TIDMASAI

RNS Number : 9867M

ASA International Group PLC

20 September 2023

Press release

ASA International Group plc reports H1 2023 results

Amsterdam, The Netherlands, 20 September 2023 - ASA

International Group plc ('ASA International', the 'Company' or the

'Group'), one of the world's largest international microfinance

institutions, today announces its half-year unaudited results for

the six-month period from 1 January to 30 June 2023 (the

'Period').

Key performance indicators

(UNAUDITED) H1 FY2022 H1 FY2021 YoY YTD YTD % Change

2023 2022

(Amounts in USD % Change % Change (constant

millions) currency)

Number of clients

(m) 2.2 2.3 2.4 2.4 -7% -3%

Number of branches 2,073 2,028 2,129 2,044 -3% 2%

Profit before tax 13.8 46.3 23.8 25.7 -42% -40% -31%

Net profit 3.7 17.9 13.1 6.4 -72% -59% -45%

OLP (1) 334.4 351.2 378.4 403.7 -12% -5% 6%

Gross OLP 346.8 367.5 399.0 430.7 -13% -6% 5%

PAR > 30 days (2) 3.8% 5.9% 5.1% 5.2%

(1) Outstanding loan portfolio ('OLP') includes off-book Business

Correspondence ('BC') loans and Direct Assignment loans, and loans

valued at fair value through the P&L ("FVTPL"), excludes interest

receivable, unamortised loan processing fees, and deducts ECL reserves

from Gross OLP.

(2) PAR>30 is the percentage of on-book OLP that has one or more

instalment of repayment of principal past due for more than 30

days and less than 365 days, divided by the Gross OLP.

H1 2023 highlights

-- The Company's operational performance in constant currency

terms improved compared to the end of 2022, with OLP growing by 6%

in constant currency terms.

-- Operational and financial results decreased in USD terms,

with profit before tax decreasing to USD 13.8 million in H1 2023

from USD 23.8 million in H1 2022.

-- The decline in profits was primarily due to (i) lower

recovery of overdue loans in India, (ii) higher ECL expense of USD

2.8 million charged to the income statement, (iii) significant

devaluations of our operating currencies vis-a-vis the USD in H1

2023 especially in our major markets of Pakistan (down 27%), Ghana

(down 12%), Nigeria (down 70%) and Kenya (down 14%), and (iv)

provision of USD 1.4 million for additional super-tax charged in

Pakistan applied on H1 2023 results and retrospectively on FY 2022

results.

-- Pakistan, the Philippines, Ghana and Tanzania made

significant positive contributions to the Group's net

profitability, due to high loan portfolio quality in all these

markets and no significant currency devaluations in the Philippines

and Tanzania.

-- PAR>30 for the Group's operating subsidiaries improved to

3.8% in H1 2023 from 5.1% in H1 2022, primarily due to the

improving portfolio quality across most markets with the exceptions

of India and Nigeria.

-- The Company increased expected credit losses ('ECL') charged

to the Income Statement to USD 2.8 million (H1 2022: USD 1.9

million and FY 2022: USD 0.6 million), primarily due to (i) low

portfolio quality in India, and (ii) deteriorating portfolio

quality in Nigeria due to the adverse impact on operations from the

national elections and demonetization. Reserves for ECL on OLP in

the Balance Sheet, including the off-book BC portfolio in India and

interest receivables, reduced to USD 13.3 million in H1 2023 from

USD 22.0 million in H1 2022.

-- The devaluations of our operating currencies contributed to

an increase in foreign exchange translation losses from USD 17.7

million in H1 2022 to USD 24.8 million in H1 2023 and a decrease of

the Company's total equity from USD 100.5 million in H1 2022 to USD

69.2 million in H1 2023.

-- The Group's cash and cash equivalents reduced to

approximately USD 45 million as of 30 June 2023 from approximately

USD 91 million as of 30 June 2022, following large debt settlements

primarily in India. The Company has a significant funding pipeline

of USD 181 million and raised USD 75 million in new debt in H1

2023.

Outlook

We continue to see improvements in the operating markets with

stability returning to markets that were recently adversely

impacted by political and economic events. As such, we continue to

expect the Group's operational performance in terms of OLP growth

and portfolio quality to improve in the second half of 2023.

