RNS Number:9542H

First Artist Corporation PLC

19 November 2007

Date: 19 November 2007

On behalf of: First Artist Corporation plc ("First Artist" or "the Group")

Embargoed for: 0700hrs

First Artist Corporation plc

Preliminary Results for the year ended 31 August 2007

First Artist Corporation plc (AIM: FAN), the media, events and entertainment

management group, today announces its final results for the year ended 31 August

2007.

Highlights from last 12 month period include:

* Turnover up 411% to #48.6 million (compared to 10 month period to

31 August 2006)

* Adjusted EBITA* up 118% to #3.6 million (EBITA #3.2 million)

* Adjusted profit before tax** up 80% to #2.7 million (Profit before tax

#1.5 million)

* Adjusted basic EPS*** up 47% to 15.71 pence (Basic EPS 6.81p)

* Consolidated net assets up 43% to #7.3 million

* Total cash inflow of #2.7 million

*(Earnings before interest, tax and amortisation (EBITA) is stated before

exceptional administrative expenses and foreign exchange gains or losses)

**(Profit before tax is stated before goodwill amortisation, exceptionals and

discounted interest on deferred consideration)

***(EPS is stated before amortisation of goodwill, discounted interest on

deferred consideration and exceptional costs)

Key Operating Highlights:

* Successful acquisition and integration of Dewynters, the UK's leading

full-service entertainment marketing group

* Successful acquisition of Yell Communications and integration within the

Events division

* Successful launch of First Rights, First Artist's sponsorship and rights

ownership agency

* Three-year Public Sector Training and Development Agency contract awarded

to The Finishing Touch

Jon Smith, Chief Executive of First Artist Corporation commented:

"This has been a transformational year for First Artist. The Group now benefits

from eight diverse income streams, spread across our three divisions: Media,

Entertainment and Events.

"The focusing of the Group into three divisions will help to drive the synergies

that exist between the different businesses. Over the next year the Group will

continue to evolve, building on the high quality, diverse earnings streams and

strong cash generation.

"The emerging media landscape presents enormous opportunities and First Artist

has positioned itself to take full advantage of the changing marketplace."

Enquiries:

Jon Smith, Chief Executive

Richard Hughes, Group Managing Director www.firstartist.com

First Artist Corporation Tel: 020 7993 0000

Emma Kane / Samantha Robbins / Sanna Lehtinen

Redleaf Communications Tel: 020 7822 0200

David Floyd

Dawnay Day, NOMAD Tel: 020 7509 4570

Katie Shelton

Daniel Stewart, Broker Tel: 020 7776 6550

Notes to Editors:

* First Artist Corporation plc floated on AIM in 2002

* First Artist's group companies are among the leading brands in their

fields under the following categories:

o Media - advertising, marketing and signage for West End, Broadway

and Las Vegas shows via the Dewynters and Newman Displays brands,

and strategic sponsorship consulting via Sponsorship Consulting

and First Rights

o Entertainment - representation of media personalities and football

players/clubs across UK, Europe and the US via its First Artist

Sport and First Artist Entertainment companies together with

wealth management under its Optimal Wealth Management arm

o Events - offers a broad range of events such as conferences,

company activity days, venue finding, delegate management and

client events for private and public sector clients such as the

Training & Development Agency, under its Finishing Touch business

* First Artist is acting as a consolidator in the fragmented media,

entertainment and events sectors focusing on high quality brands with the

potential to cross sell to other Group companies

* First Artist has strong visibility of earnings across a diverse and

non-cyclical range of activities in both live and digital formats

* The Group benefits from a strong, experienced management team with

extensive expertise across all the sectors in which it operates

Chairman and Chief Executive's Statement

The nature of media and entertainment has changed rapidly over recent years,

with the shift away from traditional forms of media into digital web-based

multi-media, driven by the advent of new technologies. This landslide is

dramatically increasing the rate of media and audience fragmentation, and of the

diversification of entertainment channels. Conversely, it has also resulted in

significant growth in the live event sector and this growth is forecast to

continue for some time.

We believe that the emerging media landscape presents enormous opportunities for

those now entering the media and entertainment sectors, particularly if they can

introduce a business model that delivers stability when previously less flexible

and more established players now find their revenue streams exposed. A

low-risk, cash generative, reliably profitable and inherently stable but

expanding group will find itself in the ideal position to exploit emerging

opportunities within this changing marketplace.

This is exactly the position in which First Artist Corporation has placed

itself. The repositioning of the Group, which began three years ago, has now

delivered a media, entertainment/sport and events group that is notable for both

the diversity and stability of its revenue streams and its robust organic

growth. We have grown the business with an emphasis on synergistic, earnings

enhancing acquisitions, precisely to take advantage of the conditions in media

and entertainment today and in the future.

We have successfully integrated eight businesses in an environment that builds

on their strengths and has accelerated the growth on the majority of these

businesses. We have identified key current opportunities for expansion within

the Group, started to develop new forms of revenue stream that are evolved to

fit the opportunities of the current marketplace, and positioned ourselves to

respond to the next wave of opportunities in a dynamic rapidly changing sector.

Both the media and the analyst community have made frequent reference to First

Artist Corporation's past as primarily a football agency, and it is true that

when we began the process of expanding and repositioning the business, three

years ago, the majority of First Artist's revenues were derived from football.

As a result, the income stream was seasonal, and exposed to the amount of TV

revenue flowing into the game.

A comparative look at the structure of today's Group revenues tells a very

different story: 87 per cent of the enlarged group revenues, and 79 per cent of

operating profits (pre. Group central costs) now come through media,

non-football entertainment and event management services, with the acquisition

of Dewynters giving First Artist Corporation the dominant role in the marketing

of theatre and cinema in the UK, and opening up exciting avenues of opportunity

in the US and Asia Pacific.

The Group now benefits from eight diverse income streams, spread across our

three divisions: Media, Entertainment/Sport and Events. Within Entertainment and

Sport, changes to the nature of football contracts have further strengthened

year-round revenues by replacing traditional, up-front agency fees with regular

payments over the life of the contract, significantly increasing visibility

through contracted earnings. Within Events, The Finishing Touch's success in

landing a significant three-year contract for the Training and Development

Agency's schools training programme secures a rapidly expanding public service

revenue stream, whilst the addition of Yell Communications further strengthened

the corporate business following record trading periods during Christmas 2006

and June 2007.

Arguably the most significant Group achievement of the past three years is the

success in finding ways to deliver stable, growing revenues, in markets where

high risks are often perceived to accompany high rewards. We believe that the

management style and group structure, supported by strong information and

financial management systems will ensure that we will continue to deliver this

robust growth.

