TIDMESO TIDMEC.P TIDMEO.P

RNS Number : 0013O

EPE Special Opportunities PLC

16 September 2013

16 September 2013

EPE Special Opportunities plc

Interim Results for the six months ended 31 July 2013

The Board of EPE Special Opportunities plc are pleased to

announce the Company's Interim Results for the six months ended 31

July 2013.

Highlights:

-- The NAV of the Company at 31 July 2013 was 109.15 pence per

share, an increase of 6.1 % since 31 January 2013.

-- Nexus delivered strong export and retail sales in the first

half year, despite a challenging retail and wholesale

environment.

-- Whittard has achieved an increase in like-for-like sales

compared to 2012 and a significant gain in gross margins as a

result of the continued success of its pricing strategy focused on

premium positioning and the cessation of discounting.

-- The rest of the underlying portfolio has also performed well,

with a number of portfolio companies ahead of budget at the half

year point.

-- The Company's residual investment in Palatinate was sold,

equating to 2.4 x Money Multiple and 43.3 % IRR. The sale was

completed at a 31.4 % premium to Palatinate's prevailing holding

value, generating an uplift in the Company's NAV of 3.79 pence per

share.

-- The overwhelming shareholder support at the AGM in favour of

extending the life of the Company to December 2020 creates a

framework for longevity and the opportunity to maximise value

within the current portfolio and in new transactions.

Geoffrey Vero, Chairman, commented: "In spite of uncertain

economic conditions, we are pleased with the performance of the

portfolio and the progress of the Company over the last six months.

We are optimistic that the Company's portfolio will continue to

perform and that there exist opportunities to acquire high quality

assets at attractive prices ."

Enquiries:

Numis Securities Ltd

+44 (0) 20 7260 1000 Nominated Advisor Stuart Skinner / Hugh Jonathan

Corporate Broker Charles Farquhar

EPIC Private Equity LLP

+44 (0) 20 7269 8865 Alex Leslie

IOMA

+44 (0) 16 2468 1250 Philip Scales

Cardew Group

+44 (0) 20 7930 0777 Richard Spiegelberg / Georgina Hall

Chairman's Statement

The six months to July 2013 showed a slightly improving economic

outlook, with a GDP increase in Q2 2013 and strong employment

figures, seemingly marking the beginning of the recovery for the UK

economy. However, a number of indicators remain weak, which could

continue to negatively impact the Company's economic environment.

Whilst domestic demand increased moderately during 2013, this was

largely offset by a pronounced fall in exports, and the weakness of

productivity suggests that the financial crisis may still be

weighing on the current effective supply capacity of the economy as

well as on demand. Given the UK's international exposure,

particularly through its financial and services sectors, its near

and medium term growth will also depend on the outlook of those

international markets. The Eurozone is in the process of recovering

and has recently shown more stability than over the last few years.

However, it is not expected to fully recover from recession until

2014 at the earliest.

The Company has not pursued any new transactions so far in 2013

as a result of these uncertain economic conditions. However, these

conditions may yet yield investment opportunities during the

remainder of the year, particularly with regards to special and

distressed situations, two areas of the Company's investment

strategy. The Company continues to actively source deals and deal

flows remain strong.

This year has so far proven encouraging for the portfolio, most

notably the Company's two largest investments, Nexus Industries and

Whittard of Chelsea. As of July 2013, Nexus is trading ahead of

budget and is continuing to expand and increase margins, supported

by its wholly-owned manufacturing facility based in China. For the

remainder of 2013, Nexus is budgeting significant double-digit

organic sales and EBITDA growth. Whittard of Chelsea continued to

perform strongly in the six months to 31 July 2013 and is expecting

to support the delivery of significantly improved margins by the

end of 2013 via its premium positioning strategy, international and

wholesale. Your Board are optimistic that economic indicators

appear to be improving and that the Company's portfolio will

continue to perform well.

On 11 June 2013, the Company exited its investment in Palatinate

Schools Holdings Limited ("Palatinate") to Minerva Education

Finance Limited, generating a total return to ESO Investments 1 LP

("ESO 1 LP") since September 2010 of 2.4x Money Multiple and a

43.3% IRR.

Your Board was pleased with the overwhelming shareholder support

at the AGM to extend the life of the Company to December 2020, with

5 year extensions thereafter. The revised structure of the Company

creates a framework for longevity, providing the opportunity to

maximise value within the current portfolio and in new

transactions. The Board believes that the increased duration of the

Company is a significant step in maximising capital gain in the

medium and long term for the benefit of shareholders.

The Board and the Investment Advisor are investigating the

possibility of raising additional funds for the Company using

senior debt, mezzanine or bond. Should the Company decide to raise

funds by way of debt or debt-like instruments it would anticipate

that those instruments and any existing Convertible Loan Notes in

aggregate would be more than 3.0x covered by the Gross Assets of

the Company. Any new funds raised would be used, inter alia, to

retire existing Convertible Loan Notes in light of the December

2015 end date, buy-in minorities in the existing investments and

support new investments.

The 31 July 2013 Net Asset Valuation of 109.15 pence per share

represents an increase of 6.1 per cent on the Net Asset Value of

per share of 102.92 pence as at 31 January 2013.

I would like to extend my thanks to the Investment Advisor, EPIC

Private Equity LLP ("EPE"), as well as my fellow Directors and

professional advisors, for their concerted efforts over the last

six months. I look forward to once again updating you on continued

success over the remainder of the year.

Geoffrey Vero

Chairman

13 September 2013

Investment Advisor's Report

In the six month period since 31 January 2013, the Investment

Advisor has focused on maintaining and creating value from within

the existing portfolios held by the Company and the Fund. The

Investment Advisor continues to undertake cost saving and revenue

improvement measures in investee companies to increase the value of

the current portfolio. These initiatives remain important given the

challenging current economic climate. At the same time, the

Investment Advisor has endeavoured to find new opportunities by way

of platform or bolt-on investment opportunities. All new

investments will be made via ESO Investments 2 LP, in which the

Company is the sole investor.