However, based on developments in the first half of 2023 and in the

current macro environment, we expect net profit to be lower this

year compared to 2022. The reasons for this are related to (i)

demonetization and further inflation impact on our operations in

Nigeria, (ii) further devaluation of operating currencies against

USD year-to-date in Pakistan, Ghana, Kenya and Nigeria, and (iii)

incidental tax claims in some of our jurisdictions, including

higher taxes now applicable in Pakistan than expected.

Karin Kersten, Chief Executive Officer of ASA International,

commented:

"The operating environment in some of our major operating

entities has been very challenging during the first six months of

the year. In particular, the unprecedented currency depreciation

and inflation in some of our key markets are the main drivers.

Having travelled recently to multiple of our operations, I see that

our clients are struggling with rising food and fuel prices."

"Despite these challenges, we see growth in OLP on a constant

currency basis and portfolio quality improvement in some of our

major markets such as Pakistan, Philippines, Tanzania and Ghana.

Additionally, we have made substantial strides with the

implementation of our digital strategy with the imminent rollout of

our core banking system in Pakistan."

"However, global market volatility, FX movements and

demonetization events in Nigeria have significantly impacted the

Group OLP and portfolio quality. This, and incidental taxes in

Pakistan have reduced financial performance in USD terms more than

expected, resulting in lower growth and profitability compared to

H1 2022."

CHIEF EXECUTIVE OFFICER'S REVIEW

Business review H1 2023

The improvement in the operating environment in most of our

markets saw demand for our loan products increase as clients

experienced an upturn in business activity. Against the backdrop of

the macroeconomic challenges faced in our operating markets due to

the global impact of food, commodities and energy inflation, the

high demand from clients contributed to the growth of our

operations in most markets. Ghana, Pakistan, Tanzania and the

Philippines grew their loan portfolios on a local currency basis

and made significant contributions to the Group's

profitability.

The Group added 54 additional branches though overall client

numbers across the Group decreased due to operational challenges

faced primarily in India and Nigeria. On a constant currency basis,

Gross OLP for the Group, grew to USD 384.7 million as at end of

June 2023 from USD 367.5 million at the end of December 2022. The

growth in Gross OLP was combined with improved portfolio quality in

most markets with PAR>30 for the Group at 3.8% as of June 2023

from 5.9% in December 2022.

In India, the Group maintained its strategy to reduce

disbursements and focus on the recovery of existing and overdue

loans, though at a slower pace which resulted in on-book Gross OLP

shrinking by USD 4.2 million in H1 2023. However, overall Gross OLP

in India increased by 11% as the off-book Gross OLP increased to

USD 31.5 million as of 30 June 2023 from USD 22.6 million as of 31

December 2022. This was due to new Business Correspondence

partnerships which commenced in H1 2023. We expect that the on-book

portfolio will also start to increase by year-end which should

translate into a positive effect on the future profitability of our

operations in India.

In Nigeria, the operating environment became challenging in H1

2023 due to the impact from recent national elections,

demonetization and high inflation following the removal of

government fuel subsidies. This resulted in a reduction of OLP and

clients, increase in overdues, and high operating expenses in H1

2023. This was compounded by significant devaluation of the

Nigerian Naira (down 70% against USD as of June 2023 YTD) which

resulted in reduced operational and financial results in USD terms

from H1 2023. However, we now see an improvement of the operating

environment which is reflected in the portfolio quality improving,

as well as collections and disbursements increasing. As such we

expect the operations to gradually recover in the second half of

2023 and contribute positively to the Group.

Against the backdrop of continued high inflation in many of our

markets, we continue to expect operations to improve across the

Group in the second half of 2023. The Group is focused on

right-sizing average loan sizes to clients in view of the

inflationary environment, while improving branch productivity as

clients continue to demand our loans and our staff in the field

remain committed and focused on supporting clients in difficult

operating circumstances.

Expected credit losses

The Company reduced its reserves in the Balance Sheet for

expected credit losses from USD 16.9 million as per end of 2022 to

USD 13.3 million as per end of June 2023, for its OLP, including

the off-book BC portfolio and interest receivables. Following an

additional write-off of the outstanding Covid affected portfolio

(USD 6.8 million as per end of June 2023 vs USD 10.8 million as per

end of 2022), the Company maintained significant reserves,

primarily due to the overdue loans in India, Myanmar and

Nigeria.

The USD 13.3 million ECL reserves on OLP is concentrated in

India (55%), Myanmar (15%) and Nigeria (15%), with the remainder

spread across the other countries as a percentage of each country's

outstanding loan portfolio or as an aggregate amount. Further

details on the ECL calculation, including the selected assumptions,

are provided in note 2.3.1 to the Interim Financial Report.

