TIDMARB

RNS Number : 3024T

Argo Blockchain PLC

14 November 2023

Press Release

14 November 2023

Argo Blockchain plc

("Argo" or "the Company")

Q3 2023 Results

Argo Blockchain plc, a global leader in cryptocurrency mining

(LSE: ARB; NASDAQ: ARBK), is pleased to announce its results for

the quarter ended 30 September 2023.

Financial Highlights ($USD)

-- Accrued $4.4 million in power credits from economic

curtailment at Helios during periods of high electricity prices,

which led to an increase in mining margin from 36% in Q2 2023 to

58% in Q3 2023

-- Decreased average direct cost per Bitcoin mined by 33% from

$17,566 per Bitcoin in Q2 2023 to $11,736 per Bitcoin in Q3

2023

-- Reduced recurring non-mining operating expenses by 11% in Q3

2023 compared to the prior quarter

-- Achieved a positive Adjusted EBITDA of $3.1 million for the

quarter (Adjusted EBITDA of $5.4 million for the nine month period

ending 30 September 2023)

-- Mined a total of 370 Bitcoin and Bitcoin Equivalents

(together, "BTC") during the quarter and generated $10.4 million of

revenue

-- Reduced debt owed to Galaxy Digital from $32 million to $27

million and ended the quarter with $70 million of debt

outstanding

-- Recorded a one-time non-cash charge of $1.2 million related

to prior period sales taxes owed to the Canadian tax authorities

based on new tax regulations

-- Net loss was $9.9 million for Q3 2023

-- The Company ended September 2023 with $8.0 million of cash and 32 BTC on its balance sheet.

Operating Highlights

-- During the quarter, the Company completed the deployment of

its BlockMiner machines, representing approximately 0.3 EH/s in

aggregate across its two Quebec facilities

-- The deployment of the BlockMiner machines increased the

Company's total hashrate capacity to 2.8 EH/s

-- The Company is involved in advanced discussions to sell

certain non-core assets, and it continues to evaluate options for

further reducing debt

Management Commentary

Argo's interim Chief Executive Officer, Seif El-Bakly, said, "I

am pleased with Argo's operating and financial performance during

the third quarter. The ability of our mining machines to curtail

operations at Helios during periods of high electricity prices

allowed us to generate significant power credits. These power

credits enabled us to achieve a fleet-wide all-in direct cost of

3.5 - 4 cents per kilowatt hour for the quarter, which contributed

to a higher mining margin and higher Adjusted EBITDA compared to

the prior quarter."

Q3 Results Management Call

Argo will host a conference call to discuss its results at 10:00

ET / 15:00 GMT on Tuesday, 14 November 2023. The conference call is

open to all existing and potential shareholders, and the live

webcast of the call can be accessed via the Investor Meet Company

platform. Questions can be submitted via the Investor Meet Company

dashboard during the live presentation.

Investors can sign up to Investor Meet Company and add Argo

Blockchain via the following link:

https://www.investormeetcompany.com/argo-blockchain-plc/register-investor

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE LOSS

(UNAUDITED)

Three Three Nine Nine

months months months months

ended ended ended ended

30 Sept 30 Sept 30 Sept 30 Sept

2023 2022 2023 2022

(unaudited) (unaudited) (unaudited) (unaudited)

$USD $'000 $'000 $'000 $'000

-------------------------------------- ------------- ------------- ------------- -------------

Revenues 10,407 13,097 34,403 47,741

Direct costs (8,770) (7,852) (23,863) (18,055)

Power credits 4,426 118 5,710 118

-------------------------------------- ------------- ------------- ------------- -------------

Mining margin 6,063 5,363 16,250 29,804

Depreciation of mining equipment (6,181) (763) (18,228) (14,844)

Change in fair value of digital

currencies (635) (2,491) (146) (57,502)

-------------------------------------- ------------- ------------- ------------- -------------

Gross margin (753) 2,109 (2,124) (42,542)

-------------------------------------- ------------- ------------- ------------- -------------

Operating costs and expenses (3,079) (11,541) (10,942) (23,195)

Restructuring and one-time items (1,526) - (2,925) -

Foreign exchange (144) 2,232 1,259 15,551

Depreciation and amortisation (528) (4,729) (1,179) (5,852)

Share based payment (920) (2,754) (2,809) (6,408)

Operating loss (6,950) (14,683) (18,720) (62,446)

-------------------------------------- ------------- ------------- ------------- -------------

Finance cost (2,763) (2,560) (9,100) (7,071)

Other income 75 (798) 75 (994)

Equity accounted loss from associate (259) - (717) (636)

Revalue of contingent consideration - - - 5,239

-------------------------------------- ------------- ------------- ------------- -------------

Loss before taxation (9,897) (18,041) (28,462) (65,908)

-------------------------------------- ------------- ------------- ------------- -------------

