Capita PLC Holding(s) in Company

September 22 2016 - 7:47AM

UK Regulatory

TIDMCPI

TR-1: NOTIFICATION OF MAJOR INTERESTS IN SHARES

1. Identity of the issuer or the underlying issuer of existing shares to which

voting rights are attached:

Capita plc

2. Reason for the notification:

An acquisition or disposal of voting rights

3. Full name of person(s) subject to the notification obligation:

Baillie Gifford & Co

4. Full name of shareholder(s) (If different from 3)

5. Date of the transaction and date on which the threshold is crossed or

reached:

20 September 2016

6. Date on which issuer notified:

21 September 2016

7. Threshold(s) that is/are crossed or reached:

5%

8. Notified details:

A: Voting rights attached to shares

Class/type of shares Situation previous to the Triggering transaction

if possible using the

ISIN CODE

Number of shares Number of voting Rights

Ordinary Below 5% Below 5%

(GB00B23K0M20)

Resulting situation after the triggering transaction

Class/type of shares Number of shares Number of voting rights % of voting rights

if possible using the

ISIN CODE

Direct Direct Indirect Direct Indirect

Ordinary 0 0 34,093,068 0 5.11%

(GB00B23K0M20)

B: Qualifying Financial Instruments

Resulting situation after the triggering transaction

N/A

C: Financial Instruments with similar economic effect to Qualifying Financial

Instruments

Resulting situation after the triggering transaction

Type of Exercise Expiration Exercise/ Number of voting % of voting rights

financial price date Conversion rights instrument

instrument period refers to

Nominal Delta

Total (A+B+C)

Number of voting % of voting rights

rights

5.11%

34,093,068

9. Chain of controlled undertakings through which the voting rights and/or the

financial instruments are effectively held, if applicable:

In the narrative below, the figures in [ ] indicate the amount of voting rights

and the percentage held by each controlled undertaking where relevant.

Baillie Gifford & Co, a discretionary investment manager, is the parent

undertaking of an investment management group.

Its wholly-owned subsidiary undertaking Baillie Gifford Overseas Limited

[21,129,403; 3.17%] is also a discretionary investment manager.

Its wholly-owned subsidiary undertaking Baillie Gifford & Co Limited

[1,814,371; 0.27%] is an OEIC Authorised Corporate Director and Unit Trust

Manager which has delegated its discretionary investment management role to

Baillie Gifford & Co.

Its wholly-owned subsidiary undertaking Baillie Gifford Life Limited

[2,835,792; 0.43%] is a life assurance company which procures discretionary

investment management services from Baillie Gifford & Co in respect of its own

account shareholdings.

Proxy Voting:

10. Name of the proxy holder:

N/A

11. Number of voting rights proxy holder will cease to hold:

N/A

12. Date on which proxy holder will cease to hold voting rights:

N/A

13. Additional information:

Issued Share Capital - 670,210,670

Issue of Shares in Treasury- 3,105,242

14. Contact name:

Francesca Todd - Capita plc

Mike Bassi - Baillie Gifford & Co

15. Contact telephone number:

+44 (0)20 7202 0641 - Capita plc

0131 275 3852- Baillie Gifford & Co

22nd September 2016

END

(END) Dow Jones Newswires

September 22, 2016 08:47 ET (12:47 GMT)

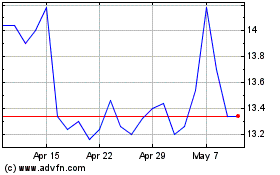

Capita (LSE:CPI)

Historical Stock Chart

From Apr 2024 to May 2024

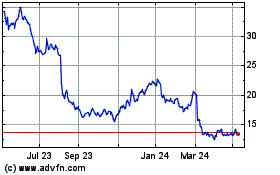

Capita (LSE:CPI)

Historical Stock Chart

From May 2023 to May 2024