Digital financial services

In anticipation of a rapidly digitising world, also in the

segment of our low-income clients, the Group is making strides with

the implementation of its digital strategy to have a more

attractive and competitive client proposition. The implementation

of the core banking system in Pakistan is well under way and

planned to go live in the coming months. In Ghana, the roll out of

the core banking system combined with the implementation of the

digital app is planned for the first half of next year. By the

implementation of these new systems, we can also significantly

reduce manual processes and increase back-office productivity.

Competitive environment

The competitive landscape remains the same across the Group. Our

strongest competitors are in India, the Philippines, Nigeria,

Tanzania and Uganda. In most other markets, we face less

competition from traditional microfinance institutions. Up until

now, we have not been affected by competition from pure digital

lenders.

Dividend

Although the Board planned to return to its pre-Covid dividend

policy in 2024 on the 2023 results, given the tough market

circumstances, the company believes it is prudent not to commit to

a dividend payment at this stage.

Webcast

Management will be hosting an audio webcast and conference call,

with Q&A today at 14:00 (BST).

To access the audio webcast and download the 2023 H1 results

presentation, please go to the Investor section of the Company's

website: Investors | Asa (asa-international.com) or use the

following link: https://brrmedia.news/ASAI_IR23

The presentation can be downloaded before the start of the

webcast.

In order to ask questions, analysts and investors are invited to

submit questions via the webcast.

2023 Interim Financial Report

Today, the Company published the Interim Financial Report for

the 6 months period ended 30 June 2023 on Investors | Asa

(asa-international.com) .

Enquiries:

ASA International Group plc

Investor Relations

Mischa Assink

ir@asa-international.com

GROUP FINANCIAL PERFORMANCE

(UNAUDITED) H1 FY2022 H1 FY2021 YoY YTD YTD %

2023 2022 Change

(Amounts in USD % Change % Change (constant

thousands) currency)

Profit before tax 13,815 46,281 23,843 25,705 -42% -40% -31%

Net profit 3,676 17,887 13,079 6,358 -72% -59% -45%

Cost/income ratio 77% 68% 66% 77%

Return on average

assets (TTM)(1) 1.5% 3.4% 4.6% 1.1%

Return on average

equity (TTM)(1) 8.7% 18.5% 25.5% 6.0%

Earnings growth

(TTM)(1) -72% 181% 807% 556%

OLP 334,400 351,151 378,371 403,738 -12% -5% 6%

Gross OLP 346,804 367,535 398,990 430,698 -13% -6% 5%

Total assets 452,332 489,752 546,093 562,554 -17% -8%

Client deposits

(2) 72,718 84,111 86,291 87,812 -16% -14%

Interest-bearing

debt (2) 245,314 257,466 299,652 314,413 -18% -5%

Share capital and

reserves 69,249 89,661 100,451 103,443 -31% -23%

Number of clients 2,224,542 2,299,558 2,403,172 2,380,690 -7% -3%

Number of branches 2,073 2,028 2,129 2,044 -3% 2%

Average Gross OLP

per client (USD) 156 160 166 181 -6% -2% 8%

PAR > 30 days 3.8% 5.9% 5.1% 5.2%

Client deposits

as % of loan portfolio 22% 24% 23% 22%

(1) TTM refers to the previous twelve months.

(2) Excludes interest payable.

Regional performance

South Asia

(UNAUDITED) H1 FY2022 H1 FY2021 YoY YTD YTD % Change

2023 2022

(Amounts in USD thousands) % Change % Change (constant

currency)

Profit before tax 3,766 12,395 7,409 -8,229 -49% -39% -19%

Net profit 487 3,103 4,653 -12,393 -90% -69% -29%

Cost/income ratio 72% 64% 60% 154%

Return on average

assets (TTM) 0.7% 1.9% 4.5% -5.5%

Return on average

equity (TTM) 3.4% 8.8% 22.1% -27.3%

Earnings growth (TTM) -90% 125% 173% -184%

OLP 112,089 118,590 151,978 182,329 -26% -5% 9%

Gross OLP 119,869 128,460 164,092 201,405 -27% -7% 6%

Total assets 106,979 133,894 181,894 198,393 -41% -20%

Client deposits 1,718 1,345 1,445 2,464 19% 28%

Interest-bearing debt 65,357 85,878 132,284 146,522 -51% -24%

Share capital and

reserves 20,526 33,393 36,868 37,506 -44% -39%

Number of clients 860,407 935,091 1,071,710 1,106,469 -20% -8%

Number of branches 661 670 788 778 -16% -1%

Average Gross OLP

per client (USD) 139 137 153 182 -9% 1% 15%

PAR > 30 days 7.3% 11.1% 5.5% 9.6%

Client deposits as

% of loan portfolio 2% 1% 1% 1%

-- Pakistan continued to maintain a strong portfolio quality throughout H1 2023.

