Glencore International PLC Merger Update - Glencore's Proposal to Xstrata (8519L)

September 10 2012 - 1:00AM

UK Regulatory

TIDMGLEN

RNS Number : 8519L

Glencore International PLC

10 September 2012

10 September 2012

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN

PART, IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD

CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF SUCH

JURISDICTION

NEWS RELEASE

Glencore International plc

Merger Update - Glencore's Proposal to Xstrata

As required by the Takeover Panel, Glencore International plc

("Glencore") announces that over the weekend it made the following

proposal (the "Proposal") to the independent board of Xstrata plc

("Xstrata"). The Proposal remains subject to the agreement of the

Xstrata board.

1. Increased merger ratio to 3.05

An increased merger ratio of 3.05 New Glencore Shares for each

Xstrata Share, excluding the Xstrata Shares already held by the

Glencore Group. Glencore confirms that it is an all-share merger

and it will not increase the merger ratio further.

The increased merger ratio represents a substantial premium for

a company with a 34 per cent. shareholder. At the close of business

on Wednesday 5 September 2012 (being the last business day prior to

any speculation of a change to the terms of the Merger), Glencore

and Xstrata were trading at an exchange ratio of 2.4x. That would

imply a premium of more than 27 per cent. would be paid with the

new proposed merger ratio.

2. Governance

In order to provide clarity on the issue of CEO succession, Mick

Davis will become the Chief Executive Officer and executive

director of the Combined Group on the Merger becoming effective but

to step down within 6 months with Ivan Glasenberg becoming Chief

Executive Officer of the Combined Group at that time.

All other governance arrangements set out in Xstrata's scheme

document and Glencore's class 1 circular and prospectus, each

published on 31 May 2012, would remain the same.

3. Management Incentive Arrangements

The Merger to remain conditional on independent Xstrata

shareholders approving appropriate management incentive

arrangements for Xstrata management and senior employees.

Glencore has confirmed that it is content with Xstrata's request

for Xstrata management and senior employees to receive appropriate

retention and incentive packages. Glencore has asked the

independent Xstrata board to consider what (if any) changes they

would propose to the retention and incentive arrangement packages

set out in Xstrata's supplementary scheme circular dated 8 August

2012, to ensure that they are acceptable to independent Xstrata

shareholders.

4. Structure

The Merger would continue to be structured as a Scheme and

Glencore could switch to a takeover offer with the consent of the

Panel and Xstrata.

For the avoidance of doubt, as noted above, these terms are

subject to the agreement of the Xstrata board.

For enquiries about Glencore, please contact:

Paul Smith (Investors) Charles Watenphul (Media) John Burton

(Company Secretary)

t: +41 (0)41 709 2487 t: +41 (0)41 709 2462 t: +41 (0)41 709

2619

m: +41 (0)79 947 1348 m:+41 (0)79 904 3320 m: +41 (0)79 944 5434

e: paul.smith@glencore.com e: charles.watenphul@glencore.com e: john.burton@glencore.com

Elisa Morniroli (Investors) Finsbury (Media)

t: +41 (0)41 709 2818 Guy Lamming

m: +41 (0)79 833 0508 Dorothy Burwell

e: elisa.morniroli@glencore.com t: +44 (0)20 7251 3801

Capitalised terms used in this announcement, unless defined

herein have the same meanings as set out in Glencore's Prospectus

published on 31 May 2012 as supplemented by the supplementary

prospectuses published on 12 July 2012, 7 August 2012 and 21 August

2012.

This announcement is for information purposes only. It is not

intended to and does not constitute, or form part of, an offer,

invitation or the solicitation of an offer to purchase, otherwise

acquire, subscribe for, sell or otherwise dispose of any

securities, or the solicitation of any vote or approval in any

jurisdiction, pursuant to the Merger or otherwise nor shall there

be any sale, issuance or transfer of securities in any jurisdiction

in contravention of applicable law.

The release, publication or distribution of this announcement in

or into jurisdictions other than the UK may be restricted by law

and therefore any persons who are subject to the law of any

jurisdiction other than the UK should inform themselves about, and

observe, any applicable requirements. Any failure to comply with

the applicable restrictions may constitute a violation of the

securities laws of any such jurisdiction.

Publication on Website

A copy of this announcement will be available on Glencore's

website (www.glencore.com) by no later than 12 noon (London time)

on the business day following the date of this announcement.

You may request a hard copy of this announcement, free of

charge, by contacting the Company Secretary of Glencore, John

Burton, at john.burton@glencore.com. You may also request that all

future documents, announcements and information to be sent to you

in relation to the Merger should be in hard copy form.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MERLMMATMBJBMLT

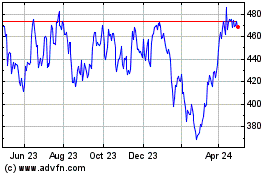

Glencore (LSE:GLEN)

Historical Stock Chart

From Dec 2024 to Jan 2025

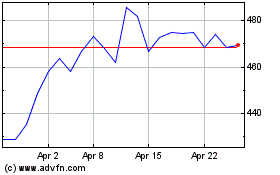

Glencore (LSE:GLEN)

Historical Stock Chart

From Jan 2024 to Jan 2025