariana Resources PLC

17 January 2024

17 January 2024

AIM: AAU

2023 PRODUCTION RESULTS AND GENERAL UPDATE

Ariana Resources plc ("Ariana" or "the Company"), the AIM-listed

mineral exploration and development company with gold mining

interests in Europe, is pleased to announce the full-year

production results for the year ended 31 December 2023 for the

Kiziltepe Mine ("Kiziltepe" or "the Project") in Turkey. Kiziltepe

is 23.5% owned by Ariana through its shareholding in Zenit

Madencilik San. ve Tic. A.S. ("Zenit").

Production Update*:

-- Kiziltepe produced (and sold) a total of 17,683 ounces of

gold during the year, including gold in carbon and in circuit at

year-end (>500 oz), exceeding full-year production guidance of

18,000 oz gold for 2023.

-- Mining operations are continuing at Arzu North, Derya, and

Banu, with new forestry permits expected to enable the extension of

the Banu pit in 2024.

-- Gross full-year revenue of US$39.2 million at an average

realised gold price of US$1,945 per ounce, with an average revenue

per gold ounce of US$2,218 (due to silver credit)*.

-- As of the end of 2023, the mine had produced a total of

151,041 ounces of gold (planned circa 100,000 oz gold) and

1,682,265 ounces of silver, recording US$274 million in revenue

since operations commenced in early 2017.

* All figures are given gross with respect to Zenit.

Dr. Kerim Sener, Managing Director, commented:

"Kiziltepe has now recorded seven highly successful years of

production and the mine continues to perform extremely well. We are

currently working towards completing an updated Resource/Reserve

Estimate, as we plan to bring Kiziltepe mining operations to a

close over the next few years. Beyond this, we continue to explore

within the immediate vicinity to identify further sources of

potential mill supply that are not currently part of the mining

plan. We anticipate that these would be operated as satellite

operations, some of which are located within Zenit-owned licences,

and others which we have identified within neighbouring licence

areas.

"During 2023, the strong gold price environment resulted in one

of the best years for gold revenue since operations started. This

has certainly boosted the capacity for Zenit to continue

self-funding the development of the Tavsan mine build without

recourse to debt finance. We are continuously monitoring the

capital requirements of the Tavsan build and balancing these

financial demands against practical and operational timelines,

given the continued poor state of the debt markets. Meanwhile,

mining operations have recently commenced at Tavsan and the Main

Pit development is proceeding well, with approximately 40,000

tonnes of ore currently stockpiled ready for heap-leaching.

Construction of the heap-leach, specifically the laying down of

liners, is currently paused due to poor weather conditions and this

work will recommence in the next drier and warmer weather period.

Steel construction and fabrication, along with the delivery of

various plant components are being staggered in accordance with

cash-flow considerations. There will be further updates on Tavsan

operations over the coming months, with first gold from the

heap-leach currently expected to be delivered during Q3 2024.

"In summary, we are pleased with our performance operationally

in 2023, and we look forward to updating the market in 2024 on the

developments of the portfolio."

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK Domestic Law by virtue of the European Union (Withdrawal) Act

2018 ("UK MAR").

Other Developments:

-- Two diamond drilling rigs are operating across the Salinbas

Project, with results from the drilling programmes at Salinbas,

Ardala, and Hizarliyayla having been announced periodically to the

market since early 2023.

-- Venus Minerals in Cyprus progresses towards its IPO and

further updates will be provided in due course .

-- Western Tethyan Resources ("WTR"), of which Ariana owns 75%,

is actively exploring in SE Europe, including drilling at the

Hertica Cu-Au Project, with the support of funding through Newmont

Mining Corporation. WTR has separately secured an earn-in agreement

on the Slivova Project in Kosovo.

-- The Asgard Metals Fund, of which Ariana owns 100%, has

completed five investments since late 2021 and is currently

actively involved in a due diligence diamond drilling programme in

Zimbabwe with Rockover Holdings Limited.

Full-Year Production Results

Unit 2023 2022 2021 2020 2019 2018 2017

Open Pit

- material

moved (wet) Tonnes 4,563,926 5,309,701 4,531,973 4,459,462 3,985,048 3,268,290 3,531,865

--------- ---------- ---------- ---------- ---------- ---------- ---------- ----------

Open Pit

- ore mined

(wet) Tonnes 226,740 259,878 411,980 360,966 192,079 285,594 185,720

--------- ---------- ---------- ---------- ---------- ---------- ---------- ----------

Open Pit

- mined g/t

grade Au 1.99 2.81 2.19 2.29 4.23 4.58 2.79

--------- ---------- ---------- ---------- ---------- ---------- ---------- ----------

Process

plant throughput Tonnes 354,583 443,387 286,024 222,628 204,866 193,212 119,316

--------- ---------- ---------- ---------- ---------- ---------- ---------- ----------

Plant feed g/t

grade Au 1.81 2.33 2.44 2.72 4.51 4.73 3.17

--------- ---------- ---------- ---------- ---------- ---------- ---------- ----------

Metallurgical

recovery % Au 94.2 92.4 95.8 93.3 93.6 93.7 90.3

--------- ---------- ---------- ---------- ---------- ---------- ---------- ----------

Troy

Gold sold Ounces 17,683 28,421 20,737 18,645 28,132 27,232 10,191

--------- ---------- ---------- ---------- ---------- ---------- ---------- ----------

Silver Troy

sold Ounces 201,254 326,206 239,572 244,372 363,646 241,615 65,600

--------- ---------- ---------- ---------- ---------- ---------- ---------- ----------