-- The significant currency depreciation in Pakistan (PKR down

27% YTD against USD) contributed to overall OLP reduction in H1

2023.

Pakistan

ASA Pakistan grew its operations over the past 6 months:

-- Number of clients increased from 606k to 608k (up 0.4% YTD).

-- Number of branches remained at 345 .

-- OLP up from PKR 17.9bn (USD 79.1m) to PKR 18.8bn (USD 65.6m) (up 5% in PKR).

-- Gross OLP/Client up from PKR 29.8k (USD 131) to PKR 31.1k (USD 108) ( up 4% YTD in PKR).

-- PAR>30 decreased from 0.7% to 0.3%.

India

ASA India intentionally shrank its operations over the past 6

months, as it focused on recovery of overdue loans while growing

the off-book portfolio:

-- Number of clients down from 284k to 207k (down 27 % YTD).

-- Number of branches down from 261 to 252 (down 3% YTD).

-- On-book portfolio decreased from INR 1.2bn (USD 14m) to INR

1.0bn (USD 12m) (down 18% YTD in INR).

-- Off-book portfolio increased from INR 1.8bn (USD 21.5m) to

INR 2.5bn (USD 30.6m) (up 41% in INR).

-- Gross OLP/Client up from INR 13K (USD 158) to INR 20k (USD 240) (up 51% YTD in INR).

-- PAR>30 decreased from 49.0% to 32.9%, and PAR>30 amount

decreased from INR 903.4m (USD 10.9m) to INR 487.2m (USD 5.9m).

-- ASA India's collection efficiency remained stable at 85% in

June 2023. As of 30 June 2023, ASA India had collected USD 5.5

million from a total of USD 26.8 million in written-off loans since

2020.

* See n ote 13.1 to the consolidated financial statements 2022

for details on the off-book portfolio .

Sri Lanka

Lak Jaya stabilized its operations over the past 6 months:

-- Number of clients remained at 45k.

-- Number of branches remained at 64.

-- OLP decreased from LKR 1.4bn (USD 3.8m) to LKR 1.3bn (USD 4.1m) (down 8% YTD in LKR).

-- Gross OLP/Client down from LKR 32.4k (USD 89) to LKR 30.1k (USD 98) (down 7% YTD in LKR).

-- PAR>30 decreased from 8.5% to 6.4%.

South East Asia

(UNAUDITED) H1 2023 FY2022 H1 2022 FY2021 YoY YTD YTD %

Change

(Amounts in USD % Change % Change (constant

thousands) currency)

Profit before tax 2,342 4,217 553 34 323% 11% 10%

Net profit 1,694 1,910 171 -339 888% 77% 76%

Cost/income ratio 83% 82% 92% 97%

Return on average

assets (TTM) 3.1% 1.8% 0.3% -0.3%

Return on average

equity (TTM) 22.5% 12.0% 2.0% -1.8%

Earnings growth

(TTM) 891% 663% -88% 90%

OLP 68,073 63,316 60,350 62,328 13% 8% 7%

Gross OLP 70,067 66,955 66,428 66,784 5% 5% 4%

Total assets 111,703 102,917 106,716 105,872 5% 9%

Client deposits 23,871 22,069 21,445 20,956 11% 8%

Interest-bearing

debt 66,178 58,416 60,402 60,392 10% 13%

Share capital and

reserves 14,666 14,980 15,481 16,827 -5% -2%

Number of clients 429,533 424,076 415,506 400,021 3% 1%

Number of branches 463 441 441 420 5% 5%

Average Gross OLP

per client (USD) 163 158 160 167 2% 3% 3%

PAR > 30 days 1.7% 6.5% 11.2% 2.1%

Client deposits

as % of loan portfolio 35% 35% 36% 34%

-- South East Asia financial and operational results continued to improve in H1 2023.

The Philippines

Pagasa Philippines operations grew over the last 6 months:

-- Number of clients up from 325k to 332k (up 2% YTD).