Stability breeds stability much as success breeds success. The strength of the

overall Group position is allowing us to explore new opportunities to develop

further, long-term, revenue streams through the ownership of media and event

rights. This year's launch of First Rights is a major step forward, leveraging

our expertise in sponsorship and media rights to take ownership of promising

sport and entertainment properties. As we expand further into media and

entertainment representation, through First Artist Management and build on this

year's tremendous advances by The Finishing Touch, we will remain alert to

further rights opportunities.

In concluding, we wish to thank all members of the First Artist Group for their

tremendous hard work over the past three years and, especially during the last

12 months. They have all contributed to the success of the Group, and to the

highly promising position in which we now find ourselves. Our Sharesave scheme,

launched this year, is designed to allow all employees to profit from success,

and we are pleased that such a large percentage took the opportunity to do so.

Jarvis Astaire & Jon Smith

16 November 2007

FIRST ARTIST MEDIA

Dewynters and Dewynters Advertising Inc.

Dewynters' leadership in the marketing of theatre and cinema in the UK has been

built on a deep passion for and understanding of its sector, consistently

original, award-winning creative and a full-service offer that incorporates all

the services required to connect audiences and performances. In addition to

print and digital development, e-business and media advertising, Dewynters works

through its subsidiaries Dewynters Advertising and Newman Displays to deliver

merchandising, souvenir programmes and spectacular front-of-house displays.

When an agency enjoys a dominant market position such as that of Dewynters, its

fortunes are closely linked to those of its sector. The company currently

supports some 26 West End shows compared to 18 in May 2006 with further shows

performing in Europe and the Far East. The UK's appetite for theatre appears

greater than ever; the pipeline of shows seeking theatres is extremely healthy,

and dedicated reality TV shows are further raising the profile of musical

theatre, in particular. Within this environment, the agency seeks continually

to protect its market position by raising its creative standards and

demonstrating its versatility, as shown in recent West End work for The Royal

Opera House, Equus, Spamalot, Grease and Lord of the Rings.

Steady growth from an extremely strong position indicates a very healthy

performance for Dewynters' core London theatre and cinema business and this year

has been its most successful in its 100-year plus history. The agency's main

opportunities for more rapid growth lie internationally, such as in the US and

Asia Pacific, in which it is also successfully developing its presence alongside

Newman Displays and Dewynters Advertising, and in expanding its role in cultural

tourism. Dewynters is the only UK agency to be a member of the Association of

British Travel Agents.

Dewynters Advertising is Dewynters' rapidly expanding merchandising and souvenir

programme operation, which has succeeded in tapping into the lucrative US

theatrical market through its offices in New York and Las Vegas.

Alongside Dewynters (UK), this company currently represents 7 shows on Broadway

and 4 in Las Vegas with further shows on US tours. Over the past year, the

company has delivered the merchandising to promote hit US shows such as The

Color Purple, Young Frankenstein and Stomp, providing a valuable tool for

extending brand awareness through word-of-mouth at the same time as ensuring a

valuable revenue stream for clients.

Live events and in particular theatre are an increasingly global business;

Broadway plays a vital role as an exporter of productions to London and around

the world. Dewynters Advertising's growing strength in the US market not only

helps to secure the broader marketing accounts for London staging of

international shows; it also plays a key role in opening up new markets such as

China to the skills and expertise of Dewynters and Newman Displays.

The creative skills and global reach of Dewynters Advertising are hugely

complementary to the strategic marketing skills, entertainment development and

event management expertise available through other divisions of the First Artist

Group.

FIRST ARTIST MEDIA

Year ended 31 10 months ended 31 Year ended 31

August August October

2007 2006 2005

#000 #000 #000

Turnover

Dewynters Group * 32,872 - -

Sponsorship Consulting ** 740 49 -

First Rights - - -

33,612 49 -

Operating Profit*** 2,428 - -

* These figures are since Acquisition in November 2006

** These figures are since Acquisition in August 2006

*** Prior to intergroup management fee and excluding foreign exchange gains or losses

DEWYNTERS GROUP

Period from Year ended 31 Year ended 31

1 November 2006 to March March

31 August 2007 2006 2005

#000 #000 #000

Turnover

Dewynters Limited 25,848 26,448 25,130

Dewynters Advertising Inc 2,633 2,696 2,862

Newman Displays Limited 4,391 4,386 2,236

32,872 33,530 30,228

Operating Profit* 2,571 864 304

* Prior to intergroup management fee and excluding foreign exchange gains or

losses

MEDIA - NEWMAN DISPLAYS

Newman Displays has pioneered the role of fascias, signage and front-of-house

displays in UK entertainment marketing and brand awareness, successfully

leveraging its 20-year record of innovation and creativity into a dominant role

in the theatre and cinema marketplace.

The West End has provided a hugely effective shop window for the company's

creativity and production expertise, with films such as Pirates of the Caribbean

At World's End, Harry Potter and the Order of the Phoenix, Shrek 3, The Simpsons

and 300; and musicals Spamalot and Wicked among the many productions benefiting

from displays during the last year. However, Newman Displays' expertise extends

beyond this: to brand campaigns, including the innovative neon signage on

display in London's Piccadilly Circus, and business-to-business and corporate

designs and exhibition stands.

The steady integration of the business within the First Artist Group offers

several new opportunities for growth, including considerable potential synergies

with First Artist's event business, The Finishing Touch, and with the

sponsorship, media rights and PR expertise of Sponsorship Consulting and First

Rights.

The business is already making considerable strides in the US, where the

strength of First Artist's Las Vegas-based operation, Dewynters Advertising,

provides opportunities to introduce its creative and production techniques to

new markets. This is also true in Europe at the Cannes Film Festival and in

China, where rapidly increasing demand for touring West End shows promises a

considerable market for its theatrical displays.

MEDIA - SPONSORSHIP CONSULTING

The approach of the 2012 Olympic games in London has done more than increase the

demand for sponsorship consultancy and implementation in the UK; it represents a

step-change in the way the industry conducts business, and in the way that

clients judge the services available. Since its arrival within the First Artist

Group just over a year ago, Sponsorship Consulting has been restructured and has

focused its future development to take full advantage of this shift and deliver

the level of brand expertise that clients will demand over the next five years

and beyond.

Sponsorship Consulting is a high-end, strategic sponsorship and corporate

responsibility consultancy with an instantly recognisable list of blue-chip

clients; the complementary range of skills available through the First Artist

Group allows it to work with First Rights on the implementation of sponsorship

sales and with The Finishing Touch on event management, whilst focusing on

delivering high-quality brand-orientated advice to both sponsors and rights

owners. At the same time, the company will continue to work on the detailed

activation and implementation of sponsorship deals for large corporates, on a

contracted basis, covering every element needed to bring sponsorship to life.

The next phase in the growth of the business will include building on its Public

Relations capabilities, in order to tap sponsorship's full potential for

creating brand experiences.

