TIDMIRG

RNS Number : 0639B

Independent Resources PLC

30 March 2017

FOR IMMEDIATE RELEASE

Independent Resources plc

("IRG" or the "Company")

Block Admission, Warrant Exercise and Total Voting Rights

Block Admission

The Company announces that applications have been made for the

block admissions of up to a total of 641,547,936 ordinary shares of

0.1p each in the Company (the "New Ordinary Shares") to trading on

AIM (the "Block Admissions") relating to eight warrant instruments,

already in existence.

New Ordinary Shares are expected to be issued from time to time

pursuant to the exercise of warrants to subscribe for ordinary

shares of 0.1p each in the Company ("Ordinary Shares") which will,

when issued, rank pari passu with the Company's existing Ordinary

Shares.

The Block Admissions have been made in respect of the issue of

Ordinary Shares pursuant to the exercise of:

(i) Warrants issued by the Company in 2015 to subscribe for new

Ordinary Shares at a price of 1.5p per new Ordinary Share (the "May

2015 Warrants - Batch 1");

(ii) Warrants issued by the Company in 2015 to subscribe for new

Ordinary Shares at a price of 1.2p per new Ordinary Share (the "May

2015 Warrants - Batch 2");

(iii) Warrants issued by the Company in 2015 to subscribe for

new Ordinary Shares at a price of 1.5p per new Ordinary Share (the

"May 2015 Warrants - Batch 3");

(iv) Warrants issued by the Company in 2015 to subscribe for new

Ordinary Shares at a price of 1.5p per new Ordinary Share (the

"July 2015 Warrants");

(v) Warrants issued by the Company in 2015 to subscribe for new

Ordinary Shares at a price of 1.0p per new Ordinary Share (the

"November 2015 Warrants - Batch 1");

(vi) Warrants issued by the Company in 2015 to subscribe for new

Ordinary Shares at a price of 0.72p per new Ordinary Share (the

"November 2015 Warrants - Batch 2");

(vii) Warrants issued by the Company in 2015 to subscribe for

new Ordinary Shares at a price of 0.12p per new Ordinary Share (the

"December 2016 Warrants - Batch 1"); and

(viii) Warrants issued by the Company in 2015 to subscribe for

new Ordinary Shares at a price of 0.08p per new Ordinary Share (the

"December 2016 Warrants - Batch 2");

May 2015 Warrants

- Batch 1 9,200,000

------------------------ ------------

May 2015 Warrants

- Batch 2 4,000,000

------------------------ ------------

May 2015 Warrants

- Batch 3 30,800,000

------------------------ ------------

July 2015 Warrants 8,724,019

------------------------ ------------

November 2015 Warrants

- Batch 1 133,333,333

------------------------ ------------

November 2015 Warrants

- Batch 2 6,000,000

------------------------ ------------

December 2016 Warrants

- Batch 1 401,578,334

------------------------ ------------

December 2016 Warrants

- Batch 2 47,912,250

------------------------ ------------

Total: 641,547,936

------------------------ ------------

The Block Admissions are expected to be effective from 05 April

2017.

Warrant Exercise

The Company also announces that it has received exercise notices

from certain of its warrant holders to exercise 10,000,000 warrants

into New Ordinary Shares as per the table below:

Exercise No. of warrants

price being exercised

--------- -----------------

0.12p 10,000,000

--------- -----------------

Total: 10,000,000

--------- -----------------

The total consideration received by the Company pursuant to the

warrant exercise will be GBP12,000.00.

Application will be made for the 10,000,000 New Ordinary Shares,

which will rank pari passu with the existing ordinary shares, to be

admitted to trading on AIM ("Admission"). Admission is expected to

occur on 05 April 2017.

Total Voting Rights

Following Admission, the total number of voting rights in the

Company will be 3,911,086,881 ordinary shares. This number may be

used by shareholders as the denominator for the calculations by

which they will determine if they are required to notify their

interest in, or a change to their interest in, the Company under

the FCA's Disclosure and Transparency Rules.

James Parsons, Chairman, commented:

"As we approach the end of the open offer we are pleased to

confirm this block listing which enables the Company to handle

future warrant exercises in a cost effective and efficient

manner.

The team and I look forward to meeting investors at the General

Meeting on 18th April where we will reveal the next step of the

Echo Energy journey."

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) 596/2014.

For more information, please visit www.ir-plc.com or

contact:

James Parsons Echo Energy plc j.parsons@echoenergyplc.com

Greg Coleman Echo Energy plc g.coleman@echoenergyplc.com

ZAI Corporate Finance

John Treacy Ltd. 020 7060 2220

Jamie Spotswood (Nominated Adviser)

Oliver Stansfield Brandon Hill Capital

Jonathan Evans (Broker) 020 3463 5000

This information is provided by RNS

The company news service from the London Stock Exchange

END

STRURRSRBKAOOAR

(END) Dow Jones Newswires

March 30, 2017 10:13 ET (14:13 GMT)

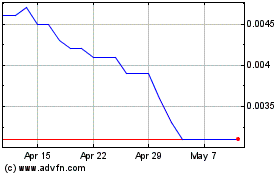

Echo Energy (LSE:ECHO)

Historical Stock Chart

From Apr 2024 to May 2024

Echo Energy (LSE:ECHO)

Historical Stock Chart

From May 2023 to May 2024