Armadale Capital PLC CSIRO Graphite Test Work Results (2498L)

January 11 2021 - 5:00AM

UK Regulatory

TIDMACP

RNS Number : 2498L

Armadale Capital PLC

11 January 2021

Armadale Capital Plc / Index: AIM / Epic: ACP / Sector:

Investment Company

11 January 2021

Armadale Capital Plc

('Armadale' or 'the Company')

Mahenge Natural Flake Graphite Testing Confirms Suitability For

Use In Lithium-Ion Battery Anodes

Armadale Capital plc the AIM quoted investment group focused on

natural resource projects in Africa, is pleased to report that the

results of the phase one test work undertaken on natural flake

graphite from Armadale's 100%-owned Mahenge Graphite Project in

south-east Tanzania ("Mahenge") have determined Mahenge graphite to

be suitable for use in lithium-ion batteries commonly used in the

exponentially evolving energy and high-tech sectors including the

rapidly growing electric vehicle battery market.

Armadale Chairman, Nick Johansen, commented:

"To have positive confirmation from Australia's Commonwealth

Scientific and Industrial Research Organisation that Armadale's

natural flake graphite from our Mahenge graphite project is

suitable for use in lithium-ion batteries is very welcome news

indeed; we are delighted to positively progress this testing

collaboration with CSIRO's world-class specialist battery team to

confirm the Mahenge natural flake graphite as a premium quality

product with the exceptionally high purity and characteristics

necessary for the lithium-ion battery market.

A great deal of technical analysis and testing has been carried

out in this initial phase of work in CSIRO's state-of-the-art

laboratories and these results justify carrying on to the more

advanced levels of testing work including micronising and

classification; spheronising; and electrode fabrication and

testing. I cannot emphasise enough how valuable this technical data

relating to the characteristics of Mahenge's natural flake graphite

is for Armadale and its shareholders in marketing this exceptional

high-quality graphite project and also in putting the Company in a

strong position to close out potential binding off take discussions

which have already been initiated with a number of selected

parties.

In terms of the graphite market itself, with commonly accepted

market perceptions of global cultural shifts towards the 'green

economy' and especially with huge demand forecasts from the

electrification of vehicles, we are of the strong opinion that

exponential demand growth for graphite will continue and are poised

to capitalise upon this momentum. Armadale has proved an

exceptionally high-quality project with compelling economics and

our timing for production coming online could be perfect. With a

number of key value-adding workstreams in flight including project

finance we look forward to 2021 being a year to remember for the

Company and its shareholders."

CSIRO Testing Process

HIGHLIGHTS

Armadale engaged CSIRO which is the Australian Governments

scientific and industrial research organisation at their facility

in Melbourne to undertake both physical characterisation and

electrochemical testing of the natural graphite flake from the

deposit for potential use in Lithium-ion batteries.

As part of that testing, two flake sizes have been characterised

and fabricated into electrodes to determine the influence of flake

size on electrode performance.

The initial characterisation work has been based on unpurified

graphite and includes

* Particle sizing

* XRF and XED analysis

* SEM analysis

For the electrochemical analysis, samples of 25 and 38 micron

flake graphite were separately processed to produce test coin cells

by the following general method.

* Slurry the sample with solvent and binder

* Coating a foil substrate

* Produce coin cells with appropriate electrolyte

The coin cells were then subject to electrochemical data

analysis including a series of charge and discharge cycles and

demonstrated good efficiency and cycling performance for unpurified

non spheronised flake graphite.

Based on the results to date the Mahenge Natural Flake Graphite

is considered suitable for use in lithium-ion battery anodes.

Further the results would justify proceeding to the next level of

test work including

* Micronising and classification

* Spheronising

* Purification

* Coating

* Electrode fabrication and testing

The results of this round of testing are highly encouraging.

Natural flake graphite for use in Lithium-ion batteries has

significant environmental benefits when compared to artificial

graphite.

The Mahenge graphite deposit can potentially provide a good

source of exceptionally high-grade natural flake graphite, and be a

valuable export commodity for Tanzania.

The information communicated in this announcement contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) No. 596/2014.

**ENDS**

Enquiries:

Armadale Capital Plc

Nick Johansen, Non-Executive Director

Tim Jones, Company Secretary +44 (0) 20 7236 1177

Nomad and broker: finnCap Ltd

Christopher Raggett / Teddy Whiley +44 (0) 20 7220 0500

Joint Broker: SI Capital Ltd

Nick Emerson +44 (0) 1483 413500

Notes

Armadale Capital Plc is focused on investing in and developing a

portfolio of investments, targeting the natural resources and/or

infrastructure sectors in Africa. The Company, led by a team with

operational experience and a strong track record in Africa, has a

strategy of identifying high growth businesses where it can take an

active role in their advancement.

The Company owns the Mahenge Liandu graphite project in

south-east Tanzania, which is now its main focus. The Project is

located in a highly prospective region with a high-grade JORC

compliant Indicated and inferred mineral resource estimate of

59.48Mt @ 9.8% TGC, making it one of the largest high-grade

resources in Tanzania, and work to date has demonstrated Mahenge

Liandu's potential as a commercially viable deposit with

significant tonnage, high-grade coarse flake and near surface

mineralisation (implying a low strip ratio) contained within one

contiguous ore body.

Other assets Armadale has an interest in, include the Mpokoto

Gold project in the Democratic Republic of Congo and a portfolio of

quoted investments.

More information can be found on the website

www.armadalecapitalplc.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDDKDBQKBKDCDD

(END) Dow Jones Newswires

January 11, 2021 06:00 ET (11:00 GMT)

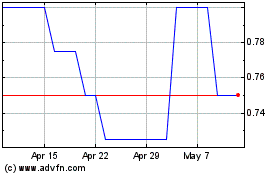

Armadale Capital (LSE:ACP)

Historical Stock Chart

From Dec 2024 to Jan 2025

Armadale Capital (LSE:ACP)

Historical Stock Chart

From Jan 2024 to Jan 2025