TIDMABF

RNS Number : 6615A

Associated British Foods PLC

24 February 2014

24 February 2014

Associated British Foods plc

Pre Close Period Trading Update

Associated British Foods plc issues the following update prior

to entering the close period for its interim results to 1 March

2014 which are scheduled to be announced on 23 April 2014.

Adjusted operating profit for the first half is expected to be

in line with last year. A much lower profit from Sugar will be

offset by another excellent performance from Primark and

encouraging results from Grocery and Ingredients. Net financing

costs in the first half will benefit from the repayment, last July,

of British Sugar's 103/4% debenture, a strong cash flow, and lower

net debt throughout the period. Together with a further reduction

in the underlying tax rate at the half year, adjusted earnings for

the first half will be firmly ahead of last year.

Sterling is continuing to strengthen against our major trading

currencies and this will have a more significant negative effect on

the translation of overseas results into sterling in the second

half. Nevertheless, with a better than expected trading performance

from the non-sugar businesses and lower financing costs, we

continue to expect adjusted earnings per share for the financial

year to be similar to 2013.

The adoption of IAS19 Employee Benefits revised will result in a

minor restatement of previously reported results. The details are

contained in a table at the end of this statement.

Cash flow and funding

Operating cash flow in the first half will be further improved

driven by a good working capital performance, particularly at

Primark where effective inventory management and strong trading

have resulted in lower stock holding levels. Capital expenditure

has been higher than last year with lower expenditure in the food

businesses being more than offset by higher investment at Primark.

Net debt at the half year is expected to be GBP0.9bn, some GBP0.4bn

lower than at the same stage last year.

Sugar

Revenue and profit from Sugar in the first half will be

substantially lower than last year. A reduction in EU sugar prices,

ahead of regime reform in 2017, has been signalled for some time,

although the speed with which the market is adjusting has been

faster than anticipated. The world sugar price has also fallen to

what we believe to be an unsustainably low level, putting further

pressure on industry revenues and margins. This will be reflected

in AB Sugar's results, particularly in China. First half sales

volumes for Spain, Illovo and China will be lower than last

year.

The UK campaign is now virtually complete. Good growing

conditions through the mild winter resulted in the crop continuing

to grow into the new year, with good beet quality and high sugar

content. All factories have operated well and sugar production is

now estimated at 1.3 million tonnes compared with 1.15 million

tonnes last year. Production volumes at the Vivergo bioethanol

plant in Hull have increased steadily in recent months. However,

both over-supply in the EU and lower seasonal demand have led to a

reduction in bioethanol prices.

In Spain, the northern campaign was delayed to maximise beet

development from the reduced area under cultivation in the 2013

crop year and, although the campaign commenced well, adverse

weather in recent weeks has resulted in challenging harvest

conditions. Sugar production volumes are expected to be lower than

last year. As in the UK, profit will also be adversely affected by

the lower prices.

Illovo's revenues have been weaker with lower domestic volumes

in Zambia and Swaziland, competition from low cost imports reducing

prices in Tanzania and South Africa, and lower EU pricing affecting

Least-Developed Country exports. The Malawian kwacha has continued

to decline against both the rand and sterling since last financial

year end.

All five factories in south China made a good start to their

campaign with sugar content and extraction both ahead of last year

compensating for the smaller area under cultivation. Total sugar

production is expected to be in line with last year. Production in

the north has been seriously reduced by flooding in Heilongjiang

and, with fewer factories in operation following last year's

rationalisation, volumes are expected to be much lower

year-on-year. The campaigns at Qianqi and Zhangbei were both

excellent with good factory throughput and higher sugar content in

the beet. Significant overhead and efficiency improvements have

been achieved in both regions resulting in a net improvement in

performance.

Agriculture

Revenue and operating profit in the first half are expected to

be similar to last year at both constant currency and actual rates.

Lower UK feed volumes have been offset by growth in China, and a

strong performance at AB Vista where Quantum Blue in South America

and Econase in Asia were the main contributors. Successful

commissioning of an animal feed enzyme granulation line at the

extrusions plant in Evansville, Indiana, was completed in the

period. Frontier traded at similar levels to last year with good

sales of crop inputs and fertilisers.

Grocery

Revenue in the first half is expected to be ahead of last year

at constant currency, but just below at actual rates. However,

margins and profit will be much improved.

Twinings Ovaltine has again performed well with strong sales

growth for tea in the US and the UK, and improved margins driven by

higher volumes and factory efficiencies. Allied Bakeries made

progress in the highly competitive UK bread market and volumes and

margins will be ahead of last year. A new bread plant was

commissioned at West Bromwich as we approach the end of a major

capital investment programme in our UK bakeries. This programme

delivers less waste, better control of our processes and

consistently high quality bread. Sales at Silver Spoon will be

lower than last year as a result of lost contracts and reduced UK

sugar pricing, but the profit impact has been partially mitigated

by overhead cost reduction.

