Rank and 888 No Longer Eye Merger With William Hill

August 18 2016 - 12:20PM

Dow Jones News

LONDON—Rank Group PLC and 888 Holdings PLC no longer intend to

make an offer for William Hill PLC, a move that would have been the

latest big deal amid a flurry of consolidation in the gambling

industry.

Casino and bingo hall operator Rank Group and online gambling

group 888 Holdings made two offer proposals to bookmaker William

Hill, the latest one valuing it at 394 pence a share, equivalent to

around 2.5 billion pounds ($4.5 billion).

"The proposed transaction would have created a transformational

force in the global betting and gaming industry and the U.K.'s

largest multichannel gambling operator by revenue and profit and

was expected to have unlocked substantial cost and revenue

synergies," said Rank and 888 in a stock exchange statement

Thursday.

"Notwithstanding 888 and Rank's belief in the inherent value of

their proposals, it has not been possible to meaningfully engage

with the board of William Hill," they added.

William Hill said following the Rank and 888 announcement that

it will continue to focus on diversifying digitally and

internationally and that it now expects full-year adjusted

operating profit to be at the top end of its previously guided £

260 million to £ 280 million range.

The merger talks were part of broader consolidation in the

European gambling sector amid rising competition and taxation and

tighter regulation.

In February 2015, 888 terminated talks and rejected a possible

offer from William Hill as the companies failed to agree on an

offer value. Later in 2015, 888 lost a bid to GVC Holdings PLC

after the latter clinched a deal to buy online gambling firm

Bwin.party digital PLC for £ 1.12 billion.

Razak Musah Baba contributed to this article

Write to Rory Gallivan at rory.gallivan@wsj.com

(END) Dow Jones Newswires

August 18, 2016 13:05 ET (17:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

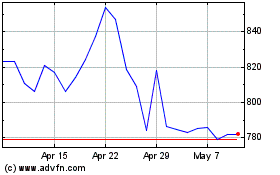

Entain (LSE:ENT)

Historical Stock Chart

From Apr 2024 to May 2024

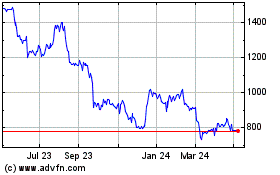

Entain (LSE:ENT)

Historical Stock Chart

From May 2023 to May 2024