-- Number of branches up from 345 to 367 (up 6% YTD).

-- OLP up from PHP 2.8bn (USD 49.6m) to PHP 2.9bn (USD 52.3m) (up 5% YTD in PHP).

-- Gross OLP/Client increased from PHP 8.6k (USD 153) to PHP 8.7k (USD 158) (up 2% YTD in PHP).

-- PAR>30 increased from 1.7% to 1.9%.

Myanmar

ASA Myanmar saw an increase in OLP over the last 6 months

despite the challenging political situation and the related civil

unrest halting operations in certain regions:

-- Number of clients down from 99k to 98k (down 2% YTD).

-- Number of branches remained at 96.

-- OLP up from MMK 28.9bn (USD 13.8m) to MMK 33.2bn (USD 15.8m) (up 15% YTD in MMK).

-- Gross OLP/Client up from MMK 362k (USD 172) to MMK 383k (USD 182) (up 6% YTD in MMK).

-- PAR>30 decreased from 20.4% to 1.2%.

st Africa

(UNAUDITED) H1 2023 FY2022 H1 2022 FY2021 YoY YTD YTD %

Change

(Amounts in USD % Change % Change (constant

thousands) currency)

Profit before tax 6,952 27,799 14,979 35,583 -54% -50% -44%

Net profit 4,220 19,215 10,454 25,019 -60% -56% -51%

Cost/income ratio 57% 43% 42% 37%

Return on average

assets (TTM) 8.2% 15.8% 17.2% 20.6%

Return on average

equity (TTM) 16.0% 33.2% 34.6% 45.4%

Earnings growth

(TTM) -60% -23% -3% 86%

OLP 60,349 82,380 87,796 94,201 -31% -27% -8%

Gross OLP 62,914 84,853 89,669 95,879 -30% -26% -6%

Total assets 85,774 108,395 120,512 134,719 -29% -21%

Client deposits 30,798 39,544 42,905 46,548 -28% -22%

Interest-bearing

debt 4,028 4,326 5,504 7,100 -27% -7%

Share capital and

reserves 42,551 54,591 62,749 61,222 -32% -22%

Number of clients 379,467 433,897 439,004 457,302 -14% -13%

Number of branches 452 446 442 440 2% 1%

Average Gross OLP

per client (USD) 166 196 204 210 -19% -15% 8%

PAR > 30 days 5.2% 4.2% 3.5% 2.6%

Client deposits

as % of loan portfolio 51% 48% 49% 49%

-- West Africa saw a deterioration in operational performance

and profitability in USD terms primarily due to the challenging

operating environment in Nigeria caused by the recent national

elections and the impacts of demonetization and depreciation of NGN

(70% down against USD in H1 2023 compared to FY 2022).

Ghana

ASA Savings & Loans operations continued to improve with

excellent portfolio quality:

-- Number of clients up from 177k to 181k (up 2% YTD).

-- Number of branches up from 137 to 143 (up 4% YTD).

-- OLP up from GHS 416.3m (USD 40.8m) to GHS 464.1m (USD 40.6m) (up 11% YTD in GHS).

-- Gross OLP/Client up from GHS 2.4k (USD 231) to GHS 2.6k (USD 226) (up 9% YTD in GHS).

-- PAR>30 decreased from 0.6% to 0.2%.

Nigeria

ASA Nigeria saw a deterioration in financial and operational

performance:

-- Number of clients down from 220k to 163k (down 26% YTD).

-- Number of branches maintained at 263.

-- OLP down from NGN 16.7bn (USD 37.3m) to NGN 11.8bn (USD 15.6m) (down 29% YTD in NGN).

-- Gross OLP/Client up from NGN 80k (USD 179) to NGN 81k (USD 107) (up 1% YTD in NGN).

-- PAR>30 increased from 7.1% to 15.5%.

Sierra Leone

ASA Sierra Leone saw a deterioration in financial and

operational performances:

-- Number of clients down from 37k to 35k (down 4% YTD).

-- Number of branches remained at 46.

-- OLP down from SLE 80.7m (USD 4.3m) to SLE 79.6m (USD 4.2m) (down 1% YTD in SLE).

-- Gross OLP/Client up from SLE 2.3m (USD 123) to SLE 2.5m (USD 133) (up 9% YTD in SLE).

-- PAR>30 increased from 10.7% to 11.3%.

