TIDMCLON

RNS Number : 0036C

Clontarf Energy PLC

08 June 2023

8(th) June 2023

Clontarf Energy plc

("Clontarf" or "the Company")

Preliminary Results for the Year Ended 31 December 2022

Clontarf Energy, the oil and gas exploration company focused on

Ghana, Bolivia and Australia today announces its preliminary

results for the year ending 31 December 2022.

The Company expects to shortly publish its 2022 Annual Report

& Accounts and a further update will be made in this regard as

and when appropriate.

This announcement contains inside information for the purposes

of Article 7 of Regulation 596/2014 .

For further information please visit http://clontarfenergy.com

or contact:

Clontarf Energy

David Horgan, Chairman

Jim Finn, Director +353 (0) 1 833 2833

Nominated & Financial Adviser

Strand Hanson Limited

Rory Murphy

Ritchie Balmer +44 (0) 20 7409 3494

Broker

Novum Securities Limited

Colin Rowbury +44 (0) 207 399 9400

Public Relations

BlytheRay

Megan Ray +44 (0) 207 138 3206

Teneo

Luke Hogg

Alan Tyrrell +353 (0) 1 661 4055

Chairman's Statement

The principal activities for Clontarf Energy plc ("Clontarf" or

the "Company") during this period were driving ahead its lithium

business in South America, by identifying and announcing the

NEXT-ChemX Bolivian joint venture with NEXT-ChemX Corporation

("NEXT-ChemX"). It is expected that the joint venture will

demonstrate the technical, commercial and environmental feasibility

of NEXT-ChemX's ion-Targeting Direct lithium Extraction ("iTDE")

technology in Bolivia.

This process included further sampling in priority salt-lakes,

as well as working with regulatory bodies and other licence-holders

to collect representative samples. The first phase of sample

analysis is confirming past laboratory testing of synthetic brines.

This process includes fine-tuning the process so as to facilitate

large-scale pilot plant testing, which should follow successful

laboratory test-work.

Ongoing discussions with Bolivia's State Lithium Company, which

is tasked with leading Bolivia's entry to international markets

under the 2017 Lithium Law, have been a priority.

The Company has also agreed, with the relevant title-holders, to

test priority brines from privately-held salt-lakes in Argentina

and Chile. These are also included in the NEXT-ChemX joint venture

on Direct Lithium Extraction ("DLE").

For many years Clontarf has promoted Bolivia's brine potential,

especially for Lithium. Until recently, markets were sceptical

about demand projections, as well as the need for higher purities

and minimising problematic residuals. Now these needs are widely

understood, with high demand growth forecast by US, EU and British

authorities. Rising quality requirements have also boosted prices,

increasing the sector's profitability.

But at the very time when demand is surging, there has been

subdued investment in development and especially exploration. There

has been opposition to expanding European mines, especially, often

most vigorously from those simultaneously clamouring for a "Green

transition". Even high levels of recycling cannot fuel a rapidly

expanding market. A further complication is that recycling

recoveries are often low, due to how such minerals are combined, in

small percentages, in complex products like batteries.

Such rising demand for most resources, especially critical

metals and minerals, cannot be supplied from existing sources, by

traditional methods. Output and quality need to be increased

simultaneously, while minimising use of water, space, ore and other

materials - and all with a limited environmental footprint.

The Directors believe the only way these lithium demand needs

can be served at scale is through DLE. Traditional evaporation

ponds allied with chemical precipitation work too slowly and

imperfectly - often with recoveries of only 40% to 60%. But so far

there is no commercial DLE working worldwide.

In April 2023, a senior Bolivian government official asked how

could we be so confident when there is currently no operating,

commercial DLE facility in South America?

We answered that setting objectives gives substance to the

vision. By naming DLE we make it possible. After that, it's about

resources and perseverance - as long as the processes doesn't defy

the laws of chemistry or physics. There is also scope for

serendipity - a mouldy growth spotted by Fleming's inquiring eye

opening the door to antibiotics.