Tax recovery - - 2,321 8,286

Net loss (9,897) (18,041) (26,141) (57,622)

-------------------------------------- ------------- ------------- ------------- -------------

Currency translation reserve 699 (30,792) (863) (36,518)

Equity accounted OCI from associate - 173 - (10,620)

Fair value loss on intangible - 537 - -

digital assets

Total other comprehensive income

(loss) 699 (30,082) (863) (47,138)

-------------------------------------- ------------- ------------- ------------- -------------

Total comprehensive loss (9,198) (48,123) (27,004) (104,760)

-------------------------------------- ------------- ------------- ------------- -------------

Weighted Average Shares outstanding

'000 523,450 477,825 493,201 472,174

Basic earnings per share* $(0.02) $(0.04) $(0.05) $(0.12)

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

(UNAUDITED)

As at As at

30 September 31 December

2023

(unaudited) 2022

(unaudited)

$USD $'000 $'000

-------------------------------------------- -------------- --------------

ASSETS

Non-current assets

Investments at fair value through income

and loss 426 414

Investments accounted for using the equity

method 2,198 2,863

Intangible assets 785 2,103

Property, plant and equipment 63,923 76,992

Right of use assets 526 525

Total non-current assets 67,858 82,897

-------------------------------------------- -------------- --------------

Current assets

Trade and other receivables 8,033 6,802

Digital assets 139 443

Cash and cash equivalents 7,987 20,092

Total current assets 16,159 27,337

-------------------------------------------- -------------- --------------

Total assets 84,017 110,234

-------------------------------------------- -------------- --------------

EQUITY AND LIABILITIES

Equity

Share capital 710 634

Share premium 209,545 202,103

Share based payment reserve 11,321 8,528

Foreign currency translation reserve (29,758) (28,895)

Accumulated surplus (deficit) (194,764) (168,623)

-------------------------------------------- -------------- --------------

Total equity (2,946) 13,747

-------------------------------------------- -------------- --------------

Current liabilities

Trade and other payables 9,802 10,028

Loans and borrowings 13,735 11,605

Deferred tax 3,820 2,648

Total current liabilities 27,357 24,281

-------------------------------------------- -------------- --------------

Non - current liabilities

Deferred tax 4,806 7,941

Issued debt - bond 38,077 37,809

Loans and borrowings 16,180 25,916

Lease liability 543 540

Total non-current liabilities 59,606 72,206

-------------------------------------------- -------------- --------------

Total equity and liabilities 84,017 110,234

-------------------------------------------- -------------- --------------

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS (UNAUDITED)

Nine months ended

30 September

2023

(unaudited)

$USD $'000

--------------------------------------------------- ----------------------

Cash flows from operating activities

Loss before tax (28,462)

Adjustments for:

Depreciation and amortisation 19,407

Foreign exchange movements (1,259)

Finance cost 9,100

Fair value change in digital assets 635

Realised loss in digital assets (489)

Share of equity accounted loss from associate 717

Share based payment expense 2,809

Working capital changes:

Increase in trade and other receivables (4,532)

Decrease in trade and other payables (117)

Decrease in digital assets 306

Net cash flow (used in)/from operating activities (1,885)

--------------------------------------------------- ----------------------

Investing activities

Proceeds from sale of intangibles/investments 989

Purchase of tangible fixed assets (1,590)

Net cash used in investing activities (601)

--------------------------------------------------- ----------------------

Financing activities

Proceeds from borrowings 811

Loan repayments (8,417)

Interest paid (8,015)

Proceeds from shares issued 7,518

--------------------------------------------------- ----------------------

Net cash from (used in)/from financing activities (8,103)

--------------------------------------------------- ----------------------

Net decrease in cash and cash equivalents (10,589)

Effect of foreign exchange changes in cash (1,516)

Cash and cash equivalents, beginning of period 20,092

--------------------------------------------------- ----------------------

Cash and cash equivalents, end of period 7,987

--------------------------------------------------- ----------------------

Non-IFRS Measures

The following table shows a reconciliation of mining margin

percentage to gross margin, the most directly comparable IFRS

measure, for the periods ended 30 September 2023 and 30 September

2022.

Three months Three months Nine months Nine months

ended ended ended ended

30 September 30 September 30 September 30 September

2023 2022 2023 2022

(unaudited) (unaudited) (unaudited) (unaudited)

$USD $'000 $'000 $'000 $'000

-------------------------- ------------- ------------- ------------- -------------

Gross margin (753) 2,109 (2,124) (42,542)

Gross margin percentage (7%) 16% (6%) (89%)

Depreciation of mining

equipment 6,181 763 18,228 14,844

Change in fair value of

digital currencies 635 2,491 146 57,502

Mining margin 6,063 5,363 16,250 29,804

-------------------------- ------------- ------------- ------------- -------------

Mining margin percentage 58% 41% 47% 62%

-------------------------- ------------- ------------- ------------- -------------

The following table shows a reconciliation of Adjusted EBITDA to

net (loss) / income, the most directly comparable IFRS measure, for

the periods ended 30 September 2023 and 30 September 2022.