The past 12 months have delivered yet more examples of the value that the

business delivers to clients in this respect. Sponsorship Consulting has

renegotiated Unilever's relationship with The Tate Modern, including a

realignment of the sponsorship deal in 2012 to take advantage of the London

Olympics; the company has extended the value of Siemens' sponsorship of rowing

into internal communications, through an indoor rowing regatta for employees;

eight separate sponsorship deals have been secured for Shell, including a

partnership with the Royal Festival Hall and the support of a new children's

gallery for the Science Museum. Meanwhile, the consultancy's work for the shoe

brand, Ekko, culminating in a three-year sponsorship of the V&A's fashion

exhibitions, showcases the powerful potential role of sponsorship in the

repositioning of brands.

MEDIA - FIRST RIGHTS

Launched in May 2007, First Rights has been developed to build on the media

rights and sponsorship sales expertise which exists within the First Artist

Group, delivering new revenue streams through its sales-led representation of

rights owners and opening up new opportunities for the Group in the ownership of

media assets. During its first few months of operation, the business has

already made encouraging strides in both of these areas. Although no revenue was

recognised during the 4 months to 31 August, the Company has four contracted

clients who will be invoiced in the first few months of the coming year.

First Rights' core business focuses on the development of sponsorship strategies

for rights owners and the subsequent execution of these strategies through

sales. The company generates revenue through both fees and sales commissions and

has already landed high-profile clients such as Sheffield United and the

European Fighting Network.

In two further cases, First Rights has opted to waive its initial consultancy

fee in exchange for a share of media rights, securing longer-term revenue

streams through equity ownership. The rights in question, to the Ocean Racing

World Cup and Carousel, a business, which controls the rights to display artwork

from The Simpsons among other entertainment properties, were carefully selected

for their long-term potential. In addition to income through the rights

themselves, First Rights will handle ongoing sales on a commission basis in each

case.

Over the next year, the business will continue to focus on the organic growth of

its fee and commissions-based sales business, whilst continuing to monitor

opportunities for further rights ownership where the potential exists to create

long-term revenue streams. The activities of First Artist group companies such

as First Artist Management and the events business The Finishing Touch have the

potential to provide a further channel to rights ownership over the medium and

longer term.

EVENTS - THE FINISHING TOUCH

FIRST ARTIST EVENTS

Year ended 31 10 months ended 31 Year ended Year ended

August August 30 April 30 April

2007 2006 2007 2006

#000 #000 #000 #000

Turnover

Corporate 3,120 1,700 2,734 2,208

Public Sector 2,037 1,393 1,705 2,230

5,157 3,093 4,439 4,438

Operating Profit* 498 218 379 **353

* Prior to intergroup management fee and foreign exchange gains or losses

** Prior to one-off pension payment

A year of extremely strong organic growth for The Finishing Touch has been

largely defined by its success in securing the three-year contract for the

Training and Development Agency's schools training programme, with a

client-controlled option for a two-year contract extension. This win, the result

of a long-running tender process, represents major growth for the public sector

division of The Finishing Touch's business, secures a significant medium-term

income stream, and positions the company superbly to win additional public

sector work. The full event planning and management services offered by The

Finishing Touch are largely unique within the public sector market, and the

company has already been approached to develop projects for several other public

sector bodies. Recent announcements of additional funding for education are

likely to increase the value of the schools training programme account still

further, with indications for 2008 suggesting the number of events will

significantly exceed initial projections. The new Public Sector contract

commenced on 1 August full benefits of which will be seen over the coming years.

The corporate side of the business also delivered strong growth during 2007 with

like-for-like income growth in excess of 33 per cent, supplemented with the

acquisition of Yell Communications delivering a contract for Prudential and a

large-scale staff education roadshow for a leading insurance group. This new

business comes in addition to The Finishing Touch's ongoing preferred supplier

corporate contract with Accenture and strong record of repeat business through

successful client retention. Record trading periods during Christmas 2006 and

June 2007 testify further to the vitality of the corporate operation.

The immediate opportunity for additional growth lies in the further expansion of

the corporate business, building on the recent launch of a new brand, corporate

identity and website for The Finishing Touch. Following the long-term tender

process for the schools training programme, new business resources are now

increasingly available to the corporate operation. At the same time, The

Finishing Touch will remain alive to the possibilities for growth arising

through its delivery of the Training and Development Agency's programme.

The Finishing Touch continues to innovate within the events business, with a

number of new venues and bespoke corporate activities in creative and commercial

development. The business is also exploring the possibility of launching wholly

owned live event properties, such as awards dinners, with rights, sponsorship

opportunities and ticket sales controlled by the First Artist Group.

FIRST ARTIST ENTERTAINMENT/ SPORT MANAGEMENT

Year ended 31 10 months ended 31 Year ended 31

August August October

2007 2006 2005

#000 #000 #000

Turnover

Sport 6,481 4,162 4,171

Entertainment 744 331 241

Wealth 2,613 1,873 592

9,838 6,366 5,004

Operating Profit* 1,982** 2,054** 1,510

* Prior to intergroup management fee and foreign exchange gains or losses

** These figures only include the results for First Artist Scandinavia for the

2006 summer football trading window and do not include the losses which occur in

the non-trading periods of a financial year. The 2007 figures reflect a full 12

months trading from the business.

FIRST ARTIST MANAGEMENT (ENTERTAINMENT)

Within a fast-consolidating entertainment representation market, scale and

ownership hold the key to increasing influence and unlocking value. Following an

important year of consolidation, First Artist Management is now in a position to

advance in both of these areas.

With a strengthened management team and a strong track record for building

credible and valuable personality brands, the acquisition of NCI Management in

2006 has transformed the basis of First Artist's Entertainment division, now

renamed First Artist Management to reflect its particular strengths as a 'Total

Management' agency. The high profile of clients such as Gillian McKeith, Andrea

Mclean, Andy Gray, Amanda Lamb and Ruud Gullit, who we recently placed as

manager of the LA Galaxy soccer team, continue to build the credibility of First

Artist Management's offer in both sport and expert-led entertainment, and we

expect the company's reputation in both of these areas to continue to encourage

organic growth. The business has continued to expand its Corporate Speaking

division and recently introduced a Celebrity Booking arm, which recently

supplied all the stars for Sky TV's Premier League AllStars competition,

alongside its developing Public Relations team.

With the focus of the television industry shifting towards light entertainment,

following the success of formats such as Strictly Come Dancing, where we worked

closely with John Barnes which followed up on last year's success with Peter

Schmeichel, the key opportunity for additional growth comes through expansion of

First Artist Management's roster of clients in this area. Scale and breadth of

an entertainment portfolio is a key stone for success in the current climate,

and First Artist Corporation intends to target complementary, value-adding

acquisitions in order to build its presence in light entertainment more rapidly

over the coming year.

