TIDMAQSG

RNS Number : 6804H

Aquila Services Group PLC

28 November 2022

For immediate release

28 November 2022

Aquila Services Group plc

Unaudited Interim Results for the six months ended 30 September

2022

Aquila Services Group plc ("the Company"), is the holding

company for Altair Consultancy and Advisory Services Ltd

("Altair"), Aquila Treasury and Finance Solutions Ltd ("ATFS") and

Oaks Consultancy Ltd ("Oaks") which form the Group ("the

Group").

The Group works in the UK and internationally. Its expertise is

in the provision, financing and management of affordable housing by

housing associations, local authorities, government agencies and

other non-profit organisations, high level business advice to the

property sector and support for organisations including

multi-academy education trusts and sports foundations working in

communities to improve health and well-being opportunities.

Results Highlights

6 Months 6 months to Year ended

to 30 Sept 2021 31 March

30 Sept 2022 (unaudited) 2022 (audited)

(unaudited)

GBP'000 GBP'000 GBP'000

Revenue 5,874 4,855 10,119

Gross profit 1,078 1,055 2,206

Operating profit 302 304 718

Profit after tax 244 247 579

Earnings per share 0.61p 0.62p 1.45p

Cash balances 1,718 1,886 2,193

Total dividend payable 0.25p 0.20p 0.60p

Dividend

The directors propose an interim dividend of 0.25p (2021:

0.20p). This will be paid on 20 December 2022 to shareholders on

the register at 9 December 2022.

A copy of the interim results will be available from the

Company's website:

https://aquilaservicesgroup.co.uk/investor-information

This announcement includes inside information as defined in

Article 7 of the Market Abuse Regulation No. 596/2014 as it forms

part of UK Domestic Law by virtue of the European Union

(Withdrawal) Act 2018 ("UK MAR").

For further information please visit

www.aquilaservicesgroup.co.uk or contact:

Aquila Services Group plc

Claire Banks

Claire.banks@aquilaservicesgrp.co.uk

Group Finance Director and Company Secretary

Tel: 020 7934 0175

Beaumont Cornish Limited, Financial Adviser

roland@b-cornish.co.uk

Roland Cornish

Tel: 020 7628 3396

Chair's statement

Dear Shareholder,

I am pleased to present the half-yearly report and the interim

results for the six months to 30 September 2022.

Aquila Services Group plc ("the Company") is the holding company

for Altair Consultancy & Advisory Services Ltd ("Altair"),

Aquila Treasury & Financial Solutions Ltd ("ATFS") and Oaks

Consultancy Ltd ("Oaks") which form the Group ("the Group").

The Group is an independent consultancy specialising in the

provision, financing, and management of affordable housing by

housing associations, local authorities, government agencies and

other non-profit organisations. The Group also provides high level

business advice to the commercial property sector and support for

organisations including multi-academy education trusts and sports

foundations, working in communities to improve health and

well-being opportunities.

The services provided by the Group are embedded in the

activities which are or should be a necessary requirement of a

responsible society. We assist our clients whether public, private

or NGO's in assisting organisations and communities in the delivery

of better housing options, education and funding opportunities for

schools and charities through our professional expertise. The Group

has a responsibility to ensure that our consultants and advisors

provide high quality services that are founded in both experience,

technical expertise and are value for money. These services embrace

an agenda that includes contributions to addressing inequalities

and reducing or reversing the impact of climate change.

The six months under review have overseen the transition from

managing the business during a pandemic to taking advantage of our

growth agenda. Increased demand has seen turnover grow by over 20%

when comparing the current period to the same period last year. To

support this expansion in certain areas of the business we have

recruited a number of senior-level consultants with specific skills

and to facilitate retention in a highly competitive marketplace

have also reviewed and enhanced our reward packages. In addition to

direct recruitment costs the period under review has seen

investment in both induction and client relationship time to ensure

the success of these new appointments.

Supplementing this expansion of senior appointments, we continue

to invest in our staff, believing in our 'grow your own' programme

with in-house and external training including offering management

development courses for all our aspiring managers. We have

successfully recruited to the second year of our graduate

programme, which continues to be an essential part of our medium

term strategy. Taken together this investment in the future has

increased direct costs so that operating profit remains at the same

level as the comparable period.

