First Artist Corporation Plc (AIM: FAN)

Interim Results for the Six months ended 30 April 2006

11th July 2006

First Artist Corporation PLC ("First Artist" or "the Group"), the acquisitive

sports and entertainment group, today announces unaudited interim results for

the six months ended 30 April 2006.

Highlights

* Operating profit* up �372,000 to �126,000

* Retained profit up �310,000 to �26,000

* Turnover up 332% to �4,513,000 (2005: �1,045,000)

* EPS before taxation, amortisation of goodwill and exceptional costs up

0.51p to 0.03p

* Consolidated net assets up 338% to �3,356,000

* Successful integration of last summer's Event Management & Wealth

Management acquisitions which are performing well

* On 11 July the Group announced 2 further acquisitions, within the

Entertainment and Football Representation Divisions

*Operating profit is stated before exceptional administrative expenses and

goodwill impairment

Commenting on the results, Jarvis Astaire, Chairman, said:

"We are pleased that this half-year has underlined the success of our expansion

strategy to date. All divisions are trading in line with market expectations

and the Board remains optimistic about the Group's continued success for the

remainder of the year and beyond.

We will be continuing this strategy to strengthen our position in the UK and

Europe by organic and acquisitive growth, integrating these with our strong

core businesses."

For further information:

First Artist Corporation plc

Jon Smith, Chief Executive +44 (0) 20 8900 1818

Richard Hughes, Finance Director

Arbuthnot Securities Limited +44 (0) 20 7012 2000

Tom Griffiths

gth media relations +44 (0) 20 7153 8039 / 8035

Toby Hall

Jade Mamarbachi

Notes to Editors

First Artist Corporation PLC (AIM: FAN) is a leading sport and entertainment

representation and event management group. With offices in London, Milan, the

USA and Middle East, it provides four distinct services: sports player

representation, celebrity representation, wealth management, and event

management. Its player representation division, First Artist Management is

recognised as one of world's leading football management groups.

CHAIRMAN'S STATEMENT

It gives me great pleasure to introduce our results for the 6 months ended 30

April 2006, which were ahead of our expectations, reporting an interim profit

after tax (�26,000) for the first time since floating on AIM. This period has

successfully demonstrated our diversification strategy and established First

Artist as a truly integrated multi-functional Sport representation,

Entertainment and Event management group. The figures for all our divisions

reflect the mutual benefits that we are gaining from this strategy.

Our business has enjoyed a successful period across all areas, both financially

and operationally, with last summer's acquisitions now fully integrated and

positively contributing to the performance of the group. Operating profit of �

126,000 for the period has set a new benchmark for the group, with the two new

acquisitions, ABG Financial Management and The Finishing Touch, providing the

backbone to this result.

The Group remains second half weighted, particularly due to the timing of the

football summer trading window, although we continue to take strides to

diversify into a broad based multi-functional plc with stable income streams

throughout the year, which has begun to become evident through these figures.

On 11 July the Group acquired the following businesses:

* NCI Management Limited an established UK Entertainment Management company

for a total maximum consideration payable of �1.75 million. Initial

consideration paid of �650,000 cash and 500,000 shares. NCI gives critical

mass to our own expanding organically grown entertainment division,

introducing further TV/media personality clientele and the ability to

produce and manage the content of our own programming.

* ProActive Scandinavia A/S, a member of the Aim listed Formation Group plc,

a leading Football Management company based in Copenhagen, Denmark for a

total consideration paid of �1.75 million cash and a further �250,000 paid

to Karsten Aabrink, Managing Director of the company. The company will be

renamed First Artist Scandinavia A/S. This will strengthen our player base

and strategically and geographically place the division within all the key

European football regions, making First Artist the largest European

football representation group.

Our traditional businesses are performing in line with expectations and we are

looking to gain from this summer's World Cup and with the recent finalisation

of the pan-European TV rights deal, the football market will continue to

advance over the coming years. We see significant consolidation within the

representation industry and our position as the leading European agency group

will only be strengthened by this development.

In early June we announced the signing of an agreement between The Complete

Leisure Group plc, chaired by Lord Coe and our event management subsidiary, The

Finishing Touch (Corporate Events) Limited, focused on generating event

management related revenues from a series of targeted events and preferred

supplier referrals.

Group and financial review

TURNOVER

Turnover for the period has increased 332% compared to last year through

increased activity in the entertainment business (up 42%) and through the

inclusion of the turnover generated from the acquisitions of ABG Financial

Management and The Finishing Touch.

