TIDMFLK

RNS Number : 5369X

Fletcher King PLC

21 December 2023

FLETCHER KING PLC

("Flecther King" or the "Company")

Interim Results for the 6 months ended 31 October 2023

Financial Highlights

Turnover: GBP1,326,000 (2022: GBP1,338,000)

Earnings before GBP50,000 (2022: GBP32,000)

tax:

Basic EPS: 0.33p per share (2022: 0.23p per

share)

Dividend proposed: nil (2022: nil)

Operational Highlights

-- Earnings before tax improved slightly on the comparative period last year.

-- The moribund commercial property market has continued to

weigh on transactional fee income but new property management

instructions have supported growth in recurring fee income.

-- Anthony Ferguson joined on 1 November 2023 to launch a new

Planning specialism unit within the business. This will provide

complementary property services to existing and new clients for

which there is a good pipeline of work.

Commenting on the results David Fletcher, Chairman of Fletcher

King said:

"Against a backdrop of extremely challenging property market

conditions, it is pleasing to report profitable performance for the

period, with overall results being slightly ahead of last year.

Capital markets are likely to remain subdued for a while yet, but

with some good instructions in the pipeline and a focus on

improving non-transactional revenues, there are grounds for

optimism that this will translate into business growth and

development in due course."

This announcement contains inside information for the purposes

of the UK Market Abuse Regulation and the Directors of the Company

are responsible for the release of this announcement.

ENQUIRIES:

Fletcher King Plc

David Fletcher / Peter Bailey

Tel: 020 7493 8400

Cairn Financial Advisers LLP (Nomad)

James Caithie / Liam Murray

Tel: 020 7213 0880

The interim results are available on the Company's website:

www.fletcherking.co.uk

CHAIRMAN'S STATEMENT

Results

Turnover for the period was GBP1,326,000 (2022: GBP1,338,000)

with a profit before tax of GBP50,000 (2022: GBP32,000).

Dividend

In view of the continued uncertainty and the low level of

profit, the Board is not declaring an interim dividend (2022: no

interim dividend).

The Commercial Property Market

Very little has changed overall in the market since my year end

statement in August 2023 and the drift in values has continued over

the second half of 2023 as high interest rates and continuing

economic and political uncertainties have taken their toll on the

commercial property market. Capital values across the market have

declined by a further 3% over the last six months, with offices

declining by nearly 10% over the same period. Over 12 months to the

end of October, values have fallen by nearly 13% and the net

initial yield on all property is currently 5.5%.

Investors are currently adopting a 'wait and see' attitude

although there is some evidence that the market could be near the

bottom and that 2024 could see a bounce in the markets. There will

undoubtedly be some interesting opportunities over the next year

for the brave investor.

On the occupational side there is some activity in the three

major sectors, particularly in the industrial sector albeit at a

much reduced level compared to pre Covid, and rents are generally

static.

Offices continue to suffer and rents are coming under increasing

pressure as hybrid working is proving to be more enduring and

becoming the norm. However, in specific sub-sectors where there is

a scarcity of grade A space such as central London and major

regional cities, demand is still strong and there is some rental

growth.

Retail space continues to come under severe pressure and rents

continue their decline.

The Board is hopeful that 2024 will herald the beginning of the

upturn although the political uncertainties may prolong

inactivity.

Business Overview

I am pleased that, despite this very difficult market, we are

again reporting a profit.

We have had strong performance in Property Asset and Fund

Management and have secured new instructions. There has also been

activity in our existing portfolios.

The performance of the valuation team has been encouraging and

we are expanding the team as new clients have been added during the

year.

A number of sizeable Rating appeals are ongoing but overall

there are still huge challenges securing the attention of the

Valuation Office Agency (VOA) to negotiate settlements. Potentially

the situation could deteriorate in 2024 when the VOA will be

commencing preparation of the 2026 Rating List which will

inevitably diminish resources allocated to clearing outstanding

appeals.

Investment transaction activity has been disappointing as a

result of the poor investment market conditions mentioned

above.

Outlook

Yet again it continues to be impossible to accurately predict

the future of the property market and the timing of its recovery.

With a focus on improving non-transactional fee income, our

activities are healthy and growing and we look forward to a

reinvigorated capital market.

We are pleased to announce an expansion of the business with the

appointment of Anthony Ferguson (Member of Royal Town Planning

Institute) to head up our newly created Planning specialism. We

have been working with Anthony for a number of years and we are

delighted to have him joining us. There is a significant pipeline

of planning work to be done.

Our balance sheet continues to remain strong, as does the

relationships we have with our long standing clients.

As always our team have worked hard in these difficult

conditions and we thank them for their efforts.

