Hazel Ren Egy VCT1 Statement Re Chargepoint Services Ltd

June 25 2019 - 6:26AM

UK Regulatory

TIDMGV1O

Gresham House Renewable Energy VCT 1 plc ("the Company")

LEI: 213800IVQHJXUQBAAC06

25 June 2019

Gresham House Renewable Energy VCT 1 and 2 announce successful exit for

ChargePoint Services via trade sale to Engie

London, 25 June 2019 - The Boards of Gresham House Renewable Energy VCT

1 plc and Gresham House Renewable Energy VCT 2 plc (the Gresham House

VCTs or the VCTs) are very pleased to report that their investments in

ChargePoint Services Ltd (CPS) have been acquired by Engie as part of

the French utility's buyout of 100% of CPS. The exit will generate a

total rate of return to shareholders of 11.9% per year based on the

initial purchase consideration, rising to 13.2% per year if all future

tranches of the purchase consideration, linked to CPS' future

performance, are received.

The Gresham House VCTs invested GBP1 million (GBP0.5 million per VCT) in

CPS in 2016 in the form of equity and a senior, secured debt instrument.

CPS is a provider of integrated electric vehicle charging solutions in

the UK which uses proprietary and best of breed end-to-end technology

for public, workplace and private sector electric vehicle (EV) charging.

Engie is the second-largest provider of EV charging stations around the

world. Through this deal Engie will add ChargePoint Service's 900 public

and workplace EV charge points, as well as its 20,000-strong customer

base and cloud-based data and control platform.

Following the VCTs two top-ups last year, the Gresham House investment

team is actively looking for new opportunities to put capital to work,

in companies in the clean technology space and seeking to help the UK's

transition to becoming a low-carbon economy.

Bozkurt Aydinoglu, Investment Director at Gresham House and co-manager

of the VCTs stated; "CPS successfully capitalised on the need in the UK

for a roll-out of EV charging points in suitable locations, by forging

partnerships with site owners and delivering a fast turnkey EV charging

solution. We are delighted that the VCTs' first investment in this space,

has delivered a strong risk-adjusted return for shareholders."

The Gresham House VCTs were launched by Gresham House New Energy

(formerly Hazel Capital LLP) in 2010. GBP41.6m was raised between 2010

and 2011 representing the most successful ever launch by a new entrant

to the VCT market. The Gresham House VCTs are ranked best in class' when

compared to all other VCT offerings launched in 2010/2011 and have the

highest total return metrics of any non-AIM VCT launched in the last ten

years (at 161.1 and 159.8 pence per share for Gresham House Renewable

Energy VCT 1 and Gresham House Renewable Energy VCT 2 respectively)(1) .

These returns exclude the 30% VCT tax rebate available to UK tax payers.

Last year in December 2018, the VCTs paid a dividend of 6 pence,

bringing the total dividend payments, to shareholders who invested at

launch, to 45 pence.

ENDS

Notes to editors:

For further information, please contact:

Montfort Communications:

Gay Collins +44 203 770 7905

Louis Supple +44 203 770 7914

GreshamHouse@montfort.london

https://www.globenewswire.com/Tracker?data=Hf_3GQBDDJI6Jg7sP7GZWV-bXz_IIQmdXse_JKy7mWQRtam_fOkz3JEvDTeZQ4cGsmjxQTnne2oiBtJt9Km3CdPRoi3ijhVl78qB0JSFGL4-xui2ZB-l4cqSRWCida7j

About the Gresham House Renewable Energy VCTs and Gresham House

Gresham House plc is an AIM quoted specialist alternative asset manager

providing funds, direct investments and tailored investment solutions,

including co-investment across a range of highly differentiated

alternative investment strategies. Expertise includes strategic public

and private equity (private assets), forestry, new energy, housing and

infrastructure.

Gresham House aims to deliver sustainable financial returns and is

committed to building long-term partnerships with clients, (institutions,

family offices, high-net-worth individuals, charities and endowments and

private individuals) to help them achieve their financial goals.

Shareholder value creation will be driven by long-term growth in

earnings as a result of increasing AUM and returns from invested

capital.

https://www.globenewswire.com/Tracker?data=7dH_G-Uh0axixth7l_cbjE3Gmma_NUgMJq7onB_DgGqJ7ozFyXWQvUHt8jAJRglNmqo_B4WaTyMK71VU3Slk1uOHfH8n15gbF8CaZTI7rWA=

www.greshamhouse.com

(1) NAV date as at 31 March 2019

(END) Dow Jones Newswires

June 25, 2019 07:26 ET (11:26 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

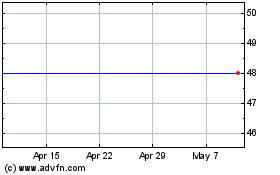

Gresham House Renewable ... (LSE:GV1O)

Historical Stock Chart

From Apr 2024 to May 2024

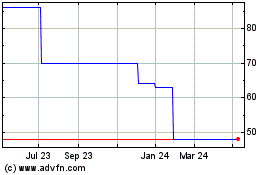

Gresham House Renewable ... (LSE:GV1O)

Historical Stock Chart

From May 2023 to May 2024