RNS Number:2610I

First Artist Corporation PLC

07 February 2005

7 February 2005

First Artist Corporation Plc

('First Artist' or 'the Company')

Final results for the year ended 31 October 2004

First Artist is a leading European management and representation company looking

after the commercial interests of footballers and other high profile media

personalities in the football and television market.

Highlights of Results for the Year ended 31 October 2004

* Sales of #3.98 million in the year ended 31 October 2004 compared to #4.23

million for the sixteen months ended 31 October 2003.

* Sales up 29% from #3.08 million for the twelve months to October 2003.

* Operating profit of #0.04 million before goodwill amortisation and

impairment and one-off exceptional costs for the twelve month period is an

upturn compared to the loss of #2.54 million for the sixteen months ended

October 2003 and also up from the loss of #1.66 million for the

corresponding twelve month period ended October 2003

* The operating loss of #0.45 million is stated after #0.09 million of

goodwill impairment and #0.39 million of exceptional charges arising from

the Group's restructuring, aborted acquisition costs and the strategic

review, undertaken in January 2004. The restructuring costs include the

costs of closure relating to the First Artist Snooker Academy and the FIMO

Geneva offices.

* At 31 October 2004 the net cash balance of the Group was #310,000, up from a

net cash balance of #19,000 as at 31 October 2003.

* There was a net #0.26 million operating cash inflow this was after the

deducting #0.39 million of one-off restructuring costs.

* Continued expansion of the Company's commercial and media division which now

represents over 30 well known sports and media personalities.

* The Group is working with other leading European agency operations, senior

European clubs and leagues to enhance the position, reputation and

transparency of the football transfer market and in particular the role of

the Football Agent. The Group wishes to establish a professional body

alongside the industry, clarify trading terms and practice.

* Acquisition of Mel Stein's Team Sports Management Limited and merger of this

operation into our London office.

For further information please contact:

First Artist Corporation PLC 020 8900 1818

Jon Smith, Chief Executive

Richard Hughes, Finance Director

Shore Capital 020 7408 4090

Alex Borrelli

Chairman's Statement

In my interim report for the six months to 30 April 2004, I stated that

following a profitable January we forecast an upturn in the 2004 summer trading

window and an improvement in the contribution from the European markets. We are

pleased to announce that this confidence has been well placed and the Group has

returned to trading profitability before exceptional administrative expenses and

goodwill amortisation for the year to 31 October 2004.

The continuing Group made a profit before exceptional costs of #57,000 (2003:

Loss #2,019,000), a significant turnaround from the previous period, underlining

the positive steps taken by the Board to restructure the business cost base in

2003.

Comparing this year to the same 12-month period to October 2003, Sales increased

29%, Gross profit 16% and overheads have reduced by 32%

As previously reported we closed the First Artist Snooker Academy in May and are

also closing the FIMO Geneva office. We continue to maintain strong management

controls of cash and costs with direct expenditure focussed on strengthening and

developing the core business.

The Group as a whole made an operating loss before interest and tax and goodwill

impairment of #355,000 (2003: Loss #3,020,000), which is after accounting for

non-recurring exceptional costs of #391,000 mainly related to restructuring and

closure costs.

OUTLOOK AND CURRENT OPERATIONS:

First Artist is one of Europe's leading football management groups and continues

to improve and expand both in the UK and across Europe with increased activity

and some notable transfers being undertaken during the summer trading window.

We are continuing to develop our presence in the Far East and US with minimal

drain on the Group's central resources.

In January 2005, the Company acquired the staff, player contracts and business

assets of Mel Stein's Team Sports Management Limited and merged this operation

into our London office. This acquisition will strengthen the London operation

both with operational and player resource.

The UK's commercial and media department is continuing its organic growth and

now represents over 30 well known sports and media personalities on a full

management basis. The department is expanding to include personalities outside

sport and a lead role in the West End was recently secured for one of our new

clients. The launch of our Corporate Division in September 2004 is proving

successful and activity is increasing as different markets are targeted and

reached. The commercial department has recently completed negotiations to

exclusively market a new product to sporting arenas worldwide and is working to

promote several major events at leading sporting venues. All aspects of this

division give us confidence of increased activity here over the coming year.

Our business diversification strategy continues to be a priority and the Group

is actively seeking suitable acquisition opportunities, which can utilise our

core-skills into non-football related sectors. Should suitable opportunities,

as with Team Sports Management, present themselves in the football market then

the Group will pursue these too.

The Group is working with other leading European agency operations, senior

European clubs and leagues to enhance the position, reputation and transparency

of the football transfer market and in particular the role of the Football

Agent. The Group wishes to establish a professional body alongside the industry

to clarify trading terms and practice.