Contacts:

Ariana Resources plc Tel: +44 (0) 20 7407 3616

Michael de Villiers, Chairman

Kerim Sener, Managing Director

Beaumont Cornish Limited (Nominated Tel: +44 (0) 20 7628 3396

Adviser)

Roland Cornish / Felicity Geidt

Panmure Gordon (UK) Limited (Joint Tel: +44 (0) 20 7886 2500

Broker)

John Prior / Hugh Rich / Atholl

Tweedie

WHIreland Limited (Joint Broker) Tel: +44 (0) 207 2201666

Harry Ansell / Katy Mitchell / George

Krokos Tel: +44 (0) 7983 521 488

Yellow Jersey PR Limited (Financial

PR)

Dom Barretto / Shivantha Thambirajah arianaresources@yellowjerseypr.com

/

Bessie Elliot

Beaumont Cornish Limited ("Beaumont Cornish") is the Company's

Nominated Adviser and is authorised and regulated by the FCA.

Beaumont Cornish's responsibilities as the Company's Nominated

Adviser, including a responsibility to advise and guide the Company

on its responsibilities under the AIM Rules for Companies and AIM

Rules for Nominated Advisers, are owed solely to the London Stock

Exchange. Beaumont Cornish is not acting for and will not be

responsible to any other persons for providing protections afforded

to customers of Beaumont Cornish nor for advising them in relation

to the proposed arrangements described in this announcement or any

matter referred to in it.

Editors' Note:

About Ariana Resources:

Ariana is an AIM-listed mineral exploration and development

company with an exceptional track-record of creating value for its

shareholders through its interests in active mining projects and

investments in exploration companies. Its current interests include

gold production in Turkey and copper-gold exploration and

development projects in Cyprus and Kosovo.

The Company holds 23.5% interest in Zenit Madencilik San. ve

Tic. A.S. a joint venture with Ozaltin Holding A.S. and Proccea

Construction Co. in Turkey which contains a depleted total of c.

2.1 million ounces of gold and other metals (as at February 2022).

The joint venture comprises the Kiziltepe Mine and the Tavsan and

Salinbas projects.

The Kiziltepe Gold-Silver Mine is located in western Turkey and

contains a depleted JORC Measured, Indicated and Inferred Resource

of 222,000 ounces gold and 3.8 million ounces silver (as at

February 2022). The mine has been in pro table production since

2017 and is expected to produce at a rate of c.20,000 ounces of

gold per annum to at least the mid-2020s. A Net Smelter Return

("NSR") royalty of 2.5% on production is being paid to

Franco-Nevada Corporation.

The Tavsan Gold Mine is located in western Turkey and contains a

JORC Measured, Indicated and Inferred Resource of 307,000 ounces

gold and 1.1 million ounces silver (as at November 2022). Following

the approval of its Environmental Impact Assessment and associated

permitting, Tavsan is being developed as the second gold mining

operation in Turkey and is currently in construction. A NSR royalty

of up to 2% on future production is payable to Sandstorm Gold.

The Salinbas Gold Project is located in north-eastern Turkey and

contains a JORC Measured, Indicated and Inferred Resource of 1.5

million ounces of gold (as at July 2020). It is located within the

multi-million ounce Artvin Gold eld, which contains the "Hot Gold

Corridor" comprising several signi cant gold- copper projects

including the 4 million ounce Hot Maden project, which lies 16km to

the south of Salinbas. A NSR royalty of up to 2% on future

production is payable to Eldorado Gold Corporation.

Ariana owns 100% of Australia-registered Asgard Metals Fund

("Asgard"), as part of the Company's proprietary Project Catalyst

Strategy. The Fund is focused on investments in high-value

potential, discovery-stage mineral exploration companies located

across the Eastern Hemisphere and within easy reach of Ariana's

operational hubs in Australia, Turkey, UK and Zimbabwe.

Ariana owns 75% of UK-registered Western Tethyan Resources Ltd

("WTR"), which operates across south-eastern Europe and is based in

Pristina, Republic of Kosovo. The company is targeting its

exploration on major copper-gold deposits across the

porphyry-epithermal transition. WTR is being funded through a

ve-year Alliance Agreement with Newmont Mining Corporation

(www.newmont.com) and is separately earning-in to up to 85% of the

Slivova Gold Project.

Ariana owns 58% of UK-registered Venus Minerals PLC ("Venus")

which is focused on the exploration and development of copper-gold

assets in Cyprus which contain a combined JORC Indicated and

Inferred Resource of 16.6Mt @ 0.45% to 0.80% copper (excluding

additional gold, silver and zinc.

Panmure Gordon (UK) Limited and WH Ireland Limited are brokers

to the Company and Beaumont Cornish Limited is the Company's

Nominated Adviser.

For further information on Ariana, you are invited to visit the

Company's website at www.arianaresources.com .

Ends.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDQKABPQBKDBDD

(END) Dow Jones Newswires

January 17, 2024 02:00 ET (07:00 GMT)

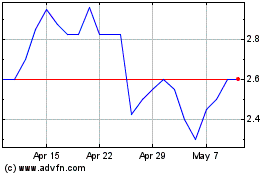

Ariana Resources (LSE:AAU)

Historical Stock Chart

From Mar 2024 to Apr 2024

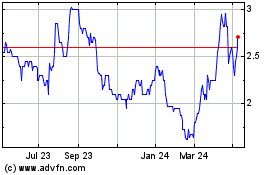

Ariana Resources (LSE:AAU)

Historical Stock Chart

From Apr 2023 to Apr 2024