TIDMFCRM

RNS Number : 5529V

Fulcrum Utility Services Ltd

06 April 2023

06 April 2023

FULCRUM UTILITY SERVICES LIMITED

("Fulcrum" or "the Group")

Trading Update and Amendment to Convertible Loan Facility

Fulcrum Utility Services Limited, a leading independent provider

of essential utility services including multi-utility connections

and renewable energy infrastructure, provides a trading update

today for its financial year ended 31 March 2023, along with

details of amendments to the Group's Convertible Loan Facility

Agreement announced on 5 December 2022 (RNS No: 5184L).

Trading update

The Group has been focused on addressing identified issues,

implementing improvements and developing a clear strategy that will

support it to capitalise on various opportunities in its markets.

Positive progress is being made and the Group confirms that its

full year performance will be in line with the expectations set out

in its Trading Update, published on 24 October 2022 (RNS

7933D).

Update on review of strategic options

As announced on 5 December 2022, the Group has initiated a

review of the various strategic options available to it in order to

maximise value for shareholders (the "Review"). The Group is

pleased to share that, to date, the Review has identified several

opportunities and operational improvements which includes the

development of a new sales strategy. A new, leaner, Senior

Leadership Team has also been formed and tasked with the effective

delivery of the Group's plans.

A further outcome of the Review is the Board's decision to exit

from the smart metering market. Since the Company's fundraise in

December 2021 the UK's energy sector has experienced significant

volatility such that the market dynamics have changed to an extent

that the Board no longer considers it an attractive opportunity or

area of the market for the Group to operate in. This exit also

enables the Group to focus on more attractive opportunities

available to it.

As the Review remains ongoing, the Board is pleased to confirm

that Interim CEO, Lindsay Austin, will continue in her role for a

minimum of a further six months to lead the Group and oversee the

Review. This includes the implementation of the identified

operational improvements and sales strategy to support Fulcrum to

capitalise on its core strengths.

Convertible Loan Facility amendment

Further to the Facility Agreement announced on 5 December 2022,

the Group today also announces that it has agreed to amend the

Facility Agreement (the "Amended Facility") under which the

provision of funding has been increased by GBP5 million such that

up to GBP11 million is provided as principal (being GBP8 million

from Bayford and GBP3 million from Harwood on a pro-rata basis).

The terms of the Amended Facility are the same as those in the

initial Facility Agreement being:

-- Repayable on or before 1 November 2023 ("Repayment Date") or such later date as may be agreed by the Lenders;

-- Convertible into Ordinary Shares at the discretion of the Lenders from 1 April 2023 ("Conversion");

-- If converted, the conversion price will be the lower of the volume weighted average market value of the Company's

Ordinary Shares in the 5 trading days immediately preceding the date of the conversion notice or 0.5p per

Ordinary Share of the Company (the "Conversion Price");

-- At or around the point of Conversion, the Company's shareholders will be entitled to participate in an open offer

or similar arrangement, at the same price as the Conversion Price;

-- Interest will be accrued from the date monies are drawn down under the Facility at a rate of 20 per cent. per

annum, repayable at the end of the term or on prepayment of the Facility;

-- A prepayment fee of 20 per cent. of the amount of the Facility prepaid early and a non-utilisation fee of 6 per

cent. per annum.

The Amended Facility will continue to support the ongoing Review

and ensure the Group continues to have adequate working capital.

Bayford has indicated to the Board that it is their current

intention to provide the Company with financial support beyond the

term of Amended Facility, if required, and the Board confirms that

this, together with the Amended Facility is expected to provide the

Group with the funding required for the trading year ahead and will

support the continued execution of the Group's strategy and

Fulcrum's journey back to profitability.

The entry into the Amended Facility by Bayford and Harwood, each

being a substantial shareholder of the Company, constitutes a

related party transaction with each Lender under rule 13 of the AIM

Rules. Accordingly, the directors who are independent of the

Facility, being Jennifer Babington and Dominic Lavelle, (the

"Independent Directors") consider, having consulted with Cenkos

Securities plc, acting in its capacity as the Company's nominated

adviser and broker, that entering into the Amended Facility is fair

and reasonable insofar as the Company's shareholders are

concerned.