Going forward, the combination of First Artist Management's strong record for

developing original programming concepts around the particular expertise of its

clients, combined with additional reach in the pure entertainment and sporting

spheres, presents exciting opportunities for the development of new TV formats.

The media sales expertise and rights-ownership model developed by First Rights

positions the Group to develop such formats into secure, long-term owned revenue

streams.

FIRST ARTIST SPORT

First Artist Sport has delivered an extremely strong performance over the past

12 months, with substantial increases in revenue across Europe, following last

year's successful acquisition of First Artist Scandinavia, the continued success

of the agency's unique pan-regional offer, and emerging industry trends are

likely to strengthen the position of the business further. The operating profit

for the 10 months ended 31 August 2006 is ahead of the current year for sport,

due to the strategic acquisition of First Artist Scandinavia in June 2006. The

timing of this acquisition enabled the Group to account for the Company's

profits generated in the summer trading window of 2006 without the losses from

the previous 9 months, whereas the current year includes the full 12 months

figures.

Despite obstacles such as transfer windows and restrictions on player movements,

the transfer market is proving extremely buoyant, delivering more revenue during

two transfer windows in 2007 than it did when an entire year of trading was

available five years ago, delivering 126 deals including 17 international cross

border brokerage deals. The English Premiership is in the first year of a new

lucrative three-year TV Rights deal, ensuring a secure flow of revenue into the

game, with the increased trend towards foreign ownership likely to inject

further capital.

The international nature of the transfer market rewards First Artist Sport's

position as the only representation agency with a true international network.

Italy's World Cup victory has helped to underpin a strong performance in that

country, First Artist Scandinavia continues to grow, and the network is

conducting more deals than ever in Germany, France and Spain. With cross-border

transfers delivering higher commissions, First Artist's international reach

results in higher margins as well as increased revenues.

Within the UK, player representation is moving in the favour of larger,

transparent and responsible agencies and First Artist is working closely with

its peers in the first co-ordinated industry effort to raise standards and

define regulatory guidelines. First Artist Sport's credibility is further raised

by its prestigious work arranging matches and pre-season tournaments for clubs

such as Arsenal, Glasgow Rangers, Ajax and Sheffield Wednesday. First Artist

Sport currently boasts the youngest and broadest roster of player talent in its

history, further building the agency's credibility and helping to ensure the

sustainability of its success.

Changes to the industry's standard model for agency remuneration are another

extremely positive development, ensuring that agency payments are spread over

the life of a contract, rather than concentrated in a single, up-front lump sum.

For a business with a healthy cash flow, such as First Artist Sport, such a

development brings major benefits, improving the stability and transparency of

revenues and further encouraging responsible representation practices.

OPTIMAL WEALTH MANAGEMENT

Year ended 31 10 months ended 31 Year ended 30 Year ended

August August June 30 June

2007 2006 2007 2006

#000 #000 #000 #000

Turnover

Investments 2,007 1,533 2,026 1,672

Renewals 606 340 559 383

2,613 1,873 2,585 2,055

Operating Profit* 836 801 961 833

* After 'joint venture' set-up costs, prior to intergroup management fee and

foreign exchange gains or losses

In the wealth management market, a company's profitability derives from the

quality of its clients and the service levels it provides. Optimal Wealth

Management's highly successful 2007 is a case in point. The company has

succeeded both in increasing the share of high net-worth individuals in its

client mix, and establishing the mechanisms to support continued injection of

high-quality work in the future; it has done so in a year that was expected to

throw up tougher conditions following the demand for wealth management services

created by the 'A Day' changes to pension regulation.

It has been Optimal's long-term strategy to improve the quality of its client

base and dramatic strides have been made in the last two years, following the

integration of the company within the First Artist Group. Synergies with First

Artist Sport's high-earning football client base have increased exposure to

top-end clients; client satisfaction and referral have multiplied the effect.

At the same time, the management support available through the Group has

furthered the development of a consistent brand strategy, focused on client

quality and increasing margins. The company continues to invest in the

development of high quality Independent Financial Advisory staff through

recruitment and training at all levels specifically designed to further

strengthen Optimal's reputation for quality service.

Expanding access to high net-worth individuals will remain the central plank of

Optimal's strategy for growth, prioritising profit margins through the quality

of the client mix. The company's 'joint venture', Fisher Family Office, with the

accountancy firm, HW Fisher, began to deliver revenues during the year and forms

a key element of this strategy. Providing a key value service to HW Fisher's

high net worth clients will give Optimal the ability to target a new stream of

high-quality wealth management work.

The wealth management market will face challenges over the next 12 months: the

summer's credit crunch can be expected to have an impact on consumer confidence,

with some effects filtering through to the high-net-worth market; increased

government regulation will also play a role, although it should be hoped that

the more forceful measures will focus on the mass market for financial services

where most cases of mis-selling occur, and where they are most obviously needed.

Set against these trends is the market's ongoing product innovation, which has

ensured a lively interest in the high-net-worth market over the last two years,

Optimal's extremely strong record for client retention and the consistent

strengthening of its revenues through a quality client mix. With the possibility

of further partnerships and joint ventures following the HW Fisher model, the

outlook for the year ahead remains a firmly positive one.

THE FUTURE

No business can plan sensibly for the future without first securing stability

and consistent growing revenue streams in the present. First Artist

Corporation's success in doing so is what makes its position in the media,

events and entertainment sectors so exciting.

Without doubt during this decade media has undergone and continues to undergo

significant and rapid change. The influence of the internet on fragmenting

media channels, changing influence models and consumer demand for control of

information has been well documented. The web's share of media budgets has

increased in response; however, digital is far from the only marketing channel

to have increased in influence in the new media landscape.

Brand experience, particularly live events, is one of the most promising routes

to overcoming media fragmentation, ensuring connections with audiences over a

number of channels. Although the delivery method is less relevant; the

connection is equally valid no matter how the experience reaches consumers.

Sponsorship, live events and branded entertainment are disciplines with an

increasing role to play; the ability to develop and control different content

formats is likely to prove ever more important to marketers.

The music industry forms a fascinating comparative benchmark for the changes

currently sweeping media and entertainment. The decline of traditional sales

under pressure from legitimate and illegitimate online activity has triggered a

dramatic realignment in the relationship of musicians and record labels to their

audiences. The focus is increasingly shifting to live performance, and

associated merchandising, as the key to unlocking value, with the value of

online music distribution seeming to lie increasingly in its promotional effect

rather than in the revenues that it generates.

First Artist Corporation has been grown to succeed in an environment just such

as this, where no single media channel can be assured of a primary role for long

- or of a broadcast audience. In such an environment the skills required to

create compelling audience experiences, through live events, original

entertainment formats, sports and exhibitions, will prove increasingly

important. The complementary skills now residing in the First Artist Group

position it to take full advantage of opportunities in these areas as they

emerge. The group will continue to seek synergistic acquisitions in its three

divisional sectors acting as a consolidator in a fragmented marketplace.