The underlying portfolio has performed well since January 2013,

with a number of companies finishing their half years to 31 July

2013 ahead of budget. Nexus finished the half year ahead of budget,

despite a challenging retail environment, thanks in part to strong

export and retail sales, as well as strong supply chain margins

delivered by its 250,000 square foot factory in China. Whittard of

Chelsea delivered a strong first half in 2013, with an increase in

retail like-for-like sales compared to 2012 and strong gross

margins showing a significant gain from last year. This reflects

the continued success of the pricing strategy initiated in 2012 to

cease discounting and drive the premium position of the brand. The

business continues to show solid growth in web and UK wholesale

activities, both at the sales and gross margin level compared to

the previous year. Key performance drivers include channel growth

in online and wholesale, gross margin improvements and continued

investment in the product offering. Indicia performed below budget

in the first six months of 2013, and its management has engaged a

recovery plan focussing on delivering additional sales by fully

converting its strong sales pipeline, as well as increasing

profitability on existing customers. Indicia has recently had some

transformational client wins including ITV, who have appointed

Indicia as its lead agency on a three year contract. Bighead

performed above budget both at sales and EBITDA level, underscored

by a strong new business pipeline for the second half of 2013.

Process Components, however, underperformed in the first half of

2013, offering lower than expected sales and EBITDA, predominantly

driven by poor trading performance in the US. However the sales

infrastructure has been restructured and there has already been an

improvement in prospect levels and quotation conversion, setting an

optimistic trend for this coming year.

On 11 June 2013, the Company disposed of its residual investment

in Palatinate to Minerva Education Finance Limited. The disposal

returned GBP6.9 million in total to ESO 1 LP at the exit date,

GBP6.8 million as cash and GBP0.1 million as warranty retention,

and a total of GBP11.4 million since the acquisition in September

2010 via income, repayment of loans in October 2012 and the

disposal proceeds. The total return to ESO 1 LP since September

2010 equates to a 2.4x Money Multiple and 43.3% IRR. The disposal

has a positive impact on the Fund and was completed at a 31.4%

premium to Palatinate's prevailing holding value of GBP5.2 million,

resulting in a NAV uplift of 3.79 pence per share between May and

June 2013.

The Net Asset Value per share as at 31 July 2013 for the Company

was 109.15 pence, calculated on the basis of 27.8 million ordinary

shares. On the basis of this Net Asset Value, the outstanding

GBP6.0m of Convertible Loan Notes ("CLNs") and GBP3.8m of Net Cash,

Gross Asset Cover of the CLNs has moved to 6.1x and Cash Interest

Cover to 19.6x. Liquidity in cash and facilities at ESO plc and ESO

Investments 1 LP remains high at GBP10.6m. The Company continues to

allocate capital prudently having returned to stakeholders a

combined c.GBP7.0m of par value of CLNs and ordinary shares at a

cost of GBP4.7m since September 2010.

The Company maintains a low third party debt position of 1.7x

EBITDA across its portfolio, whilst arithmetic average Net Debt to

EBITDA across the portfolio is 2.3x. The portfolio remains

conservatively valued with a weighted average Enterprise Value to

EBITDA multiple of 5.4x.

Investment highlights from the inception of the Company (16

September 2003) to date include: deployed GBP65 million of capital

and returned over GBP53 million to the Company in capital and

income; generated gross income of GBP16 million; paid dividends of

GBP5 million; the underlying portfolio, as at 31 July 2013, is

valued at a gross 2.7x money multiple and 27% internal rate of

return.

The UK's economic outlook is improving slowly. Consumer spending

figures are showing some upward momentum, mainly due to a rise in

real income, reflecting stronger employment growth and an easing in

inflation expected later in the year. However, despite the

improving economic environment, the recovery of the UK economy

remains timid. UK exports and imports remain weak, and trading

conditions in the retail sector, which concerns several portfolio

investments of the Company, remain poor. Lending growth,

particularly to businesses, has shown little upward momentum.

Furthermore, any real boost in growth is tied to the full recovery

of international markets including the Eurozone, which is not

expected until the end of 2014. The Company therefore continues to

focus on consolidation with a view to preserving value in its core

investments.

Whilst current economic conditions remain challenging for the

Company's underlying portfolio, they may provide opportunities to

acquire high quality assets at relatively low price points and

opportunities continue to be assessed.

Investment Strategy

The Investment Advisor believes that the current economic

environment continues to create a wide range of investment

opportunities. As a result, the Investment Advisor continues to use

proprietary deal sourcing approaches to source these opportunities,

as well as engaging actively with the wider restructuring and

advisory community to communicate the Company's investment

strategy. The Company seeks to target growth and buyout

opportunities, as well as special situations and distressed

transactions, making investments where it believes pricing to be

attractive and the potential for value creation strong. The Company

will continue to target the following types of investments:

-- Growth, Buyout and Pre-IPO opportunities: leveraging the

Investment Advisor's investment experience, contacts and ability.

The Company is particularly focussed on making investments in

sectors where the opportunity exists to create a unique asset via

the consolidation of a number of smaller companies, taking

advantage of the lack of liquidity in the SME market and the

attraction to secondary buyers of larger operations.

-- Special Situations: investment opportunities where the

Investment Advisor believes that assets are undervalued due to

specific, event-driven circumstances and where asset-backing may be

available and the opportunity exists for recovery and significant

upside. Target companies may or may not be distressed as a result

of the situation. The Investment Advisor will aim to use its

restructuring and refinancing expertise to resolve the situation

and achieve a controlling position in the target company. The

Company seeks to acquire distressed debt, undervalued equity or the

assets of target businesses in solvent or insolvent situations.

