TIDMHOC

RNS Number : 6833A

Hochschild Mining PLC

24 January 2024

_____________________________________________________________________________________

24 January 2024

Production Report for the 12 months ended 31 December 2023

Eduardo Landin, Chief Executive Officer said:

"Our operational team delivered a robust performance in the

fourth quarter of 2023, and we have therefore ended the year at the

top end of our revised production guidance with costs anticipated

to be in line with expectations. I am also very pleased with our

safety and environmental performance, where we achieved our best

results in recent Company history.

In Brazil, we are in the final stages of the Mara Rosa project's

construction and commissioning phases and are looking forward to

the first gold pour in February. This exciting new mine forms a key

part of our recently announced growth strategy and is set to enable

Hochschild to increase output this year by over 15%."

Operational highlights

-- Full year attributable production ([1])

o 186,091 ounces of gold

o 9.5 million ounces of silver

o 300,749 gold equivalent ounces at the high end of revised

guidance of 289,000-303,000 ounces

o 25.0 million silver equivalent ounces

-- 2023 all-in sustaining costs expected to meet revised

guidance of $1,490-1,580 per gold equivalent ounce ($18.0-19.0 per

silver equivalent ounce)

Project highlights

-- Mara Rosa project is 99.8% complete with first gold pour

expected in February

o On time and on budget

o 5 million hours completed on the project without any loss time

accidents

Financial position

-- Total cash of approximately $89 million as at 31 December

2023 ($144 million as at 31 December 2022)

-- Net debt of approximately $252 million as at 31 December 2022

(net debt of $175 million as at 31 December 2022)

-- Current Net Debt/LTM EBITDA of approximately 0.97x as at 31

December 2023, improved from 1.12x in September 2023

-- Zero cost collar executed for 100,000oz of 2024 gold

production from Inmaculada an average floor of $2,000/oz and an

average cap of $2,252/oz

2023 ESG highlights

-- Lost Time Injury Frequency Rate of 0.99 (FY 2022: 1.37)

([2])

-- Accident Severity Index of 37 (FY 2022: 93) ([3])

-- Water Consumption of 163 lt/person/day (FY 2022: 171

lt/person/day)

-- Domestic waste generation of 0.93 kg/person/day (FY 2022:

1.05 kg/person/day)

-- ECO score of 5.76 out of 6 (FY 2022: 5.27) ([4])

Growth in 2024

-- New Mara Rosa mine set to produce 83,000-93,000 ounces of

gold at AISC of $1,090-$1,120 per ounce

-- Overall production target:

o 343,000-360,000 gold equivalent ounces

-- All-in sustaining costs target:

o $1,510-$1,550 per gold equivalent ounce

-- Total sustaining and development capital expenditure expected

to be approximately $171-178 million

________________________________________________________________________________________

A conference call will be held at 2.00pm (London time) on

Wednesday 24 January 2024 for analysts and investors.

Dial in details as follows:

UK Toll-Free: 0808 109 0700

International Dial in: +44 (0)330 551 0200

US Toll-Free: 866-580-3963

Canada Toll-Free: 866-378-3566

Password: Hochschild Mining

A recording of the conference call will be available on demand

on the Company's website: www.hochschildmining.com

________________________________________________________________________________________

Overview

In Q4 2023, Hochschild Mining PLC (HOC.LN) (OTCMKTS: $HCHDF)

("Hochschild" or "the Company") delivered attributable production

of 82,251 gold equivalent ounces or 6.8 million silver equivalent

ounces, slightly stronger than Q3. Overall 2023 attributable

production was 300,749 gold equivalent ounces or 25.0 million

silver equivalent ounces. The result was at the upper end of

revised guidance, due to a better-than-forecast performance at

Inmaculada.

