TIDMBLND

RNS Number : 2177Y

British Land Co PLC

01 March 2017

British Land and Oxford Properties exchange contracts for the

sale of The Leadenhall Building

to C C Land

1 March 2017

British Land and Oxford Properties (the global real estate arm

of OMERS, the pension plan for Ontario's municipal employees) have

exchanged contracts for the sale of The Leadenhall Building to C C

Land for a headline price of GBP1.15 billion. Completion is

conditional on approval by the shareholders of C C Land.

British Land and Oxford Properties developed and own The

Leadenhall Building as an investment in a 50/50 joint venture

formed in 2010.

Construction of The Leadenhall Building started in early 2011

and completed in summer 2014. The building is fully let, with an

average remaining lease term of over 10 years to break, and has

achieved record rents for the City of more than GBP100 per sq ft.

It is occupied by high calibre businesses including insurers Aon

and MS Amlin, and the building's architects Rogers Stirk Harbour +

Partners.

At 736 feet, The Leadenhall Building is the tallest building in

the City of London. It provides 610,000 sq ft of world class office

accommodation over 46 floors, in a prime location. Its distinctive

sloping shape was designed to protect views of St Paul's Cathedral

and offers a range of floorplates with spectacular views over

London. The building was voted City of London Building of the Year

2015 by the Worshipful Company of Chartered Architects.

Tim Roberts, Head of Offices and Residential, British Land,

said: "British Land and Oxford Properties took a bold step at the

early stages of the UK's economic recovery to develop The

Leadenhall Building to generate a high quality, long term income

stream. It's a decision which has really paid off. Through a

strong, collaborative partnership, we have delivered an iconic,

award-winning building let to high calibre occupiers at record City

rents. This sale shows continued investor appetite for best in

class, well located property in London."

Paul Brundage, Executive Vice President and Senior Managing

Director - Europe, Oxford Properties, said: "Oxford Properties has

enjoyed a highly successful partnership with British Land through

our joint investment in the development, delivery and management of

this iconic building. We have delivered on our strategy of ensuring

that The Leadenhall Building meets its potential to become one of

the most commercially successful investments in London. The

Leadenhall Building has been a cornerstone of our London business

and has propelled Oxford Properties to a leading position in

European real estate development and investment. We are fully

committed to the UK and Europe for the long term and are looking

forward to pursuing further investment opportunities going forward

either on our own or with like-minded partners such as British

Land."

The sale agreement provides for British Land and Oxford

Properties to sell their entire shareholdings in the company which

holds the investment in The Leadenhall Building to C C Land. The

consideration for the sale will be calculated by reference to the

net asset value of that company based on the agreed property value

of GBP1.15 billion, subject to adjustment for top-ups in respect of

rent free periods and rent guarantees currently estimated to be

approximately GBP12.7 million. The consideration will be received

in cash and apportioned in equal shares to British Land and Oxford

Properties.

The sale is subject to approval by the shareholders of C C Land

(by simple majority) in a Special General Meeting in accordance

with the Hong Kong Listing Rules. The Chairman of C C Land, Mr.

Cheung Chung Kiu, is the sole shareholder of two companies (Fame

Seeker Holdings Limited and Thrivetrade Limited) which in aggregate

hold approximately 50.4% of the issued share capital of C C Land as

at the date of this announcement, and has given an irrevocable

undertaking to procure that these companies vote in favour of the

resolution approving the transaction. The C C Land circular to

shareholders, including a notice convening the Special General

Meeting, will be despatched as soon as possible taking into account

the minimum time anticipated for preparing the necessary reports

and financial information for inclusion in the circular. Completion

is expected to take place no more than five business days after

shareholder approval is obtained, provided shareholder approval is

obtained no later than 28 June 2017, unless extended by

agreement.

The buyer has paid an amount of GBP287.5 million to the sellers'

solicitors. If approval of the C C Land shareholders is not

obtained on or before 28 June 2017, or such other date agreed by

the parties, then a total of GBP40 million of this amount is

released to the sellers, with the remainder to be returned to the

buyer. If approval of the C C Land shareholders is obtained then

the whole of the GBP287.5 million is released to the sellers at the

earlier of completion (along with payment of the balance of the

consideration by the buyer) and 28 June 2017, or such other date

agreed by the parties, subject to compliance by the sellers with

their completion obligations.

