AEW UK REIT plc: Asset Sale (1156153)

December 18 2020 - 1:00AM

UK Regulatory

AEW UK REIT plc (AEWU)

AEW UK REIT plc: Asset Sale

18-Dec-2020 / 07:00 GMT/BST

Dissemination of a Regulatory Announcement, transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

18 December 2020

****************

AEW UK REIT plc (the "Company")

Asset Sale Announcement

The Company is pleased to announce that it has unconditionally exchanged

contracts for the sale of Sandford House, Homer Road, Solihull for the price

of GBP10.5 million.

The sale price crystallises significant profit by exceeding both the

valuation level immediately prior to the sale by over 9% and the acquisition

price by 94%. The asset was acquired in August 2015 for GBP5.4 million and has

been fully let to the Secretary of State for Communities and Local

Government since this time producing a net income yield against the purchase

price of 9.6%. The Company had invested no further capital in the asset

during its hold period.

A new 15-year lease agreement was signed with the tenant in July 2020, which

increased the rental income received from the asset by 30%. The lease also

provides for five yearly open market rent reviews and a tenant break option

at year 10. The tenant intends to carry out a major refurbishment of the

property over the coming weeks.

The sale is due to complete on 1 February 2021 and the Company will receive

income from the asset until this date. Subsequent to this, the Investment

Manager intends to reinvest sale proceeds on behalf of the Company and has

identified an attractive pipeline of suitable assets.

Commenting on the sale, Alex Short and Laura Elkin, Portfolio Managers of

AEW UK REIT said, "The completion of the sale of this property will deliver

to the Company an IRR in excess of 20% which, particularly at the current

time, highlights the defensive nature of the Company's strategy. Seeking

mispriced assets has been a feature of the strategy since IPO and this

example demonstrates well how shorter income assets in prime locations can

be used to create value for shareholders over the long run."

For further information, please contact:

AEW UK

Alex Short alex.short@eu.aew.com

+44(0) 20 7016 4848

Laura Elkin laura.elkin@eu.aew.com

+44(0) 20 7016 4869

Nicki Gladstone nicki.gladstone-ext@eu.aew.com

+44(0) 7711 401 021

Company Secretary aewu.cosec@linkgroup.co.uk

Link Company Matters Limited +44(0) 7867 467 624

TB Cardew aew@tbcardew.com

Ed Orlebar +44 (0) 7738 724 630

Tania Wild +44 (0) 7425 536 903

Lucas Bramwell +44 (0) 7939 694 437

Liberum Capital

Gillian Martin / Owen Matthews +44 (0) 20 3100 2000

Notes to Editors

About AEW UK REIT

AEW UK REIT plc (LSE: AEWU) aims to deliver an attractive total return to

shareholders by investing predominantly in smaller commercial properties

(typically less than GBP15 million), on shorter occupational leases in strong

commercial locations across the United Kingdom. The Company was listed on

the Official List of the UK Listing Authority and admitted to trading on the

Main Market of the London Stock Exchange on 12 May 2015, raising GBP100.5m.

Since IPO it has raised a further GBP58m.

The Company is currently invested in office, retail, industrial and leisure

assets, with a focus on active asset management, repositioning the

properties and improving the quality of the income stream.

AEWU is currently paying an annualised dividend of 8p per share.

www.aewukreit.com [1] [1]

About AEW UK Investment Management LLP

AEW UK Investment Management LLP employs a well-resourced team comprising 26

individuals covering investment, asset management, operations and strategy.

It is part of AEW Group, one of the world's largest real estate managers,

with &euro68.9bn of assets under management as at 30 September 2020. AEW has

over 700 employees, with its main offices located in Boston, London, Paris

and Hong Kong and offers a wide range of real estate investment products

including comingled funds, separate accounts and securities mandates across

the full spectrum of investment strategies. The Investment Manager is a

50:50 joint venture between the principals of the Investment Manager and

AEW. In May 2019, AEW UK Investment Management LLP was awarded Property

Manager of the Year at the Pensions and Investment Provider Awards.

www.aewuk.co.uk [2]

LEI: 21380073LDXHV2LP5K50

ISIN: GB00BWD24154

Category Code: MSCM

TIDM: AEWU

LEI Code: 21380073LDXHV2LP5K50

OAM Categories: 3.1. Additional regulated information required to be

disclosed under the laws of a Member State

Sequence No.: 89911

EQS News ID: 1156153

End of Announcement EQS News Service

1: https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=redirect&url=9220892e63355ca6947a3a3423a3bac8&application_id=1156153&site_id=vwd&application_name=news

2: https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=redirect&url=3dcece580bf8b63de6000dcaabfd645a&application_id=1156153&site_id=vwd&application_name=news

(END) Dow Jones Newswires

December 18, 2020 02:00 ET (07:00 GMT)

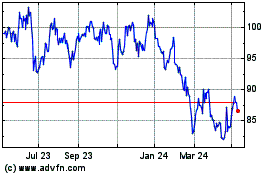

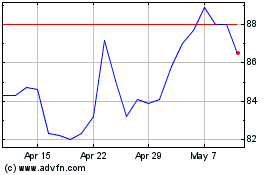

Aew Uk Reit (LSE:AEWU)

Historical Stock Chart

From Jan 2025 to Feb 2025

Aew Uk Reit (LSE:AEWU)

Historical Stock Chart

From Feb 2024 to Feb 2025