The Company reiterates that its all-in sustaining cost for 2023

is expected to be in line with the revised guidance of between

$1,490-1,580 per gold equivalent ounce ($18.0-19.0 per silver

equivalent ounce)

TOTAL GROUP PRODUCTION

Q4 2023 Q3 2023 Q4 2022 12 mths 12 mths

2023 2022

-------- -------- -------- --------

Silver production

(koz) 3,086 3,205 3,632 11,683 13,596

Gold production

(koz) 64.41 60.81 68.11 225.77 244.63

Total silver equivalent

(koz) 8,432 8,252 9,285 30,423 33,900

Total gold equivalent

(koz) 101.59 99.42 111.87 366.54 408.43

Silver sold (koz) 3,231 2,911 3,596 11,567 13,536

Gold sold (koz) 68.14 53.93 67.40 221.86 242.89

------------------------- -------- -------- -------- -------- --------

Total production includes 100% of all production, including

production attributable to Hochschild's joint venture partner at

San Jose.

ATTRIBUTABLE GROUP PRODUCTION

Q4 2023 Q3 2023 Q4 2022 12 mths 12 mths

2023 2022

-------- -------- -------- --------

Silver production

(koz) 2,450 2,624 2,931 9,517 11,003

Gold production

(koz) 52.73 50.00 56.94 186.09 206.01

Silver equivalent

(koz) 6,827 6,774 7,657 24,962 28,102

Gold equivalent

(koz) 82.25 81.62 92.26 300.75 338.57

------------------- -------- -------- -------- -------- --------

Attributable production includes 100% of all production from

Inmaculada, Pallancata and 51% from San Jose.

Production

Inmaculada

Product Q4 2023 Q3 2023 Q4 2022 12 mths 12 mths

2023 2022

-------------- -------------- --------------- ----------

Ore production

(tonnes treated) 301,127 300,076 323,870 1,137,109 1,329,177

Average grade silver

(g/t) 186 166 182 177 156

Average grade gold

(g/t) 4.63 3.97 4.29 4.09 3.81

Silver produced

(koz) 1,500 1,442 1,602 5,515 5,936

Gold produced (koz) 39.35 36.19 42.36 137.40 154.85

Silver equivalent

(koz) 4,766 4,446 5,118 16,919 18,788

Gold equivalent

(koz) 57.42 53.57 61.66 203.85 226.36

Silver sold (koz) 1,587 1,340 1,599 5,488 5,918

Gold sold (koz) 41.95 33.32 42.15 136.66 154.93

---------------------- -------------- -------------- --------------- ---------- ----------

Fourth quarter production at Inmaculada was 39,354 ounces of

gold and 1.5 million ounces of silver, which amounts to a gold

equivalent output of 57,425 ounces, with higher tonnage and grades

from newer mining areas. Overall, in 2023, Inmaculada has delivered

gold equivalent production of 203,849 ounces (2022: 226,363

ounces), slightly above the revised forecast published in

August.

Pallancata

Product Q4 2023 Q3 2023 Q4 2022 12 mths 12 mths

2023 2022

---------------- ----------------- ---------------- --------

Ore production

(tonnes treated) 51,738 122,681 155,530 414,044 559,799

Average grade silver

(g/t) 199 171 139 155 151

Average grade gold

(g/t) 0.84 0.73 0.68 0.64 0.69

Silver produced

(koz) 288 578 600 1,746 2,368

Gold produced (koz) 1.22 2.56 2.95 7.39 10.98

Silver equivalent

(koz) 390 791 845 2,359 3,279

Gold equivalent

(koz) 4.70 9.53 10.18 28.43 39.50

Silver sold (koz) 285 576 561 1,785 2,315

Gold sold (koz) 1.20 2.57 2.80 7.52 10.76

---------------------- ---------------- ----------------- ---------------- -------- --------

In Q4, Pallancata produced 0.3 million ounces of silver and

1,224 ounces of gold bringing the silver equivalent total to 0.4

million, with the mine still operating a little later in the

quarter than expected. Overall, in 2023, Pallancata produced 2.4

million silver equivalent ounces (2022: 3.3 million ounces)

slightly above the revised forecast (2.0 -2.2 million ounces). In

Q4, as previously announced, Pallancata suspended operations and

was placed on care and maintenance.

The process of amending Pallancata's environmental impact

assessment ("Third MEIA") to incorporate the Royropata discovery

into the permitted area formally began in December and is advancing

on schedule. Feasibility engineering is over 90% completed and

environmental and social baseline studies will be conducted during

2024.