Proceeds received by British Land for its interest will

initially be used to pay down revolving credit facilities, pending

redeployment. The Leadenhall Building was last valued on behalf of

the current owners on 30 September 2016 at GBP915 million (100%

interest). The net rental income recognised for the year to 31

March 2016 was GBP27 million (100% interest) and annualised

contracted rent for the building is currently GBP40 million (100%

interest). The disposal is slightly dilutive to British Land's

earnings per share and slightly accretive to its net asset value

per share.

British Land and Oxford Properties were advised by Cushman &

Wakefield, Eastdil Secured, Mayer Brown and Herbert Smith

Freehills.

S

Enquiries

British Land

Investor Relations:

Jonathan Rae, British Land 020 7467 2938

Media:

Pip Wood, British Land 020 7467 2838

Guy Lamming, Finsbury Group 020 7251 3801

Gordon Simpson, Finsbury Group 020 7251 3801

Oxford Properties

Media:

Sally Saadeh, Oxford Properties 020 7822 2844

James Devas, Maitland 020 7379 5151

About British Land

We are one of Europe's largest publicly listed real estate

companies. We own, manage, develop and finance a portfolio of high

quality UK commercial property, focused on Retail and London

Offices and Residential. We own or manage total assets of GBP19.0

billion (British Land share is GBP13.9 billion) as valued at 30

September 2016. Our properties are home to over 1,200 different

organisations ranging from international brands to local

start-ups.

Our strategy is to create Places People Prefer. It is based on

long term trends and creates a portfolio suited to current and

future needs which are aligned to modern lifestyles. We employ our

placemaking skills, and increasingly our mixed-use expertise to

expand the appeal to a broader range of occupiers and drive long

term performance.

Retail accounts for 49% of our portfolio. We create outstanding

places for modern consumer lifestyles, places to shop, eat and be

entertained. Comprising over 20 million sq ft of Retail and Leisure

space across regional and local multi-let destinations,

superstores, department stores and leisure assets, the Retail

portfolio is modern, flexible and adaptable to a wide range of

formats.

Office and Residential accounts for 49% of our portfolio. It

comprises 7.6 million sq ft of well-connected office-led campuses

and 'campus-lite' clusters of high quality buildings. Office

campuses include Regent's Place and Paddington Central in the West

End and Broadgate (50% share) in the City. Other assets include

York House, 10 Portman Square and Marble Arch House and our

residential assets are at Clarges Mayfair, The Hempel Collection

and Aldgate Place.

Two per cent of our portfolio is at Canada Water - a 46 acre

redevelopment opportunity in our medium term pipeline to create a

new mixed-use urban centre for London.

Sustainability is embedded throughout our business. Our places

become part of their local communities and promote health, improve

productivity and increase enjoyment. We protect asset value through

energy generation and efficiency, materials innovation and flood

risk reduction and we develop skills and opportunities to help

local people and businesses grow.

In April 2016 British Land received the Queen's Award for

Enterprise: Sustainable Development, the UK's highest accolade for

business success for economic, social and environmental benefits

achievements over the last five years.

Further details can be found on the British Land website at

www.britishland.com.

About Oxford Properties Group

Oxford Properties Group is one of the world's premier real

estate investment, development and management companies.

Established in 1960, Oxford manages over $40 billion of real estate

assets on behalf of its co-owners and investment partners, with a

global portfolio spanning over 60 million square feet. We have

offices across Canada and in London, Luxembourg, Boston, Washington

DC and New York, with regional investment, development and

management professionals who have deep real estate expertise and

local market insight. Oxford now has approximately C$7bn of assets

under management in Europe, with a focus on core office and high

street retail assets in Central London and Paris. Oxford is the

global real estate arm of OMERS, the pension plan for Ontario's

municipal employees.

For more information about Oxford visit:

www.oxfordproperties.com.

MSCUGUAUWUPMGGG

(END) Dow Jones Newswires

March 01, 2017 06:08 ET (11:08 GMT)

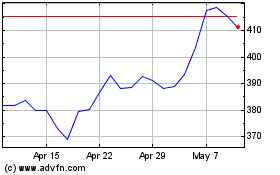

British Land (LSE:BLND)

Historical Stock Chart

From Mar 2025 to Apr 2025

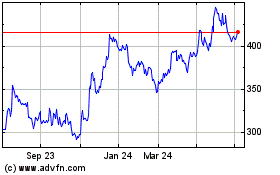

British Land (LSE:BLND)

Historical Stock Chart

From Apr 2024 to Apr 2025