RNS Number:1951P

First Artist Corporation PLC

22 July 2005

22 July 2005

First Artist Corporation plc

Proposed Acquisition and Placing

Summary

* First Artist Corporation plc ("FAC"), a pan-European football

management and representation group, today announces the proposed acquisition of

ABG Financial Management Limited ("ABGFM") for a maximum consideration of #3

million in cash and shares with an initial issue and allotment to the Vendors of

1.25 million Initial Consideration Shares and #1.3 million in cash.

* Deferred Consideration will be payable on the achievement by ABGFM of

certain financial performance targets over the next two years.

* The acquisition and ongoing working capital requirements of the

Enlarged Group will be funded through a new committed banking facility totalling

#1 million provided by AIB Group (UK) p.l.c. and a Placing.

* Under the terms of the Placing Agreement, Shore Capital has

conditionally placed 25,000,000 new Ordinary Shares at 5p per share to raise

#1.25 million, before expenses.

* Based in London, ABGFM was established in 1987 as an IFA and has a total

of 16 staff. ABGFM's principal activity is to provide a range of taxation and

financial consultancy services to a growing number of clients including

corporate entities, sportsmen and media personalities.

* ABGFM has continued to grow profitably since inception and, in the

financial year ended 30 June 2004, had turnover of #1.6 million and profit

before tax of #0.4 million.

* The acquisition of ABGFM constitutes a reverse takeover under the AIM

Rules and is subject inter alia to Shareholders' approval. A document is being

sent to Shareholders today containing notice of an EGM to be held on 15 August

2005.

The Board believes the acquisition of ABGFM by FAC to be an excellent strategic

fit and in particular believes that:

* it represents a significant step in FAC's strategy to enhance and

strengthen the Group's service offering to its clients by adding a wealth

management capability to the range of services already available;

* it satisfies FAC's strategic objective of diversifying and reducing

its dependence on the seasonal football market by developing a broader business

in the key areas of wealth management, sports player representation, talent and

personality management and event and promotion management; and

* it introduces FAC's clients to ABGFM's range of financial services.

Commenting on the acquisition, Jon Smith, Chief Executive of First Artist, said:

"We outlined our strategy to grow by acquisition and are delighted to have

announced this first significant transaction today.

"We have had a working relationship with ABGFM for a number of years and are

very pleased to have acquired what is a high quality business. This acquisition

will be easily integrated within the Group.

"We remain focused on diversifying and reducing our dependence on the seasonal

football market and the acquisition of ABGFM has set our strategy in motion."

In addition, FAC today announced interim results for the six month period ended

30 April 2005.

For further information:

First Artist Corporation plc

Jon Smith, Chief Executive Tel. +44 (0) 20 8900 1818

Richard Hughes, Finance Director

Shore Capital

Alex Borrelli Tel. + 44 (0) 20 7408 4090

Smithfield Consultants

George Hudson Tel. + 44 (0) 20 7360 4900

22 July 2005

First Artist Corporation PLC

Proposed Acquisition and Placing

The Board announces today that First Artist has agreed, subject inter alia to

Shareholders' approval, to acquire ABG Financial Management Limited ("ABGFM")

for an initial consideration of #1.3 million in cash and the issue and allotment

to the Vendors of the Initial Consideration Shares. ABGFM is a company whose

principal activity is that of acting as financial adviser and consultant

providing a range of taxation and financial services. The Acquisition

represents a significant step in First Artist's strategy to enhance and

strengthen the Group's service offering to its clients by adding a wealth

management capability to the range of services already available.

The Acquisition and the ongoing working capital requirements of the Enlarged

Group will be funded through a new committed banking facility totalling #1

million provided by AIB and a Placing of 25 million Placing Shares at 5p per

share to raise approximately #1.25 million, before expenses.

In view of its size, the Acquisition will constitute a reverse takeover under

the AIM Rules and is therefore conditional inter alia upon the approval of

Shareholders at the EGM to be held at Bond Street House, 14 Clifford Street,

London W1S 4JU on 15 August 2005. If the Resolutions are passed at the EGM, the

Company's existing quotation on AIM will be cancelled and the Company will apply

for the Enlarged Share Capital to be admitted immediately to trading on AIM.

Background and reasons for the Acquisition

First Artist is a pan-European football management and representation group

active in the UK and across Europe whilst developing its presence in Asia and

the US.