OPERATING PROFIT

The operating profit for the Group, before goodwill amortisation and impairment

and one-off exceptional costs was �126,000, an increase of �372,000 for the

comparative period.

A more detailed composition of the results by division can be seen in the

business reviews.

GOODWILL AMORTISATION AND EXCEPTIONALS

Exceptional costs for the last 6 months resulted from the closure costs

associated with the FIMO Geneva office and First Artist international.

Both of the above companies are in the process of being struck off.

INTEREST PAYABLE, FUNDING AND LIQUIDITY

At 30 April 2006 the cash balance of the group was �292,000, up �473,000 from

the corresponding period last year.

Deferred consideration has been reclassified as provisions for liabilities and

charges. This balance is contingent on the performance of the acquired

businesses, ABG Financial Management Limited and The Finishing Touch (Corporate

Events) Limited and is subject to change.

Deferred consideration is therefore not considered in net debt calculations and

will be financed entirely by the individual performance of each business.

Net debt of �1.48 million (2005: �0.65 million) at the period end was comprised

of

6 months ended 6 months ended Year ended

30th April 2006 30th April 31st October

2005 2005

�'millions

�'millions �'millions

Five year bank loan (1.41) - (1.55)

Other group net debts (0.36) (0.48) (0.37)

Cash in hand and bank overdrafts 0.29 (0.18) 1.27

Group net debt (1.48) (0.66) (0.65)

TAXATION

The tax charge of �41,000 includes a 5% withholding tax charge of �51,000 on a

dividend paid out by FIMO Sport Promotion AG to First Artist Corporation Plc,

as part of the closure costs.

EARNINGS PER SHARE

Earnings per share before exceptional items and goodwill increased from a loss

of 0.48p to a profit of 0.03p, and basic earnings per share also increased from

a loss of 0.59p to a profit of 0.03p. This is directly due to the increased

profitability of the enlarged group and the earnings enhancing means of

financing the acquisitions.

SHAREHOLDERS' FUNDS

Shareholders funds increased from �3.31 million to �3.36 million over the last

6 months, resulting in an increase in net assets per share of 0.1p to 3.8p.

OUTLOOK AND ACQUISITIONS

Our strategy of providing distinct but wholly complementary services: sports

player representation, entertainment and celebrity management, wealth

management and event management, is now a reality and we can look to push

forward as a business, both organically and by further acquisitions.

As well as pursuing organic growth, via cross referrals within the Group and

increased sales activities, we are actively seeking, in addition to the

acquisitions announced on 11 July, further acquisitions and joint ventures in

all business areas.

In particular within;

* Strategic sports marketing and sponsorship as a complementary skill-set and

to exploit our pre-eminent position as one of the leading representation

businesses in Europe

* Media companies within the entertainment sector to enable us to promote our

representation and corporate clients

* Event production businesses within sport, entertainment and fashion, to

compliment our event management and entertainment division

* Wealth management to increase our client base through joint ventures with

other professional service companies

We are pleased that this half-year has underlined the success of our expansion

strategy to date. All divisions are trading in line with market expectations

and the Board remains optimistic about the Group's continued success for the

remainder of the year and beyond.

We will be continuing this strategy to strengthen our position in the UK and

Europe by organic and acquisitive growth, integrating these with our strong

core businesses

Jarvis Astaire

Chairman

11th July 2006

Consolidated Profit and Loss Account

For the six months ended 30 April 2006

Notes Six months Six months Year ended to

ended ended

31 October

30 April 30 April 2005

2006 2005

(Unaudited) (Audited)

�000's (Unaudited)

�000's

�000's

Sales Continuing 4,478 1,034 4,385

Acquisitions - - 1,449

Discontinued 35 11 27

4,513 1,045 5,861

Cost of sales (2,039) (68) (1,325)

Gross profit 2,474 977 4,536

Administrative expenses (2,348) (1,223) (3,482)

Exceptional administrative 2 (5) (51) (161)

expenses

Operating profit/(loss)

before goodwill

Continuing 88 (268) 754

Acquisitions - - 290

Discontinued 33 (29) (151)

121 (297) 893

Administrative expenses - - - (43)

goodwill impairment and

amortisation

Total operating profit/ 121 (297) 850

(loss)

Investment income 19 2 11

Interest payable (73) (17) (52)

Profit/(loss) on ordinary 67 (312) 809

activities before

taxation

Taxation 3 (41) 28 (299)