Sales in local currency will be ahead at George Weston Foods in

Australia, driven by higher bread prices and increased meat

volumes. These businesses both made progress with cost reduction

initiatives and Don KRC achieved further yield improvements and

efficiencies at its Castlemaine factory. Revenue and profit at ACH

is expected to be ahead of last year with higher corn oil volumes

and margins.

Ingredients

Revenue in the first half is expected to be ahead of last year

at constant currency but slightly lower at actual rates. Profit

from continuing operations will be well ahead of last year's

break-even result, with the absence of restructuring costs and

early signs of improvement in yeast and bakery ingredients.

Whilst AB Mauri's markets remain competitive, particularly in

Asia, a number of new initiatives are starting to yield positive

results. Cost inflation in South America has either been recovered

through pricing or offset by cost reduction. Revenue and profit in

North America will be ahead of last year driven by higher volumes

and continued investment in people, processes, and business

development. The new yeast factory in Mexico is now operational

enabling further expansion of distribution throughout North and

Central America. In January we completed the acquisition of a small

bakery ingredients business in Western Europe which complements our

existing operations in the region. The integration of these two

businesses will broaden our product range and strengthen our

presence in a number of key markets.

At ABF Ingredients, the new extrusions factory at Evansville in

the US has been successfully commissioned, products have been

approved by key customers and the factory is fully operational.

Closure of the yeast extracts plant in China was completed with a

number of contracts successfully transferred to our Hamburg

facility.

Retail

Sales at Primark in the first half have been very strong and are

expected to be 13% ahead of the same period last year at constant

currency and, with the benefit of a stronger euro in this period,

14% ahead at actual rates. This has been driven by 4% like-for-like

sales growth, an increase in retail selling space and superior

sales densities in the larger new stores. Like-for-like sales in

the first eight weeks of the financial year were held back by

unseasonably warm weather and strong comparatives in the previous

year, but the rest of the period saw excellent trading including

the Christmas period. New store openings have added 8% more selling

space since the last half year.

Operating profit margin is now expected to be higher than in the

same period last year, benefiting from warehouse and distribution

efficiencies and lower freight rates. Christmas trading was strong

in both years.

Retail selling space has increased by 0.6 million sq ft since

the financial year end and, at 1 March 2014, 269 stores will be

trading from 9.6 million sq ft. We have opened 16 new stores in the

period including our first two stores in France: Marseille which

began trading from 63,000 sq ft on 16 December 2013, and Dijon

which began trading from 44,000 sq ft on 3 February, both of which

have traded strongly to date. In Spain we opened six new stores and

closed the smaller of our two stores in La Coruña and Zaragoza,

bringing the total there to 39. Three further stores were added in

the UK, including Crawley where we relocated to a larger site, and

we also closed our small store in Leytonstone. Two new stores were

added in the Netherlands and one each in Germany, Austria and

Portugal, all of which have traded exceptionally well.

We expect to add a further 0.5 million sq ft of selling space in

this financial year, bringing the net additions for the year to 1.1

million sq ft which is substantially more than the 0.8 million

achieved in 2013. The additional stores will include a further

three in France, located in shopping centres in the suburbs of

Paris; two additional German stores, our second in Berlin and one

in Cologne; three new UK stores including a relocation in Cardiff;

and we will also relocate our Plenilunio store, our first in Spain,

to a location twice its size. As we opened no stores in the second

half of last year, these openings will accelerate the 8% selling

space growth achieved in the first half. Capital expenditure for

the full year is planned to be ahead of last year.

For further enquiries please contact:

Associated British Foods

John Bason, Finance Director Tel: 020 7399 6500

Flic Howard-Allen, Head of External Affairs

Citigate Dewe Rogerson

Chris Barrie, Eleni Menikou Tel: 020 7638 9571

Jonathan Clare Tel: 07770 321881

Note to editors:

The results for the year ended 14 September 2013 and the interim

results for the 24 weeks ended 2 March 2013 will be restated with

effect from 15 September 2013, upon adoption of IAS19 Employee

Benefits Revised. The impact of this restatement on the income

statement is summarised below:

24 weeks ended 2 March Year ended 14 September

2013 2013

--------------------------- ------------------------- --------------------------

restated previously restated previously

reported reported

Adjusted operating profit

(GBPm) 493 496 1,180 1,185

Adjusted profit before

tax (GBPm) 448 452 1,088 1,096

Adjusted earnings (GBPm) 328 331 775 781

Adjusted earnings per

share (p) 41.5 41.9 98.1 98.9

--------------------------- ----------- ------------ ----------- -------------

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTBXGDDLGDBGSB

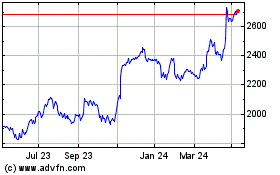

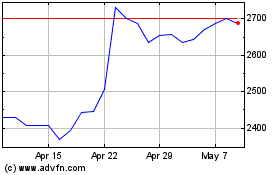

Associated British Foods (LSE:ABF)

Historical Stock Chart

From Jan 2025 to Feb 2025

Associated British Foods (LSE:ABF)

Historical Stock Chart

From Feb 2024 to Feb 2025