For years we have worked in industrial minerals, investigating

emerging technologies in Germany, the USA and Asia. Some techniques

achieved reasonable output, but at low recoveries. Some delivered

good output, but with deleterious contaminants and inadequate

grade. A few deliver acceptable purities, but not commercially.

The mining industry is conservative, lacking imagination,

fearing the alien and disruptive. It has necessarily focused on

burning lithium-rich hard rock ores, mainly in Western Australia

and southern Africa. However, few ores have the grade and

minerology necessary to produce adequate lithium salt volumes in

such ways. Burning rocks for days at 800 deg C, usually in

coal-fired Chinese furnaces, is too dirty to be credibly clean

enough for the "Green transition" of electric vehicles (EVs) or

grid storage. EV buyers now account for 80% of lithium demand, and

it is only a matter of time until they become more

discriminating.

Traditional miners tend to resist alternative thinking, merely

extending what worked before. But incremental innovation cannot

satisfy anticipated demand growth. The extractive industry must

provide a "fair trade" lithium, which is low emission and low water

use, but also able to deliver sustainable volumes for many years,

and whose economic benefits are fairly shared with local

people.

Breakthroughs require innovative thinking, which rarely unfolds

in an orderly, predictable, or easily managed way. You must imagine

solutions that are not yet there. One answer is to find a

successful process working in different applications, in other

jurisdictions.

Innovation occurs elsewhere and is applied in new ways: working

with our joint venture partners, NEXT-ChemX, we identified

techniques that had previously purified fluids of radioactive

elements through a technique mimicking the human kidney. This

avoids the need for high water, or power usage, facilitating a

continuous process, rather than batch process.

This cutting-edge extraction technology concentrates desired

ions (e.g. Li+) by drawing them out of a solution (such as a brine)

across a special purpose membrane using a technology iTDE, which

can work in low concentrations.

Such inventions are the tangible realising of a vision . Even

creators may not initially see the whole potential, or disruption

as invention destroys the cherished and understood past . That's

why incumbents are so reluctant to disrupt, because innovation is

emerging, and non-linear creative destruction.

It has been harder to get investors excited about oil & gas

exploration. For juniors to boom we really need a positive stock

market, and ideally a strong farm-out market.

Over recent months we have transferred funds to our Australian

10% Working Interest , on which the partners drilled the Sasanof-1

well in May/June 2022. While this well did not flow commercial

hydrocarbons, it showed that 1,000m offshore wells can again be

funded. Clontarf's liquidity and international contacts helped

attract funding above the share price. That punter optimism slowed

with the non-commercial well and moderating of the Asian LNG price

to circa $11 per million BTU. The strong recovery in Asian demand,

as China emerged from a series of lock-downs, and the desire to

displace coal, promised future demand growth. A possible concern is

the Australian Federal Government policy review on fossil fuel

exports (which may import EPA approvals for new projects) - though

the WA State authorities remain supportive.

The ongoing war in Ukraine, and sabotage of the Nordsteam

pipelines (with a combined capacity of 110bcm - vs the pre-war

Russian gas exports to Europe of 155bcm) now make Liquified Natural

Gas ("LNG") critical for the European gas market.

As well as this Clontarf has restored contacts with the Ghanaian

authorities to update the acreage to be explored and resuscitate

the ratification of its signed Petroleum Agreement on Tano 2A

Block. Slowness in ratification of signed contracts had constrained

the development of Ghana's oil and gas industry. The current

Ghanaian government has indicated its determination to recover

momentum, working with the IMF to overcome Covid-19 and legacy

liabilities. Ghanaian fiscal terms remain competitive, while West

African infrastructure steadily improves.