First Artist's primary business activity is (and has, during the Historic

Financial Period, been) the representation of the commercial interests of

professional footballers, sports commentators and leading personalities in this

fast-moving market. The majority of First Artist's revenue is generated from the

transfer of its football player clients from one club to another, where the

Company receives commission from transfer fees, signing-on fees and players' new

remuneration packages. First Artist also has strong relationships with football

clubs, which engage First Artist to identify potential transfer targets and

buyers for their existing players (some of those players retain First Artist on

a continuing basis).

The Group is experienced in promotional work and event management having

arranged the 2001 World Sport Awards at the Royal Albert Hall, promoted Mikhail

Gorbachev's lecture tour in 1993 and the golden jubilee celebrations on behalf

of Her Majesty's Government for VE day and VJ day in 1995. The Group was also

responsible for promoting the NHL and the NBA to the UK.

Strategic objectives

The Board, in order to broaden the services currently offered by the Group to

its clients, has developed a strategy to diversify and reduce the Group's

dependence on the seasonal football market by developing a broader business

utilising its skills in personality and player management. The Group is

therefore proposing to expand (by both organic growth and acquisition) in the

following areas:

* wealth management (to be aimed at corporations and high net

worth individuals including sporting and media personalities);

* sports player representation;

* talent and personality management; and

* sports and other events and promotions management.

In order to achieve these objectives, the Board has been actively seeking

suitable acquisitions to broaden the commercial base of the Group into

non-football related sectors whilst utilising its core-skills and is currently

in initial discussions with a view to acquiring a private corporate event

management business.

Wealth management

Over the past twelve months the Board has identified and evaluated a number of

potential acquisition opportunities, and is delighted to have found ABGFM, a

London based independent financial adviser. The majority of ABGFM's clients are

high net worth individuals, a number of whom are within the corporate, sport and

entertainment sectors, which complements the Board's intention to add a wealth

management capability to the Company's current product portfolio.

Notwithstanding this diversification, the Board still believes firmly that the

global football market offers exciting growth potential. This, combined with the

Group's recognised First Artist brand in football, leads the Board to conclude

that the Company is extremely well positioned to capture this growth and develop

further areas complementary to the Group's existing product portfolio.

The Board believes the acquisition of ABGFM to be an excellent strategic fit.

Information on ABG Financial Management Limited

ABGFM is a financial advisory and consultancy company based in London operating

as an independent financial adviser ("IFA") with a total of 16 staff. It was

established in 1987 by ABG (a provider of audit, accountancy, tax and business

consultancy services) and Sean Scahill (managing director) in order to market

independent services to ABG's client base. Sean Scahill and fellow director

Peter Kelsey (who joined ABGFM in 1997) are beneficially interested in 35 per

cent. in aggregate of ABGFM with the balance held by certain partners of ABG (or

their connected persons).

ABGFM has continued to grow profitably since inception and now has a core base

of six FSA registered advisers with a growing number of clients including

corporate entities, sportsmen and media personalities. ABGFM has strong

relationships with a number of financial product providers including Standard

Life, Prudential and Legal & General. Approximately 98 per cent. of ABGFM's

income is commission based, generated from new business and renewals of

policies, with the remainder being derived from fees.

ABGFM's range of services includes (and has for at least the period since 1 July

2001, included) retirement planning, taxation planning, mortgages, insurance

schemes, corporate keyman insurance, group pensions and investment planning.

Pension planning represents the largest proportion of income generated by ABGFM

and amounted to approximately one third of total revenues over the previous two

years. ABGFM has invested in its software for the comprehensive management of

its business including payments, client data and compliance.

As an IFA, ABGFM is authorised and regulated by the FSA. It regards the recent

significant increase in financial services industry regulation as positive and

is a promoter of best practice, including the recent amendment requiring the

introduction of charging menus for clients, which ABGFM has been operating for

some time. In fact, ABGFM foresees positive advantages to be gained from the

forthcoming simplification of pensions rules known as "A" day.

The Directors believe that there is considerable potential for the development

of ABGFM's business through the training and recruitment of additional

consultants and the extension of its client base in addition to the

opportunities for marketing to First Artist's own complementary client base.

Financial information on ABGFM

The table below summarises the profit and loss accounts of ABGFM for the three

years ended 30 June 2004 and the nine months ended 31 March 2005. Detailed

financial information on ABGFM is set out in Parts III and IV of the Document.

The summarised historical results of ABGFM set out below have been extracted

without material adjustment.