Importantly, the Group is not a vision of the future waiting impatiently for

reality to catch up. By a strict policy of acquiring synergistic, value-adding,

profitable and growing businesses, First Artist Corporation has built up its

position of strength and potential without sacrificing stability or short-term

revenue. It is the strong track record for organic growth and the credibility

and expertise that come through success that position the Group so strongly for

the future.

OPERATING & FINANCIAL REVIEW

Competitive Performance

Year Ended 10 Months Ended Variance

31 August 31 August 2006

2007 (Restated)

#'000s % growth #'000s #'000s

Turnover 48,607 411% 9,508 39,099

Adjusted Operating Profit 3,533 118% 1,620 1,913

Exceptional items (322) (170) (152)

Goodwill (500) - (500)

Operating Profit 2,711 1,450 1,261

Net interest (1,220) (283) (937)

Profit before tax 1,491 28% 1,167 324

Taxation (639) (502) (137)

Retained Profit 852 665 187

EPS 6.81 pence 7.08 pence

(Basic earnings per share)

EPS 15.71 pence 10.66 pence

(Basic earnings per share

before goodwill and exceptional)

Outline

Our media division was the principal growth area for the financial year,

following on from the acquisition of the Dewynters Group in November 2006. The

number of shows currently being supported by Dewynters in the UK has grown to 26

(18 in May 2006), combined with the strong growth from the Dewynters' US

merchandising operation (11 shows on Broadway and in Las Vegas) and the theatre

and cinema display business Newman Displays this has led to a significant

increase in the division's performance, with the entire division now accounting

for 69% of Group turnover and 49% of Group operating profit (pre. group central

costs).

The events division, The Finishing Touch, experienced 60% like-for-like turnover

growth and successfully integrated the acquisition of event logistics business

Yell Communications. In August, the business also successfully gained a

significant three-year Public Sector event management contract for The Training

and Development Agency for Schools the true benefits of which will be enjoyed in

the coming year.

Group gross profit to adjusted operating profit margins have reduced to 18%

(2006: 26%) in the current year, due mainly to the additional central management

and support costs required to operate the considerably enlarged Group. These

costs will flatten in 2008 as the increased administrative costs will be spread

over a full twelve-month period. It is believed that margins could be improved

above current levels and a key aim of the group is to further rationalise the

supplier base and benefit from the associated economies of scale, along with

operational efficiencies improving gross profit margins. In September 2007 a

number of group companies consolidated into new West End offices. Although this

move will generate some savings and significant operational benefits from

businesses working in close proximity, there will be increased property costs

going forward. Despite this we believe that a gross to adjusted operating

profit margin in excess of 20% would be considered achievable in the short to

medium term.

Turnover

Group turnover for the year has increased 411% compared to the previous 10-month

period. This figure includes 10 months trading from Dewynters Group following

the acquisition during the year.

Adjusted Operating Profit

The adjusted operating profit for the Group, before goodwill amortisation and

exceptional costs, increased 118% to #3.53 million.

Accounting for foreign exchange gains or losses the adjusted operating profit is

#3.61 million (2006: #1.66 million).

Gross profits in the year increased by 210% compared to the previous ten-month

period, whilst Group administrative expenses, excluding goodwill amortisation,

foreign exchange gains or losses and exceptional charges, increased by 240% to

#16.04 million.

The acquisitions over the last 30 months have transformed the Group, resulting

in a broad based integrated media, events and entertainment/sport management

group, significantly increasing visibility of earnings, and generating positive

cash flow, although the group still remains slightly second-half weighted.

Foreign Exchange

Foreign exchange costs amounted to #0.08 million (2006: #0.04 million), mainly

due to the devaluation of the US dollar against Sterling.

Key Performance Indicators (KPI)

A number of percentage-based KPI's are used for internal reporting purposes,

relating to gross profit, operating profit and personnel costs. KPI's are also

calculated on staff numbers to give gross profit, operating profit and gross

profit per head.

As a summary the operating profit to gross profit margin was in line with

expectations, with personnel costs per gross profit better than expected due to

tight controls over rising personnel and recruitment costs.

Goodwill impairment, amortisation and exceptionals

The valuation of goodwill is subject to amortisation charges and annual

impairment reviews. Impairment provisions are made as appropriate. The

amortisation charge for the year of #0.50 million is a non-cash adjustment and

will be reversed in next year's financial statements as a result of the

implementation of International Financial Reporting Standards (IFRS). A new

non-cash charge based on the amortisation of identifiable intangible assets will

replace the existing goodwill amortisation under the reporting guidelines.

Exceptional costs incurred during the year resulted from the acquisitions in the

year.

Interest payable, funding and liquidity

Net interest payable was #1.22 million (2006: #0.28 million). A total of #0.29

million relates directly to the unwinding of the discounted deferred

consideration, in accordance with FRS7, "Fair value in acquisition accounting".

This FRS7 charge is a non-cash adjustment and relates to the provision of a net

present valuation on deferred consideration required under this standard.

The first drawdown on the new bank loans was in January 2007, with the interest

charge for the year in respect of these loans totalling #0.93 million. A bank

loan arrangement fee amounted to #0.25 million, which is also subject to a

non-cash unwinding adjustment, based over the seven year period of the loan and

accounting for #0.02 million during the year.

Taxation

The tax charge of #0.64 million (2006: #0.50 million) fully utilises the

Company's taxable losses for the year across the whole Group. The effective tax

rate for the year of 43% is particularly high due to the goodwill amortisation

charge of #0.50 million and the unwinding of discount on deferred consideration

of #0.29 million.

Earning per share

Basic earnings per share was 6.81p (2006: 7.08p) with earnings per share before

exceptional administrative items, deemed interest on deferred consideration and

goodwill amortisation being 15.71p (2006: 10.66p). The latter increase is due

to the significantly enhanced profitability (excluding goodwill amortisation,

deemed interest on deferred consideration and exceptional costs) of the enlarged

Group following the roll out of the acquisition programme from 2005 to present.

Divisional Performance

Year Ended 10 Months Ended 31 Year Ended

31 August August 31 October

2007 2006 2005

(Restated)

Division

#'000s #'000s #'000s

Media 33,612 69% 49 - - -

Events 5,157 11% 3,093 33% 857 15%

Entertainment / Sport Management* 9,838 20% 6,366 67% 5,004 85%

Turnover 48,607 9,508 5,861

Media 2,428 49% - - - -

Events 498 10% 218 10% 76 5%

Entertainment / Sport Management* 1,982 41% 2,054 90% 1,510 95%

Group Costs (1,296) (613) (588)

Adjusted Operating Profit** 3,612 1,659 998

*Incorporating Wealth Management

** Before exceptional administrative expenses, goodwill amortisation and foreign

exchange gains or losses

Turnover

Following the acquisition of Dewynters in the year group turnover of #48.61

million is heavily weighted in favour of the media division (#33.61 million),

with this sector accounting for 69% of turnover. The entertainment/sport

division now accounts for 20% of turnover compared to 85% two years ago. This

clearly indicates the transformation undertaken by the Group, moving away from

being predominantly reliant on seasonal sport income.

