TIDMATM

RNS Number : 4023L

Andrada Mining Limited

05 September 2023

5 September 2023

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 (MAR) as in force in

the United Kingdom pursuant to the European Union (Withdrawal) Act

2018. Upon the publication of this announcement via Regulatory

Information Service (RIS), this inside information will be in the

public domain.

Andrada Mining Limited

("Andrada" or the "Company"

and with its subsidiaries, the "Group")

Conclusion of the Development Bank of Namibia financing.

Financing to improve tin recovery up to 69%.

Further to the announcement of 15 August 2023, Andrada Mining

Limited (AIM: ATM, OTCQB: ATMTF), an African technology metals

mining company with a portfolio of mining and exploration assets in

Namibia, is pleased to confirm that the Development Bank of Namibia

("DBN") has served notice confirming that all conditions have been

fulfilled or waived and that financial close has occurred.

Accordingly, the Group is in the process of requesting the drawdown

of the NAD100 million (cUS$5.8m) facility ("the Funds") which are

expected to arrive this week. These Funds will be used to expedite

the implementation of the Uis Mine Stage II Continuous Improvement

Project ("CI2").

HIGHLIGHTS

-- Funding is ring-fenced for the implementation of the Uis Mine

CI2.

-- As set out in the announcement of 5 June 2023, the terms

are:

- Term of 10 years ranked as senior secured debt pari passu to the Standard Bank Namibia loan.

- No interest or capital repayments for the initial 12 months after execution.

- Interest will accrue at Namibian prime lending rate (currently 11.5%) plus 2.5% per annum.

Anth ony Viljoen, Chief Executive Officer, commented:

"The conclusion of the DBN funding is an essential component of

the overall funding and development strategy. These proceeds will

be used to implement the improvements at Uis Mine which will

enhance the plant's productivity and output. The targeted increase

in the tin recovery rate should complement the royalty portion of

the Orion funding by enabling Andrada to achieve the requisite

thresholds of concentrate tonnages. The improvement in cost

efficiencies and overall productivity at Uis, lays the foundation

for the management of the lithium processing plant and other future

operations.

The funding sourced since the successful US$22.8 million equity

raise in September 2022, has significantly strengthened Andrada's

balance sheet and provides us with optionality on how to expedite

our multi-tech development strategy. Importantly, the DBN and Orion

funding (see announcement 15 August 2023) will enable us to

implement various strategic initiatives necessary for further

production growth and the stabilisation of the Company's assets.

Partnering with the DBN and gaining the bank's confidence, will

enable the Company to secure additional infrastructure development

financing potentially required for our future growth

aspirations.

As we continue with the Barclays-led strategic process to

identify an appropriate partner for our lithium development

strategy, we are simultaneously expanding our resource through an

extensive exploration programme and determining the optimal way to

become a multi-tech-metals producer through the metallurgy

programme."

DBN FINANCING TERM sheet

As announced on 5 July 2023 and 5 July 2022, the loan has a t

erm of 10 years and is ranked as senior secured debt pari passu to

the Standard Bank Namibia loan. There are no interest or capital

repayments for the initial 12 months after execution and interest

will accrue at the Namibian prime lending rate (currently 11.5%)

plus 2.5% per annum.

The funding is ring-fenced for the Uis Mine CI2 to complement

the expansion project completed in October 2022.

Uis mine continuous improvement

The modular expansion of the crushing and tin concentration

circuits during the third quarter of FY 2023, resulted in

approximately 70% increased capacity. The primary objective of the

expansion was to increase production tonnage to reduce costs

through economies of scale. The enhanced plant performance has

revealed bottlenecks that need to be eliminated to ensure that the

increased output and higher production rates are sustainable. To

that effect, the CI2 is expected to improve processing efficiencies

to maximise the tin concentrate recovery rate, establish business

sustainability through the enhancement of operational support

infrastructure and reduce operating costs. Ultimately, the CI2 is

targeted to increase the plant throughput to greater than

1Mtpa.