Year Year Year Period ended

ended ended ended 31 March

30 June 30 June 30 June 2005

2002 2003 2004 #'000

#'000 #'000 #'000 (Unaudited )

(Audited ) (Audited ) (Audited )

Turnover 1,661 1,292 1,607 1,165

Gross profit 1,660 1,287 1,607 1,165

Operating profit 557 173 424 360

Profit on ordinary activities before taxation 560 176 428 365

Taxation ( 109 ) ( 35 ) (130 ) (105 )

Profit on ordinary activities after taxation 451 141 298 260

Financing the Acquisition

In addition to the proceeds of the Placing, the five year New Banking Facility

which First Artist has entered into with AIB is a committed facility totalling

#1 million (conditional, inter alia, on the Placing). Further details of the New

Banking Facility are set out in paragraph 8.1.5 of Part VII of the Document. The

initial cash consideration of the Acquisition is #1.3 million.

The Board believes that the level of gearing that will result if the

Shareholders approve the Acquisition will be acceptable given the cash

generative nature of the Enlarged Group and it is envisaged that borrowing

levels will be steadily reduced. The Directors are confident that the Enlarged

Group will retain sufficient financial flexibility to continue to invest in

developing its businesses.

Principal terms of the Acquisition Agreement

The Company has agreed to acquire ABGFM for a maximum consideration of #3

million (comprising the Initial Consideration and the Deferred Consideration)

conditional on approval of the Resolutions, Placing, the New Banking Facility

and Admission.

Deferred Consideration will be payable on the achievement by ABGFM of average

net profits exceeding:

(a) #400,000 in respect of the two 12 month financial periods of ABGFM from

1 July 2004 to 30 June 2006 ("First Threshold"); and

(b) #425,000 in respect of the two 12 month financial periods of ABGFM from

1 July 2005 to 30 June 2007 ("Second Threshold").

If the First Threshold is exceeded, the Vendors will receive:

(a) notional value of #3.25 for every #1 of excess which will be satisfied

as to the first #350,000 in cash and thereafter, at the Company's election, in

cash or (provided the Ordinary Shares are quoted) by the issue of Deferred

Consideration Shares; and

(b) 1.25 Deferred Consideration Shares for every #1 of excess (provided the

Ordinary Shares are quoted, failing which further cash would be payable).

If the Second Threshold is exceeded, the Vendors will receive:

(a) notional value of #3.25 for every #1 of excess which will be satisfied

as to the first #350,000 in cash and thereafter, at the Company's election, in

cash or (provided the Ordinary Shares are quoted) by the issue of Deferred

Consideration Shares; and

(b) 1 Deferred Consideration Share for every #1 of excess (provided the

Ordinary Shares are quoted, failing which further cash would be payable).

Pursuant to the Acquisition Agreement, each Vendor has undertaken to the Company

(save in limited circumstances) not to dispose of any Consideration Shares for a

period of twelve months following allotment and thereafter will only dispose of

Consideration Shares via the Company's stockbrokers, so as to maintain an

orderly market.

The Acquisition Agreement contains various warranties and indemnities from the

Warrantors in favour of the Company regarding ABGFM's business and tax position.

Further information on the Acquisition Agreement is set out in paragraph 8.1 in

Part VII of the Document.

Information on First Artist

First Artist is a pan-European football management and representation group

which is active in the UK and across Europe. The Group has undertaken some

notable transfers during the current trading window. The Group has offices in

London and Milan and is developing its presence in the Far East and US without

significant additional central overhead.

History and development

First Artist's business was started in 1986. The Company's then issued share

capital was admitted to trading on OFEX on 26 March 2001. In December 2001 First

Artist's shares were admitted to trading on AIM and it acquired FIMO (which

provides professional football representation and consulting services to

football players and clubs) and thereby its Italian subsidiary Promosport srl.

The demise of ITV Digital in May 2002 and the impact on European football clubs'

income from the restructuring of the pan-European television rights market both

had an adverse effect on the liquidity of the European transfer market during

2002 and 2003.

Furthermore, during 2003, the Company's business was adversely affected by the

changes to the football regulatory environment and the consequent imposition of

specified football trading windows (of one month during January of each year and

three months from 1 June in each year). As a result of the decline at this time

in the continental European marketplace, the Group initiated a major

rationalisation programme, which resulted in the closure of some offices and the

termination of a number of employment contracts. Head-count of the Group was

reduced by approximately 40 per cent., which contributed to a Group saving of

around #1.6 million.