San Jose (the Company has a 51% interest in San Jose)

Product Q4 2023 Q3 2023 Q4 2022 12 mths 12 mths

2023 2022

-------------- -------- ------------- --------

Ore production

(tonnes treated) 154,308 152,729 152,692 579,100 507,189

Average grade silver

(g/t) 297 271 332 270 369

Average grade gold

(g/t) 5.51 5.16 5.38 5.03 5.55

Silver produced

(koz) 1,297 1,184 1,430 4,422 5,292

Gold produced (koz) 23.84 22.05 22.80 80.99 78.80

Silver equivalent

(koz) 3,276 3,015 3,323 11,144 11,833

Gold equivalent

(koz) 39.47 36.32 40.03 134.26 142.57

Silver sold (koz) 1,339 994 1,435 4,274 5,303

Gold sold (koz) 24.54 18.03 22.46 77.23 77.20

---------------------- -------------- -------- ------------- -------- --------

The San Jose mine experienced lower than expected grades,

resulting in production of 1.3 million ounces of silver and 22,836

ounces of gold in the quarter, which represents 3.3 million silver

equivalent ounces. This amounts to a 2023 total production of 11.1

million silver equivalent ounces (2022: 11.8 million ounces).

Average realisable prices and sales

Average realisable precious metal prices in Q4 2023 (which are

reported before the deduction of commercial discounts) were

$2,036/ounce for gold and $23.7/ounce for silver (Q4 2022:

$1,767/ounce for gold and $25.8/ounce for silver).

For 2023 as a whole, average realisable precious metal prices

were $1,974/ounce for gold and $23.7/ounce for silver (2022:

$1,791/ounce for gold and $23.3/ounce for silver).

Advanced Project: Mara Rosa

The Mara Rosa project is progressing on schedule and budget with

total project progress at 99.8%. The Company continues to expect

first gold pour during the month of February and commercial

production in the second quarter.

Health and Safety

Proactive corporate safety indicators are being monitored to

ensure optimal working conditions for all personnel and the project

has completed approximately five million hours without loss time

accident. Frequency and severity indices for 2023 were 0.54 and 2,

respectively, both better than corporate goals

Procurement

Main plant reagents and materials, including cyanide, balls for

the mills, lime and activated carbon have been purchased and

deliveries are on track to meet the start of operations.

Mine and Pre-Stripping

Total pre-stripping volume was 2,091 kt of which there is

approximately 136.5 kt to guarantee availability of mineral for the

ramp-up and operation. Waste dumps and ore stockpiles are complete

and being used.

Processing plant

The crushing and screening areas were commissioned during Q4

whilst commissioning began of the thickener and ball mill. Full

project commissioning and the beginning of the project's ramp-up is

expected during the first quarter.

Quality control teams are consistently monitoring all critical

project progress such assembly of metallic structures, equipment,

piping, welding and commissioning activities.

Infrastructure

Construction of the dry stack was completed in December 2023 and

the Pequi water reservoir is fully operational and filled to 95%

capacity with the water required for 2024 operations.

The Administrative buildings are fully operational including

offices, cafeteria, first aid and nursery areas.

Permitting & Sustainability

During Q4, Mara Rosa received authorisation for commissioning of

the wet circuit with the dry circuit already permitted. During

early December, the project was visited by officials from EPA-Goias

to assess the issuance of the Operating License which is expected

to occur in February.

The Company organised three festivities to celebrate Children's

Day in Mara Rosa and Amaralina with over 3,100 participants whilst

on 2 November, a meeting with the local communities from both towns

was held with the objective of updating them on project progress

and strengthening local relationships and dialogue.

Brownfield exploration

Inmaculada

In Q4 2023, the Company performed 900m of potential drilling,

intercepting two new structures, Nicolas and Andrea, which will be

further investigated in this quarter.

Vein Results (potential drilling)

Nicolas IMS23-207: 1.8m @ 27.0g/t Au & 5,768g/t

Ag

----------------------------------------

Andrea IMS23-207: 3.3m @ 19.4g/t Au & 79g/t Ag

----------------------------------------

Saly IMS23-207: 2.2m @ 3.2g/t Au & 90g/t Ag

----------------------------------------

San Jose

At San Jose, the brownfield team carried out 906m of potential

drilling and 4,420m of resource drilling in the Suspiro, Sigmoid

Molle, Guadaluoe veins with the key vein expected to be the Suspira

quartz sulphide vein which has high silver grades.