Profit/(loss) on ordinary 26 (284) 510

activities after taxation

Dividends - - -

Retained profit/(loss) 26 (284) 510

for the period

RETAINED EARNINGS / 4 0.03 p (0.59) p 0.89 p

(LOSSES) PER SHARE

Basic profit/(loss) per

share

Fully diluted profit/ 4 0.03 p (0.59) p 0.88 p

(loss) per share

Consolidated Balance Sheet

As at 30 April 2006

Notes As at As at As at

30 April 30 April 31 October

2006 2005 2005

(Unaudited) (Unaudited) (Audited)

�000's �000's �000's

FIXED ASSETS

Intangible assets 5,952 50 5,295

Tangible assets 739 715 719

Investments 100 - -

6,791 765 6,014

CURRENT ASSETS

Debtors 4,003 2,140 4,746

Cash at bank and in hand 691 197 1,527

4,694 2,337 6,273

CREDITORS: Amounts falling (3,705) (2,201) (5,055)

due within one year

NET CURRENT ASSETS 989 136 1,218

TOTAL ASSETS LESS CURRENT 7,780 901 7,232

LIABILITIES

CREDITORS: Amounts falling (1,172) (136) (1,303)

due after more than one year

PROVISIONS for liabilities 5 (3,252) - (2,623)

and charges

NET ASSETS 3,356 765 3,306

CAPITAL AND RESERVES

Called up share capital 224 120 224

Capital redemption reserve 15 15 15

Share premium account 7,902 6,217 7,888

Profit and loss account (4,785) (5,587) (4,821)

10 3,356 765 3,306

Statement of Total Recognised Gains and Losses

For the Six months ended 30 April 2006

Six months Six months Year ended

ended ended

31 October

30 April 30 April 2005

2006 2005

(Audited)

(Unaudited) (Unaudited)

�000's

�000's �000's

Profit / (loss) for the financial 26 (284) 510

period

Currency translation differences 10 (28) (56)

on net foreign currency

investments

Total recognised gains and losses 36 (312) 454

Consolidated Cash Flow Statement

For the Six Months ended 30 April 2006

Notes Six months Six months Year ended

ended ended

31 October

30 April 30 April 2005

2006 2005

(Audited)

(Unaudited) (Unaudited)

�000's

�000's �000's

Cash (outflow) from 7 (340) (477) (12)

operating activities

Returns on investments and (54) (15) (35)

servicing of finance

Taxation (261) - (4)

Capital expenditure and (42) 6 (3)

financial investment

Acquisitions and disposals 8 (129) (25) (2,126)

Cash (outflow) / inflow (826) (511) (2,180)

before financing

FINANCING:

Issue of share capital 14 - 2,001

Costs of issue of shares - - (361)

Bank loans (131) - 1,545

Directors' loans - - 92

Other loans (28) 50 (135)

Capital element of finance (5) (30) (47)

lease rental payments

(150) 20 3,095

(Decrease) / increase in (976) (491) 915

cash in the period

Cash used to (increase) / 164 (20) (1,412)

decrease debt financing

New finance leases (15) - -

(827) (511) (497)

Net debt at the beginning of 9 (648) (151) (151)

the period

Net debt at the end of the 9 (1,475) (662) (648)

period

Notes to the Interim Accounts:

For the six months ended 30 April 2006

1. Basis of preparation

The financial information contained within this interim report does not

constitute statutory accounts within the meaning of Section 240 of the

Companies Act 1985. The interim financial information has been prepared on the

basis of the accounting policies set out in the Group's statutory accounts for

the year ended 31 October 2005.

The figures for the six months ended 30 April 2006 and 30 April 2005 are

unaudited. The figures for the year ended 31 October 2005 have been extracted

from the statutory accounts which have been filed with the Registrar of

Companies and did not contain a statement under Section 237 (2) or (3) of the

Companies Act 1985.

2. Exceptional administrative expenses

Six months Six months Year ended

ended ended

31 October

30 April 30 April

2006 2005 2005

(Unaudited) (Unaudited) (Audited)

�000's �000's �000's

Costs of Abortive Acquisitions - 12 12

Restructuring costs and 5 39 149

Redundancies

5 51 161

3. Tax charge/(credit)

The tax charge/(credit) is based on the estimated effective rate for the period

as a whole.