-- Private Investment in Public Equities (PIPEs): the Company

may consider making investments in a number of smaller quoted

companies, primarily ones whose shares are admitted to AIM. The

Company will either seek to acquire and de-list the target company

or make an investment in the ordinary equity of a quoted target

company. The Company may offer ordinary shares in the Company as

all or part of the consideration for such investments.

-- Secondary portfolios / LP positions (Secondary or Primary) /

EPE Funds: the Company is able, through EPE's Placement business,

to invest as a limited partner in various Private Equity funds on

substantially improved terms. On occasion, the Company will seek to

take advantage of these commitments. The EPE skill-set and

experience is well suited to the requirements of co-investing in

funds.

The Company will consider most industry sectors, including

consumer, retail, manufacturing, financial services, healthcare,

support services and media industries. The Company partners with

management and entrepreneurs to maximise value by combining

financial and operational expertise in each investment.

The Company will seek to invest between GBP2 million and GBP10

million in a range of debt and equity instruments with a view to

generating returns through both yield and capital gain. Whilst in

general the Company aims to take controlling equity positions, it

may seek to develop companies as a minority investor. Occasionally

the Board may authorise investments of less than GBP2 million. For

investments larger than GBP5 million, the Company may seek

co-investment from third parties.

Portfolio Diversification

The Company's current portfolio, as at 31 July 2013, is

diversified by sector and instrument as follows:

SECTOR DIVERSIFICATION

Sector %

---------------------------- -----

Retail / FMCG 30%

Engineering, Manufacturing

and Distribution 51%

Business Services 16%

Healthcare 3%

---------------------------- -----

Total 100%

---------------------------- -----

INSTRUMENT DIVERSIFICATION

Instrument %

------------------- -----

Mezzanine Loans 20%

Shareholder Loans 37%

Equity 43%

------------------- -----

Total 100%

------------------- -----

Current Portfolio: ESO Investments (PC) LLP

Process Components

Process Components is an engineering parts and equipment

supplier to the powder processing industries, primarily food,

agriculture and pharmaceuticals. The business was formed in June

2009 and since then has demonstrated substantial year-on-year

growth, doubling EBITDA in that time. However, trading to the year

ending June 2013 has been challenging, driven by poor trading in

the US with new product lines taking longer to achieve recognition.

Nevertheless, a programme of investment in new product development,

sales and marketing is already driving growth over the short to

medium term. Customers are blue chip global manufacturers, and the

business has been growing its international supply operations,

seeking to expand its infrastructure from the US and Europe into

Asia with the opening of a new office in the region. The business

is also seeking to grow via acquisition and targeting suppliers of

adjacent products.

Current Portfolio: ESO Investments 1 LP

Nexus Industries

Nexus Industries ("Nexus") is a manufacturer and distributor of

electrical accessories in the UK, operating under the brand names

Masterplug and British General, supplying both the retail and

wholesale markets. The business had a strong first half of 2013,

despite the current market conditions, with substantial

year-on-year growth driven by the retail and international

divisions. Organic sales growth and margin improvements are

expected to be driven by the wholly-owned production facility

located in mainland China. International expansion is a major focus

for the business, with penetration growing in the US, China and

Australasia. Nexus is also working on acquiring complementary

businesses in both adjacent product categories and new

strategically suitable locations. The Investment Advisor is of the

view that maximum value will be achieved from Nexus by holding for

the medium to long term, giving the management team the opportunity

to implement the organic and acquisition-led growth strategies.

Indicia

Indicia is a direct marketing business focussed on database and

multi-channel analytics. Indicia was formed through the acquisition

and consolidation of three separate businesses and is currently

initiating a partnership with a larger US agency. The business has

underperformed against budget in the first half of 2013, leading

Indicia's senior management to implement a plan focussed on driving

additional sales out of existing clients and accelerating the

conversion of pipeline clients. This plan is expected to underpin

the full year forecast and support future growth. Despite this

weaker performance, Indicia's strategy of investing in its

commercial team continues to generate a strong pipeline of

potential new clients.

Whittard of Chelsea

Whittard of Chelsea is a specialist retailer of tea and coffee.

The Investment Advisor has focussed on developing the Whittard of

Chelsea brand by growing the online, wholesale and franchise

channels. The strategy has driven a very strong turnaround in

profitability since the date of investment. The cessation of

discounting and focus on the premium positioning of the brand this

year has achieved a significant improvement in gross margins. The

Investment Advisor is of the view that maximum value will be

achieved from Whittard of Chelsea by holding for the medium to long

term, giving the management team the opportunity to build on the

platform created by the successful turnaround and achieve

significant growth in both turnover and profitability.

Bighead Bonding Fasteners

Bighead Bonding Fasteners ("Bighead") is a specialist

engineering business manufacturing specialist load-spreading

fasteners and fixings for composites, plastics and traditional

materials. 2013 so far has seen strong trading at sales and EBITDA

level. The new business pipeline is very strong, with significant

new business potential in the automotive sector. The Company

continues to invest in sales and process engineering to secure and

support future growth, particularly focussed on the Automotive

sector. The Investment Advisor, over the long-term, aims to

replicate Bighead's local success in high-end niche applications by

establishing an international network of distributors for the

Company's products and to focus resources on the growth in

lightweight technologies. The Company continues to seek new

distribution and technology partners to facilitate growth.

Pharmacy2U

Pharmacy2U is an online pharmacy business, delivering National

Health Service and private prescriptions direct to the home using

an innovative, in-house developed technology, Electronic

Prescription Service ("EPSr2").

Valuation Methodology

The Company values its investments with reference to the BVCA

guidelines which state that portfolio companies should be valued on

an EBITDA multiple basis using publicly quoted comparables and/or

transaction comparables, then discounting the equity value by an

appropriate percentage to account for marketability considerations.