To expedite the long-delayed ratification of our acreage, the

authorities have floated the proposal for alternative acreage, in

the neighbouring region. While some of the acreage has interesting

plays that would attract interest in a better market, it does not

compare with the original Tano 2A acreage - or indeed, neighbouring

acreage bordering discoveries since 2008. We are keen to work out a

mutually attractive solution that will enable ratification and

bringing in of larger partners to explore this acreage, and

hopefully develop any discovery.

We remain in contact on Chad (where we signed a Memorandum of

Understanding in 2020) and other prospective African countries. So

far, the main hurdle has been the requested fiscal terms - which

reflect the hot market of 2003 through 2014, rather than current

investor hostility to petroleum and the retrenchment of some

western majors who would otherwise be our go-to partners for such

frontier exploration.

However, the petroleum industry is cyclical, and the extreme

under-investment in the sector since 2010 is now creating shortages

as demand recovers, especially in Asia. Demand for oil, gas and

even coal are now at or near historic records, while investment is

mostly limited to developments of existing Blocks in mature basins.

That will change.

Financial markets and farm-out interest in petroleum had been

depressed since the oil price war starting in 2014 and continuing

periodically until 2022. This had constrained our options for early

seismic or wells in Ghana or Chad. But recent price volatility

shows that major new investment is required to service global

demand. Clontarf plans to participate in the coming boom.

Anticipated lithium salts' demand cannot be served without

developing DLE technology, including on several Bolivian

salt-lakes. We are now involved in a sample testing process, and

additionally expect that the Bolivian Lithium Law will be updated

to confirm the legal basis for Joint Ventures with the

authorities.

In oil and gas, the tightening hydrocarbons' supply-demand

balance promises a revival of exploration and the farm-out

market.

The resurgence of interest in African exploration and

development may lead to additional proposals in the coming

months.

In summary, Clontarf has progressed its interests in Bolivia,

Australia, and Africa, maintaining cordial communications with the

relevant authorities, and has continued to operate efficiently on

minimal expenditure.

Funding

Clontarf has successfully fundraised two times since May 2022.

With the greatest interest among Australian and Asian investors.

Subject to technical verification of its exploration projects, and

permitting, Clontarf is confident of adequate funding, whether in

London or Australia, for near to medium term ongoing

activities.

David Horgan

Chairman

7(th) June 2023

CLONTARF ENERGY PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEARED 31 DECEMBER 2022

2022 2021

GBP GBP

Administrative expenses (671,352) (401,427)

Impairment of exploration and evaluation assets (4,095,294) (62,074)

--------------- ----------

Loss from operations (4,766,646) (463,501)

--------------- ----------

Loss before tax (4,766,646) (463,501)

Income tax - -

Total comprehensive income (4,766,646) (463,501)

=============== ==========

Earnings per share attributable to the ordinary equity holders of the parent

2022 2021

Pence Pence

Loss per share - basic and diluted (0.26) (0.06)

=============== ==========

CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER

2022

2022 2021

GBP GBP

Assets

Non-current assets

Intangible assets 868,043 868,043

------------- -------------

868,043 868,043

------------- -------------

Current assets

Other receivables - 1,934

Cash and cash equivalents 931,902 344,253

------------- -------------

931,902 346,187

------------- -------------

Total assets 1,799,945 1,214,230

------------- -------------

Liabilities

Current liabilities

Trade and other liabilities (3,026,514) (1,485,848)

------------- -------------

Total liabilities (3,026,514) (1,485,848)

------------- -------------

Net liabilities (1,226,569) (271,618)

============= =============

Equity

Share capital 5,927,065 2,177,065

Share premium reserve 10,985,758 10,985,758

Share based payment reserve 247,838 186,143

Retained deficit (18,387,230) (13,620,584)

------------- -------------

Total equity (1,226,569) (271,618)

============= =============

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 31 DECEMBER 2022

Share

Share Based

Share Premium Payment Retained Total

Capital Reserve Reserve Deficit Equity

GBP GBP GBP GBP GBP

At 1 January 2021 1,792,450 10,900,373 103,879 (13,157,083) (360,381)