DAVID FLETCHER

CHAIRMAN

20 December 2023

Fletcher King Plc

Consolidated Interim Statement of Profit or Loss and

Comprehensive Income

for the 6 months ended 31 October 2023

6 months 6 months

ended ended Year ended

31 October 31 October 30 April

2023 2022

(Unaudited) (Unaudited) 2023 (Audited)

GBP000 GBP000 GBP000

------------------------------------- -------------- -------------- ---------------

Revenue 1,326 1,338 3,079

Employee benefits expense (764) (744) (1,704)

Depreciation and amortisation

expense (97) (99) (197)

Other operating expenses (470) (496) (1,064)

Other operating income 27 26 51

Share based payment expense (9) (9) (17)

(1,313) (1,322) (2,931)

Investment income 7 24 42

Finance income 37 2 21

Finance expense (7) (10) (19)

-------------- -------------- ---------------

Profit before taxation 50 32 192

Taxation (16) (8) 41

-------------- -------------- ---------------

Profit for the period 34 24 233

-------------- -------------- ---------------

Other comprehensive income

Fair value loss on financial

assets through other comprehensive

income - - (44)

Total comprehensive income

for the period 34 24 189

-------------- -------------- ---------------

Earnings per share (note 4)

- Basic 0.33p 0.23p 2.27p

- Diluted 0.30p 0.21p 2.09p

Dividends per share

Interim dividend proposed - - -

Dividends paid 0.75p 0.50p 0.50p

Fletcher King Plc

Consolidated Interim Statement of Financial Position

as at 31 October 2023

31 October 31 October 30 April

2023 2022 2023

(Unaudited) (Unaudited) (Audited)

GBP000 GBP000 GBP000

-------------------------------- -------------- -------------- -----------

Assets

Non-current assets

Software 53 69 61

Property, plant and equipment 173 237 205

Right-of-use asset 321 436 378

Financial assets 485 529 485

Deferred tax asset 57 24 73

1,089 1,295 1,202

Current Assets

Trade and other receivables 1,242 1,346 1,553

Cash and cash equivalents 2,606 2,418 2,755

3,848 3,764 4,308

Total assets 4,937 5,059 5,510

Liabilities

Current liabilities

Trade and other payables 419 567 901

Lease liabilities 141 154 141

Total current liabilities 560 721 1,042

Non current liabilities

Lease liabilities 229 329 286

Shareholders' equity

Share capital 1,025 1,025 1,025

Share premium 522 522 522

Investment revaluation reserve (145) (101) (145)

Share option reserve 36 19 27

Reserves 2,710 2,544 2,753

Total shareholders' equity 4,148 4,009 4,182

Total equity and liabilities 4,937 5,059 5,510

Fletcher King Plc

Consolidated Interim Statement of Changes in Equity

for the 6 months ended 31 October 2023

Investment Share

Share Share revaluation Option Retained TOTAL

capital premium reserve Reserve earnings EQUITY

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------------------------- ------------- ------------- ------------ -------- --------- -------

Balance at 1

May 2023 1,025 522 (145) 27 2,753 4,182

Profit for the

period - - - - 34 34

Equity dividends

paid - - - - (77) (77)

Share based payment

expense - - - 9 - 9

---------------------------- ------------- ------------- ------------ -------- --------- -------

Balance at 31

October 2023 (Unaudited) 1,025 522 (145) 36 2,710 4,148

============================ ============= ============= ============ ======== ========= =======

Balance at 1

May 2022 1,025 522 (101) 10 2,571 4,027

Profit for the

period - - - - 24 24

Equity dividends

paid - - - - (51) (51)

Share based payment

expense - - - 9 - 9

---------------------------- ------------- ------------- ------------ -------- --------- -------

Balance at 31

October 2022 (Unaudited) 1,025 522 (101) 19 2,544 4,009

============================ ============= ============= ============ ======== ========= =======

Balance at 1

May 2022 1,025 522 (101) 10 2,571 4,027

Profit for the

year - - - - 233 233

Fair value loss

on financial assets

through - - (44) - - (44)

other comprehensive

income

Share based payment

expense - - - 17 - 17

Equity dividends

paid - - - - (51) (51)

Balance at 30

April 2023 (Audited) 1,025 522 (145) 27 2,753 4,182

============================ ============= ============= ============ ======== ========= =======

Fletcher King Plc

Consolidated Interim Statement of Cash Flows

for the 6 months ended 31 October 2023

6 months 6 months

ended ended Year ended

31 October 31 October 30 April

2023

2023 (Unaudited) 2022 (Unaudited) (Audited)

GBP000 GBP000 GBP000

---------------------------------- ------------------ ------------------ -----------

Cash flows from operating

activities

Profit before taxation from

continuing operations 50 32 192

Adjustments for:

Movement in provision - (25) (25)

Depreciation and amortisation

expense 97 99 197

Investment income (7) (24) (42)

Finance income (37) (2) (21)

Finance expense 7 10 19

Share based payment expense 9 9 17

Cash flows from operating

activities

before movement in working

capital 119 99 337

Decrease/(increase) in trade

and other receivables 311 (17) (224)

