TIDMHICL

RNS Number : 8183H

HICL Infrastructure PLC

01 August 2023

1 August 2023

HICL Infrastructure PLC

"HICL" or "the Company" and, together with its subsidiaries,

"the Group", the London-listed infrastructure investment company

managed by InfraRed Capital Partners Limited ("InfraRed" or "the

Investment Manager".)

Interim Update Statement

The Board of HICL is issuing this Interim Update Statement,

which relates to the period from 1 April 2023 to 31 July 2023.

Mike Bane, Chair of HICL said:

"HICL's portfolio performed well over the period owing to its

defensive positioning and strong inflation correlation, which serve

to protect the Company's NAV in the current macro environment. The

Company continues to deliver on its asset recycling strategy, which

enhances portfolio composition and supports asset valuations as

well as providing a valuable source of funding when equity capital

markets are closed."

Key Highlights

-- Good operational performance across the portfolio

in the period demonstrating the resilient nature

of the underlying assets. The Company is on track

to deliver its target dividend of 8.25p per share

for the financial year to 31 March 2024, with cash

generation in line with expectations.

-- High Speed 1, which represents 4% of the portfolio(1)

, recommenced distributions in the period demonstrating

the asset's continued recovery from the effects

of Covid-19.

-- The partial disposal of Northwest Parkway ("NWP")

above its carrying value completed in June 2023.

The Company has other live disposal activity which

will continue to enhance portfolio composition,

while also providing support for valuations and

cash proceeds to reduce drawings on HICL's Revolving

Credit Facility ("RCF").

-- HICL completed its previously disclosed investments

in Texas Nevada Transmission, Altitude Infra in

May and the Hornsea II OFTO in July.

-- The prospect of higher UK interest rates has continued

to weigh on the Company's share price, which has

consistently traded at a discount to NAV over the

period. In the Board's view, the Company's current

share rating does not fully reflect the positive

impact of higher than assumed inflation on HICL's

cashflows.

-- HICL's defensive portfolio continues to be well

positioned amidst the uncertain macro environment,

benefiting from its strong inflation correlation

and limited variable interest rate exposure.

Portfolio Performance

-- Overall, the portfolio performed in line with expectations

in the period, underpinned by high quality cashflows,

long-term capital structures with limited exposure

to higher interest rates and active asset management.

-- Affinity Water (7% of portfolio value(1) ) performed

well operationally in the period, aided by mild

weather. The business has a stable financial position,

enhanced by the continuing reinvestment of free

cash into Affinity's substantial investment programme,

reducing external gearing, as well as effective

treasury management with no refinancing events before

2027. As a water-only company with no exposure to

sewerage services, Affinity Water is also not impacted

by some of the specific operational challenges in

the wastewater sector.

-- First distributions received in the period for Texas

Nevada Transmission (USA) and Fortysouth (NZ), in

line with acquisition assumptions.

Financial Performance

-- The Company is on track to deliver its target dividend

of 8.25p per share for the financial year to 31

March 2024(2) , with cash generation in the period

in line with expectations.

-- The Company has received the proceeds from its Northwest

Parkway disposal. These proceeds were fully hedged

with a FX forward which settled on 31 July 2023.

In August 2023 these proceeds will be used to repay

a portion of the RCF. By 31 August 2023, the drawn

balance on the Company's GBP650m RCF will be GBP370m.

Together with the Private Placement and letters

of credit, the Company's gearing will be 16%. To

protect against further rises in interest rates,

but allow it to benefit if rates decrease, the Company

purchased an option to cap GBP200m of its SONIA

exposure to 6.5% for three years.

-- The portfolio has low cashflow exposure to rising

interest rates, with the vast majority of portfolio

holdings benefiting from fixed-rate, amortising

debt. Five assets have exposure to debt refinancing,

with only one due to be refinanced before 2027.

For reference, plus / minus 100bps on the cost of

debt for all future refinancings in the portfolio

would negatively / positively impact HICL's NAV

per share by (1.7p) / 2.1p respectively.

-- Higher interest rates also flow through to cash

on deposit within underlying portfolio companies.

For reference, plus / minus 100bps on the rate attracted

by deposits placed by portfolio companies would

positively / negatively impact HICL's NAV per share

by 2.8p / (2.8p) respectively.

Valuation

-- The Investment Manager continues to observe a material

disconnect between public and private markets in

the valuations applied to inflation-correlated core

infrastructure assets. Transaction data points in

private markets, albeit in lower volumes, support

the view that valuations are generally remaining

stable as inflation correlation provides a hedge

against higher discount rates. This is further validated

by the valuations seen across the Company's NWP

sale, a recent UK PPP sale by a separate InfraRed-managed

fund, and HICL's live disposal activity.

-- However, public markets appear to be applying higher

UK Gilt yields to perceived discount rates for alternative

asset funds without a corresponding adjustment for

the benefit of inflation. The implied inflation

rate in the long-term (30 year) UK government bond

yield is currently c. 3.4%(3) , which compares to

the Company's long term UK inflation assumption

in its 31 March 2023 valuation of 2%.