Six months Six months Year ended

ended ended

31 October

30 April 30 April

2006 2005 2005

(Unaudited) (Unaudited) (Audited)

�000's �000's �000's

UK corporation tax charge 70 - 106

Adjustments in respect of prior - - -

periods

Foreign taxes adjustment 51 2 118

Current tax charge for the period 121 2 224

Deferred Taxation: (80) (30) 75

Origination and reversal of timing

differences

Tax charge on ordinary activities 41 (28) 299

4. Earnings / (loss) per share

The calculations of earnings / (loss) per share are based on the following

profits and numbers of shares.

Six months Six months Year ended

ended ended

31 October

30 April 30 April

2006 2005 2005

(Unaudited) (Unaudited) (Audited)

Number Number Number

Weighted average number of 0.25

pence ordinary shares in issue

during the period

For basic earnings per share 89,523,729 47,906,523 57,034,181

Exercise of share options 2,268,829 3,481,347 1,005,773

For diluted earnings per share 91,792,557 51,387,870 58,039,954

�'000s �'000s �'000s

Earnings /(loss) for the financial 26 (284) 510

period

5. Provisions for liabilities and charges

The provisions for liabilities and charges relate to deferred consideration. In

earlier periods this was disclosed as part of creditors.

Deferred consideration represents the estimated amounts payable, although the

final amounts payable are dependent upon the results of the acquired

businesses.

Six months Six months Year ended

ended

ended 31 October

30 April

30 April 2006 2005 2005

(Unaudited) (Unaudited) (Audited)

�000's �000's �000's

Deferred consideration due within 1,231 - 1,118

one year

Deferred consideration due after 2,021 - 1,505

one year

Total deferred consideration 3,252 - 2,623

6. FRS7

The Company has considered the implications of FRS7. Due to the second half

weighting of the group it has not been able to accurately determine the

standard's effect on these accounts and believes them not to be material. The

effects of the standard will be fully reflected in the Annual statutory

accounts for the year to 31st October 2006.

7. Reconciliation of operating profit to net operating cash flow

Six months Six months Year ended

ended

ended 31 October

30 April

30 April 2006 2005 2005

(Unaudited) (Unaudited) (Audited)

�000's �000's �000's

Operating profit / (loss) 121 (297) 850

Depreciation 40 29 65

Impairment and amortisation of - - 43

goodwill

Loss on disposal of fixed assets (2) 4 5

Decrease in debtors 743 133 (1,608)

(Decrease) in creditors (1,252) (318) 689

Exchange 10 (28) (56)

Net cash outflow from operating (340) (477) (12)

activities

8. Acquisitions and disposals on cash flow

Six months Six months Year ended

ended

ended 31 October

30 April

30 April 2006 2005 2005

(Unaudited) (Unaudited) (Audited)

�000's �000's �000's

Consideration on acquisition of (107) (25) (2,126)

subsidiary undertakings and other

investments

Payment of deferred consideration (22) - -

Net cash outflow (129) (25) (2,126)

9. Analysis of changes in net debt

At 1 Cash flow Non-Cash At 30 April

November changes 2006

2005 �'000s

�'000s �'000s

�'000s

Cash at bank and in hand 1,527 (836) - 691

Bank overdrafts (259) (140) - (399)

1,268 (976) - 292

Finance Leases (24) 5 (15) (34)

Debt due within one year (607) 22 - (585)

Debt due after more than (1,285) 137 - (1,148)

one year

(1,916) 164 (22) (1,767)

Total (648) (812) (15) (1,475)

10. Reconciliation of movement in shareholders' funds

Six months Six months Year ended

ended

ended 31 October

30 April

30 April 2006 2005 2005

(Unaudited) (Unaudited) (Audited)

�000's �000's �000's

Profit / (loss) for the financial 26 (284) 510

period

Shares issued to acquire - - 135

subsidiary undertakings

Shares issued 14 - 2,001

Issue costs - - (361)

Foreign exchange adjustment 10 (28) (56)

Increase/(decrease) in 50 (312) 2,229

shareholders' funds

Opening shareholders' funds 3,306 1,077 1,077

Closing shareholders' funds 3,356 765 3,306

Shareholders' funds are entirely attributable to equity interests.

11. Interim Report

Copies of this interim report are being sent to all shareholders and are

available to the public at the Company's registered office, First Artist House,

87 Wembley Hill Road, Wembley, Middlesex HA9 8BU.

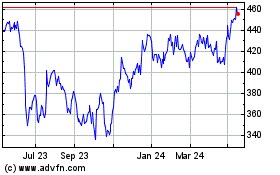

Volution (LSE:FAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Volution (LSE:FAN)

Historical Stock Chart

From Jul 2023 to Jul 2024