I am pleased to report that turnover for the six months ended 30

September 2022 was GBP5.9m (30 September 2021 GBP4.9m), earnings

before tax were GBP302k (30 September 2021 GBP304k) and net current

assets including cash of GBP1.7m continues to be strong at GBP2.7m

(30 September 2021 GBP2.4m including cash of GBP1.9m).

The Directors have declared an interim dividend of 0.25p per

share (interim 30 September 2021 0.20p per share), an increase of

25% which will be paid on 20 December 2022 to shareholders on the

register at 9 December 2022. This increase reflects the progressive

dividend strategy of the Group going forward.

The results for the half year are encouraging given the

transition that was needed as the pandemic restrictions were

lifted, moving delivery to reflect the requirements of clients

which included more on-site working as well as continued virtual

engagement. This had to be balanced with increased recruitment and

training responsibility for members of the Executive team.

Not all the sectors we work in have opened up at the same pace.

The housing and sporting sectors have moved ahead faster than

education and international though both the latter are now showing

early signs of recovery. Despite the travails of the world economy

especially the tragedy of the Ukraine invasion and the confused

domestic political, economic and fiscal environment we continue to

see opportunities for growth in our business sectors. To take

advantage of these we need to continue our investment in

consultancy resources and into our development of digital

platforms.

A successful future for the Group is achieved by ensuring that

there is a continuing balance between investment in service

provision, growing reserves to ensure the Group continues to be

financially resilient and enhancing returns to shareholders such as

through the progressive dividend policy. Current business trends

give us confidence that we have the resources and strategies in

place to continue to grow and meet all three objectives.

The Group works with organisations and agencies whose objectives

are those of social responsibility in enhancing the life

opportunities of their communities. For us to support our clients

both efficiently and successfully we must share those objectives

and understand the needs of both clients and their constituents. We

want everybody who works for us, with us and those that support us,

including our shareholders, to join our clients in being proud of

what is being achieved.

Derek Joseph - Chair

25 November 2022

Management report

The Management of the Group are pleased to present their report

for the period ended 30 September 2022.

Aquila at a Glance

Aquila Services Group plc ('the Company') is the holding company

for Altair Consultancy and Advisory Services Ltd ('Altair'), Aquila

Treasury and Financial Solutions Ltd ('ATFS') and Oaks Consultancy

Ltd ('Oaks') which form the group ('the Group').

The Group continues to implement its business strategy to

encompass all the professional consultancy services that the

Group's client base demands. The Group now provides advice and

support across the affordable housing, regeneration, sport, charity

and education sectors. Its purpose is to assist organisations that

benefit local communities such as housing associations, local

authorities, government agencies, multi-academy trusts, charities,

other non-profit organisations and those set up for community

benefit, as well as providing related high-level business advice to

the commercial property sector.

Business performance and position

Altair Consultancy and Advisory Services Ltd ("Altair")

Altair is a specialist management consultancy company that works

with organisations that govern, manage, regulate or build housing.

Operating within the UK and Europe, its international client base

is increasing with continuing and new contracts in Africa and

investment in expansion into Asia.

The services that Altair offers cover housing development and

regeneration, property asset management, health and safety

compliance and building safety advice, strategic financial advice,

governance and risk management, executive and non-executive

recruitment. Our digital, transformation and people services and

our technical asset team are areas of continued significant

investment and growth.

Clients contract with Altair on a fixed-fee basis, through

retained contracts in our finance, governance and transformation

business streams, and placements for members of the property team,

and increasingly for our transformation team, at client sites.

The first half of the year has seen significant growth,

specifically in our technology, transformation and people business

stream where we have been successful in winning further large-scale

projects with housing associations wishing to transform their

businesses in a post-COVID world where different working practices

have been developed and the infrastructure now needs to change to

reflect this. We have continued to invest in this growing team,

both with permanent and associate consultants.

We have further invested in our technical team, dealing with

health and safety compliance, building safety and asset management.