The Group (together with other interested parties) is currently in discussions

with UK football regulatory bodies regarding the introduction of a

self-regulatory code of conduct for football agents which the Directors hope

will improve the transparency and integrity of the football transfer market.

Sports representation

In January 2005, the Company acquired the staff, player contracts and business

assets of Mel Stein's Team Sports Management Limited and merged this operation

into the Group's London based office. This acquisition has strengthened the

London operation both operationally and from a player resource perspective.

First Artist represents a significant number of players and, in the summer of

2005, the Company has successfully negotiated the transfers of Andy O'Brien

(Newcastle to Portsmouth), Kevin Phillips (Southampton to Aston Villa) and

Mikael Forssell (Chelsea to Birmingham) amongst others.

Whilst the Group's business diversification strategy continues to be a priority,

should further suitable opportunities present themselves in the football market,

then the Group intends to pursue these. The Group is currently working with

other leading European agency operations, senior European clubs and leagues to

enhance the position, reputation and transparency of the football transfer

market and in particular the role of the football agent.

Commercial and media

The Company's commercial and media department is continuing its organic growth

and now represents over 20 sports and media personalities. The department is

expanding to include personalities outside sport and a lead theatrical role in

the West End was recently secured for one of the Company's new clients.

Corporate

The launch of the Company's corporate division in September 2004 is proving

successful and activity is increasing as different markets are targeted and

reached. The corporate department has recently completed negotiations to market

exclusively a new interactive supporter's product and is working to promote

several major events at leading sporting venues. All aspects of this division

give the Directors confidence of increased activity over the coming year.

Financial information on First Artist

The table below summarises the profit and loss account of the Group for the year

ended 30 June 2002, the period ended 31 October 2003, the year ended 31 October

2004 and the six months ended 30 April 2005. Detailed financial information on

the Group is set out in Parts V and VI of this Document. The summarised

historical results of the Group set out below have been extracted without

material adjustment.

Year ended Period Year ended Interim

30 June ended 31 October Period ended

2002 31 October 2004 30 April

#'000 2003 #'000 2005

(Audited) #'000 (Audited) #'000

(Audited) (Unaudited)

Turnover 6,700 4,229 3,975 1,045

Gross profit 5,454 3,082 2,832 977

Operating profit/(loss) before goodwill 2,009 (3,020 ) ( 355 ) ( 297 )

amortisation

Profit/(loss) on ordinary activities before 642 (15,006 ) ( 493 ) ( 312 )

taxation

Taxation (321 ) 414 167 28

Profit/(loss) on ordinary activities after 321 (14,592 ) ( 326 ) ( 284 )

taxation

Current trading and prospects

For the first six months of this financial year to 30 April 2005, which only

includes the one month January trading window, like for like continuing gross

profit rose slightly in the period compared to last year, with overheads falling

14 per cent. to #1.2 million. After exceptional charges, this resulted in an

operating loss for the period of #0.3 million compared to a loss of #0.49

million in the corresponding period last year. The Group loss for the period was

#0.28 million after deducting a #0.05 million loss incurred due to the closure

of the Swiss and Singapore offices (2004: loss #0.39 million).

Trading conditions in the UK and European football market have stabilised and

the Board remains confident as regards its prospective 2005 turnover. That said,

there remains a natural level of uncertainty in the marketplace and visibility

of earnings continues to be unpredictable.

Current trading at ABGFM continues to be profitable and the Directors believe

that average sales per consultant are significantly ahead of the industry

averages.

The Placing and the Initial Consideration Shares

First Artist has agreed, subject, inter alia, to obtaining Shareholders'

approval and the Placing, to acquire ABGFM for an initial consideration of #1.3

million in cash and 1.25 million Initial Consideration Shares. The Company

proposes to raise approximately #1.25 million (before expenses) by the issue of

25 million Placing Shares at the Placing Price.

The Placing Shares and the Initial Consideration Shares will rank pari passu in

all respects with the Existing Ordinary Shares, including the right to receive

all dividends and other distributions declared, made or paid after the

applicable dates of allotment.

The Placing is conditional, inter alia, upon the Placing Agreement becoming

unconditional in all respects and not being terminated in accordance with its

terms; the passing of the Resolutions; and Admission. Further details of the

Placing Agreement are set out in paragraph 8.1.2 of Part VII of the Document.

Application will be made for the New Ordinary Shares to be admitted to trading

on AIM. It is expected that Admission will become effective and that dealings

will commence on 17 August 2005. The New Ordinary Shares will represent

approximately 35.4 per cent. of the Enlarged Share Capital.