(Decrease)/increase in trade

and other payables (482) (557) (223)

------------------ ------------------ -----------

Cash absorbed by operations (52) (475) (110)

Taxation received - 97 97

------------------ ------------------ -----------

Net cash flows used in operating

activities (52) (378) (13)

--------------------------------------- ------------------ ------------------ -----------

Cash flows from investing

activities

Purchase of fixed assets - (5) (5)

Investment income 7 24 42

Finance income 37 2 21

Net cash flows from investing

activities 44 21 58

--------------------------------------- ------------------ ------------------ -----------

Cash flows from financing

activities

Lease payments (64) (539) (604)

Dividends paid to shareholders (77) (51) (51)

------------------ ------------------ -----------

Net cash flows from financing

activities (141) (590) (655)

--------------------------------------- ------------------ ------------------ -----------

Net decrease in cash and

cash equivalents (149) (947) (610)

Cash and cash equivalents

at start of period 2,755 3,365 3,365

------------------ ------------------ -----------

Cash and cash equivalents

at end of period 2,606 2,418 2,755

Fletcher King Plc

Explanatory Notes

1. General information

The Company is a public limited company incorporated and

domiciled in England and Wales. The address of its registered

office is 19-20 Great Pulteney Street, London W1F 9NF.

These interim financial statements were approved by the Board of

Directors on 20 December 2023.

2. Basis of preparation

The interim financial information in this report has been

prepared using accounting policies consistent with IFRS as endorsed

by the UK. IFRS is subject to amendment and interpretation by the

International Accounting Standards Board (IASB) and the

International Financial Reporting Standards Interpretations

Committee (IFRIC) and there is an ongoing process of review and

endorsement by the UK Endorsement Board. The financial information

has been prepared on the basis of IFRS that the Directors expect to

apply for the year ended 30 April 2024.

The accounting policies applied by the Group in this interim

report are the same as those applied by the Group in the

consolidated financial statements for the year ended 30 April 2023.

There are no new standards, interpretations and amendments,

effective for the first time from 1 May 2023, that have had a

material effect on the financial statements of the Group.

3. Non Statutory Accounts

The financial information for the periods ended 31 October 2023

and 31 October 2022 and the year ended 30 April 2023 set out in

this interim report does not constitute the Group's statutory

accounts for that period. Whilst the financial figures included in

this interim report have been computed in accordance with IFRS,

this interim report does not contain sufficient information to

constitute an interim financial report as that term is defined in

IAS34. The statutory accounts for the year ended 30 April 2023 have

been delivered to the Registrar of Companies. The auditors reported

on those accounts; their report was unqualified, did not contain a

statement under either Section 498(2) or Section 498(3) of the

Companies Act 2006 and did not include references to any matters to

which the auditor drew attention by way of emphasis.

The financial information for the 6 months ended 31 October 2023

and 31 October 2022 is unaudited.

Fletcher King Plc

Explanatory Notes

4. Earnings per share

6 months 6 months Year ended

to 31 October to 31 October 30 April

2023 2022 2023

Number Number Number

Weighted average number of shares

for basic earnings per share 10,252,209 10,252,209 10,252,209

Share options 920,000 920,000 920,000

--------------- --------------- -------------

Weighted average number of shares

for diluted earnings per share 11,172,209 11,172,209 11,172,209

=============== =============== =============

GBP000 GBP000 GBP000

--------------- --------------- -------------

Earnings for basic and diluted earnings

per share: 34 24 233

=============== =============== =============

Basic earnings per share 0.33p 0.23p 2.27p

Diluted earnings per share 0.30p 0.21p 2.09p

=============== =============== =============

Forward Looking Statements

Certain statements in this announcement are forward-looking

statements relating to the Company's operations, performance and

financial position based on current expectations of, and

assumptions and forecasts made by, management. They are subject to

a number of risks, uncertainties and other factors which could

cause actual results, performance or achievements of the Company to

differ materially from any outcomes or results expressed or implied

by such forward-looking statements. Undue reliance should not be

placed on such forward looking statements. They are made only as of

the date of this announcement and no representation, assurance,

guarantee or warranty is given in relation to them including as to

their accuracy, completeness, or the basis on which they are

made.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FEDEESEDSEIE

(END) Dow Jones Newswires

December 21, 2023 02:00 ET (07:00 GMT)

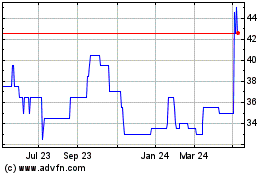

Fletcher King (LSE:FLK)

Historical Stock Chart

From Dec 2024 to Jan 2025

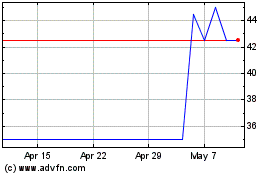

Fletcher King (LSE:FLK)

Historical Stock Chart

From Jan 2024 to Jan 2025