Our partnership with Cadline Ltd to develop a digital Building

Information Management-aligned tool, DynamicAIM, has led to a

number of pilot projects being implemented within our client base.

All organisations need to hold digital records of their buildings

over 18 metres as required by the Building Safety Act 2022 and

indications are that this may be rolled out on a wider basis to

smaller buildings in coming regulatory updates. We are leading the

way in developing a digital tool and will continue to invest in

this important area of building safety.

There continues to be demands for our property team, both

assisting Registered Providers and Local Authorities in their

development and regeneration programmes. Our digital appraisal

model Podplan has had further success with circa 40 clients now

using the model.

Our international work is returning and we have won new

contracts in Burkina Faso and Rwanda. With the ongoing housing

crisis in many developing countries, some caused by climate change,

we continue to develop our products and services for these

markets.

Governance and finance continue to be resilient and our teams

are delivering work across the United Kingdom and Republic of

Ireland. We have won the first merger advisory piece of work in the

Republic of Ireland which will provide the template for future

partnerships.

We expect to see a return on the investment in employees in the

second half of the year. The uncertain economic and policy

landscape will provide further opportunities for us to further

support our clients across the entirety of their business.

Aquila Treasury and Financial Solutions Ltd ("ATFS")

ATFS is a specialist treasury management consultancy authorised

and regulated by the Financial Conduct Authority that operates

across the UK and Europe. It provides advice on treasury policy and

strategy, debt and capital market finance, banking and card

merchant services, value for money, and financial market

information services to local authorities, charities, housing

associations, education bodies, private sector housing providers

and government bodies.

Work is delivered through fixed price contracts as retained

general treasury advisers and information subscription agreements.

Specific advisory project contracts are on a fixed fee basis, won

through competitive procurement tenders, payable on agreed project

milestones.

Following the retirement of the Chief Executive at the end of

the financial year we have recruited a Corporate Finance Director

to lead the team and further develop its products to reflect the

changing landscape, including a new ESG offering.

The housing business in England continues to perform in-line

with expectations and the next half should see further improvement

in this position. Competitive pressures have slowed the work in

Scotland and we are refining our offering to be able to ensure a

stronger second half.

The debt advisory work within the education sector continues to

be challenging and we have increased our marketing and relationship

management across this area. The card services business has seen a

successful transition following the retirement of the previous

director and we continue to be a leader in this area.

Oaks Consultancy Limited ("Oaks")

Oaks is a specialist sports, charity, statutory and education

consultancy operating within the UK and Europe with an increasing

international presence. Oaks' clients include national and

international sports teams and governing bodies, national and

international charities, statutory organisations and local

authorities, multi academy trusts and teaching school alliances,

housing associations and corporate businesses.

Oaks provides consultancy advice and guidance on strategy and

business planning, organisational and cultural change programmes,

impact measurement, together with implementation support in

relation to income generation and diversification. Contracts

are

delivered through a mix of fixed-fee projects and retained

contracts for general advisory services.

The sports and charities sector have proved to be resilient and

provided Oaks with a strong start to the year. The Education sector

continues to be challenging and the business has reviewed its

offering in this area to reflect the changed economic environment.

We anticipate this continuing into the second half. To

counter-balance this the work in the charities sector has grown,

providing strategic advice to national charities as well as

fund-raising opportunities to smaller organisations.

Advice to the sports sector continues to be the central pillar

of Oaks work. The UEFA contracts within Europe have continued and

grown and being able to travel has meant that work can be delivered

in-country. The large number of Sports Foundations have provided

sustainable projects on and retainers for the delivery of their

community projects plus assisting them in raising the necessary

funds.

In addition to its current European profile, Oaks is delivering

commissions in the USA through its Laureus relationship and is

exploring further international opportunities.

Cross-group working continues, specifically within the housing

sector and this will provide opportunities for further growth.

Investments

The Group continues to hold a 5.3% equity stake in AssetCore, a

company building a financial debt management platform for the

affordable housing sector.

Group-wide initiatives

Green Group

The objective of the Green Group is to reduce the Group's

environmental impact, to maintain Carbon Neutral Plus status and

develop further initiatives to mitigate the Group's impact on the

environment.