It is expected that the relevant New Ordinary Shares will be delivered into

CREST on 17 August 2005 and that share certificates for the New Ordinary Shares

will be despatched by 19 August 2005.

Following Admission the Directors will be interested in an aggregate of

27,740,378 Ordinary Shares representing approximately 37.4 per cent. of the

Enlarged Share Capital.

Working capital

The Directors are of the opinion, having made due and careful enquiry and taking

into account the net proceeds of the Placing and the bank facilities available,

that the Enlarged Group has sufficient working capital for its present

requirements, that is, for at least twelve months from Admission.

Extraordinary General Meeting

Set out at the end of the Document is a notice convening an EGM to be held at

Bond Street House, 14 Clifford Street, London W1S 4JU at 10.00 a.m. on 15 August

2005 at which the following Resolutions will be proposed for the following

purposes:

1. to approve the Acquisition;

2. to increase the authorised share capital of First Artist;

3. to authorise the Directors to allot and issue Ordinary Shares with an

aggregate nominal value of up to #255,233.69 under section 80 of the Act inter

alia for the New Ordinary Shares and the Deferred Consideration Shares; and

4. to disapply the statutory pre-emption provisions under section 89 of

the Act in relation to the issue of Ordinary Shares with an aggregate nominal

value of up to #187,500, for the New Ordinary Shares, the Deferred Consideration

Shares and certain other issues.

For further information:

First Artist Corporation plc

Jon Smith, Chief Executive Tel. +44 (0) 20 8900 1818

Richard Hughes, Finance Director

Shore Capital

Alex Borrelli Tel. + 44 (0) 20 7408 4090

Smithfield Consultants

George Hudson Tel. + 44 (0) 20 7360 4900

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

2005

Latest time and date for receipt of completed Forms of Proxy for the EGM 10.00 a.m. on 13 August

EGM 10.00 a.m. on 15 August

Completion of the Acquisition, subject to Admission 15 August

Commencement of dealings on AIM in the Enlarged Share Capital 8.00 a.m. 17 August

CREST accounts expected to be credited 8.00 a.m. 17 August

Despatch of definitive share certificates (if applicable) no later than 19 August

NEW ISSUE STATISTICS

Number of Ordinary Shares currently in issue 47,906,523

Number of Initial Consideration Shares to be issued on Completion in respect of 1,250,000

the Acquisition

Number of Placing Shares to be issued in respect of the Placing 25,000,000

Number of Ordinary Shares in issue following the issue of the New Ordinary 74,156,523

Shares

Percentage of Enlarged Share Capital represented by the New Ordinary Shares 35.4%

Net proceeds of the Placing #915,000

Market capitalisation on Completion at the Placing Price #3.7 million

DEFINITIONS

The following definitions shall apply throughout this announcement.

"ABG" Arram Berlyn Gardner, chartered accountants

"ABGFM" ABG Financial Management Limited, a company registered in England and Wales

with number 2187610, whose registered office is at 30 City Road, London EC1Y

2AB

"Act" the Companies Act 1985, as amended

"Acquisition" the proposed acquisition by the Company of the entire issued share capital of

ABGFM pursuant to the Acquisition Agreement

"Acquisition Agreement" the conditional agreement dated 21 July 2005 between (1) the Company (2) the

Warrantors and (3) the Vendors relating to the Acquisition, conditional upon

approval of the Resolutions, receipt by the Company of funds from AIB and

Admission

"Admission" admission of the Enlarged Share Capital to trading on AIM

"AGM" annual general meeting

"AIB" AIB Group (UK) p.l.c., whose registered office is at 4 Queen's Square Belfast

BT1 3DJ

"AIM" the AIM Market of the London Stock Exchange

"AIM Rules" the rules of the London Stock Exchange governing AIM

"Annual Report and Accounts the annual report and consolidated accounts of First Artist for the year

of First Artist" ended 31 October 2004

"Articles" the Company's articles of association

"Audit Committee" the audit committee of the Board

"Business Day" a day other than a Saturday or Sunday or a public holiday in England and

Wales

"Combined Code" the Combined Code of Corporate Governance published by the Financial

Reporting Council in July 2003

"Company" or "First Artist" First Artist Corporation plc, a company registered in England and Wales with

number 2725009

"Completion" completion of the Acquisition

"Consideration Shares" the Initial Consideration Shares and the Deferred Consideration Shares

"Deferred Consideration" the deferred consideration conditionally payable under the Acquisition