Cost may be considered as fair value in some cases but assets will

always be held at fair value, whether this is at, above or below

cost, and the value of such assets is reviewed periodically to

ensure that such is the case.

The Company intends to announce an estimated net asset value per

ordinary share on a monthly basis following a review of the

valuation of the Company's investments. The Company continues to

endeavour to comply with industry standards and the Fund applies

the International Private Equity and Venture Capital Valuation

Guidelines. The Company believes that there is unlikely to be any

material effect on the valuation process as a result of this

process. The Investment Advisor adopts a conservative approach to

valuation with reference to the aforementioned methodology having

regard for on-going volatile market conditions, particularly in the

UK retail sector, and credit restraints.

Review report by KPMG Audit LLC to EPE Special Opportunities

plc

Introduction

We have been engaged by the Company to review the condensed set

of financial statements in the half-yearly report for the six

months ended 31 July 2013, which comprises the consolidated

statement of comprehensive income, the consolidated statement of

assets and liabilities, the consolidated statement of changes in

equity, the consolidated statement of cash flows and the related

explanatory notes. We have read the other information contained in

the half-yearly report and considered whether it contains any

apparent misstatements or material inconsistencies with the

information in the condensed set of financial statements.

This report is made solely to the Company in accordance with the

terms of our engagement. Our review has been undertaken so that we

might state to the Company those matters we are required to state

to it in this report and for no other purpose. To the fullest

extent permitted by law, we do not accept or assume responsibility

to anyone other than the Company for our review work, for this

report, or for the conclusions we have reached.

Directors' responsibilities

The half-yearly report is the responsibility of, and has been

approved by, the Directors. The Directors are responsible for

preparing the half-yearly report in accordance with the AIM

Rules.

The annual financial statements of the Group are prepared in

accordance with IFRSs, as adopted by the EU. The condensed set of

financial statements included in this half-yearly report has been

prepared in accordance with IAS 34 Interim Financial Reporting.

Our responsibility

Our responsibility is to express to the Company a conclusion on

the condensed set of consolidated financial statements in the

half-yearly report based on our review.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410 Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity issued by the Auditing Practices Board for use in the

UK. A review of interim financial information consists of making

enquiries, primarily of persons responsible for financial and

accounting matters, and applying analytical and other review

procedures. A review is substantially less in scope than an audit

conducted in accordance with International Standards on Auditing

(UK and Ireland) and consequently does not enable us to obtain

assurance that we would become aware of all significant matters

that might be identified in an audit. Accordingly, we do not

express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of consolidated

financial statements in the half-yearly report for the six months

ended 31 July 2013 is not prepared, in all material respects, in

accordance with IAS 34 and the AIM Rules.

KPMG Audit LLC

Chartered Accountants

Heritage Court

41 Athol Street

Douglas

Isle of Man IM99 1HN

13 September 2013

Consolidated Statement of Comprehensive Income

For the six months ended 31 July 2013

1 Feb

1 Feb 2012

2012 to to 31

1 Feb 2013 to 31 Jul 31 Jul Jan

2013 2012 2013

Revenue Capital Total Total Total

(unaudited) (unaudited) (unaudited) (unaudited) (audited)

------------- ------------- ------------- ------------- -----------

Note GBP GBP GBP GBP GBP

----------------------------------- ------------- ------------- ------------- ------------- -----------

Income

Rental income - - - 11,979 (12,243)

Interest income 1,680 - 1,680 681 3,157

----------------------------------- ------------- ------------- ------------- ------------- -----------

Total income 1,680 - 1,680 12,660 (9,086)

----------------------------------- ------------- ------------- ------------- ------------- -----------

Expenses

5 Investment advisor's fees (266,165) - (266,165) - (216,667)

Administration fees (34,150) - (34,150) (21,596) (54,133)

Directors' fees (62,000) - (62,000) (53,918) (126,500)

Directors' and Officers' insurance (2,062) - (2,062) (2,000) (7,412)

Professional fees (17,388) - (17,388) (50,104) (32,811)

Board meeting and travel expenses (6,207) - (6,207) (3,976) (6,490)

Auditors' remuneration (19,766) - (19,766) (18,002) (32,952)

Bank charges (349) - (349) (252) (960)

Irrecoverable VAT (97,382) - (97,382) (39,639) (100,863)

Share based payment expense (72,453) - (72,453) - (14,092)

Sundry expenses (14,817) - (14,817) (11,171) (11,256)

Listing fees (9,589) - (9,589) (8,689) (19,632)

Nominated advisor and broker

fees (32,147) - (32,147) (15,000) (40,357)

Total expenses (634,475) - (634,475) (224,347) (664,125)

----------------------------------- ------------- ------------- ------------- ------------- -----------

Net income/(expense) (632,795) - (632,795) (211,687) (673,211)

----------------------------------- ------------- ------------- ------------- ------------- -----------

Gains on investments

Share of profit of equity

6 accounted investees - 2,375,921 2,375,921 201,558 4,013,103

Deconsolidation of subsidiary - (9,003) (9,003) - -

Amounts due from equity accounted

investees written off - - - (167,750) (167,750)

Revaluation of investment

property - - - (7,840) (27,840)

Gain on buy-back of convertible

loan notes - - - - 303,629

Gain for the period/year on

investments - 2,366,918 2,366,918 25,968 4,121,142

----------------------------------- ------------- ------------- ------------- ------------- -----------

Finance charges

11 Interest on mortgage loan - - - (13,395) (16,869)

Interest on convertible loan

11 note instruments (241,222) - (241,222) (265,294) (504,819)

Profit/(loss) for the period/year

before taxation (874,017) 2,366,918 1,492,901 (464,408) 2,926,243

Taxation - - - - -

------------- -------------

Profit/(loss) for the period/year (874,017) 2,366,918 1,492,901 (464,408) 2,926,243

----------------------------------- ------------- ------------- ------------- ------------- -----------