East Africa

(UNAUDITED) H1 2023 FY2022 H1 2022 FY2021 YoY YTD YTD %

Change

(Amounts in USD % Change % Change (constant

thousands) currency)

Profit before tax 5,993 11,241 5,433 6,605 10% 7% 9%

Net profit 3,717 6,913 3,267 4,631 14% 8% 10%

Cost/income ratio 69% 68% 67% 75%

Return on average

assets (TTM) 6.8% 7.0% 7.4% 6.5%

Return on average

equity (TTM) 30.4% 29.8% 33.7% 25.5%

Earnings growth

(TTM) 14% 49% 131% 333%

OLP 93,889 86,865 78,247 64,881 20% 8% 13%

Gross OLP 93,955 87,267 78,801 66,629 19% 8% 13%

Total assets 116,542 113,791 101,842 83,602 14% 2%

Client deposits 16,332 21,153 20,495 17,843 -20% -23%

Interest-bearing

debt 62,115 59,871 50,934 41,201 22% 4%

Share capital and

reserves 26,878 26,445 22,036 19,973 22% 2%

Number of clients 555,135 506,494 476,952 416,898 16% 10%

Number of branches 497 471 458 406 9% 6%

Average Gross OLP

per client (USD) 169 172 165 160 2% -2% 3%

PAR > 30 days 1.1% 0.9% 0.9% 1.3%

Client deposits

as % of loan portfolio 17% 24% 26% 28%

-- East Africa saw an improvement in operational performance due

to continued growth in Tanzania.

Tanzania

ASA Tanzania managed to expand its operations over the last 6

months:

-- Number of clients up from 217k to 227k (up 5% YTD).

-- Number of branches up from 180 to 190 (up 6% YTD).

-- OLP up from TZS 119.5bn (USD 51.2m) to TZS 136.1bn (USD 56.3m) (up 14% YTD in TZS).

-- Gross OLP/Client up from TZS 553k (USD 237) to TZS 602k (USD 249) (up 9% YTD in TZS).

-- PAR>30 increased from 0.4% to 0.7%.

Kenya

ASA Kenya expanded its operations over the 6 months period:

-- Number of clients up from 141k to 180k (up 27% YTD).

-- Number of branches up from 124 to 130 (up 5% YTD).

-- OLP up from KES 2.1bn (USD 16.9m) to KES 2.6bn (USD 18.3m) (up 23% YTD in KES).

-- Gross OLP/Client down from KES 15K (USD 120) to KES 14k (USD 102) (down 4% YTD in KES).

-- PAR>30 decreased from 0.8% to 0.5%.

Uganda

ASA Uganda saw a slight deterioration in operations over the

last 6 months:

-- Number of clients down from 107k to 106k (down 0.4% YTD).

-- Number of branches up from 110 to 118 (up 7% YTD).

-- OLP up from UGX 43.0bn (USD 11.6m) to UGX 44.2bn (USD 12.0m) (up 3% YTD in UGX).

-- Gross OLP/Client down from UGX 405k (USD 109) to UGX 403k (USD 110) (down 0.5% YTD in UGX).

-- PAR>30 remained at 0.9%.

Rwanda

ASA Rwanda saw a deterioration in operations over the last 6

months:

-- Number of clients down from 21k to 20k (down 7% YTD).

-- Number of branches maintained at 30.

-- OLP down from RWF 4.6bn (USD 4.3m) to RWF 4.4bn (USD 3.7m) (down 5% YTD in RWF).

-- Gross OLP/Client up from RWF 220k (USD 207) to RWF 227k (USD 194) (up 3% YTD in RWF).

-- PAR>30 increased from 4.6% to 6.8%.

Zambia

ASA Zambia managed to expand its operations:

-- Number of clients increased from 21k to 23k (up 8% YTD).

-- Number of branches increased from 27 to 29 (up 7% YTD).

-- OLP up from ZMW 51.7m (USD 2.9m) to ZMW 62.2m (USD 3.5m) (up 20% YTD in ZMW).

-- Gross OLP/Client increased from ZMW 2.5k (USD 139) to ZMW 2.8k (USD 161) (up 12% YTD in ZMW).

-- PAR>30 decreased from 5.0% to 4.2%.

Regulatory environment

The Company operates in a wide range of jurisdictions, each with

their own regulatory regimes applicable to microfinance

institutions.

Key events H1 2023

Pakistan

-- ASA Pakistan received the Microfinance Banking ('MFB')

licence from the State Bank of Pakistan ('SBP') on 24 May 2022 and

is awaiting receipt of the certificate of commencement.