EDI Group

The purpose of the Equality Diversity and Inclusion (EDI) Group

is to drive the EDI agenda across subsidiaries including developing

frameworks and raising awareness for the implementation of a range

of initiatives to foster a culture of equality, diversity and

inclusion at Aquila.

Further information about, and activities within the groups, is

available on the website.

Outlook

The strong performance and investment in the first half has

positioned the Group well for the second half of the year being

reported.

Challenges remain with the uncertain economic outlook and the

cost-of-living pressures which affects clients and colleagues

alike. We have reviewed and invested in those areas that will help

organisations through this period to ensure there is potential for

continued growth across the Group.

The focus on technology, transformation, building safety and

asset management in the housing sector should provide a significant

return on the investment in the first half of the year. The changes

in Government and the economic pressures, including the recent

announcement in the Autumn Statement capping social housing rents

at 7% (the previously agreed rent formula would have meant a rent

increase of 11.1%), will mean significantly reduced income for

these organisations. This will require changes to their operating

model, development and investment programmes, and some will need to

seek partnerships and mergers for their long-term future. The Group

is positioned well to respond to these pressures.

There continues to be opportunities within the sports and

charities sectors for raising funds through grant awards during

this time of 'economic squeeze' which in turn provides the platform

for further work on developing and changing strategies to ensure a

robust future for our clients.

Our changed approach to delivering treasury advice into the

housing and education sectors is leading to new contracts and the

increasing importance of ESG across all sectors gives the Group the

opportunity to provide advice to new and existing clients.

Going concern basis

The Board updates its three-year business plan annually. This

includes a review of the Company's cash flows and other key

financial ratios over the period. These metrics are subject to

sensitivity analysis which involves flexing a number of the main

assumptions underlying the forecast, both individually and in

unison. Where appropriate, this analysis is carried out to evaluate

the potential impact of the Company's principal risks. The

three-year review also makes certain assumptions about the normal

level of capital investment likely to occur and considers whether

additional financing facilities will be required.

The Group does not have any bank debt and remains in a strong

cash position with balances at the end of September 2022 at GBP1.7m

and net current assets at GBP2.7m.

The Directors continue to review the forecasts on a monthly

basis applying stress tests to the reforecasts to ensure viability

of the outputs. The Group continue to monitor cash balances,

debtors and cash generation on a daily basis. Based on the results

of these analyses, the Directors have a reasonable expectation that

the Company will be able to continue in operation and meet its

liabilities as they fall due in the next twelve months and over the

three-year period of their assessment.

Risks and uncertainties

The key risks and uncertainties relating to the Group's

operations remain largely consistent with those disclosed in the

Group's Annual Report and Accounts for the year ended 31 March

2022. These are listed below:

-- Financial risk

-- Unfavourable economic conditions and/or changes to government policy

-- Competition

-- Staff skills, retention, recruitment and succession

-- Data governance

The Group seeks to mitigate all these risks through ensuring

that it monitors changes in statutory, regulatory and financial

requirements and maintains good relationships with its clients,

principal contacts within government, regulators and other key

influencers within the sector. The Group is well placed to provide

the full range of services needed by its clients as the external

environment changes.

A detailed explanation of the risks relevant to the Group is on

Page 22 of the Annual Report and Accounts for the year ended 31

March 2022 and is available on the Company's website at

www.aquilaservicesgroup.co.uk .

Fiona Underwood - Executive Director

25 November 2022

Directors' report

Responsibility Statement

The Directors, whose names and functions are set out at the end

of this report, are responsible for preparing the Unaudited Interim

Condensed Consolidated Financial Statements in accordance with the

Disclosure Guidance and Transparency Rules of the United Kingdom's

Financial Conduct Authority ("DTR") and with International

Accounting Standard 34 on Interim Financial reporting ("IAS 34").

The Directors confirm that, to the best of their knowledge, this

Unaudited Interim Condensed Consolidated Report has been prepared

in accordance with UK-adopted International Accounting Standard 34.