Issue of share capital 384,615 115,385 - - 500,000

Share issue expenses - (30,000) (30,000)

Share based payment charge - - 82,264 - 82,264

Total comprehensive loss for the year - - - (463,501) (463,501)

--------- ---------- -------- ------------ -----------

At 31 December 2021 2,177,065 10,985,758 186,143 (13,620,584) (271,618)

Issue of share capital 3,750,000 - - - 3,750,000

Share based payment charge - - 61,695 - 61,695

Total comprehensive loss for the year - - - (4,766,646) (4,766,646)

--------- ---------- -------- ------------ -----------

At 31 December 2022 5,927,065 10,985,758 247,838 (18,387,230) (1,226,569)

CONSOLIDATED CASH FLOW STATEMENT

FOR THE YEARED 31 DECEMBER 2022

2022 2021

GBP GBP

Cash flows from operating activities

Loss for the year (4,766,646) (463,501)

Adjustments for

Share based payment charge 61,695 82,264

Foreign exchange loss 3,442 1,516

Impairment of exploration and evaluation assets 4,095,294 62,074

------------ ----------

(606,215) (317,647)

Movements in working capital:

Decrease/(Increase) in other receivables 1,934 (148)

Increase in trade and other payables 1,540,666 119,141

------------ ----------

Net cash used in operating activities 936,385 (198,654)

------------ ----------

Cash flows from investing activities

Additions to exploration and evaluation assets (4,095,294) (15,000)

------------ ----------

Net cash used in investing activities (4,095,294) (15,000)

------------ ----------

Cash flows from financing activities

Issue of Ordinary Shares 3,750,000 500,000

Share issue expenses - (30,000)

------------ ----------

Net cash generated from financing activities 3,750,000 470,000

------------ ----------

Net cash increase in cash and cash equivalents 591,091 256,346

Cash and cash equivalents at the beginning of year 344,253 89,423

Exchange loss on cash and cash equivalents (3,442) (1,516)

------------ ----------

Cash and cash equivalents at the end of the year 931,902 344,253

============ ==========

Notes:

1. ACCOUNTING POLICIES

There were no changes in accounting policies from those used to

prepare the Group's Annual Report for financial year ended 31

December 2022. The financial statements have been prepared in

accordance with the Companies Act 2006.

2. LOSS PER SHARE

Basic loss per share is computed by dividing the loss after

taxation for the year attributable to ordinary shareholders by the

weighted average number of Ordinary Shares in issue and ranking for

dividend during the year. Diluted earnings per share is computed by

dividing the profit or loss after taxation for the year by the

weighted average number of Ordinary Shares in issue, adjusted for

the effect of all dilutive potential Ordinary Shares that were

outstanding during the year.

2022 2021

GBP GBP

Numerator

For basic and diluted EPS Loss after taxation (4,766,646) (463,501)

====================== ==================

Denominator No. No.

For basic and diluted EPS 1,856,031,596 817,717,558

====================== ==================

Basic EPS (0.26p) (0.09p)

Diluted EPS (0.26p) (0.09p)

====================== ==================

The following potential Ordinary Shares are anti-dilutive and are therefore excluded from

the weighted average number of shares for the purposes of the diluted earnings per share:

No. No.

Share options 40,500,000 40,500,000

====================== ==================

3. GOING CONCERN

The Group incurred a loss for the year of GBP4,766,646 (2021:

GBP463,501) and had net current liabilities of GBP2,094,612 (2021:

GBP1,139,661) at the balance sheet date. These conditions, as well

as those noted below, represent a material uncertainty that may

cast doubt on the Group's ability to continue as a going

concern.

Included in current liabilities is an amount of GBP1,525,565

(2021: GBP1,420,565) owed to Directors in respect of Directors'

remuneration due at the balance sheet date. The Directors have

confirmed that they will not seek settlement of these amounts in

cash until after end of 2024.