Other comprehensive income - - - - -

----------------------------------- ------------- ------------- ------------- ------------- -----------

Total comprehensive income/(loss)

for the period/year (874,017) 2,366,918 1,492,901 (464,408) 2,926,243

----------------------------------- ------------- ------------- ------------- ------------- -----------

Basic earnings/(loss) per

9 ordinary share (pence) (3.11) 8.42 5.31 (1.57) 9.95

----------------------------------- ------------- ------------- ------------- ------------- -----------

Diluted earnings/(loss) per

9 ordinary share (pence) (3.11) 8.22 5.19 (1.57) 9.85

----------------------------------- ------------- ------------- ------------- ------------- -----------

The total column of this statement represents the Group's

Consolidated Statement of Comprehensive Income, prepared in

accordance with IFRS. The supplementary revenue return and capital

return columns are both prepared under Board approved guidelines in

relation to the allocation between revenue and capital. All items

in the above statement derive from continuing activities.

The notes section forms an integral part of these financial

statements

Consolidated Statement of Assets and Liabilities

As at 31 July 2013

31 July 31 July 31 January

2013 2012 2013

(unaudited) (unaudited) (audited)

Note GBP GBP GBP

---------------------------------- --------------- --------------- ------------

Non-current assets

6 Investment property - 447,575 -

Investment in equity accounted

6 investees 25,972,474 27,209,829 28,736,582

Loans to equity accounted investees

6,7 and related companies 1,495,027 1,834,406 1,854,227

27,467,501 29,491,810 30,590,809

---------------------------------- --------------- --------------- ------------

Current assets

Cash and cash equivalents 8,824,502 4,275,247 4,417,775

Trade and other receivables 98,696 212,046 66,486

8,923,198 4,487,293 4,484,261

---------------------------------- --------------- --------------- ------------

Current liabilities

Trade and other payables (44,985) (22,485) (53,074)

---------------------------------- --------------- --------------- ------------

(44,985) (22,485) (53,074)

----------------------------------

Net current assets 8,878,213 4,464,808 4,431,187

---------------------------------- --------------- --------------- ------------

Non-current liabilities

11 Convertible loan note instruments (5,991,256) (7,322,889) (5,977,377)

11 Bank loan - (447,575) -

---------------------------------- --------------- --------------- ------------

(5,991,256) (7,770,464) (5,977,377)

---------------------------------- --------------- --------------- ------------

Net assets 30,354,458 26,186,154 29,044,619

---------------------------------- --------------- --------------- ------------

Equity

8 Share capital 1,540,146 1,540,146 1,540,146

Share premium 1,815,385 1,815,385 1,815,385

Capital reserve (1,898,974) (8,361,066) (4,265,892)

Revenue reserve 28,897,901 31,187,252 29,950,543

Capital redemption reserve - 4,437 4,437

Total equity 30,354,458 26,186,154 29,044,619

---------------------------------- --------------- --------------- ------------

10 Net asset value per share (pence) 109.15 89.20 102.92

---------------------------------- --------------- --------------- ------------

Consolidated Statement of Changes in Equity

For the six months ended 31 July 2013

Six months ended 31 July 2013

(Unaudited)

Share Share Capital Capital Revenue Total

capital premium redemption reserve reserve

reserve

GBP GBP GBP GBP GBP GBP

------------------------ ---------- ---------- ------------ ------------ ----------- -----------

Balance at 1 February

2013 1,540,146 1,815,385 4,437 (4,265,892) 29,950,543 29,044,619

Total comprehensive

income for the period - - - 2,366,918 (874,017) 1,492,901

------------------------ ---------- ---------- ------------ ------------ ----------- -----------

Contributions by

and distributions

to owners

Share based payment

charge - - - - 47,453 47,453

Cash received from

JSOP participants - - - - 17,599 17,599

Purchase of treasury

shares - - - - (248,114) (248,114)

Removal of capital

redemption reserve - - (4,437) - 4,437 -

Total transactions

with owners - - (4,437) - (178,625) (183,062)

------------------------ ---------- ---------- ------------ ------------ ----------- -----------

Balance at 31 July

2013 1,540,146 1,815,385 - (1,898,974) 28,897,901 30,354,458

------------------------ ---------- ---------- ------------ ------------ ----------- -----------

Six months ended 31 July 2012

(Unaudited)

Share Share Capital Capital Revenue Total

capital premium redemption reserve reserve

reserve

GBP GBP GBP GBP GBP GBP

------------------------ ---------- ---------- ------------ ------------ ----------- -----------

Balance at 1 February

2012 1,540,146 1,815,385 4,437 (8,387,034) 32,187,320 27,160,254

Total comprehensive

income for the period - - - 25,968 (490,376) (464,408)

------------------------ ---------- ---------- ------------ ------------ ----------- -----------

Contributions by

and distributions

to owners

Purchase of treasury

shares - - - - (509,692) (509,692)

Total transactions

with owners - - - - (509,692) (509,692)

------------------------ ---------- ---------- ------------ ------------ ----------- -----------

Balance at 31 July

2012 1,540,146 1,815,385 4,437 (8,361,066) 31,187,252 26,186,154

------------------------ ---------- ---------- ------------ ------------ ----------- -----------

Year ended 31 January

2013 (Audited)

Share Share Capital Capital Revenue Total

capital premium redemption reserve reserve

reserve

GBP GBP GBP GBP GBP GBP

----------------------- ---------- ---------- ------------ ------------ ------------ ------------

Balance at 1 February

2012 1,540,146 1,815,385 4,437 (8,387,034) 32,187,320 27,160,254

Total comprehensive

income for the year - - - 4,121,142 (1,194,899) 2,926,243

Contributions by

and distributions

to owners

Share based payment

charge - - - - 14,092 14,092

Cash received from

JSOP participants - - - - 17,671 17,671

Purchase of treasury

shares - - - - (1,073,641) (1,073,641)