The interim management report includes a fair review of the

information required by DTR 4.2.7 and DTR 4.2.8 namely:

-- an indication of key events occurred during the period and

their impact on the Unaudited Interim Condensed Consolidated

Financial Statements and a description of the principal risks and

uncertainties for the second half of the financial year; and

-- material related party transactions that have taken place

during the period and that have materially affected the financial

position or the performance of the business during that period.

Remuneration of Directors and key management personnel

The remuneration of the key management personnel of the Group,

including all directors of subsidiary companies, is set out below

in aggregate for each of the categories specified in IAS 24 Related

Party Disclosures.

6 months to 6 months to Year ended

30 September 30 September 31 March

2022 (unaudited) 2021 (unaudited) 2022

(audited)

GBP'000 GBP'000 GBP'000

Wages and salaries 499 580 1,189

Share-based payments 5 (7) (7)

Post-retirement benefits 24 24 49

------------------ ------------------ ------------

528 597 1,228

================== ================== ============

Claire Banks - Group Finance Director

25 November 2022

Condensed Consolidated Statement of Comprehensive Income

For the six months ended 30 September 2022

Six months to 30 September 2022 Six months to 30 September 2021 Year ended

31 March

2022

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Revenue 5,874 4,855 10,119

Cost of sales (4,796) (3,800) (7,913)

-------------------------------- -------------------------------- -----------

Gross profit 1,078 1,055 2,206

Administrative expenses (776) (751) (1,488)

-------------------------------- -------------------------------- -----------

Operating profit 302 304 718

Income tax expense (58) (57) (139)

-------------------------------- -------------------------------- -----------

Profit for the period 244 247 579

================================ ================================ ===========

Earnings per share attributable to

owners of the parent

Weighted average number of shares: '000 '000 '000

* Basic 39,962 39,962 39,962

* Diluted 41,016 41,153 41,153

Basic earnings per share 0.61p 0.62p 1.45p

Diluted earnings per share 0.60p 0.60p 1.41p

Condensed Consolidated Statement of Financial Position

As at 30 September 2022

30 September 2022 30 September 2021 31 March

2022

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Non-current assets

Goodwill 3,317 3,317 3,317

Right of use assets 229 317 273

Property, plant and equipment 50 32 40

Investments 71 71 71

------------------ ------------------ ----------

3,667 3,737 3,701

Current assets

Trade and other receivables 2,574 2,110 2,593

Cash and bank balances 1,718 1,886 2,193

------------------ ------------------ ----------

4,292 3,996 4,786

Current liabilities

Trade and other payables 1,266 1,380 1,917

Lease liabilities 89 85 88

Corporation tax 222 157 144

1,577 1,622 2,149

Net current assets 2,715 2,374 2,637

------------------ ------------------ ----------

Non-current lease liabilities 150 241 196

Net assets 6,232 5,870 6,142

================== ================== ==========

Equity

Share capital 1,998 1,998 1,998

Share premium account 1,712 1,712 1,712

Merger reserve 3,042 3,042 3,042

Share-based payment reserve 358 396 415

Retained losses (878) (1,278) (1,025)

------------------ ------------------ ----------

Equity attributable to the owners of the parent 6,232 5,870 6,142

Condensed Consolidated Statement of Changes in Equity

Share Share based

Share premium Merger payment Retained Total

capital account reserve reserve losses equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at

1 April 2021 1,998 1,712 3,042 580 (1,537) 5,795

Transfer on

reserves - - - (172) 172 -

Total comprehensive

income - - - - 247 247

Share based

payment charge - - - (12) - (12)

Dividend - - - - (160) (160)

Balance at

30 September

2021 1,998 1,712 3,042 396 (1,278) 5,870

-------- -------- -------- ------------ --------- --------

Transfer on

reserves - - - (1) 1 -

Total comprehensive

income - - - - 332 332

Share based

payment charge - - - 20 - 20

Dividend - - - - (80) (80)

Balance at

31 March 2022 1,998 1,712 3,042 415 (1,025) 6,142

Transfer on

reserves - - - (63) 63 -

Total comprehensive

income - - - - 244 244

Share based

payment charge - - - 6 - 6

Dividend - - - - (160) (160)