The Group had a cash balance of GBP931,902 (2021: GBP344,253) at

the balance sheet date. The Directors have prepared cashflow

projections for a period of at least 12 months from the date of

approval of the financial statements which indicate that the group

may require additional finance to fund working capital requirements

and develop existing projects. As the Group is not revenue or cash

generating it relies on raising capital from the public market. On

16 January 2023 the Group raised GBP1,300,000 on a placing and a

further GBP350,000 was raised on 1 June 2023, further information

is detailed in Note 6 of these accounts.

As in previous years the Directors have given careful

consideration to the appropriateness of the going concern basis in

the preparation of the financial statements and believe the going

concern basis is appropriate for these financial statements. The

financial statements do not include the adjustments that would

result if the Group and Company were unable to continue as a going

concern.

4. INTANGIBLE ASSETS

Group Group

2022 2021

GBP GBP

Cost

At 1 January 8,640,329 8,625,329

Additions 4,095,294 15,000

----------- ----------

At 31 December 12,735,623 8,640,329

----------- ----------

Impairment

At 1 January 7,772,286 7,710,212

Impairment 4,095,294 62,074

----------- ----------

At 31 December 11,867,580 7,772,286

----------- ----------

Carrying Value:

At 1 January 868,043 915,117

=========== ==========

At 31 December 868,043 868,043

=========== ==========

Segmental analysis

Group Group

2022 2021

GBP GBP

Bolivia - -

Ghana 868,043 868,043

----------- ----------

868,043 868,043

=========== ==========

Exploration and evaluation assets relate to expenditure incurred

in prospecting and exploration for lithium, oil and gas in Bolivia

and Ghana. The Directors are aware that by its nature there is an

inherent uncertainty in exploration and evaluation assets and

therefore inherent uncertainty in relation to the carrying value of

capitalised exploration and evaluation assets.

On 9 May 2022 the Company acquired a 10 per cent. interest in

the high-impact multi-TCF (Trillion Cubic Feet) Sasanof exploration

prospect (located mainly within Exploration Permit WA-519-P )

through the acquisition of a 10 per cent. interest in Western Gas,

which wholly owns the prospect.

The Acquisition consideration comprised of a cash consideration

of US$4,000,000, and 100,000,000 ordinary shares of 0.25p each in

the Company. In the event of a discovery being declared at the

Sasanof-1 Well, further consideration would have been payable.

On 6 June 2022 the Company announced that no commercial

hydrocarbons were intersected and the Sasanof-1 Well would be

plugged and permanently abandoned. De-mobilisation activities

commenced. Accordingly, the total costs of GBP4,095,294 incurred on

the Sasanof-1 Well were written off in full in the current

year.

During 2018 the Group resolved the outstanding issues with the

Ghana National Petroleum Company (GNPC) regarding a contract for

the development of the Tano 2A Block. The Group has signed a

Petroleum Agreement in relation to the block and this agreement

awaits ratification by the Ghanian government.

The Company is in negotiations with the Vice-Ministry of

Electrical Technologies and the State Lithium Company in Bolivia on

exploration and development of salt-lakes in accordance with law.

Samples have been analysed and process work is underway.

The Directors believe that there were no facts or circumstances

indicating that the carrying value of the remaining intangible

assets may exceed their recoverable amount and thus no impairment

review was deemed necessary by the Directors. The realisation of

these intangibles assets is dependent on the successful discovery

and development of economic deposit resources and the ability of

the Group to raise sufficient finance to develop the projects. It

is subject to a number of potential significant risks, as set out

below:

-- licence obligations;

-- exchange rate risks;

-- uncertainties over development and operational costs;

-- political and legal risks, including arrangements with

governments for licences, profit sharing and taxation;

-- foreign investment risks including increases in taxes,

royalties and renegotiation of contracts;

-- title to assets;

-- financial risk management;

-- going concern; and

-- ability to raise finance.