-- Aligning HICL's long-term inflation assumptions(4)

to the implied inflation rates in current long-term

government bond yields across HICL's markets, would

result in a 21.4p uplift in NAV, based on the 31

March 2023 valuation. To remain NAV neutral, this

equates to an equivalent increase in the Company's

weighted average discount rate of 1.1% to 8.3%.

-- In the short-term, current inflation forecasts for

FY2024 remain significantly ahead of the UK RPI

assumptions(4) for the year ended 31 March 2024.

For reference, if inflation is 3% higher than the

Company's forecast assumptions until March 2024

in all jurisdictions, then 3.1p will be added to

its NAV per share.

-- Overall, the weighted average risk-free rate across

HICL's markets has increased by 0.6% since the Company's

valuation at 31 March 2023. All things being equal,

this would suggest the adoption of higher discount

rates, weighted towards the UK, for HICL's next

valuation at 30 September 2023. The valuation impact

of this is expected to be materially offset by the

impact of higher actual and forecast inflation.

This offsetting effect for inflation-correlated

core infrastructure aligns with transaction data

points observed by InfraRed in the market.

Market and Outlook

-- HICL's portfolio continues to perform well amidst

macroeconomic volatility. Underlying asset valuations

are resilient, with limited cashflow sensitivity

to higher interest rates, and strong inflation correlation

providing an effective hedge against the risk of

higher discount rates.

-- The Board and Investment Manager are focused on

conservative capital management, including the application

of disposal proceeds to reduce the drawings on the

Company's RCF. This strategy of asset recycling

allows the Company to continue to refine portfolio

composition and enhance the investment proposition

for shareholders.

-- Over the medium-term, core infrastructure investment

continues to be propelled by the powerful growth

drivers of digitalisation, decarbonisation and the

need to renew ageing infrastructure.

1. Based on the Directors' Valuation of GBP3,772.8m at 31 March 2023

2. This is target only and not a profit forecast. There can be

no assurance that this target will be met

3. As at 31 July 2023

4. UK RPI 5.00% to March 2024, 2.75% to March 2030, 2.00%

thereafter, CPI: 4.25% to March 2024, 2.00% thereafter. The

inflation assumptions for the rest of the world are shown on page

49 of the 2023 Annual Report and Accounts

-Ends-

Enquiries

InfraRed Capital Partners +44 (0) 20 7484 1800 / info@hicl.com

Limited

Edward Hunt

Helen Price

Mohammed Zaheer

Brunswick +44 (0) 20 7404 5959 / hicl@brunswickgroup.com

Sofie Brewis

Investec Bank

plc +44(0) 20 7597 4952

David Yovichic

RBC Capital Markets +44 (0) 20 7653 4000

Matthew Coakes

Elizabeth Evans

Aztec Financial Services

(UK) Limited +44(0) 203 818 0246

Chris Copperwaite

Sarah Felmingham

HICL Infrastructure PLC

HICL Infrastructure PLC ("HICL") is a long-term investor in

infrastructure assets which are predominantly operational and

yielding steady returns. It was the first infrastructure investment

company to be listed on the London Stock Exchange.

With a current portfolio of over 100 infrastructure investments,

HICL is seeking further suitable opportunities in core

infrastructure, which are inherently positioned at the lower end of

the risk spectrum.

Further details can be found on the HICL website www.hicl.com

.

Investment Manager (InfraRed Capital Partners)

The Investment Manager to HICL is InfraRed Capital Partners

Limited ("InfraRed") which has successfully invested in

infrastructure projects since 1997. InfraRed is a leading

international investment manager, operating worldwide from offices

in London, New York, Seoul and Sydney and managing equity capital

in multiple private and listed funds, primarily for institutional

investors across the globe. InfraRed is authorised and regulated by

the Financial Conduct Authority.

The infrastructure investment team at InfraRed consists of over

100 investment professionals, all with an infrastructure investment

background and a broad range of relevant skills, including private

equity, structured finance, construction, renewable energy and

facilities management.

InfraRed implements best-in-class practices to underpin asset

management and investment decisions, promotes ethical behaviour and

has established community engagement initiatives to support good

causes in the wider community. InfraRed is a signatory of the

Principles of Responsible Investment.

Further details can be found on InfraRed's website www.ircp.com

.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDSDUEFFEDSEFW

(END) Dow Jones Newswires

August 01, 2023 02:00 ET (06:00 GMT)

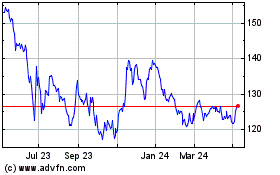

Hicl Infrastructure (LSE:HICL)

Historical Stock Chart

From Apr 2024 to May 2024

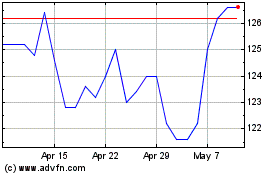

Hicl Infrastructure (LSE:HICL)

Historical Stock Chart

From May 2023 to May 2024