Balance at

30 September

2022 1,998 1,712 3,042 358 (878) 6,232

======== ======== ======== ============ ========= ========

Condensed Consolidated Statement of Cash Flows

for the six months ended 30 September 2022

Six months to 30 September Six months to 30 September Year ended

31 March

2022 2021 2022

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Cash flow from operating activities

Profit for the period 244 247 579

Income tax expense 58 57 139

Share based payment charge 6 (12) 8

Depreciation 59 56 118

--------------------------- --------------------------- -----------

Operating cash flows before movement in

working capital 367 348 844

Decrease/(increase) in trade and other

receivables 19 163 (320)

(Decrease) in trade and other payables (652) (549) (12)

--------------------------- --------------------------- -----------

Cash generated by operations (266) (38) 512

Income taxes refunded/(paid) 20 11 (84)

Net cash (outflow)/inflow from operating

activities (246) (27) 428

Cash flows from investing activities

Purchase of property, plant and equipment (25) (11) (37)

Net cash (outflow) from investing activities (25) (11) (37)

Cash flows from financing activities

Lease liability payments (44) (43) (85)

Dividends paid (160) (160) (240)

Net cash (outflow) from financing activities (204) (203) (325)

Net (decrease)/increase in cash and cash

equivalents (475) (241) 66

Cash and cash equivalents at beginning of the

period 2,193 2,127 2,127

--------------------------- --------------------------- -----------

Cash and cash equivalents at end of the period 1,718 1,886 2,193

=========================== =========================== ===========

Notes to the Condensed set of Financial Statements

for the six months ended 30 September 2022

1. General information

The Company and its subsidiaries (together "the Group") are a

major provider of consultancy services to organisations that

develop, fund or manage affordable housing. It provides specialist

housing, sport, education and treasury management consultancy

services.

The Company is a public limited company domiciled in the United

Kingdom and incorporated under registered number 08988813 in

England and Wales. The Company's registered office is Tempus Wharf,

29a Bermondsey Wall West, London, SE16 4SA.

2. Basis of preparation

The Unaudited Condensed Consolidated Interim Financial

Statements of the Group have been prepared on the basis of the

accounting policies, presentation, methods of computation and

estimation techniques used in the preparation of the audited

accounts for the period ended 31 March 2022 and expected to be

adopted in the financial information by the Company in preparing

its annual report for the year ending 31 March 2023.

This Interim Consolidated Financial Information for the six

months ended 30 September 2022 has been prepared in accordance with

UK-adopted International Accounting Standard 34. This Interim

Consolidated Financial Information is not the Group's statutory

financial statements and should be read in conjunction with the

annual financial statements for the year ended 31 March 2022, which

were prepared in accordance with UK-adopted International

Accounting Standards and have been delivered to the Registrar of

Companies. The auditors reported on those accounts; their report

was unqualified, did not include references to any matters to which

the auditors drew attention by way of emphasis of matter without

qualifying their report and did not contain statements under

section 498(2) or (3) of the Companies Act 2006.

The Interim Consolidated Financial Information for the six

months ended 30 September 2022 is unaudited. In the opinion of the

Directors, the Interim Consolidated Financial Information presents

fairly the financial position, and results from operations and cash

flows for the period.

The Directors have made an assessment of the Group's ability to

continue as a going concern and are satisfied that the Group has

adequate resources to continue in operational existence for the

foreseeable future. The Group, therefore, continues to adopt the

going concern basis in preparing its consolidated financial

statements.

The financial statements are presented in sterling, which is the

Group's functional currency as the UK is the primary environment in

which it operates.

3. Operating segments

The Group has two reportable segments being: consultancy, and

treasury management services, the results of which are included

within the financial information. In accordance with IFRS8

'Operating Segments', information on segment assets is not shown,

as this is not provided to the chief operating decision-maker.

The principal activities of the Group are as follows:

Consultancy - a range of services to support the business needs

of a diverse range of organisations across the housing (including

housing associations and local authorities), education and sports

sectors. Most consultancy projects run over one to two months and

on-going business development is required to ensure a full pipeline

of consultancy work for the employed team.