Included in the additions for the year are GBPNil (2021:

GBP15,000) of Directors' remuneration. The remaining balance

pertains to the amounts capitalised to the respective projects held

by the entity.

5. TRADE AND OTHER PAYABLES

Group Group

2022 2021

GBP GBP

Trade payables 56,575 48,783

Creditor - Western Gas 553,133 -

Other accruals 16,500 16,500

Other payables 1,525,565 1,420,565

Cash received in advance for share placing 870,022 -

Related parties 4,719 -

3,026,514 1,485,848

========== ==========

It is the Company's normal practice to agree terms of

transactions, including payment terms, with suppliers and provided

suppliers perform in accordance with the agreed terms, payment is

made accordingly. In the absence of agreed terms it is the

Company's policy that the majority of payments are made between 30

to 40 days. The carrying amount of trade and other payables

approximates to their fair value.

Other payables relate to amounts due to Directors' remuneration

of GBP1,525,565 (2021: GBP1,420,565) accrued but not paid at year

end.

Creditor - Western Gas relate to cash calls due for costs

incurred on the Sasanof-1 Well accrued but not paid at period

end.

6. SHARE CAPITAL

Deferred Shares - nominal value of 0.24p (2021: Nil)

Number Share Capital Share Premium

GBP GBP

At 1 January 2022 - - -

Transfer from ordinary shares 2,370,826,117 5,689,982 -

----------------- -------------- --------------

At 31 December 2022 2,370,826,117 5,689,982 -

================= ============== ==============

Ordinary Shares - nominal value of 0.01p (2021: 0.25p)

Allotted, called-up and fully paid:

Number Share Capital Share Premium

GBP GBP

At 1 January 2021 716,979,964 1,792,450 10,900,373

Issued during the year 153,846,153 384,615 115,385

Share issue expenses - (30,000)

----------------- -------------- --------------

At 31 December 2021 870,826,117 2,177,065 10,985,758

Issued during the year 1,500,000,000 3,750,000 -

----------------- -------------- --------------

2,370,826,117 5,927,065 10,985,758

Transfer to deferred shares (5,689,982) -

----------------- -------------- --------------

At 31 December 2022 2,370,826,117 237,083 10,985,758

================= ============== ==============

Movements in issued share capital

On 6 May 2021 the Company raised GBP500,000 via a placing of

153,846,153 ordinary shares at a price of 0.325p per share.

Proceeds raised were used to provide additional working capital and

fund development costs.

On 27 April 2022 the Company raised GBP3,500,000 via a placing

of 1,400,000,000 ordinary shares at a price of 0.25p per share.

Proceeds raised were used to finance the drilling of the Sasanof-1

Well in Western Australia.

On 9 May 2022, as part of the acquisition of a 10% interest in

the Sasanof-1 Well, the Company issued 100,000,000 shares at a

price of 0.25p per share to Western Gas Australia

On 4 August 2022 the 2,370,826,117 issued ordinary shares were

subdivided via ordinary resolution into 2,370,826,117 ordinary

shares of 0.01p each and 2,370,826,117 deferred shares of 0.24p

each.

Share Options

A total of 40,500,000 share options were in issue at 31 December

2022 (2021: 40,500,000). These options are exercisable, at prices

ranging between 0.70p and 0.725p, up to seven years from the date

of granting of the options unless otherwise determined by the

Board. Further information relating to Share Options is outlined in

Note 7.

7. SHARE BASED PAYMENTS

The Group issues equity-settled share-based payments to certain

Directors and individuals who have performed services for the

Group. Equity-settled share-based payments are measured at fair

value at the date of grant. Shares granted to individuals and

Directors will vest 3 years from the period that the awards

relates.

Fair value is measured by the use of a Black-Scholes model.

The Group plan provides for a grant price equal to the average

quoted market price of the ordinary shares on the date of

grant.