Vein Results (potential/resource drilling)

Suspira SJD-2737: 1.2m @ 17.4g/t Au & 2,477g/t

Ag

---------------------------------------

Tensiona EW SJM-647: 1.0m @ 7.7g/t Au & 938g/t Ag

---------------------------------------

RML861V SJD-2728: 1.1m @ 6.9g/t Au & 615g/t Ag

---------------------------------------

Sig Molle SJM-647: 2.8m @ 5.7g/t Au & 656g/t Ag

---------------------------------------

RML861w SJD-2731: 1.3m @ 5.5g/t Au & 8g/t Ag

---------------------------------------

The plan for the first quarter is to perform 1,500m of potential

drilling at San Jose in the Telken North and Cerro Saavedra

areas.

Financial position

Total cash was approximately $89 million as at 31 December 2023,

resulting in net debt of approximately $252 million.

To ensure an ongoing level of cash flow stability from

Inmaculada, the Company has secured a zero-cost collar with

JPMorgan for 100,000 ounces of our 2024 gold production with an

average floor at $2,000/oz and an average cap at $2,252/oz.

____________________________________________________________________________________

Enquiries:

Hochschild Mining PLC

Charles Gordon

+44 (0)20 3709 3264

Head of Investor Relations

Hudson Sandler

Charlie Jack

+44 (0)207 796 4133

Public Relations

_____________________________________________________________________________________

About Hochschild Mining PLC

Hochschild Mining PLC is a leading precious metals company

listed on the London Stock Exchange (HOCM.L / HOC LN) with a

primary focus on the exploration, mining, processing and sale of

silver and gold. Hochschild has over fifty years' experience in the

mining of precious metal epithermal vein deposits and currently

operates three underground epithermal vein mines, two located in

southern Peru and one in southern Argentina. Hochschild also owns

the Mara Rosa Advanced Project in Brazil as well as numerous

long-term projects throughout the Americas.

_____________________________________________________________________________________

Forward looking statements

This announcement may contain forward looking statements. By

their nature, forward looking statements involve risks and

uncertainties because they relate to events and depend on

circumstances that will or may occur in the future. Actual results,

performance or achievements of Hochschild Mining PLC may, for

various reasons, be materially different from any future results,

performance or achievements expressed or implied by such forward

looking statements.

The forward looking statements reflect knowledge and information

available at the date of preparation of this announcement. Except

as required by the Listing Rules and applicable law, the Board of

Hochschild Mining PLC does not undertake any obligation to update

or change any forward looking statements to reflect events

occurring after the date of this announcement. Nothing in this

announcement should be construed as a profit forecast.

This announcement contains information which prior to its

release could be considered inside information.

LEI: 549300JK10TVQ3CCJQ89

- ends -

[1] 2023 equivalent figures calculated using the Company

gold/silver ratio of 83x. All 2024 forecasts assume the average

gold/silver ratio for 2023 also at 83x

[2] Calculated as total number of accidents per million labour

hours

([3]) Calculated as total number of days lost per million labour

hours.

[4] The ECO Score is an internally designed Key Performance

Indicator measuring environmental performance in one number and

encompassing numerous fronts including management of waste water,

outcome of regulatory inspections and sound environmental practices

relating to water consumption and the recycling of materials.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTKXLFLZFLZBBE

(END) Dow Jones Newswires

January 24, 2024 02:00 ET (07:00 GMT)

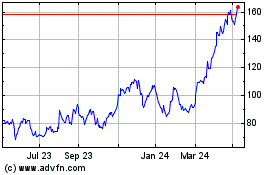

Hochschild Mining (LSE:HOC)

Historical Stock Chart

From Mar 2024 to Apr 2024

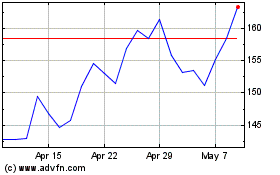

Hochschild Mining (LSE:HOC)

Historical Stock Chart

From Apr 2023 to Apr 2024