Process improvement efficiency

The objective is to maximise the tin recovery rate up to c69% by

improving the visibility of plant operating parameters to

operational staff, and by enhancing metal accounting through an

increased rate of metallurgical sampling. Furthermore, improvements

on the slurry pumps and lines will be implemented by installing

appropriately sized equipment with wear resistant parts and the

best material type for piping throughout the plant. A third shaking

table set will be installed for increased concentrate production

and a new belt scale, as well as flow meters will be installed to

further improve metal accounting. Finally, the plant laboratory

function will be expanded.

Enhancements of the business sustainability support

infrastructure

These enhancements will ensure a safe working environment to

eliminate the risk of long duration operational disruptions. Major

enhancements in terms of support infrastructure will entail the

expansion of the main and plant substations to ensure reliable

electricity supply in line with the higher production rates.

Additional process water supply will be developed to cater for the

increased production in the wet plant. An improved stormwater

management plan will be implemented including the installation of

berm channels, construction of a return water dam and settling

pond. For enhanced safety, firefighting protocols will be improved,

fences installed, and roads constructed within the whole

operational area.

Reduction of operational costs

The key cost reduction initiative is designed to implement

efficient supply chain management. Sufficient inventory of critical

spares will reduce costs by eliminating emergency procurement. The

target is to reduce operational costs by up to 10%.

Conclusion

The planned improvements will be implemented over the next 6

months with the initial results of the CI2 expected from Q1 FY

2024.

Lithium Ridge exploration drilling results update

The Company anticipates releasing the assay results from the

ML133 lithium exploration drill programme, for the initial 14 drill

holes, within the next few days.

Andrada Mining Limited +27 (11) 268 6555

Anthony Viljoen, CEO investorrelations@andradamining.com

Sakhile Ndlovu, Investor Relations

Nominated Adviser

WH Ireland Limited

Katy Mitchell +44 (0) 207 220 1666

Corporate Adviser and Joint

Broker

H&P Advisory Limited

Andrew Chubb

Jay Ashfield

Matt Hasson +44 (0) 20 7907 8500

Stifel Nicolaus Europe Limited

Ashton Clanfield

Calum Stewart

Varun Talwar +44 (0) 20 7710 7600

Tavistock Financial PR (United +44 (0) 207 920 3150

Kingdom) andrada@tavistock.co.uk

Jos Simson

Catherine Drummond

Adam Baynes

About Andrada Mining Limited

Andrada Mining Limited, formerly Afritin Mining Limited, is a

London-listed technology metals mining company with a vision to

create a portfolio of globally significant, conflict-free,

production and exploration assets. The Company's flagship asset is

the Uis Mine in Namibia, formerly the world's largest hard-rock

open cast tin mine.

An exploration drilling programme is currently underway with the

aim of expanding the tin resource over the fourteen additional,

historically mined pegmatites, all of which occur within a 5 km

radius of the current processing plant. The Company has set a

mineral resource target of 200 Mt to be delineated within the next

5 years. The existing mine, together with substantial mineral

resource potential, allows the Company to consider economies of

scale.

Andrada is managed by a board of directors with extensive

industry knowledge and a management team with extensive commercial

and technical skills. Furthermore, the Company is committed to the

sustainable development of its operations and the growth of its

business. This is demonstrated by the manner in which the

leadership team places significant emphasis on creating value for

the wider community, investors, and other key stakeholders. Andrada

has established an environmental, social and governance system

which has been implemented at all levels of the Company and aligns

with international standards. [END]

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEELBBXKLBBBX

(END) Dow Jones Newswires

September 05, 2023 02:00 ET (06:00 GMT)

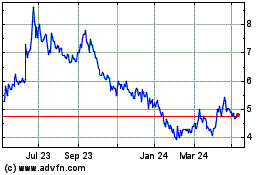

Andrada Mining (LSE:ATM)

Historical Stock Chart

From Dec 2024 to Jan 2025

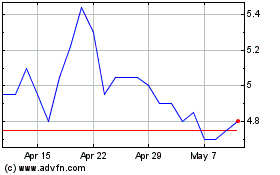

Andrada Mining (LSE:ATM)

Historical Stock Chart

From Jan 2024 to Jan 2025