Important matters to note for minority shareholders

The exercise of equity conversion rights by either Lender under

the Amended Facility may result in that Lender acquiring Ordinary

Shares carrying more than 30 per cent. of the voting rights in

Fulcrum, and in certain circumstances more than 50 per cent.

Although Fulcrum is not a company that is subject to the UK

Takeover Code, the Company's Articles of Association (the

"Articles") contain certain protections equivalent to that afforded

to shareholders under Rule 9 of the City Code on Takeovers and

Mergers. As a condition of the Amended Facility, the Independent

Directors of Fulcrum have agreed to exercise their discretion,

pursuant to the Articles, to waive any requirement for a mandatory

offer for the remaining Ordinary Shares in the Company which may

otherwise apply upon the exercise of equity conversion rights under

the Facility. For these purposes, the Independent Directors have

not made any determination that the Lenders are acting in concert

and each Lender has been granted a separate waiver.

In order to enable minority shareholders to participate in the

raising of funds for the Company on similar terms to the Lenders,

the Amended Facility contains an entitlement for minority

shareholders, at or around the point of Conversion, to participate

in an open offer or similar arrangement at the Conversion Price,

with a right to subscribe for additional shares in the capital of

the Company pro rata to their existing shareholdings at that time.

This offer is expected to be undertaken shortly following exercise

by the Lenders of their Conversion right.

The issue of shares to the Lenders, resulting from Conversion,

is also subject to shareholders approving certain resolutions (the

"Resolutions"). A shareholder circular convening a general meeting

for the purposes of seeking approval of the Resolutions will be

sent to shareholders in due course. Shareholders should be aware

that it is a term of the Amended Facility that these Resolutions

are approved by the requisite majority and the Amended Facility may

be terminated if they are not so approved. The termination of the

Amended Facility would likely result in little or no value for

Shareholders. Accordingly, it is important that Shareholders vote

in favour of all of the Resolutions so that Conversion may proceed

and all funding options are available to the Board.

Capitalised terms used in this announcement have the meanings

given to them in the announcement of 5 December 2022 (RNS No:

5184L) unless the context provides otherwise.

Jennifer Babington, Chair, said:

"The Board and I are pleased to confirm that the Group's full

year performance will be in line with expectations. Turning the

Group's performance around is an ongoing and challenging task, but

we are making positive progress as we implement a clear strategy

that puts the Group on a path back to profitability.

We are also pleased to confirm the continued support from our

major shareholders as we execute our plans and move the business

forward. Again, we view this as a clear indication of their

confidence in Fulcrum and its return to profitability.

The Group's future is also supported by m edium to long-term

market fundamentals, which remain strong. This, coupled with the

improvements we are implementing, means that the Group continues to

be ever better positioned to capitalise on the long-term

opportunities presented by the UK's transition to a low carbon

economy ."

This announcement contains inside information.

Enquiries:

Fulcrum Utility Services Limited +44 (0)114 280

Jonathan Jager, Chief Financial Officer 4150

Cenkos Securities plc (Nominated adviser and broker)

Camilla Hume / Callum Davidson (Nomad) / Michael +44 (0)20 7397

Johnson (Sales) 8900

Notes to Editors:

Fulcrum is a multi-utility infrastructure and services provider.

The Group operates nationally with its head office in Sheffield,

UK. It designs, builds, owns and maintains utility infrastructure

and offers smart meter exchange programmes.

https://investors.fulcrum.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCDELFBXZLLBBF

(END) Dow Jones Newswires

April 06, 2023 02:00 ET (06:00 GMT)

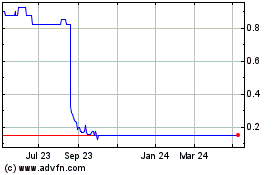

Fulcrum Utility Services... (LSE:FCRM)

Historical Stock Chart

From Oct 2024 to Nov 2024

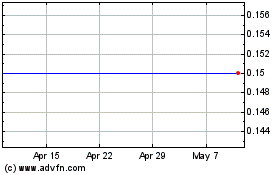

Fulcrum Utility Services... (LSE:FCRM)

Historical Stock Chart

From Nov 2023 to Nov 2024