Share Options

31 December 2022 31 December 2021

Options Weighted Options Weighted

average average

exercise exercise

price in price in

pence pence

Outstanding

at

beginning

of year 40,500,000 0.7 40,500,000 0.7

Issued - - - -

Expired - - - -

------------------------------- ----------------------------- ------------------------------- -----------------------------

Outstanding

at end of

year 40,500,000 0.7 40,500,000 0.7

=============================== ============================= =============================== =============================

Exercisable

at end of

year 40,500,000 0.7 30,500,000 0.7

=============================== ============================= =============================== =============================

During 2019 40,500,000 options were granted with a fair value of

GBP246,788. These fair values were calculated using the

Black-Scholes valuation model. These options will vest over a 3

year period and will be capitalised or expensed on a straight line

basis over the vesting period.

The inputs into the Black-Scholes valuation model were as

follows:

Grant 2 October 2019

Weighted average share price at date of grant (in pence)

0.7p

Weighted average exercise price (in pence)

0.7p

Expected volatility

116.23%

Expected life

7 years

Risk free rate

1.3%

Expected dividends

none

Expected volatility was determined by management based on their

cumulative experience of the movement in share prices. The terms of

the options granted do not contain any market conditions within the

meaning of IFRS 2

The Group capitalised expenses of GBPNil (2021: GBPNil) and

expensed costs of GBP61,695 (2021: GBP82,264) relating to

equity-settled share-based payment transactions during the

year.

Warrants

31 December 2022 31 December 2021

Warrants Weighted Warrants Weighted

average average

exercise exercise

price in price in

pence pence

Outstanding - - - -

at beginning

of year

Issued 435,683,300 0.25 - -

Expired - - - -

-------------------------------- ----------------------------- ----------------------------- -----------------------------

Outstanding

at end of

year 435,683,300 0.25 - -

================================ ============================= ============================= =============================

On 12 January 2022 the Company issued 435,683,300 warrants over

ordinary shares to the Directors who have accrued salary not paid

to them since 2010. The accrued liability as at 31 December 2021

for the three longest serving Directors (Dr Teeling, Mr Horgan and

Mr Finn) was GBP1,340,564. The Board remains cognisant of the need

to conserve cash resources in the current environment and therefore

these three Directors have agreed to continue deferring payment of

this amount, in cash, until the end of 2024.

In consideration for this past and continued deferral, these

Directors have been issued 3.25 warrants over ordinary shares per

each 1p of accrued salary due until 31 December 2021. The Warrants

are exercisable at 0.25p at any time until 11 January 2025 and have

been allocated as follows:

Accrued salary (GBP) Warrants exercisable at conversion price of 0.25p per

share

David Horgan GBP569,037 184,937,025

John Teeling (resigned 1 July 2022) GBP395,704 128,603,800

James Finn GBP375,823 122,142,475

Accordingly, in aggregate, 435,683,300 Warrants have been issued

to the above Directors. Any exercise of the Warrants is restricted

to the extent that, if by exercising, the Warrant holders in

aggregate hold greater than 29.9 per cent. of the total voting

rights of the Company.

For the avoidance of doubt, the deferred salaries, unless

otherwise settled, will remain payable in cash after the end of

2024.

8. OTHER RESERVES

Share Based Payment Reserve

GBP

Balance at 1 January 2021 103,879

Vested during the year 82,264

----------------------------

Balance at 31 December 2021 186,143

Vested during the year 61,695

----------------------------

Balance at 31 December 2022 247,838

============================

Share Based Payment Reserve

The share based payment reserve arises on the grant of share

options under the share option plan as detailed in Note 7.

9. RETAINED DEFICIT

2022 2021

GBP GBP

Opening Balance (13,620,584) (13,157,083)

Loss for the year (4,776,646) (463,501)

------------- -------------

Closing Balance (18,387,230) (13,620,584)

============= =============

Retained Deficit

Retained deficit comprises of losses incurred in the current and

prior years.