The events turnover has delivered a 67% increase in the main through organic

growth within the Corporate Sector.

Adjusted operating profit after adjusting for foreign exchange gains or losses

The media division has made a significant contribution in the period, with

operating profits of #2.43 million (before Group recharges) for the year covered

by this report, compared to nil contribution in the previous period.

The media operating profit generated equates to 49% of all profits and again

indicates the transformation undertaken with the acquisition strategy over the

past two financial periods. Indeed, two years ago the sport and entertainment

division accounted for 95% of operating profit, compared to 41% this year.

The events division has increased operating profits by 128% in comparison to the

prior 10-month period. This performance was significantly helped by the best

Christmas figures in The Finishing Touch's history, as well as a packed

programme over the summer months and the benefit of work derived from the Yell

Communications contracts.

Key Performance Indicators (KPI)

Within the media division Dewynters showed a favourable operating profit to

gross profit indicating efficiency within the Company. Personnel costs per head

were also within the KPI target. Sponsorship Consulting showed high personnel

costs to gross profit and low gross profits per head due to the losses made

during the year, although we are forecasting this to be reversed into profits in

the coming year.

The events division also showed operational efficiency, with operating profit to

gross profit beating the KPI target. Operating profit per head was slightly down

on target due to the need to 'staff up' in advance of the new TDA contract

beginning in August.

Within the entertainment/sport management division the gross profit for sport

was slightly down on the KPI target, due to a number of the larger deals

involving third parties. Personnel costs per head were better than KPI due to

sport not recruiting any further senior agents. Optimal beat the KPI target on

operating profit per head by some distance, emphasising the excellent set of

results.

Geographical Performance

Year Ended 10 Months Ended 31 Year Ended

31 August August 31 October

2007 2006 2005

(Restated)

Geographic Region

#'000s #'000s #'000s

United Kingdom 40,719 84% 7,419 78% 4,113 70%

Europe 3,490 7% 2,089 22% 1,738 30%

United States 4,398 9% - - 10 -

Turnover 48,607 9,508 5,861

United Kingdom 4,234 86% 1,780 78% 1,385 87%

Europe 550 11% 492 22% 201 13%

United States 124 3% - - - -

Group Costs (1,296) (613) (588)

Adjusted Operating Profit** 3,612 1,659 998

*Incorporating Wealth Management

** Before exceptional administrative expenses, goodwill amortisation and foreign

exchange gains or losses

Turnover

Group turnover is naturally heavily weighted in the United Kingdom, with

Dewynters Ltd largely accounting for the percentage split of 84% (2006: 78%).

European income although has grown some 67% this year whilst reducing as a

percentage of the total to 7% (2006: 22%). Turnover from the United States is a

growth area and relates purely to the merchandising operation, Dewynters

Advertising Inc. which now accounts for 9% of turnover (2006: Nil).

Adjusted operating profit after adjusting for foreign exchange gains or losses

The United Kingdom accounted for 86% of Group adjusted operating profits (2006:

78%), Europe 11% (2006: 22%) and US 3% (2006: Nil) . The above graphical

illustration above gives a snapshot view of the growing UK business as well as

the emergence of the US market over the year.

Review of Operations

Balance Sheet

Shareholders' funds

Shareholders' funds increased by 43% million to #7.27 million. The increase was

mainly due to net profit and foreign exchange of #0.89 million and net proceeds

from share issues of #0.81 million.

Cash Flow

During the year the Group secured a new seven-year banking loan facility of

#11.00 million and a new two-year banking loan facility of #2.79 million, both

with Allied Irish Bank. These were used to provide working capital and

facilitate the acquisition programme of the Group. The table below indicates the

split of net debt over 3 periods.

The Board believes that the level of gearing, at 133% (2006: 75%), that has

resulted from these transactions is acceptable given the cash generative nature

of the enlarged Group. The Board envisages that the current Group's borrowing

levels will steadily reduce whilst it retains sufficient financial flexibility

to continue to invest in developing its businesses. Interest cover of 3.6 times

underlines this assertion.

The Board has assessed the level of risk in the Group and feels that this has

been reduced significantly through the creation of a broad based integrated

group of individually trading profit centres.

31 August 31 August 31 October

2007 2006 2005

#m #m #m

One year bank loan - (1.00) -

Two year mezzanine bank loan (2.79) - -

Five year bank loans - (2.78) (1.55)

Seven year bank loan (9.98) - -

Other group net debts (0.48) (0.90) (0.37)

Cash in hand and bank overdrafts 3.55 0.88 1.27

(9.70) (3.80) (0.65)

The Group has become significantly more cash generative in the last year as can

be seen in the analysis below.

Year Ending 31 10 Months ended 31

August 2007 August 2006

Audit Audit (Restated)

#'000s #'000s

Operating Profit 2,711 1,450

Depreciation 416 73

Working capital & other movements (199) (1,443)

Goodwill amortization & impairment 500 -

Net interest paid & similar changes (1,167) (102)

Tax paid (535) (450)

Net cash generation 1,726 (472)

Capital Expenditure (823) (241)

Acquisition payments (7,566) (2,749)

Net share capital raised 812 900

Bank & other loans 8,525 2,171

Net cash inflow/(outflow) 2,674 (391)

Acquisitions

Two businesses were acquired and successfully integrated into the Group during

the last year. The full results of operational cost savings and increased income

through the cross-referral of business should be seen in next year's Report and

Accounts.

November 2006 Dewynters Limited (including Dewynters Advertising Inc & Newman

Displays Limited)

Media / Marketing

Total maximum consideration payable (excluding discount for Net

Present Value) #15.50 million

Initial consideration paid #9.60 million cash and 0.1 million

shares

May 2007 Yell Communications Limited

Event Management

Total maximum consideration payable (excluding discount for Net

Present Value) #1.00 million

Initial consideration paid #0.40 million cash

Risks associated with the Group

The Group is subject to a number of macro economic factors, as with other

businesses, such as interest rate and foreign exchange rate fluctuations, which

are outside the Group's control.

On a more specific basis the regulatory environments in football and wealth

management continue to change, impacting on risk. However, certainly in

football, the Group is well positioned for any changes due to its involvement

with the Agents Association. The loss of key personnel can also be considered a

risk, although the retention post earn-out of the key figures in Optimal

suggests that this risk is being managed effectively.

