Armadale Capital PLC ESIA Approval from NEMC of Tanzania (9491T)

March 30 2021 - 3:58AM

UK Regulatory

TIDMACP

RNS Number : 9491T

Armadale Capital PLC

30 March 2021

Armadale Capital Plc / Index: AIM / Epic: ACP / Sector:

Investment Company

30 March 2021

Armadale Capital Plc

('Armadale' or 'the Company')

ESIA Approval from NEMC of Tanzania

Armadale Capital plc, the AIM quoted investment group focused on

natural resource projects in Africa, is pleased to report that the

National Environment Management Council ('NEMC') of Tanzania has

formally granted approval of the Company's Environmental and Social

Impact Assessment ('ESIA') for the production of natural flake

graphite from Armadale's 100%-owned Mahenge Graphite Project

('Mahenge Liandu') in south-east Tanzania.

The ESIA is the final necessary step in the Mining Licence

application process and now that it has been approved by the NEMC

it is now being submitted to the Department of Energy and Minerals

to complete the mining licence application process.

Armadale Chairman, Nick Johansen, commented:

"We are extremely pleased with the formal approval of the ESIA

by the Tanzanian National Environment Management Council. An

important milestone for Armadale as a company as it is a final

essential step prior to being able to be granted the full Mining

Licence by the Department of Energy and Minerals .

Armadale has made considerable progress over this past year

continually making steps forward in derisking Mahenge Liandu to

advance through development towards production at a time where

global demand for graphite products is set to rise exponentially

especially in spherical graphite manufacturing for the EV

market.Our recent successful testwork in both Chinese and

Australian labs have demonstrated encouraging results that high

purity graphite concentrate from our Project is suitable for the

battery anode market.

Armadale management are fully aligned with shareholders and we

continue to make progress for all shareholders in driving value by

moving through development towards production. A great deal of

important work is being carried out in individual workstreams

relating to testing, offtake, financing and the detailed design

engineering and this will continue throughout 2021. We look forward

to updating shareholders across workstreams with regularity

throughout the year at a time where there is considerable focus and

demand by heigh-quality graphite projects."

Board Changes:

Mr Steve Mahede has resigned from the board of directors of the

Company with effect from 31 March 2021. Since joining the board in

August 2016 Mr Mahede has made a significant contribution to the

Company and has been a key part of advancing Armadale's key asset,

the Mahenge Liandu Graphite Project, from an early stage

exploration project to an advanced development project. Mr Mahede

has made himself available for consultation with the Company over

the coming months in order to ensure an orderly transition.

The board is initiating a process to review its composition and

consider suitable candidates for the vacancies made recently.

The information communicated in this announcement contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) No. 596/2014.

**ENDS**

Enquiries:

Armadale Capital Plc

Nick Johansen, Non-Executive Director

Tim Jones, Company Secretary +44 (0) 20 7236 1177

Nomad and broker: finnCap Ltd

Christopher Raggett / Teddy Whiley +44 (0) 20 7220 0500

Joint Broker: SI Capital Ltd

Nick Emerson +44 (0) 1483 413500

Notes

Armadale Capital Plc is focused on investing in and developing a

portfolio of investments, targeting the natural resources and/or

infrastructure sectors in Africa. The Company, led by a team with

operational experience and a strong track record in Africa, has a

strategy of identifying high growth businesses where it can take an

active role in their advancement.

The Company owns the Mahenge Liandu graphite project in

south-east Tanzania, which is now its main focus. The Project is

located in a highly prospective region with a high-grade JORC

compliant Indicated and inferred mineral resource estimate of

59.48Mt @ 9.8% TGC, making it one of the largest high-grade

resources in Tanzania, and work to date has demonstrated Mahenge

Liandu's potential as a commercially viable deposit with

significant tonnage, high-grade coarse flake and near surface

mineralisation (implying a low strip ratio) contained within one

contiguous ore body.

Other assets Armadale has an interest in, include the Mpokoto

Gold project in the Democratic Republic of Congo and a portfolio of

quoted investments.

More information can be found on the website

www.armadalecapitalplc.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCVBLBXFXLEBBZ

(END) Dow Jones Newswires

March 30, 2021 04:58 ET (08:58 GMT)

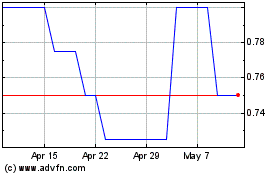

Armadale Capital (LSE:ACP)

Historical Stock Chart

From Dec 2024 to Jan 2025

Armadale Capital (LSE:ACP)

Historical Stock Chart

From Jan 2024 to Jan 2025