Treasury Management - a range of services providing treasury

advice and fund-raising services to non-profit making organisations

working in the affordable housing and education sectors. Within

this segment of the business several client organisations enter

fixed period retainers to ensure immediate call-off of the required

services.

The accounting policies of the reportable segments are the same

as the Group's accounting policies. Segment profit represents the

profit earned by each segment, without allocation of central

administration costs, including Directors' salaries, finance costs

and income tax expense. This is the measure reported to the Group's

executives for the purpose of resource allocation and assessment of

segment performance.

6 months 6 Months

to 30 Sept to 30 Sept

2022 2021

GBP'000 GBP'000

Revenue from Consultancy 5,647 4,566

Revenue from Treasury Management 227 289

------------ ------------

5,874 4,855

============ ============

Within consultancy revenues, approximately 16% (2021: 8%) has

arisen from the segment's largest customer; within treasury

management 20% (2021: 27%).

Geographical information

Revenues from external customers, based on location of the

customer, are shown below:

6 months 6 months

to 30 Sept to 30 Sept

2022 2021

GBP'000 GBP'000

UK 5,658 4,652

Europe 193 195

Rest of World 23 8

------------ ------------

5,874 4,855

============ ============

4. Share capital

The Company has one class of share in issue being ordinary

shares with a par value of 5p. Allotted, issued and called up

ordinary shares of GBP0.05 each:

Number Amount called up and fully paid

GBP'000

'000

As at 1 April 2021 39,961 1,998

As at 30 September 2021 39,961 1,998

As at 31 March 2022 39,961 1,998

As at 30 September 2022 39,961 1,998

======= ================================

5. Share-based payment transactions

The Company operates an Unapproved Scheme and an Enterprise

Management Incentives Scheme. The total cost recognised in the

period to 30 September 2022 arising from share-based payment

transactions is GBP6k (the credit for the period ended 30 September

2021: GBP12k).

Unapproved scheme Number Weighted average

'000 exercise price

Number of options outstanding at 1 April 171 GBP0.35

2022 and 30 September 2022

=======

The exercise price of the options outstanding at 30 September

2022 is GBP0.35

Number Weighted average

EMI scheme '000 exercise price

Number of options outstanding at 1 April

2022 1,474 GBP0.05

Lapsed during period (169) GBP0.05

Granted during period 931 GBP0.26

Cancelled during period (40) GBP0.26

-------

Number of options outstanding at 30 September

2022 2,196 GBP0.14

-------

Number of options exercisable at 30 September

2022 1,305 GBP0.05

=======

6. Going concern

The Group has sufficient financial resources to enable it to

continue its operational activities for the foreseeable future.

Accordingly, the Directors consider it appropriate to adopt the

going concern basis in preparing these interim accounts.

7. Dividend

An interim dividend of 0.25p will be paid on 20 December 2022 to

shareholders on the register at 9 December 2022 at a cost of

GBP99,905.

8. Related party disclosures

Balances and transactions between the Group and other related

parties are disclosed below:

During the 6 months to 30 September 2022, Derek Joseph, Chair,

was paid GBP11.7k (6 months to September 2021: GBP11.5k) which

includes GBP6.7k (6 months to September 2021: GBP6.5k) of

consultancy fees in relation the Group's International

business.

Richard Wollenberg, non-executive director, accrued fees of

GBP2k (6 months to September 2021: GBP2k). At 30 September 2022,

the balance owed to Richard Wollenberg for services as a

non-executive director was GBP6k (6 months to September 2021:

GBP2k).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EELFLLFLEFBK

(END) Dow Jones Newswires

November 28, 2022 02:00 ET (07:00 GMT)

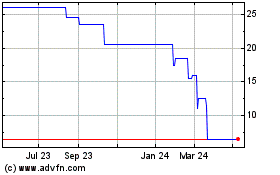

Aquila Services (LSE:AQSG)

Historical Stock Chart

From Dec 2024 to Jan 2025

Aquila Services (LSE:AQSG)

Historical Stock Chart

From Jan 2024 to Jan 2025