10. POST BALANCE SHEET EVENTS

On 16 January 2023 the Company has raised GBP1,300,000 (before

expenses) via the placing of, and subscription for, 2 billion new

ordinary shares 0.01p each in the Company, via several Australian

based brokers, at a price of 0.065p per Placing Share .

The net proceeds of the Placing will be used to advance

Clontarf's lithium projects in Bolivia, and petroleum projects in

Ghana, Australia, and elsewhere.

On 17 January 2023 following long-term, incentive share options

the Company granted over, in aggregate, 160,000,000 ordinary shares

of 0.01p each in the Company. The Options vest immediately, have an

exercise price of 0.0725p and an expiry date of 16 January 2030.

The exercise price represents a premium of c. 4% to the closing

price on 16 January 2023, being the last trading day before the

award of the Options.

The Options have been awarded as follows:

Number of Share Options granted

David Horgan, Chairman 60,000,000

Peter O'Toole, Independent Non-Executive

Director 40,000,000

James Finn, Financial Director and Company

Secretary 40,000,000

Dipti Mehta, Financial Controller 20,000,000

On 15 February 2023 the Company announced a heads of agreement

around the potential formation of a 50:50 Joint Venture with US

based, OTC Markets traded, technology company, NEXT-ChemX

Corporation ("NCX") covering testing, marketing, and deploying of

NCX's proprietary (patent pending) DLE technology in Bolivia.

Further on 5 May 2023 the Company announced that all conditions

precedent have now been satisfied with respect to the JV with

Next-ChemX. In this regard the Company has paid NCX US$500,000 and

has issued 385 million new Ordinary shares in the capital of

Clontarf of which half will be subject to a 12 month lock-in.

On 1 June 2023 the Company announced it had raised GBP350,000

(before expenses) via the placing of, and subscription for,

437,500,000 new ordinary shares of 0.01p each in the capital of the

Company at a price of 0.08p per Placing Share.

The net proceeds of the Placing will be used to advance

Clontarf's lithium projects in Bolivia, and neighbouring countries,

as well as on petroleum projects in Ghana, Australia, and

elsewhere.

There are no other post balance sheet events apart from those

noted above.

11. ANNUAL GENERAL MEETING

The Company's Annual General Meeting will be held on Thursday

13(th) July 2023 at 11.00am at Canal Court Hotel, Merchants Quay,

Newry, BT35 8HF, United Kingdom. Further information, including the

Notice of Annual General Meeting, will be provided shortly.

12. GENERAL INFORMATION

The financial information set out above does not constitute the

Company's audited financial statements for the year ended 31

December 2022 or the year ended 31 December 2021. The financial

information for 2021 is derived from the financial statements for

2021 which have been delivered to Companies House. The auditors had

reported on the 2021 statements; their report was unqualified and

did not contain a statement under section 498(2) or 498(3) of the

Companies Act 2006. The financial statements for 2022 will be

delivered to Companies House.

A copy of the Company's Annual Report and Accounts for 2022 will

be mailed shortly only to those shareholders who have elected to

receive it. Otherwise, shareholders will be notified that the

Annual Report will be available on the website

www.clontarfenergy.com . Copies of the Annual Report will also be

available for collection from the Company's registered office,

Suite 1, 7(th) Floor, 50 Broadway, London, SW1H 0BL.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UPUQAQUPWGAM

(END) Dow Jones Newswires

June 08, 2023 02:00 ET (06:00 GMT)

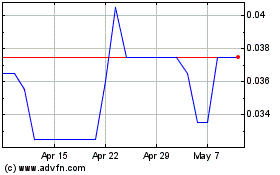

Clontarf Energy (LSE:CLON)

Historical Stock Chart

From Apr 2024 to May 2024

Clontarf Energy (LSE:CLON)

Historical Stock Chart

From May 2023 to May 2024