-- ASA Pakistan declared a dividend on FY 2022 results, and has

applied to the SBP for approval of the remittance. The approval is

still pending.

Ghana

-- In Q1 2023, the Bank of Ghana approved the Company's

application for implementing Digital Financial Services.

-- The dividend declared on 2022 results was approved by the

Bank of Ghana in September 2023, and it was partly paid.

Nigeria

-- In 2022, the Central Bank delayed the approval of payment of

dividends declared in the past. The dividend declared on 2021

results was approved in March 2023, and it was fully paid. The

dividend declared on 2022 results is still pending for

approval.

Kenya

-- In 2022, the Digital Credit Providers Act took effect, which

prohibits credit-only MFIs to take collateral. MFIs are required to

apply for a Digital Credit Providers licence, Microfinance Bank

licence or any other suitable licence.

-- ASA Kenya submitted a pro forma application for Digital

Credit Providers licence in May 2023 to ensure it is compliant with

the law, but is desirous to acquire a deposit taking license.

Regulatory capital

Many of the Group's operating subsidiaries are regulated and

subject to minimum regulatory capital requirements. As of 30 June

2023, the Group and its subsidiaries were in full compliance with

minimum regulatory capital requirements.

Asset/liability and risk management

ASA International has strict policies and procedures for the

management of its assets and liabilities as well as various

non-operational risks. In 2022, the Group established an

Asset-Liability Committee ('ALCO'), and the Terms of Reference of

the ALCO was approved by the Board. The ALCO will continuously

manage the Group's assets and liabilities to ensure that:

-- The average tenor of loans to customers is substantially

shorter than the average tenor of debt provided by third-party

banks and other third-party lenders to the Group and any of its

subsidiaries.

-- Foreign exchange losses are minimised by having all loans to

any of the Group's operating subsidiaries denominated or duly

hedged in the local operating currency. All loans from the Group to

any of its subsidiaries denominated in local currency are also

hedged in US Dollars.

-- Foreign translation losses affecting the Group's balance sheet are minimised by preventing over-capitalisation of any of the Group's subsidiaries by distributing dividends and/or hedging capital.

Nevertheless, the Group will always remain exposed to currency

movements in both (i) the profit and loss statement, which will be

affected by the translation of profits in local currencies into

USD, and (ii) the balance sheet, due to the erosion of capital of

each of its operating subsidiaries in local currency when

translated in USD, where the US Dollar strengthens against the

currency of any of its operating subsidiaries.

Funding

The funding profile of the Group has not materially changed

during H1 2023:

In USD millions

30 Jun 31 Dec 30 Jun 31 Dec

23 22 22 21

Local Deposits 72.7 84.1 86.3 87.8

Loans from Financial Institutions 204.9 216.6 241.9 249.8

Microfinance Loan Funds 22.9 21.5 36.5 36.5

Loans from Dev. Banks

& Foundations 17.5 19.4 21.3 28.1

Equity 69.2 89.7 100.5 103.4

Total Funding 387.2 431.3 486.5 505.6

The Group maintains a favourable maturity profile with the

average tenor of all funding from third parties being substantially

longer than the average tenor at issuance of loans to customers

which ranges from six to twelve months for majority of the

loans.

Cash and cash equivalents reduced to approximately USD 45

million as of 30 June 2023 following large debt settlements,

primarily in India . The Group managed to raise approximately USD

75 million in new debt funding in H1 2023. In line with market

developments, funding rates have increased by approximately 100

bps, which will have limited impact on our 2023 results, as

majority of the outstanding funding are with fixed interest rates.

Also, the Group has a strong funding pipeline of USD 181 million

fresh loans, with over 91% having agreed terms and can be accessed

in the short to medium term as of 30 June 2023.

The Group and its subsidiaries have existing credit

relationships with more than 60 lenders throughout the world, which

has provided reliable access to competitively priced funding for

the growth of its loan portfolio.

Over past three years and during H1 2023, a number of loan

covenants were breached across the Group, particularly related to

the portfolio quality in India. As of 30 June 2023, the balance for

credit lines with breached covenants and which did not have waivers

amounts to USD 55 million out of which waivers have been

subsequently received for USD 36 million.

