Fresnillo Shares Fall on 2019 Production Target Cut -- Update

July 17 2019 - 5:26AM

Dow Jones News

--Fresnillo shares fell after the company cut its guidance for

silver and gold output this year

--Second-quarter silver and gold production fell 6% and 5.4%

respectively on year

--The company guided toward a negative impact of around $135

million on its adjusted production costs

By Carlo Martuscelli and Oliver Griffin

Shares in precious metals miner Fresnillo PLC (FRES.LN) fell

Wednesday after it cut its full-year production in silver and gold

due to lower-than-expected grades at its namesake mine and

construction delays at one of its plants.

Fresnillo, the world's largest silver miner, said it now expects

to produce between 55 million ounces and 58 million ounces of

silver in 2019, down from an earlier range of 58 million ounces to

61 million ounces.

The company also shaved its full-year gold production guidance

to a range of 880,000 thousand ounces to 910,000 thousand ounces,

down from a previous 910,000 thousand ounces to 930,000 thousand

ounces. It attributed the decrease to delays in the construction of

a leaching pad.

Shares at 0939 GMT were down 1.4% at 908.40 pence.

During the second quarter, Fresnillo's silver production,

including its silverstream contract, fell 6% to 14.4 million

ounces, from 15.3 million ounces in the year-ealier period. Gold

production fell 5.4% to 221,307 ounces, the company said.

Fresnillo also said it expected a negative cost impact for the

first half of the year of around $135 million. The company said its

first-half adjusted production costs would be hit by previously

disclosed accounting reclassifications and growth initiatives,

among other factors.

Despite the cut to guidance and production falling on year,

analysts weren't too perturbed by Fresnillo's output. Analysts at

Morgan Stanley said silver production came in 1% ahead of its own

estimates, while Citi analysts said the result was 4% higher than

they had estimated.

Chief Executive Octavio Alvidrez said Fresnillo's production has

continued to recover toward targeted levels since the first

quarter, which he attributed to "the positive impact of operational

measures and investments we have made into infrastructure,

equipment and infill drilling."

Compared with production in the first three months of the year,

second-quarter production of silver and gold rose 9.7% and 4.8%,

from 13.1 million ounces and 211,110 ounces respectively.

Write to Carlo Martuscelli at carlo.martuscelli@dowjones.com.

Write to Oliver Griffin at oliver.griffin@dowjones.com;

@OliGGriffin

(END) Dow Jones Newswires

July 17, 2019 06:11 ET (10:11 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

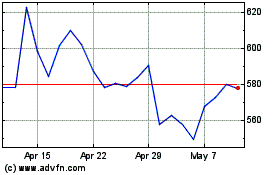

Fresnillo (LSE:FRES)

Historical Stock Chart

From Apr 2024 to May 2024

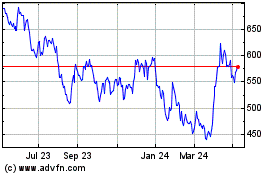

Fresnillo (LSE:FRES)

Historical Stock Chart

From May 2023 to May 2024