Total transactions

with owners - - - - (1,041,878) (1,041,878)

----------------------- ---------- ---------- ------------ ------------ ------------ ------------

Balance at 31 January

2013 1,540,146 1,815,385 4,437 (4,265,892) 29,950,543 29,044,619

----------------------- ---------- ---------- ------------ ------------ ------------ ------------

Consolidated Statement of Cash Flows

For the six months ended 31 July 2013

1 Feb 2013 1 Feb 2012 1 Feb 2012

to 31 Jul to 31 Jul to 31 Jan

2013 2012 2013

(unaudited) (unaudited) (audited)

GBP GBP GBP

--------------------------------------- -------------- -------------- ------------

Operating activities

Rental income received - - 33,750

Interest income received 1,680 681 3,157

Expenses paid (643,389) (271,712) (732,225)

Net cash used in operating activities (641,709) (271,031) (695,318)

-------------------------------------------- -------------- -------------- ------------

Investing activities

Loan repayments from investee

companies 80,000 - 117,273

Net receipts from associate and

related companies 5,433,000 1,512,904 3,681,921

Deconsolidation of ERPC II Limited (6,706) - -

Net cash generated from investing

activities 5,506,294 1,512,904 3,799,194

-------------------------------------------- -------------- -------------- ------------

Financing activities

Mortgage loan interest paid - (13,395) (24,709)

Part payment of mortgage loan - (7,840) -

Convertible loan note interest

paid (227,343) (375,000) (505,067)

Convertible loan note repurchases - (1,955,246) (2,994,902)

Purchase of treasury shares (248,114) (509,692) (1,073,641)

Share ownership scheme participation 17,599 - 17,671

Net cash used in financing activities (457,858) (2,861,173) (4,580,648)

-------------------------------------------- -------------- -------------- ------------

Increase/(decrease) in cash and

cash equivalents 4,406,727 (1,619,300) (1,476,772)

Cash and cash equivalents at

start of period/year 4,417,775 5,894,547 5,894,547

-------------------------------------------- -------------- -------------- ------------

Cash and cash equivalents at

end of period/year 8,824,502 4,275,247 4,417,775

-------------------------------------------- -------------- -------------- ------------

Notes to the Unaudited Interim Financial Statements

For the six months ended 31 July 2013

1 The Company

The Company was incorporated with limited liability in the Isle

of Man on 25 July 2003. The Company then re-registered under the

Isle of Man Companies Act 2006, with registration number 008597V.

The Company's ordinary shares are listed on the Alternative

Investment Market ("AIM") and the ICAP Securities and Derivatives

Exchange ("ICAP").

The interim consolidated financial statements as at and for the

six months ended 31 July 2013 comprise the Company and its

subsidiaries (together "the Group"). The interim consolidated

financial statements are unaudited.

The consolidated financial statements of the Group as at and for

the year ended 31 January 2013 are available upon request from the

Company's registered office at IOMA House, Hope Street, Douglas,

Isle of Man, IM1 1AP, or at www.epicpe.com.

The Company has two wholly owned subsidiary companies. EPIC

Reconstruction Property Company (IOM) Limited, a company

incorporated on 29 October 2005 in the Isle of Man and Corvina

Limited, a company incorporated on 16 November 2012 in the Isle of

Man. The Group lost control of EPIC Reconstruction Property Company

II Limited and as from 1 February 2013 was deconsolidated from the

Group accounts.

The Company also has interests in two partnerships that are

accounted for as associates. The partnerships comprise one limited

liability partnership, ESO Investments (PC) LLP, and one limited

partnership, ESO Investments 1 LP. The Company also has an interest

in a third partnership, ESO Investments 2 LP, through which new

investments will be made. As at 31 July 2013, ESO Investments 2 LP

had made no investments.

Following the approval of the Share Matching Plan at the Annual

General Meeting on 20 July 2012, the Company has established an

employee benefit trust located in the Isle of Man to administer the

scheme.

2 Statement of compliance

These interim consolidated and company financial statements have

been prepared in accordance with IAS 34 Interim Financial

Reporting.

The interim consolidated financial statements do not include all

of the information required for full annual financial statements,

and should be read in conjunction with the consolidated financial

statements of the Group as at and for the year ended 31 January

2013.

The interim consolidated financial statements were approved by

the Board of Directors on 16 September 2013.

3 Significant accounting policies

The accounting policies applied by the Group in these interim

consolidated financial statements are the same as those applied by

the Group as at and for the year ended 31 January 2013, except as

described below.

The following changes are also expected to be reflected in the

Group's consolidated financial statements as at and for the year

ended 31 January 2014.

The Group has adopted the following new standard with a date of

initial application of 1 February 2013.

-- IFRS 13: Fair Value Measurement

IFRS 13 establishes a single framework for measuring fair value

and making disclosures about fair value measurements, when such

measurements are required or permitted by IFRSs. In particular, it

unifies the definition of fair value as the price at which an

orderly transaction to sell an asset or transfer a liability would

take place between market participants at the measurement date. In

accordance with the transitional provisions of IFRS 13, the Group

has applied the new fair value measurement guidance prospectively

in valuation of unquoted investments held by the partnerships. The

change has no significant impact on the measurements of the Group's

assets and liabilities.

The Company holds interests in ESO Investments 1 LP, ESO

Investments 2 LP and ESO Investments (PC) LLP, which are managed

and controlled by EPIC Private Equity LLP for the benefit of the

Company and the other members. The Company has the power to appoint

members to the investment committee of ESO Investments 1 LP, ESO

Investments 2 LP and ESO Investments (PC) LLP but does not have the

ability to direct the activities of ESO Investments 1 LP, ESO

Investments 2 LP and ESO Investments (PC) LLP. The Directors

consider that ESO Investments 1 LP, ESO Investments 2 LP and ESO

Investments (PC) LLP do not meet the definition of subsidiaries.