We previously reported that the Board would be seeking approval from its

shareholders and confirmation by the High Court to restructure its balance sheet

to remove the deficit on the profit and loss account by cancellation of the

share premium account. In light of the cost involved in undertaking such an

exercise the Board has decided to reinvest this expenditure into the development

of the Group with the intention to revisit the option at a more appropriate

time.

I would like to thank all those involved in the restructuring of this group and

thank the Board for its continued commitment in turning around a group in what

remains a difficult environment.

Alex Johnston

Chairman

7 February 2005

CONSOLIDATED PROFIT AND LOSS ACCOUNT

FOR THE YEAR ENDED 31 OCTOBER 2004

Continuing Discontinued

Operations Operations Total Period from 1

Year ended Year ended Year ended July 2002 to

31 October 31 October 31 October 31 October

2004 2004 2004 2003

#000 #000 #000 #000

TURNOVER 3,739 236 3,975 4,229

Cost of sales (1,114) (29) (1,143) (1,147)

GROSS PROFIT 2,625 207 2,832 3,082

Administrative expenses (2,568) (228) (2,796) (5,622)

Profit/(loss) before exceptional 57 (21) 36 (2,540)

administrative expenses

Exceptional administrative expenses (113) (278) (391) (480)

OPERATING LOSS before goodwill amortisation (56) (299) (355) (3,020)

Administrative expenses - goodwill impairment - (92) (92) (11,820)

and amortisation

GROUP OPERATING LOSS (56) (391) (447) (14,840)

Share of operating loss of associates - - - (97)

TOTAL OPERATING LOSS (56) (391) (447) (14,937)

Loss on disposal of investment - (26)

(447) (14,963)

Investment income 8 11

Interest payable (54) (54)

LOSS ON ORDINARY ACTIVITIES BEFORE TAXATION (493) (15,006)

Taxation 167 414

LOSS ON ORDINARY ACTIVITIES AFTER TAXATION (326) (14,592)

Dividends - -

RETAINED LOSS FOR THE YEAR (326) (14,592)

LOSS PER SHARE

Basic loss per share (0.63) (27.08)

pence pence

Fully diluted loss per share (0.62) (27.08)

pence pence

Basic earnings/(loss) per share before 0.30 (4.21)

goodwill amortisation and exceptional costs pence pence

Fully diluted earnings/(loss) per share 0.30 (4.21)

before goodwill amortisation and exceptional pence pence

costs

CONSOLIDATED BALANCE SHEET

AS AT 31 OCTOBER 2004

2004 2003

#000 #000

FIXED ASSETS

Intangible assets - -

Tangible assets 755 811

755 811

CURRENT ASSETS

Debtors 2,243 3,504

Cash at bank and in hand 310 156

2,553 3,660

CREDITORS: Amounts falling due within one year (2,133) (2,908)

NET CURRENT ASSETS 420 752

TOTAL ASSETS LESS CURRENT LIABILITIES 1,175 1,563

CREDITORS: Amounts falling due after more than one year (98) (87)

NET ASSETS 1,077 1,476

CAPITAL AND RESERVES

Called up share capital 120 135

Capital redemption Reserve 15 -

Share premium account 6,217 6,217

Profit and loss account (5,275) (4,876)

EQUITY SHAREHOLDERS' FUNDS 1,077 1,476

CONSOLIDATED CASH FLOW STATEMENT

FOR THE YEAR ENDED 31 OCTOBER 2004

Year ended Period from 1 July

31 October 2002 to 31 October

2004 2003

#000 #000

Cash inflow/(outflow) from operating activities 313 (623)

Returns on investments and servicing of finance (46) (43)

Taxation 87 (97)

Capital expenditure and financial investment 22 43

Acquisitions and investments (92) (141)

CASH INFLOW/(OUTFLOW) BEFORE FINANCING 284 (861)

Financing 7 (600)

INCREASE/(DECREASE) IN CASH IN THE PERIOD 291 (1,461)

RECONCILIATION OF NET CASH FLOW TO MOVEMENT IN NET DEBT

Year ended Period from 1 July

31 October 2002 to 31 October

2004 2003

#000 #000

Increase/(decrease) in cash in the period 291 (1,461)

Cash from increase in debt financing (7) 600

New finance leases (32) (104)

Deferred consideration on acquisition of subsidiaries - 1,627

252 662

NET DEBT AT 1 NOVEMBER 2003 (403) (1,065)

NET DEBT AT 31 OCTOBER 2004 (151) (403)

STATEMENT OF TOTAL RECOGNISED GAINS AND LOSSES

FOR THE YEAR ENDED 31 OCTOBER 2004

Year ended Period from 1 July

31 October 2002 to 31 October

2004 2003

#000 #000

Loss for the financial period (326) (14,592)

Currency translation differences on net foreign currency investments (73) 59

Total recognised gains and losses relating to the period (399) (14,533)

NOTES

1. BASIS OF PREPARATION

The financial information contained in this report does not constitute statutory

accounts within the meaning of Section 240 of the Companies act 1985.