Agreement

"Deferred Consideration the new Ordinary Shares to be allotted to the Vendors to satisfy in part the

Shares" Deferred Consideration (if any becomes payable)

"Directors" or "Board" the directors of the Company

"Document" the AIM admission document to be dated 22 July 2005

"EGM" or "Extraordinary the extraordinary general meeting of the Company convened for 15 August 2005

General Meeting" at 10.00 a.m., or any adjournment thereof, notice of which is set out at the

end of the Document

"Enlarged Group" the Group following Completion

"Enlarged Share Capital" the issued share capital of the Company following the issue of the New

Ordinary Shares (excluding the Deferred Consideration Shares)

"Existing Ordinary Shares" the Ordinary Shares currently in issue

"FIFA" Federation Internationale de Football Associations, worldwide football

regulator

"FIMO" FIMO Sport Promotion AG, a company registered in Switzerland

"Form of Proxy" the form of proxy for use by Shareholders to enable Shareholders to appoint

one or more proxies to attend the EGM and, on a poll, to vote instead of that

Shareholder

"FSA" the Financial Services Authority

"Group" the Company and its subsidiaries

"Historic Financial Period" the following financial periods of the Company:

i. the 12 month financial period ended 30 June 2002;

ii. the 16 month financial period ended 31 October 2003;

and

iii. the 12 month financial period ended 31 October 2004

"Initial Consideration" #1.3 million in cash and the Initial Consideration Shares

"Initial Consideration 1,250,000 new Ordinary Shares to be allotted to the Vendors on Completion

Shares"

"Interim Results" the unaudited results of the Group for the six month period ended 30 April

2005

"London Stock Exchange" London Stock Exchange plc

"Model Code" the model code on directors' and employees' share dealings

"New Banking Facility" the new banking facility entered into between the Group and AIB

"NBA" US National Basketball Association

"New Ordinary Shares" the Initial Consideration Shares and the Placing Shares

"NHL" US National Hockey League

"NFL" US National Football League

"OFEX" the market operated by Ofex plc, a company regulated by the FSA, for dealings

in securities of companies traded on that market

"Official List" the Official List of the UK Listing Authority of the FSA as the competent

authority under the Financial Services and Markets Act 2000

"Options" means options to acquire new Ordinary Shares pursuant to the Share Option

Schemes

"Optionholders" means the holders of Options

"Ordinary Shares" ordinary shares of 0.25p each in the share capital of the Company

"Overseas Shareholders" holders of Ordinary Shares with registered addresses outside the United

Kingdom and who have not given First Artist an address for the service of

notice within the United Kingdom

"Placing" the conditional placing of the Placing Shares at the Placing Price, pursuant

to the Placing Agreement

"Placing Agreement" the conditional agreement dated 20 July 2005 between (1) the Company (2)

Shore Capital (3) Shore Capital Stockbrokers Limited and (4) the Directors

relating to the Placing

"Placing Price" 5 pence per Ordinary Share

"Placing Shares" 25,000,000 new Ordinary Shares to be issued, which have been placed

conditionally by Shore Capital pursuant to the Placing Agreement

"Proposals" the Acquisition, the Placing and Admission

"Regulatory Information any of the services set out in Schedule 12 of the Listing Rules of the UK

Service" Listing Authority

"Resolutions" the resolutions contained in the notice of EGM

"Shareholders" the persons who are registered as holders of Ordinary Shares

"Share Option Schemes" the unapproved share option scheme, the approved share option scheme and the

enterprise management incentive scheme of the Company

"Shore Capital" Shore Capital and Corporate Limited, nominated adviser to the Company,

authorised and regulated by the FSA

"UEFA" Union of European Football Associations

"United Kingdom" or "UK" United Kingdom of Great Britain and Northern Ireland

"United States" or "US" United States of America, its territories and possessions, any state of the

United States of America and the District of Columbia and all other areas

subject to its jurisdiction

"Vendors" the current shareholders of ABGFM

"Warrantors" those persons who have agreed, pursuant to the Acquisition Agreement, to give

to the Company warranties and indemnities regarding ABGFM

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQRTMMTMMMTBRA

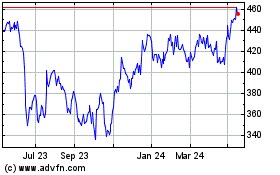

Volution (LSE:FAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Volution (LSE:FAN)

Historical Stock Chart

From Jul 2023 to Jul 2024