These entities are instead treated as associates.

4 Financial risk management

The Group financial risk management objectives and policies are

consistent with those disclosed in the consolidated financial

statements as at and for the year ended 31 January 2013.

5 Investment advisory fees

The investment advisory fee payable to EPIC Private Equity LLP

was, until 31 August 2010, calculated at 2% of the Group's Net

Asset Value ("NAV"), with a minimum of GBP325,000 payable per

annum. On 31 August 2010, the Investment Advisor agreed to waive

the fee from the Company for a period of two years in return for a

priority profit share paid from ESO Investments 1 LP. Consequently

the payment of fees has resumed at a rate of 2% per annum of the

Company's NAV (including its share of the Fund) plus VAT. The

charge for the current period was GBP266,165 (period ended 31 July

2012: GBPnil, year ended 31 January 2013: GBP216,667).

6 Non-current assets

31 July 31 July 31 January

2013 2012 2013

------------------------------------- ----------- ----------- -----------

Group Group Group

GBP GBP GBP

------------------------------------- ----------- ----------- -----------

Investment property - 447,575 -

Financial assets

Investments in equity accounted

investee/associate 25,972,474 27,209,829 28,736,582

Loans to equity accounted investees

and related companies 1,495,027 1,834,406 1,854,227

27,467,501 29,491,810 30,590,809

------------------------------------- ----------- ----------- -----------

The Investment Advisor has applied appropriate valuation methods

with reference to BVCA guidelines and the valuation principles of

IAS 39 Financial Instruments: Recognition and Measurement.

Underlying investments in the equity accounted investees are valued

using these principles.

Investment in equity accounted associates

Investments in equity accounted associates comprise the

investment in ESO Investments 1 LP and ESO Investments (PC) LLP

(formerly ESO Investments 2 LLP) which are stated at cost plus the

share of profit and loss to date. The equity accounted associates

have accounted for their equity investments at fair value.

During the period, the Company received GBP5,140,000 (year ended

31 January 2013: GBP3,681,921) from ESO Investments 1 LP.

Summary of financial information of equity accounted investees

as at 31 July 2013 is as follows:

31 July

2013 31 January 2013

------------------ ---------------- ---------------- ------------ ---------------- ------------------------------

ESO Investments ESO Investments ESO Investments ESO Investments

(PC) LLP 1 LP Total (PC) LLP 1 LP Total

------------------ ---------------- ---------------- ------------ ---------------- ---------------- ------------

GBP GBP GBP GBP GBP GBP

Non-current

assets 4,500,000 37,203,734 41,703,734 4,500,000 38,058,325 42,558,325

Current assets 100 2,676,905 2,677,005 100 5,053,476 5,053,576

Total assets 4,500,100 39,880,639 44,380,739 4,500,100 43,111,801 47,611,901

------------------ ---------------- ---------------- ------------ ---------------- ---------------- ------------

Current

liabilities (482,972) (2,381,432) (2,864,404) (550,972) (1,313,485) (1,864,457)

Total liabilities (482,972) (2,381,432) (2,864,404) (550,972) (1,313,485) (1,864,457)

------------------ ---------------- ---------------- ------------ ---------------- ---------------- ------------

Group's share

of net assets 3,257,320 22,715,154 25,972,474 3,197,202 25,539,380 28,736,582

------------------ ---------------- ---------------- ------------ ---------------- ---------------- ------------

Income 80,000 1,151,963 1,231,963 26,149 2,330,911 2,357,060

Gains on

investments - 3,065,211 3,065,211 55,144 5,160,596 5,215,740

Expenses (12,000) (107,554) (119,554) (11,258) (240,238) (251,496)

Profit 68,000 4,109,620 4,177,620 70,035 7,251,269 7,321,304

------------------ ---------------- ---------------- ------------ ---------------- ---------------- ------------

Group's share

of profit 60,118 2,315,803 2,375,921 67,312 3,945,791 4,013,103

------------------ ---------------- ---------------- ------------ ---------------- ---------------- ------------

Key terms of the ESO Investments 1 LP Partnership Agreement

Profits or losses are credited or debited to each Member's

account to reflect the distributions payable to each Member were

the LP to be liquidated at its statement of financial position

value.

Prior to the First Hurdle Point (being the point at which each

member has received repayment of the loans advanced and a Hurdle

amount being 8% per annum on the loan balances) distributions shall

be made as:

-- 37% to DES Holdings IV(A) LLC

-- 63% to EPE Special Opportunities plc.

At the First Hurdle Point for an investor an amount equal to 25%

of the Hurdle shall be credited from that investor to EPE Carry LP.

After the First Hurdle Point distributions shall be as stated above

less 20% which shall be credited to EPE Carry LP until the Second

Hurdle Point.

At the Second Hurdle Point, (being the point at which DES

Holdings IV(A) LLC has received 1.5 times its loans advanced)

distributions shall be made as:

-- 25% to DES Holdings IV(A) LLC

-- 75% to EPE Special Opportunities plc.

Subject to a 20% allocation to EPE Carry LP in the event that

the First Hurdle Point has been reached.

At the Third Hurdle Point, (being the point at which DES

Holdings IV(A) LLC has received 2 times its loans advanced)

distributions shall be made as:

-- 18% to DES Holdings IV(A) LLC

-- 82% to EPE Special Opportunities plc.

Subject to a 20% allocation to EPE Carry LP in the event that

the Second Hurdle Point has been reached.

7 Loans to equity accounted investees and related companies

31 July 2013 31 July 2012 31 January

2013

Group Group Group

GBP GBP GBP

-------------------------- ------------- ------------- -----------

ESO Investments 1 LP 512,055 793,192 549,172

EPIC Structured Finance

Limited 500,000 500,000 805,055

ESO Investments (PC) LLP 482,972 541,214 500,000

1,495,027 1,834,406 1,854,227

-------------------------- ------------- ------------- -----------

The loans to equity accounted investees and related companies

are unsecured, interest free and not subject to any fixed repayment

terms.