The financial information for the period ended 31 October 2003 contained in this

report has been extracted from the audited accounts of the Company for which the

auditors have given an unqualified report.

2. GOING CONCERN

In view of the Group's losses, the Directors have been closely monitoring the

financial situation and the restructuring of the business during the current and

previous period has led to a subsequent return to profitability (before

exceptional items and goodwill). The Directors continue to closely monitor and

control the Group's financial situation and through diversification seek new

ways in which to reduce reliance on traditional deal based revenue and to review

opportunities in sports other than football.

The Directors have considered in detail the trading and cash flow forecasts for

the next twelve months. Whilst the Directors cannot predict the future trading

and funding requirements of the Group with certainty, they consider that the

above actions and the continued support of the Company's bankers will provide

sufficient finance to enable the Group to meet its liabilities as they fall due.

Therefore it is appropriate for the financial statements to be prepared on a

going concern basis. The financial statements do not include any adjustment

that might result from the Directors' forecasts not being met.

3. TAXATION Year Period

2004 2003

#000 #000

Current tax:

UK corporation tax (credit)/charge on (losses)/profits of the period - (66)

Foreign taxes (91) (294)

Adjustments in respect of previous periods (56) 8

Current tax (credit)/charge for the period (147) (352)

Deferred taxation:

Origination and reversal of timing differences (20) (62)

Tax (credit)/charge on profit on ordinary activities (167) (414)

4. EARNINGS PER SHARE

Basic loss per share has been calculated on a loss on ordinary activities after

taxation of #326,000 (2003: loss of #14,952,000) and on a weighted average of

51,784,044 (2003: 53,893,666) ordinary shares in issue during the year.

Fully diluted loss per share is based on a loss of #324,000 (2003: #14,592,000)

and on a weighted average of 52,409,427 (2003: 53,893,666) potential shares in

issue.

In addition, the Directors have included earnings per share calculations based

on earnings before the amortisation of goodwill and before exceptional costs as

they believe that these figures provide a more meaningful and useful indication

of the Group's performance during the period.

The basic earnings/(loss) per share before amortisation of goodwill and

exceptional costs has been calculated on a profit on ordinary activities after

taxation of #157,000 (2002: loss of #2,266,000) and on a weighted average of

51,784,044 (2003: 53,893,666) ordinary shares in issue during the year.

The fully diluted earnings/(loss) per share before amortisation of goodwill and

exceptional costs is based on a profit of #159,000 (2003: loss of #2,266,000)

and on a weighted average of 52,409,427 (2003: 53,893,666) potential shares in

issue.

5. RESERVES AND RECONCILIATION OF MOVEMENT

IN SHAREHOLDERS' FUNDS

Capital Total

Share redemption Share Profit and shareholders'

capital Reserve premium loss account Funds

#000 #000 #000 #000 #000

GROUP

1 November 2003 135 - 6,217 (4,876) 1,476

Loss for the financial period - - - (326) (326)

Purchase of own shares (15) 15 - - -

Exchange adjustments - - - (73) (73)

31 October 2004 120 15 6,217 (5,275) 1,077

Capital Total

Share redemption Share Profit and shareholders'

capital Reserve premium loss account Funds

#000 #000 #000 #000 #000

COMPANY

1 November 2003 135 - 6,217 (4,619) 1,733

Loss for the financial period - - - (530) (530)

Purchase of own shares (15) 15 - - -

31 October 2004 120 15 6,217 (5,149) 1,203

6. CASH FLOWS Year Period

2004 2003

#000 #000

Reconciliation of operating loss to net cash inflow/(outflow) from

operating activities

Operating loss (447) (14,937)

Depreciation 67 166

Amortisation of goodwill 92 11,820

Loss on disposals of fixed assets (1) 41

Share of operating loss of associates - 97

Decrease in debtors 1,208 2,232

Decrease in creditors (533) (101)

Exchange (73) 59

Net cash inflow/(outflow) from operating activities 313 (623)

7. ANNUAL REPORT

Copies of the Annual Report and Financial Statements will be circulated to

Shareholders shortly and may be obtained after the posting date from the Company

Secretary, First Artist Corporation plc, First Artist House, 87 Wembley Hill

Road, Middlesex, HA9 8BU, or from the Companies Website www.firstartist.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR TIMFTMMBMBTA

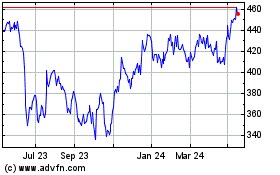

Volution (LSE:FAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Volution (LSE:FAN)

Historical Stock Chart

From Jul 2023 to Jul 2024