The Group has also received temporary waivers, no-action and/or

comfort letters from some of its major lenders for expected

portfolio quality covenant breaches (primarily PAR>30) in 2023

caused primarily by the overdue loans in India. The impact of these

potential covenant breaches was further assessed in the evaluation

of the Group's going concern as disclosed in note 2.1.2 of the

Interim Financial Report. However, the current economic and market

conditions make it difficult to assess the likelihood of further

debt covenant breaches and whether the waivers necessary to avoid

the immediate repayment of debt or further extension of loan terms

will be forthcoming. As a result, senior management and the

Directors have concluded that this represents a material

uncertainty that may cast significant doubt over the Group's

ability to continue as a going concern. Nevertheless, given the

historical and continuing support received from lenders regarding

these particular covenant breaches and based on continued improved

operating performance in most markets, the Group has a reasonable

expectation that it will have adequate resources to continue in

operational existence throughout the Going Concern assessment

period.

Impact of foreign exchange rates

As a US Dollar reporting company with operations in thirteen

different currencies, currency movements can have a major effect on

the Group's USD financial performance and reporting.

The effect of this is that generally (i) existing and future

local currency earnings translate into less US Dollar earnings, and

(ii) local currency capital of any of the operating subsidiaries

will translate into less US Dollar capital.

Countries 30 Jun 31 Dec 30 Jun 31 Dec <DELTA> <DELTA>

23 22 22 21 30 Jun 31 Dec 2022

2022 - 30 Jun

- 30 Jun 2023

2023

Pakistan (PKR) 287.1 226.4 205.4 177.5 (40%) (27%)

India (INR) 82.1 82.7 78.8 74.4 (4%) 1%

Sri Lanka (LKR) 308.2 366.3 360.0 202.9 14% 16%

The Philippines

(PHP) 55.3 55.7 55.0 51.1 (1%) 1%

Myanmar (MMK) 2,102.2 2,100.0 1,858.1 1,778.5 (13%) (0.1%)

Ghana (GHS) 11.4 10.2 8.0 6.2 (42%) (12%)

Nigeria (NGN) 761.1 448.1 415.2 411.5 (83%) (70%)

Sierra Leone (SLE) 18.9 18.9 13.2 11.3 (44%) (0.1%)

Tanzania (TZS) 2,416.1 2,332.5 2,332.1 2,303.7 (4%) (4%)

Kenya (KES) 140.4 123.5 117.9 113.2 (19%) (14%)

Uganda (UGX) 3,673.8 3,717.6 3,765.9 3,546.2 2% 1%

Rwanda (RWF) 1,172.0 1,067.0 1,026.0 1,031.8 (14%) (10%)

Zambia (ZMW) 17.6 18.1 17.0 16.7 (3%) 3%

During H1 2023, the local currencies PKR -27%, GHS -12%, NGN

-70% and KES -14% particularly weakened against the USD. This had

an additional negative impact on the USD earnings contribution of

these subsidiaries to the Group and also contributed to an increase

in foreign exchange translation losses. The total contribution to

the foreign exchange translation loss reserve during H1 2023

amounted to USD 24.8 million of which USD 8.8 million related to

the depreciation of the PKR, USD 2.3 million related to the

depreciation of the GHS, USD 12.7 million related to the

depreciation of the NGN, and USD 0.8 million related to the

depreciation of the KES.

Transfer pricing

The South East Asia and East Africa regions are contributing

intercompany franchise fees and corporate service fees to the

holding companies of the Group, whereas approval for most of such

intercompany charges are pending in certain countries in South Asia

and West Africa. The intercompany charges per region are detailed

in the Segment Information as included in note 3 to the Interim

Financial Report.

Forward-looking statement and disclaimers

This announcement does not constitute or form part of any offer

or invitation to purchase, otherwise acquire, issue, subscribe for,

sell or otherwise dispose of any securities, nor any solicitation

of any offer to purchase, otherwise acquire, issue, subscribe for,

sell, or otherwise dispose of any securities. The release,

publication or distribution of this announcement in certain

jurisdictions may be restricted by law and therefore persons in

such jurisdictions into which this announcement is released,

published or distributed should inform themselves about and observe

such restriction.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SFMFUUEDSEIU

(END) Dow Jones Newswires

September 20, 2023 02:00 ET (06:00 GMT)

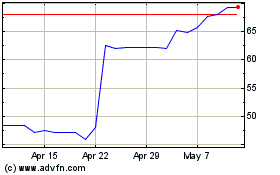

Asa (LSE:ASAI)

Historical Stock Chart

From Oct 2024 to Nov 2024

Asa (LSE:ASAI)

Historical Stock Chart

From Nov 2023 to Nov 2024