8 Share capital

31 July 2013 31 July 2012 31 January 2013

------------------------ ------------------------ ------------------------

Number GBP Number GBP Number GBP

--------------------- ------------ ---------- ------------ ---------- ------------ ----------

Authorised share

capital

Ordinary shares

of 5p each 33,000,000 1,650,000 33,000,000 1,650,000 33,000,000 1,650,000

--------------------- ------------ ---------- ------------ ---------- ------------ ----------

Called up, allotted

and fully paid

Ordinary shares

of 5p each 30,802,911 1,540,146 30,802,911 1,540,146 30,802,911 1,540,146

Ordinary shares

of 5p each held

in treasury (2,992,719) - (1,446,142) - (2,583,551) -

27,810,192 1,540,146 29,356,769 1,540,146 28,219,360 1,540,146

--------------------- ------------ ---------- ------------ ---------- ------------ ----------

9 Basic and diluted earnings per ordinary share

The basic earnings per share is calculated by dividing the

profit for the period attributable to ordinary shareholders by the

weighted average number of shares outstanding during the period of

28,119,630 (six month period ended 31 July 2012: 29,581,304 after

share consolidation, year ended 31 January 2013: 29,403,897).

The diluted earnings per share is calculated by dividing the

profit for the period attributable to ordinary shareholders by the

weighted average number of shares outstanding during the period, as

adjusted for the effects of all dilutive potential ordinary shares

of 28,778,809 (six month period ended 31 July 2012: 29,581,304

after share consolidation, year ended 31 January 2013:

29,704,938).

10 Net asset value per share (pence)

The net asset value per share is based on the net assets at the

period end of GBP30,354,458 divided by 27,810,192 ordinary shares

in issue at the end of the period (31 July 2012: GBP26,186,154 and

29,356,769 ordinary shares, 31 January 2013: GBP29,044,619 and

28,219,360 ordinary shares).

The diluted net asset value per share of 106.62 pence, is based

on the net assets of the Group and the Company at the year-end of

GBP30,354,458 divided by the shares in issue at the end of the

year, as adjusted for the effects of dilutive potential ordinary

shares, of 28,469,371, after excluding treasury shares (31 July

2012: GBP26,186,154 and 29,356,769 ordinary shares, 31 January

2013: GBP29,044,619 and 28,520,401 ordinary shares).

11 Non-current liabilities

31 July 2013 31 July 2012 31 January

2013

Group Group Group

GBP GBP GBP

----------------------------------- ------------- ------------- -----------

Convertible loan note instruments 5,991,256 7,322,889 5,977,377

Mortgage loan - 447,575 -

----------------------------------- ------------- ------------- -----------

5,991,256 7,770,464 5,977,377

----------------------------------- ------------- ------------- -----------

Convertible loan note instruments were issued on 31 August 2010

to The Equity Partnership Investment Company plc. The notes carry

interest at 7.5% per annum and are convertible at the option of the

holder at a price of 170 pence per ordinary share. The convertible

shares fall under the definition of compound financial instruments

within IAS 32 Financial Instruments: Presentation. The Directors

are required to assess the element

of liability contained with the compound instrument. The

Directors consider that the instrument has no equity element.

Issue costs of GBP129,696 have been offset against the value of

the convertible loan note instruments and are being amortised over

the life of the instrument at an effective interest rate of 0.24%

per annum.

The convertible loan notes are repayable on 31 December 2015

unless the shareholders of the Company pass a resolution on or

before 30 September 2015 for the continuation of the Company beyond

31 December 2016, in which case the final repayment date shall be

31 December 2016, but each noteholder has the right to require the

redemption of some or all of their notes on 31 December 2015 by

providing the Company with written notice up to the close of

business on 30 November 2015.

12 Financial commitments and guarantees

Under the terms of the limited partnership agreement the Company

is committed to provide a maximum of GBP2.0 million additional

investment to ESO Investments 1 LP. To date no draw downs have been

made.

The Company historically provided certain guarantees to Lloyds

TSB Bank plc ("Lloyds") on the facilities that Lloyds provided to

Past Times Trading Limited. In July of this year the administrators

received the final balance of funds retained by Lloyds together

with a confirmation that all such guarantees provided by the

Company to Lloyds had been released. The administration is in its

final stages and surplus funds received by the administrators from

the administration process to date have been paid across to the

Company.

13 Subsequent events

There were no significant subsequent events.

Company Information

Directors Bankers

GO Vero (Chairman) Barclays Bank plc

RBM Quayle 1 Churchill Place

CL Spears Canary Wharf

NV Wilson London E14 5HP

Secretary Investment Advisor

P.P. Scales EPIC Private Equity

LLP

Audrey House

Registrar and Registered Office 16-20 Ely Place

IOMA Fund and Investment Management London EC1N 6SN

Limited

IOMA House

Hope Street Auditors and Reporting

Accountants

Douglas KPMG Audit LLC

Isle of Man IM1 1AP Heritage Court

41 Athol Street

Nominated Advisor and Broker Douglas

Numis Securities Limited Isle of Man IM99 1HN

10 Paternoster Square

London EC4M 7LT

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR GGUBUBUPWGAW

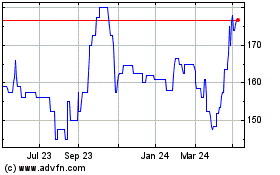

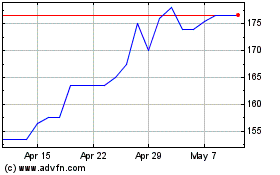

Epe Special Opportunities (LSE:ESO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Epe Special Opportunities (LSE:ESO)

Historical Stock Chart

From Jul 2023 to Jul 2024