On a competitive basis, although Dewynters dominates its market it could be

argued that the business is reliant on the success of the West End Productions

and the general economic climate. In fact, Dewynters benefits two-fold in the

majority of cases as new productions have higher spends and hence profits,

whilst lower seat numbers often lead to higher marketing spends by the

production house.

Finally, the football market is saturated and dependent upon the agents securing

transfer contracts during the trading windows, often involving large sums of

money. This ensures period to period comparisons cannot be fully relied upon.

Here, the pipeline income generated in this area has grown considerably over the

last year, which helps to remove the uncertainty over income generation.

Richard Hughes

Group Managing Director

16 November 2007

CONSOLIDATED PROFIT AND LOSS ACCOUNT

for the year ended 31 August 2007

Notes Continuing Acquisitions Total year Total 10 months

operations year ended ended ended

year ended 31 August 31 August 31 August

31 August 2007 2007 2006

2007 (restated)

#000 #000 #000 #000

TURNOVER 2 15,728 32,879 48,607 9,508

Cost of sales (5,664) (23,249) (28,913) (3,168)

GROSS PROFIT 10,064 9,630 19,694 6,340

Administrative expenses (9,639) (7,344) (16,983) (4,890)

OPERATING PROFIT before exceptional

administrative expenses 1,247 2,286 3,533 1,620

Exceptional administrative expenses (322) - (322) (170)

Goodwill amortisation (500) - (500) -

OPERATING PROFIT 425 2,286 2,711 1,450

Interest receivable 61 21

Interest payable (1,281) (304)

PROFIT ON ORDINARY ACTIVITIES BEFORE 1,491 1,167

TAXATION

Taxation 3 (639) (502)

RETAINED PROFIT FOR THE YEAR / PERIOD 852 665

EARNINGS PER SHARE

Basic earnings per share 4 6.81 pence 7.08 pence

Fully diluted earnings per share 6.26 pence 6.23 pence

CONSOLIDATED STATEMENT OF TOTAL RECOGNISED GAINS AND LOSSES

for the year ended 31 August 2007

Year ended 10 months ended

31 August 31 August

2007 2006

(restated)

#000 #000

Profit for the financial year/period 852 665

Currency translation differences on net foreign currency 34 6

investments

Total recognised gains and losses relating to the year/period 886 671

Prior year adjustment (133)

Total recognised gains and losses since last financial statements 753

CONSOLIDATED BALANCE SHEET

31 August 2007

31 August 31 August

2007 2006

Notes (restated)

#000 #000

FIXED ASSETS

Intangible assets 21,847 9,517

Tangible assets 2,157 835

Investments 118 118

24,122 10,470

CURRENT ASSETS

Stock 1,074 -

Debtors 11,832 6,895

Cash at bank and in hand 3,914 1,108

16,820 8,003

CREDITORS: Amounts falling due within one year (14,609) (7,709)

NET CURRENT ASSETS 2,211 294

TOTAL ASSETS LESS CURRENT LIABILITIES 26,333 10,764

CREDITORS: Amounts falling due after more than one year (11,494) (2,252)

PROVISIONS FOR LIABILITIES (7,572) (3,423)

NET ASSETS 7,267 5,089

CAPITAL AND RESERVES

Called up share capital 328 270

Capital redemption reserve 5 15 15

Share premium account 5 10,011 8,849

Shares to be issued 5 - 5

Share option reserve 5 210 133

Profit and loss account 5 (3,297) (4,183)

EQUITY SHAREHOLDERS' FUNDS 7,267 5,089

CONSOLIDATED CASH FLOW STATEMENT

for the year ended 31 August 2007

Notes Year ended 10 months ended

31 August 31 August

2007 2006

#000 #000

Cash inflow from operating activities 6a 3,428 80

Returns on investments and servicing of finance 6b (1,167) (102)

Taxation 6b (535) (450)

Capital expenditure and financial investment 6b (823) (241)

Acquisitions 6b (7,566) (2,749)

CASH OUTFLOW BEFORE FINANCING (6,663) (3,462)

Financing 6b 9,337 3,071

INCREASE / (DECREASE) IN CASH IN THE YEAR / PERIOD 2,674 (391)

RECONCILIATION OF NET CASH FLOW TO MOVEMENT IN NET DEBT

Year ended 10 months ended

31 August 31 August

2007 2006

#000 #000

Increase / (decrease) in cash in the year / period 2,674 (391)

Cash from increase in debt financing (8,299) (2,173)

New finance leases (2) 34

Loan notes and additional funding (277) (623)

(5,904) (3,153)

NET DEBT AT START OF YEAR / PERIOD (3,801) (648)

NET DEBT AT END OF YEAR / PERIOD (9,705) (3,801)

NOTES TO THE FINANCIAL STATEMENTS

for the year ended 31 August 2007

1. BASIS OF ACCOUNTING

The financial information contained in this report does not constitute statutory

accounts within the meaning of Section 240 of the Companies act 1985.

The financial information contained in this report has been extracted from the

audited accounts of the Company for the year to 31 August 2007 for which the

auditors have given an unqualified report.

The financial statements have been prepared under the historical cost convention

and in accordance with applicable accounting standards in the United Kingdom.

2. SEGMENTAL REPORT

The group's net assets, turnover and profit/(loss) before taxation were all

derived from activities in the following geographical markets:

Year ended 31 August 2007 10 Months ended 31 August 2006

Net assets Turnover Profit before Net assets Turnover Profit before

tax tax

#000 #000 #000 #000 #000 #000

United Kingdom 6,617 40,719 1,355 4,552 7,419 675

Europe 664 3,490 24 727 2,089 492

Other (14) 4,398 112 (190) - -

7,267 48,607 1,491 5,089 9,508 1,167

Net assets, turnover and profit before tax by destination are not materially

different from the above.

The group's net assets, turnover and profit before taxation originated from the

following activities:

Year ended 31 August 2007 10 Months ended 31 August 2006

Net assets Turnover Profit/(loss) Net assets Turnover Profit/(loss)

before tax before tax

#000 #000 #000 #000 #000 #000

Media 3,612 33,612 2,189 90 49 -

Events 121 5,157 298 776 3,093 230

Entertainment /Sport 1,903 9,838 1,099 2,837 6,366 1,994

Group Net Assets/ 1,631 - (2,095) 1,386 - (1,057)

Costs

7,267 48,607 1,491 5,089 9,508 1,167

3. TAXATION

Year ended 31 10 months ended 31

August 2007 August

#000 2006

#000

Current tax:

UK corporation tax charge on profits of the period 630 351

Foreign taxes 46 175

Adjustments in respect of previous periods 1 (24)

Current tax charge for the period 677 502

Deferred taxation:

Origination and reversal of timing differences (38) -

Tax charge on profit on ordinary activities 639 502

Factors affecting tax charge for period: 2007 2006

#000 #000

The tax assessed for the period differs from the standard rate of

corporation tax in the UK (30%). The differences are explained below:

Profit on ordinary activities before tax 1,491 1,167

Profit on ordinary activities multiplied by standard rate of

corporation tax in the UK 30% (2006: 30%)

447 350

Effects of:

Expenses not deductible for tax purposes 59 83

Capital allowances in excess of depreciation (15) (1)

Amortisation of goodwill 150 -

Tax losses (utilised) / not utilised - (46)

Differences in foreign tax rates 35 140

Adjustment to tax charge in respect of previous periods 1 (24)

Current tax charge for period 677 502

4. EARNINGS PER SHARE

The calculations of earnings per share are based on the following profits and

number of shares:

Year ended 31 10 months ended 31

August August

2007 2006

#000 #000

Profit on ordinary activities after taxation 852 665

2007 2006

No of Shares No of Shares

(restated)*

For basic earnings per share 12,506,588 9,392,581

Dilutive effect of share options 1,109,621 1,276,898

For diluted earnings per share 13,616,209 10,669,479

*The number of shares has been restated to show the effect of the 10 for 1 share

consolidation on 27 December 2006.

5. RESERVES AND RECONCILIATION OF MOVEMENT IN SHAREHOLDERS' FUNDS

Share Shares to Capital Share Share Profit and Total Total

capital be issued redemption premium option shareholders' shareholders'

reserve reserve Loss funds funds

(restated) account

(restated) 2007 2006

(restated)

#000 #000 #000 #000 #000 #000 #000 #000

GROUP

At start of year/ 270 5 15 8,849 - (4,050) 5,089 3,306

period

Prior year adjustment - - - - 133 (133) - -

At start of year/ 270 5 15 8,849 133 (4,183) 5,089 3,306

period restated

Retained profit for - - - - - 852 852 665

the financial period

Share placement issue 40 - - 960 - - 1,000 1,005

Shares issued to 3 - - 60 - - 63 71

vendors to acquire

subsidiary

undertakings

Shares issued to 14 - - 391 - - 405 36

vendors as deferred

consideration

Shares to be issued to - (5) - - - - (5) 5

vendors as deferred

consideration

Shares issued 1 - - 18 - - 19 15

Issue costs - - - (267) - - (267) (120)

Share based payment - - - - 77 - 77 100

charge

Exchange adjustments - - - - - 34 34 6

At end of year/period 328 - 15 10,011 210 (3,297) 7,267 5,089

Share Shares to Capital Share Share Profit and Total Total

capital be issued redemption premium option shareholders' shareholders'

reserve reserve Loss funds funds

(restated) account

(restated) 2007 2006

(restated)

#000 #000 #000 #000 #000 #000 #000 #000

COMPANY

At start of year/ 270 5 15 8,849 - (4,047) 5,092 2,695

period

Prior year adjustment - - - - 133 (133) - -

At start of year/ 270 5 15 8,849 133 (4,180) 5,092 2,695

period restated

Retained profit for - - - - - 1,116 1,116 1,285

the financial year

Share placement issue 40 - - 960 - - 1,000 1,005

Shares issued to 3 - - 60 - - 63 71

vendors to acquire

subsidiary

undertakings

Shares issued to 14 - - 391 - - 405 36

vendors as deferred

consideration

Shares to be issued to - (5) - - - - (5) 5

vendors as deferred

consideration

Shares issued 1 - - 18 - - 19 15

Issue costs - - - (267) - - (267) (120)

Share based payment - - - - 77 - 77 100

charge

At end of year/period 328 - 15 10,011 210 (3,064) 7,500 5,092

6. CASH FLOWS

a. Reconciliation of operating profit to net cash inflow from operating

activities

Year ended 31 10 months ended 31

August August

2007 2006

(restated)

#000 #000

Operating profit 2,711 1,450

Depreciation 416 73

Amortisation of goodwill 500 -

Profit on disposals of fixed assets - (9)

Share options charge 77 100

Increase in inventories (108) -

Decrease/ (increase) in debtors 223 (1,389)

Decrease in creditors (425) (151)

Exchange differences 34 6

Net cash inflow from operating activities 3,428 80

b. Analysis of cash flows for headings netted in the cash flow

Year ended 31 10 months ended 31

August August

2007 2006

(restated)

#000 #000

Returns on investments and servicing of finance

Interest received 61 21

Interest on bank loans (925) (99)

Issue costs of bank loan (226) -

Other interest paid (75) (20)

Interest element of finance lease rental payments (2) (4)

Net cash outflow from returns on investments and servicing of finance (1,167) (102)

Taxation

UK corporation tax paid (352) (450)

Overseas tax paid (183) -

Net cash outflow from taxation (535) (450)

Capital expenditure and financial investment

Purchase of tangible fixed assets (823) (129)

Sale of tangible fixed assets - 6

Other investments - (118)

Net cash outflow from capital expenditure and financial investment (823) (241)

Acquisitions

Consideration on acquisition of subsidiary undertakings 11,092 3,420

Cash on acquisition of subsidiary undertakings (3,526) (671)

Net cash outflow on acqusitions (7,566) (2,749)

b. Analysis of cash flows for headings netted in the cash flow (continued)

Year ended 31 10 months ended 31

August August

2007 2006

(restated)

#000 #000

Financing

Issue of share capital 1,019 1,020

Costs of issue of shares (207) (120)

New bank loans 12,999 2,500

Director's loans (33) (60)

Other loans (4,441) (258)

Capital element of finance lease rental payments - (11)

Net cash inflow from financing 9,337 3,071

c. Analysis of changes in net debt

At Cash flow Other non cash At

changes

1 September 31 August

2006 2007

#000 #000 #000 #000

Cash at bank and in hand 1,108 2,806 - 3,914

Bank overdrafts (231) (132) - (363)

877 2,674 - 3,551

Finance leases (48) - (2) (50)

Debt due within one year (2,411) 720 (277) (1,968)

Debt due after more than one year (2,219) (9,019) - (11,238)

(4,678) (8,299) (279) (13,256)

Total (3,801) (5,625) (279) (9,705)

Non cash changes include an amount of #432,000 relating to loan notes payable on

the acquisition of the Finishing Touch (Corporate Events) Limited. These are

payable in January 2008.

7. ANNUAL REPORT

Copies of the Annual report and Financial Statements will be will be circulated

to Shareholders shortly and may be obtained after the posting date from the

Company Secretary, First Artist Corporation plc, 3 Tenterden Street, London, W1S

1TD, or from the Company's website: www.firstartist.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR BFBPTMMIBBIR

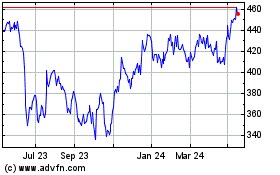

Volution (LSE:FAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Volution (LSE:FAN)

Historical Stock Chart

From Jul 2023 to Jul 2024