Three months Three months Nine months Nine months

ended ended ended ended

30 September 30 September 30 September 30 September

2023 2022 2023 2022

(unaudited) (unaudited) (unaudited) (unaudited)

$USD $'000 $'000 $'000 $'000

------------------------------- ------------- ------------- ------------- -------------

Net loss (9,897) (18,041) (26,141) (57,622)

Interest expense 2,763 2,560 9,100 7,071

Depreciation and amortisation 6,709 5,492 19,407 20,696

Income tax - - (2,321) (8,286)

Restructuring and one-time

items 1,526 - 2,925 -

Foreign exchange 144 (2,232) (1,259) (15,551)

Share based payment 920 2,754 2,809 6,408

Change in fair value of

digital currencies 635 2,491 146 57,502

Equity accounting loss

from associate 259 - 717 636

------------------------------- ------------- ------------- ------------- -------------

Adjusted EBITDA 3,059 (6,976) 5,383 10,854

------------------------------- ------------- ------------- ------------- -------------

Inside Information and Forward-Looking Statements

This announcement contains inside information and includes

forward-looking statements which reflect the Company's current

views, interpretations, beliefs or expectations with respect to the

Company's financial performance, business strategy and plans and

objectives of management for future operations. These statements

include forward-looking statements both with respect to the Company

and the sector and industry in which the Company operates.

Statements which include the words "remains confident", "expects",

"intends", "plans", "believes", "projects", "anticipates", "will",

"targets", "aims", "may", "would", "could", "continue", "estimate",

"future", "opportunity", "potential" or, in each case, their

negatives, and similar statements of a future or forward-looking

nature identify forward-looking statements. All forward-looking

statements address matters that involve risks and uncertainties

because they relate to events that may or may not occur in the

future, including the risk that the Company may receive the

benefits contemplated by its transactions with Galaxy, the Company

may be unable to secure sufficient additional financing to meet its

operating needs, and the Company may not generate sufficient

working capital to fund its operations for the next twelve months

as contemplated. Forward-looking statements are not guarantees of

future performance. Accordingly, there are or will be important

factors that could cause the Company's actual results, prospects

and performance to differ materially from those indicated in these

statements. In addition, even if the Company's actual results,

prospects and performance are consistent with the forward-looking

statements contained in this document, those results may not be

indicative of results in subsequent periods. These forward-looking

statements speak only as of the date of this announcement. Subject

to any obligations under the Prospectus Regulation Rules, the

Market Abuse Regulation, the Listing Rules and the Disclosure and

Transparency Rules and except as required by the FCA, the London

Stock Exchange, the City Code or applicable law and regulations,

the Company undertakes no obligation publicly to update or review

any forward-looking statement, whether as a result of new

information, future developments or otherwise. For a more complete

discussion of factors that could cause our actual

results to differ from those described in this announcement,

please refer to the filings that Company makes from time to time

with the United States Securities and Exchange Commission and the

United Kingdom Financial Conduct Authority, including the section

entitled "Risk Factors" in the Company's Annual Report on Form

20-F.

For further information please contact:

Argo Blockchain

Investor Relations ir@argoblockchain.com

---------------------------------------

Tennyson Securities

---------------------------------------

Corporate Broker

Peter Krens +44 207 186 9030

---------------------------------------

Fortified Securities

---------------------------------------

Joint Broker +44 7493 989014

Guy Wheatley, CFA guy.wheatley@fortifiedsecurities.com

---------------------------------------

Tancredi Intelligent Communication argoblock@tancredigroup.com

UK & Europe Media Relations

---------------------------------------

About Argo:

Argo Blockchain plc is a dual-listed (LSE: ARB; NASDAQ: ARBK)

blockchain technology company focused on large-scale cryptocurrency

mining. With mining facilities in Quebec, mining operations in

Texas, and offices in the US, Canada, and the UK, Argo's global,

sustainable operations are predominantly powered by renewable

energy. In 2021, Argo became the first climate positive

cryptocurrency mining company, and a signatory to the Crypto

Climate Accord. For more information, visit www.argoblockchain.com

.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRTFLFVALDLVLIV

(END) Dow Jones Newswires

November 14, 2023 02:00 ET (07:00 GMT)

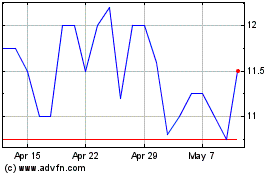

Argo Blockchain (LSE:ARB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Argo Blockchain (LSE:ARB)

Historical Stock Chart

From Apr 2023 to Apr 2024